The celebration, running from October 13, 2021 to January 03, 2022, will include the sale of a collection of NFTs

New York City, United States of America, 13th October, 2021 – The co-inventors of the early blockchain, Drs. Stuart Haber and W. Scott Stornetta, are joining with a team of industry-leading partners to commemorate the birth of blockchain technology, its past, present, and future. It’s a tribute to the journey and the community.

Today’s announcement marks the 30th anniversary of the public appearance of what might be called the “genesis block” of what is in fact the world’s oldest continuously running primitive blockchain, as explained here.

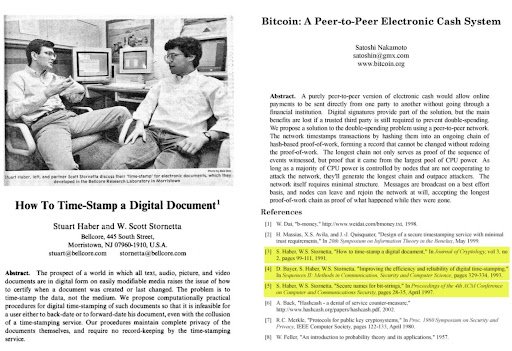

The celebration will conclude on January 03, 2022, the 13th anniversary of the Bitcoin genesis block. Bitcoin’s design, as described in Satoshi Nakamoto’s white paper, Bitcoin: A Peer-to-Peer Electronic Cash System, relies on Haber and Stornetta’s mechanism for ensuring the integrity of all of its transactions. In fact, three of Satoshi’s eight footnotes reference their technical papers.

The history of the blockchain will be celebrated with a collection of NFTs that both involve and honor the founders, innovators, and thought leaders of the blockchain community. The NFTs, demonstrating the range and diversity of the blockchain ecosystem, will be auctioned through a novel mechanism and will involve a number of innovative layer-1 blockchains and their communities.

Jason Bailey, global thought leader in NFTs and founder of Artnome.com and ClubNFT, said, “Without the work of Stuart Haber and Scott Stornetta there are no NFTs, no Bitcoin, and no blockchain. I’m thrilled that they are using this opportunity to create an NFT with the goal of unifying everyone within the blockchain ecosystem in a way that I believe only they can.”

“Kadena is thrilled and honored to participate in Immutable Record’s celebration of blockchain,” said Stuart Popejoy, the co-founder and CEO of the Kadena blockchain and smart contract platform. “Immutable Record’s NFT offering drives the space forward with a multi-protocol approach that also exploits many of Kadena’s unique advantages such as institutional-quality provenance, entirely on-chain minting, and custom marketplaces.”

“This historic drop allows us to highlight Cardano’s unique protocol capabilities during this multi-chain celebration,” said Chris J. Snook, founder, and CEO of SDK Co, a consumer-facing blockchain-based company utilizing Cardano’s platform.

Haber and Stornetta concluded with “We are happy to join the celebration of the blockchain, and will be announcing the involvement of other leading layer-1 blockchains and thought leaders. Stay tuned. The best is yet to come.”

For media inquiries please contact media@immutablerecord.com.

For more information visit the website https://immutablerecord.com/

About Kadena

Kadena is the industry’s only scalable layer-1 Proof of Work (PoW) blockchain, featuring Pact, the safest and easiest-to-use smart contract technology. Kadena’s platform provides the world the tools and environment to turn ideas and ambitions into reality, from DeFi applications to NFT marketplaces. As the only blockchain that can scale both speed and storage limitlessly, decentralized services on the Kadena platform allows users and builders to exceed current limitations in blockchain such as high gas fees and storage constraints, and even “mint marketplaces” where exchange and trading of tokens and NFTs can be customized endlessly. Founded by Stuart Popejoy and William Martino who created JP Morgan’s first blockchain and led the SEC’s Crypto Committee, Kadena aims to allow for true blockchain mass adoption. Visit us at www.kadena.io and follow our twitter account at www.twitter.com/kadena_io to learn more.

About SDK Co SDK Co builds technologies powering personal choice that enable customers to regain control over their personal data by offering secure connected hardware and software. SDK Co utilizes the Cardano blockchain, a platform designed for changemakers, innovators, and visionaries. SDK Co’s ecosystem of technology offerings also includes digital collectables/NFTs for Fortune 100 brands and partners. To learn more visit https://www.sdkco.io/

Crypto2 years ago

Crypto2 years ago

Blockchain4 years ago

Blockchain4 years ago

Press Release4 years ago

Press Release4 years ago

Press Release4 years ago

Press Release4 years ago

Blockchain4 years ago

Blockchain4 years ago

Press Release3 years ago

Press Release3 years ago

Press Release4 years ago

Press Release4 years ago

Blockchain4 years ago

Blockchain4 years ago