Financial

Analysis of Curve Finance Reentrancy Attack

In July 2023, the Curve Finance reentrancy attack posed a significant security challenge for the leading decentralized finance (DeFi) platform, Curve Finance.

A reentrancy vulnerability within its system was exploited, leading to substantial financial losses across multiple DeFi projects.

We will now explore the vulnerability’s origins, its discovery, and the subsequent steps taken by Curve Finance and the broader DeFi community to address the security lapse.

What is Reentrancy?

On DeFi platforms, reentrancy attacks are malicious vulnerabilities in which a function is indirectly executed by itself before the initial execution is complete.

Such recursion may result in unwanted transactions that exploit smart contract flaws.

In the context of blockchain and Ethereum, in which Curve Finance operates, these flaws can cause significant financial damage due to the irreversible nature of transactions.

Reentrancy occurs when functions call other, untrusted contracts before resolving their effects (such as updating balances), allowing the external contract to re-enter the original function and causing logical disruptions.

For instance, this can lead to several withdrawals from the same deposit, depleting money that ought to be safeguarded.

Historical Context and Previous Incidents

The infamous DAO attack in 2016 was a landmark incident involving a reentrancy exploit, where an attacker drained around a third of the DAO’s funds by repeatedly recalling a function to withdraw Ether.

This event not only led to a significant financial loss but also prompted a hard fork in Ethereum, highlighting the critical importance of secure smart contract design.

Since then, the Ethereum community has prioritized enhancing security measures, yet reentrancy remains a daunting challenge. Various other incidents across the DeFi landscape have echoed the persistent vulnerability to such attacks, underscoring an ongoing battle against exploits in complex smart contract interactions.

This context sets the stage for understanding the recent incident with Curve Finance, in which similar vulnerabilities were exploited due to outdated compiler versions in their smart contracts.

To protect against changing threats in the DeFi sector, the incident serves as a clear reminder of the need for strict security protocols as well as ongoing updates and audits of the smart contract codebase.

Discovery and Response to the Curve Finance Vulnerability

The reentrancy vulnerability in Curve Finance was identified during a routine security audit by an independent developer who was examining the code for potential flaws.

Initial Discovery of the Bug

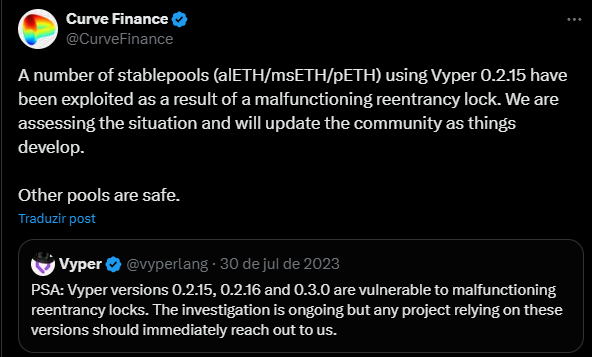

The vulnerability stemmed from the use of outdated versions of the Vyper compiler, versions 0.2.15, 0.2.16, and 0.3.0, which failed to implement effective reentrancy guards.

This oversight left certain smart contracts open to exploitation, particularly those involving transactions linked to native ETH or tokens adhering to the ERC-777 standard.

Curve Finance and Vyper posted on the social platform X stating:

Technical Analysis of the Vulnerability

The specific flaw allowed attackers to manipulate the contract’s functions to withdraw funds repeatedly before the contract state could be updated to reflect each transaction.

This type of attack exploits the gap between the initiation of a contract call and the state update, a critical period during which the contract is vulnerable.

The Vyper programming language, known for its Python-like syntax and targeted at Ethereum’s virtual machine, was central to the issue.

The language’s updates had not adequately addressed the reentrancy guard, which should prevent multiple entries into vulnerable functions during a single transaction.

Curve Finance’s Immediate Actions

Upon discovery, Curve Finance swiftly responded by halting affected transactions and patching the vulnerability. They updated the compiler and adjusted the smart contracts to include enhanced security checks.

Additionally, the platform launched a white-hat program, encouraging ethical hackers to find and report vulnerabilities in return for bounties. This initiative not only helped fix the immediate issue but also bolstered the platform’s defenses against future attacks.

The response was part of a broader effort to reinforce trust and security within the Curve Finance ecosystem and the DeFi community at large.

Implications for the DeFi Ecosystem

The revelation of the reentrancy vulnerability in Curve Finance triggered a swift and coordinated response across the DeFi community. Various platforms initiated reviews of their protocols, especially those written in Vyper or similar languages prone to similar issues.

Immediate Community Reaction and Long-term Impact on DeFi Security

The incident fueled a widespread reassessment of security strategies within the DeFi space, with many platforms accelerating their security audits and patch implementations to fortify their systems against similar vulnerabilities.

The incident involving Curve Finance is an important reminder of the security risks that are part and parcel of the DeFi industry.

It emphasized the need for continuous improvement in smart contract design and validation techniques. As a result, there has been a significant increase in the adoption of more rigorous testing environments and security frameworks, which are critical for maintaining trust and stability in DeFi.

The incident has also underscored the necessity of community vigilance and the role of white-hat hackers in detecting and mitigating possible dangers before they can cause widespread damage.

Strengthening DeFi Security

To mitigate risks such as reentrancy attacks, developers must implement best practices in smart contract design, such as the checks-effects-interactions pattern, which organizes code to make unexpected reentries difficult.

Regular security audits and the integration of security tools that automate the detection of common vulnerabilities are crucial.

Developers are also encouraged to use updated and secure compilers to avoid introducing flaws that can be exploited.

Strategic Recommendations for DeFi Platforms

DeFi platforms should establish robust security frameworks that include continuous monitoring and rapid response systems.

Encouraging a culture of security within the development community and incentivizing the disclosure of potential vulnerabilities through bug bounty programs are effective strategies.

These efforts enhance not only the security of individual platforms but also contribute to the resilience and trustworthiness of the entire DeFi ecosystem.

Enhancing DeFi Security Post-Curve Finance Reentrancy Attack

The reentrancy vulnerability exposed in Curve Finance served as a critical wake-up call for the DeFi sector.

It underscored the perpetual need for vigilance, robust security protocols, and the proactive involvement of the community in safeguarding digital assets.

The occurrence sparked a round of security reassessments across several DeFi platforms, emphasizing the significance of ongoing development in smart contract design and implementation.

DeFi platforms must adopt secure coding practices, prioritize thorough and frequent audits, and keep up with the most recent advancements in smart contract security if they are to improve security measures.

The implementation of automated vulnerability detection tools and the promotion of a security-first approach among developers will be pivotal in averting such incidents.

Final thoughts and FAQ:

The incident highlights the effectiveness of community-driven security enhancements, such as bug bounty programs and white-hat initiatives, which not only help in identifying vulnerabilities but also foster a collaborative approach to security.

As DeFi continues to evolve, the commitment to implementing these best practices will be pivotal in shaping its resilience and ensuring the trust of users and investors in this dynamic and promising sector of the financial industry.

- What is a reentrancy attack in DeFi?

When a malicious actor takes advantage of a smart contract vulnerability that allows a function to be called more than once before its initial invocation is finished, it can result in unauthorized actions like multiple withdrawals. This type of attack is known as a reentrancy attack in the context of decentralized finance (DeFi). - How was the Curve Finance reentrancy vulnerability discovered?

When an independent developer conducted a routine audit, they discovered the Curve Finance reentrancy vulnerability. Outdated versions of the Vyper compiler did not properly implement reentrancy guards, leaving smart contracts vulnerable to attacks. - What steps did Curve Finance take in response to the vulnerability?

The affected smart contracts were updated, security measures were strengthened, and Curve Finance introduced a bug bounty program to incentivize the community to report possible security flaws. Curve Finance swiftly addressed the vulnerability. - What are the best practices to prevent reentrancy attacks in DeFi?

Best practices include using the checks-effects-interactions pattern in smart contract development, conducting regular and comprehensive security audits, and employing up-to-date and secure compilers to minimize risks. - What impact did the reentrancy exploit have on the DeFi ecosystem?

The exploit led to significant financial losses and prompted a broader reassessment of security protocols across multiple DeFi platforms. It highlighted the need for continuous improvement in security practices and community engagement in the security process.

Financial

BlockDAG’s 100M BDAG Airdrop Turns Heads as AAVE Price Chart Weakens & Aptos Price Target Slips

Crypto’s constant shake-ups keep even seasoned traders on edge. The AAVE price chart continues to swing as DeFi lending adapts to market shifts and regulatory moves, while the Aptos (APT) price target attracts fresh speculation thanks to its speed-focused Layer-1 upgrades. But as these familiar names test new highs and lows, BlockDAG (BDAG) is taking a bolder route that demands real buyer attention; its massive 100M BDAG Airdrop Campaign is now live.

Early users can claim a share of 100 million BDAG by completing simple quests, adding extra upside beyond its already impressive presale. With over $329 million raised, 23.6 billion coins, and nearly 18,300 miners sold, BlockDAG’s growing network and $0.0016 entry window until August 11 signal why it’s being called the best crypto right now. This comparison breaks down how AAVE price chart trends, the Aptos (APT) price target, and BlockDAG’s airdrop opportunity stack up.

AAVE Price Chart Trends Reveal Hidden Upside in DeFi Shakeups

AAVE remains one of the most recognised DeFi protocols, standing tall for its open-source liquidity market that allows users to lend and borrow crypto with variable or stable interest rates. Recent trends show that the AAVE price chart has seen significant swings, reflecting both market uncertainty and the community’s active governance decisions.

AAVE’s strengths lie in its flexibility, multi-chain expansion, and security measures, which have helped it maintain its standing as a top DeFi project. However, it faces challenges too. The DeFi space is fiercely competitive, and regulatory scrutiny on lending protocols has made some investors cautious. Still, with constant upgrades and a proactive approach to risk management, AAVE stays relevant for traders scanning the AAVE price chart for possible entry points in this fast-paced market.

Aptos Price Target Pushes Higher as Layer-1 Race Heats Up

Aptos (APT) keeps catching the eye of Layer-1 watchers as developers push its scalability and security benefits. Designed with the Move programming language and promising thousands of transactions per second, Aptos aims to solve long-standing blockchain bottlenecks. The current Aptos (APT) price target remains optimistic, especially as more partnerships and ecosystem tools roll out.

With a growing number of dApps and a strong developer community, Aptos holds its position as a future-ready network that prioritises speed and low fees. Yet, there are concerns about whether it can keep up with larger competitors like Ethereum or Solana, which already have deeply established communities. For now, the Aptos (APT) price target keeps climbing as more eyes look for new Layer-1 solutions that deliver real-world utility and next-level performance.

BlockDAG 100M BDAG Airdrop: A Big Win for Early Supporters

BlockDAG isn’t just another presale; it’s carving out an identity with aggressive network growth and real user incentives. One of BlockDAG’s most compelling moves right now is the 100M BDAG Airdrop Campaign, allowing early buyers to claim 100 million BDAG by completing four simple quests.

This campaign is designed to reward early supporters while building a broader community base. But the numbers behind BlockDAG speak even louder: it has already raised over $329 million in its presale, sold 23.6 billion coins, and 18,284 miners.

Though it’s currently in batch 29 at $0.0276, the BlockDAG opens a limited-time window, allowing buyers to secure BDAG at just $0.0016 until August 11, one of the lowest prices since its earliest batches, offering a potential 3,025% profit.

Together, the rare entry window and the 100M BDAG Airdrop are turning BlockDAG into one of the most watched presale projects this season. On the security front, BlockDAG has been Halborn and CertiK approved, strengthening confidence in its infrastructure and resilience against threats.

Combined with ongoing developments, an expanding mining community, and clear audit transparency, BlockDAG proves it’s more than just a presale. It’s a network that’s live, growing, and built on trust. For anyone eyeing the crypto market closely, this window is a rare chance to get in before momentum accelerates.

In Summary

AAVE’s proven DeFi model keeps it a magnet for traders tracking the AAVE price chart, while Aptos leverages its robust Layer-1 foundation and developer community to aim for a higher Aptos (APT) price target. Both projects showcase strong market positions and evolving roadmaps. Yet BlockDAG’s approach hits differently. Its presale dominance, the huge 100M BDAG Airdrop Campaign, deep community mining, and high-profile audits give it a real edge in scalability and trust.

Add in the current price window of $0.0016, and it’s clear why BlockDAG is being called the best crypto right now for buyers seeking strong upside potential. As always, research and timing are key, but with its track record and community focus, BlockDAG is shaping up to be one to watch closely this year.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Financial

BlockDAG GLOBAL LAUNCH Release Brings $0.0016 Unlock Deal Until August 11 While Bitcoin Solaris Targets $9 Phase 9

Bitcoin Solaris has caught people’s attention with its phase 9 sale at $9. So far, it has pulled in over $5 million and grown its holder base to more than 11,500. What adds an interesting angle is the Nova App, which allows mobile mining, plus the built-in on-chain casino that keeps traders engaged. The confirmed Bitcoin Solaris listing on LBank has made many hopeful, with a $20 launch price already forecast. For those chasing quick wins and stories that drive early interest, Bitcoin Solaris’ phase 9 looks attractive right now.

But compare that to what BlockDAG is doing, and the gap is obvious. BlockDAG presale has already raised over $326 million. Its tools are live, its roadmap is unfolding, and it’s not just hoping for a breakout. It’s focused on real delivery and staying power. From simple DApp kits to actual grants for devs, BlockDAG is rolling out the kind of ecosystem that most coins only talk about.

Bitcoin Solaris Gathers Heat, But Can It Keep It Going?

Bitcoin Solaris’ phase 9 has pulled plenty of eyes to its side. Over 4.2 million coins have sold so far, and its confirmed LBank listing keeps the spotlight on. Traders expect Bitcoin Solaris trading volume to get a strong boost once the $20 launch happens, giving more reason for people to jump in early.

The Nova App’s mobile mining plus the casino experience make it stand out. But there’s still a technical gap. There’s no live testnet yet, no solid dApp launch layer, and very little around an active ecosystem that builders can plug into. So while the Bitcoin Solaris phase 9 push feels promising now, it’s still uncertain if Bitcoin Solaris trading interest can last after its listing. It has to prove it’s more than a short-term play and turn that hype into a solid, lasting project.

BlockDAG Delivers the Infrastructure Bitcoin Solaris Still Lacks

BlockDAG is already showing real progress with 23.4B coins and 18,250 miners already sold. The X1 miner app has over 2 million users tapping away, generating up to 20 BDAG daily. This is real usage, not just a concept.

Its structure relies on DAG technology for fast and efficient transactions. Developers can already use low-code and no-code DApp tools to launch apps quickly. BlockDAG’s security is covered with thorough audits from both CertiK and Halborn

BlockDAG is planning for the long term, too. It’s driving developer engagement with hackathons, grants, and the BlockDAG Academy. Exchange listings are moving forward, and the community keeps growing.

As part of BlockDAG GLOBAL LAUNCH release, BDAG coins are now available at a lower price of $0.0016 until August 11. This brings back one of the lowest prices since batch 1, giving early buyers a shot at up to 3,025% profit when the final $0.05 launch price goes live.

While Bitcoin Solaris works to prove itself, BlockDAG is already running, scaling, and giving back real performance. It’s the difference between big talk and a real network you can use today.

Bitcoin Solaris or BlockDAG: What Really Stands the Test of Time?

If you want to see what separates Bitcoin Solaris from BlockDAG, you have to look deeper than today’s hype. Bitcoin Solaris phase 9 has sparked momentum at $9 with its LBank listing, an increase in trading volume, mobile mining, and its gamified casino. It’s getting strong attention because it fits the fast-move narrative that some traders enjoy.

BlockDAG, on the other hand, is not chasing headlines. It’s building layer by layer. Its $326 million raise fuels a working testnet, advanced DAG architecture, solid audits, and a mobile miner app already serving 2 million users. Developers have access to live tools now, not just promises.

In the end, Bitcoin Solaris might run on short-term energy. BlockDAG is setting itself up for the long game with real systems and an active, growing base. One is about quick moves; the other is about proven scale and staying power.

Final Thoughts

Bitcoin Solaris has created a spark in the market. Its phase 9 sale sits at $9, with a $20 launch on LBank around the corner. Traders expect Bitcoin Solaris trading volume to climb after the listing. For some, this could mean big moves in the short run.

But BlockDAG is in a different league. With $326 million presale, 23.4 billion coins sold, and a testnet already live, it’s doing what many projects only promise. The limited time entry price of $0.0016 until August 11 just sweetens the deal for those looking to get in before the final $0.05 price. It’s not just hype, it’s a working setup, a real community, and clear growth.

For anyone who wants more than just the next jump, BlockDAG stands out as the clear pick for true scale, real delivery, and lasting potential.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Financial

100M BDAG Airdrop Live Now! Join Early While $0.0080 Entry Is Open Before the Next Price Explosion

In a crypto space filled with giveaways that often reward bots, BlockDAG is taking a different approach. With a 100 million BDAG airdrop in motion, this isn’t just about free coins; it’s a mission to activate an entire Layer 1 network. The campaign spans four categories and aims to onboard 10 million users who genuinely interact with the ecosystem.

Forget random snapshots or idle claims. This structure is purpose-built to onboard, educate, and retain active contributors from day one. As the mainnet nears, BlockDAG (BDAG) is making participation the only way in. If you want a place in this ecosystem, you’ve got to act now.

Step Into the BlockDAG Airdrop: Quests That Pay to Engage

BlockDAG’s airdrop is driven by action. Users complete tasks in four tracks: Testnet, Presale, Social, and Referral. Each track supports the network’s foundation and rewards users with BDAG.

Testnet Quests: Users perform tasks within BlockDAG’s testnet, such as bug reporting, smart contract deployment, and test wallet usage. These actions help strengthen the network before the full launch.

Presale Quests: This involves buying BDAG, using the X1 Miner App, and ordering physical miners. It helps fuel platform development while giving users real engagement opportunities.

Social Quests: Community growth is key. Users interact via Twitter (X) and Telegram by following, reposting, and commenting to grow the platform’s reach.

Referral Quests: Through invites, users grow the ecosystem and earn BDAG. This peer-driven method ensures sustained, organic network expansion.

Tap to Earn: How the X1 App Brings Millions Into Mining

BlockDAG’s X1 mobile mining app, now used by over 2 million people in 100+ countries, makes crypto simple. Just one tap a day lets users mine BDAG via a Proof-of-Engagement model. It’s battery-light, easy to use, and rewards commitment.

This app is more than a mining tool; it’s a growth engine. It welcomes users with no prior experience and turns them into daily contributors. Paired with the airdrop, the app ensures a broad and engaged user base.

At present, BDAG is in Batch 29, priced at $0.0080, with a final launch price of $0.05. Over $325 million has been raised, 23.3 billion BDAG sold, and over 18,201 miners purchased. This creates urgency for those who want in before the price rises again.

$325M Presale & Counting: Why the Ecosystem Is Built Before Launch

BlockDAG isn’t waiting until launch to build traction. With the airdrop active, the team is already collecting feedback, running user tasks, and testing systems in real time.

This strategy unites every arm of development: coding through testnet, funding through presale, visibility through social, and growth through referrals. Each BDAG coin given away has a purpose. Each task completed adds strength.

Most launches miss key elements like users, funds, or feedback. BlockDAG solves all of that before launch. It’s an early, user-driven network rollout fueled by real action, not speculation.

The full tech stack, including EVM compatibility and DAG-based structure, supports the project’s push for mass adoption. And it starts now with a tap, a quest, and a growing global base.

The Bottom Line

BlockDAG isn’t just offering airdropped coins. It’s handing users a role in something much larger. From technical contributors to casual users with a phone, everyone has a place.

Take part now. Complete the quests, refer to your network, and claim your stake. With $325 million already raised in presale, the early window of $0.0080 is closing fast.

Ten million users are about to be part of this network. Are you going to be one of them?

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

-

Crypto3 years ago

Crypto3 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release4 years ago

Press Release4 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain5 years ago

Blockchain5 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins