Financial

Ethereum surpassed Visa in 2021 concerning the sums traded.

Published

5 months agoon

By

Ethereum has a high usage rate and a high fee structure, and the implementation of EIP-1559 has resolved some issues. In 2021 Ethereum Surpassed Visa concerning the sums traded on the network.

A detailed analysis of Ethereum in 2021 by Josh Stark points out that the second-largest cryptocurrency in the world has overtaken Visa in terms of value transacted.

Last year alone, the Ethereum network handled the equivalent of $11.6 trillion in transactions.

In addition to this information, the article also provides data on the total fees paid on different blockchains, including Bitcoin.

It also analyzes the arrival of second-layer solutions and the arrival of different players in the sector.

Finally, it is also possible to find detailed information about the ratio between emission and burning of ETH after the introduction of EIP-1559.

Ethereum surpassed Visa

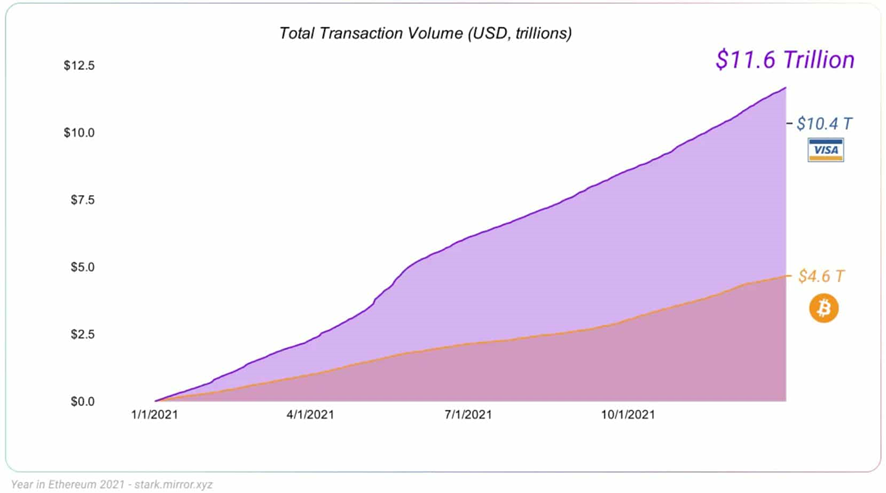

The sums traded by Bitcoin and Ethereum are perhaps the most unexpected facts uncovered in this research.

While Visa transacted a total of 10.4 trillion dollars in 2021, Bitcoin moved US$ 4.6 trillion, passing PayPal.

Ethereum managed to double the volume of BTC and surpass Visa after closing the year with a volume of transactions equivalent to 11.6 trillion dollars.

Although it seems that Bitcoin is losing this fight, it is worth remembering that most transactions on Ethereum involve tokens, fungible or not. That is, both have their merits here.

High Usage and High Fees on Ethereum Network

As most blockchains work as an auction system, where transactions with higher fees are accepted first, it is no surprise to find expensive fees when networks are overloaded.

With the explosion of DeFi, NFT, play-to-earn gaming sectors, scalability has been Ethereum’s weak point ever since. In other words, he could be a lot bigger if his rates were cheaper.

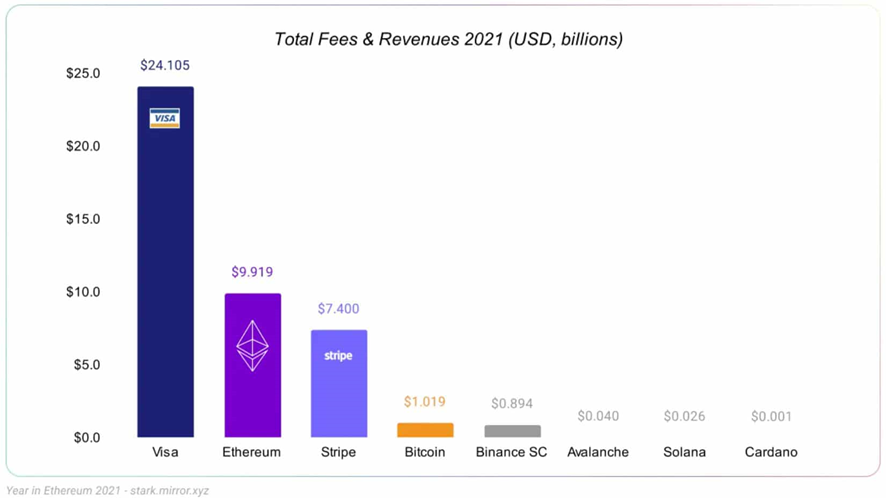

The chart below compares some payment solutions’ total fees paid in 2021.

While a 10-fold difference between ETH and BTC draws attention, Visa’s $24 billion is the focus. After all, this profit belongs to the company. In cryptocurrencies, this profit goes to the miners.

Second layer solutions

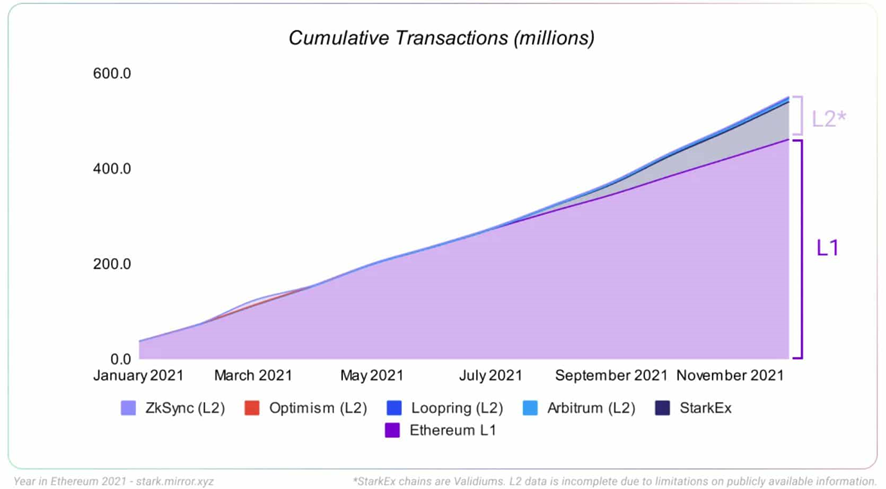

Because of the scalability mentioned above, the latter half of 2021 was defined by second-tier solutions on Ethereum. Escaping high fees is the main reason.

The article highlights that Ethereum validated around 1.2 million transactions per day and that the arrival of these second-tier solutions is managing to increase this number, which is currently at its limit.

The Growth in use cases of Cryptocurrency

Another important observation from Stark’s Ethereum 2021 retrospective is the expansion of cryptocurrency use cases, mainly linked to Ethereum itself.

While until the year 2020, the vast majority of people who lived off cryptocurrencies were investors, developers, and companies. The expansion of non-fungible tokens (NFTs) attracted other professionals to this universe.

For example, artists selling their artwork on NFT are often used by athletes such as Stephen Curry, which also has strong ties to Bitcoin and cryptocurrencies. Currently, he is a partner in one of the largest exchanges in the world and collects NFTs.

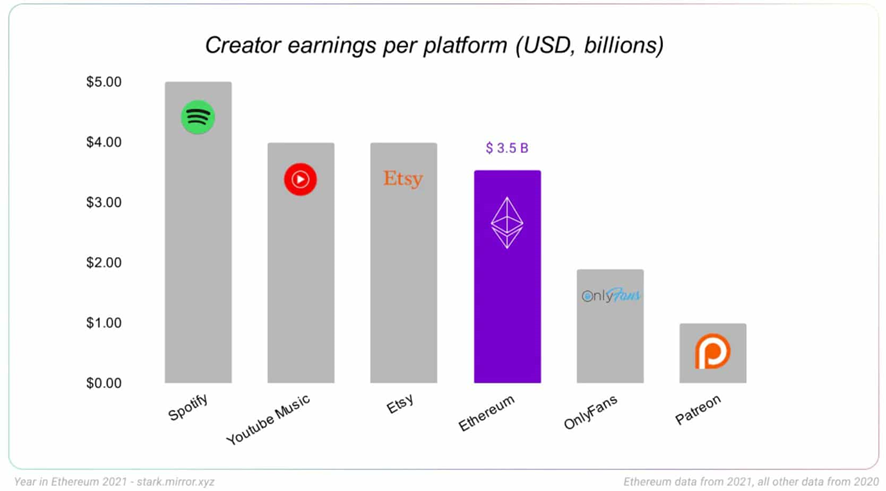

Stark compares revenue between Ethereum and other services used by artists such as Spotify and YouTube Music in the chart above. Pointing out the potential of blockchain, still little explored.

The Ethereum burns with the EIP-1559.

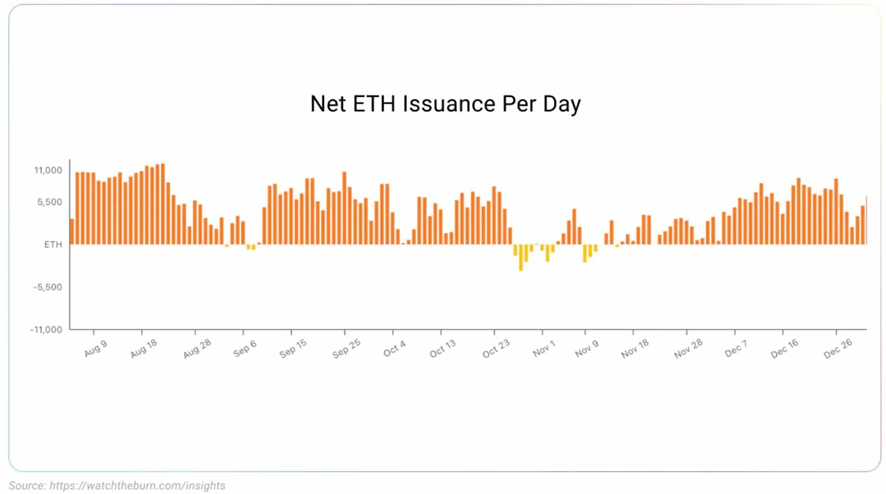

Finally, the report highlights Ethereum’s economic shift in August through EIP-1559. With it, part of the transaction fees began to be burned, reducing the total supply of ETH.

With a reward of 2 ETH per block, generated every ~15 seconds, Ethereum would have inflation of around 11,520 ethers per day. In November, the network burned its one-millionth ETH.

Despite this, the amount was lowered once the burn was introduced.

Highlighting the end of October, when Ethereum became a deflationary asset for eight consecutive days, that is, the number of ethers decreased in this period.

Ultimately, this shows that ignoring cryptocurrencies is a mistake.

Like the director of Microsoft, the most visionary already admit that Ethereum will be the new application store.

On the other hand, Bitcoin gains more space as a store of value with each passing day, and today both are dominant in their areas.

You may like

TradFi and DeFi Integration meeting point is a watershed moment in the financial industry.

A new era of financial interactions is emerging as financial goods that are established in traditional markets make their way into the DeFi arena. This move unites two disparate financial domains and presents a fascinating confluence of innovation, security, and regulatory obstacles.

The Convergence of TradFi and DeFi

Integrating traditional financial products into the DeFi landscape transforms our perception and interaction with financial services.

By combining the dependability of traditional financial mechanisms with the innovative, blockchain-based approaches of DeFi, this transformation promises to improve accessibility, transparency, and efficiency across the board.

It offers a unique opportunity to see such a merger’s potential benefits and challenges.

Understanding Traditional Financial Products

As traditional financial products enter the decentralized finance (DeFi) landscape, they bring proven lending mechanisms, derivatives trading, and the promise of tokenized real-world assets (RWAs).

These elements are traditionally managed through centralized systems such as banks and regulated exchanges, where central authorities control the assets, ensuring security and regulatory compliance, but at higher transaction fees and limited accessibility.

In traditional finance, consumers often face barriers such as minimum balance requirements, credit score thresholds, and geographical limitations.

The central tenets of DeFi—decentralization, transparency, and direct asset control via cryptographic keys—stand in stark contrast to the centralization and opaqueness of traditional finance systems.

DeFi’s use of public blockchains, which make all transactions open and verifiable and boost participant trust, demonstrates the company’s dedication to transparency.

This operational model promotes a more inclusive financial environment by lowering entry barriers and facilitating access to financial services for individuals globally, including the ‘unbanked.’

Platforms such as DeFi lending protocols, which enable peer-to-peer lending without intermediaries, help ease the transition from traditional financial products to DeFi, reducing paperwork, processing times, and transaction costs.

This ongoing integration suggests a future where financial services are more interoperable, accessible, and aligned with the modern need for efficiency and transparency. However, this transformation also requires careful navigation of regulatory compliance and security complexities.

Core Principles of TradFi and DeFi Integration

Decentralized Finance (DeFi) stands for a change in thinking in how financial services are delivered, leveraging blockchain technology to decentralize operations traditionally handled by central institutions like banks.

This revolutionary model hinges on four core principles that distinguish it significantly from traditional finance (TradFi) systems.

Decentralization and Autonomy:

DeFi drops intermediaries using smart contracts on blockchain platforms, primarily Ethereum.

These contracts automate and secure financial operations, allowing transactions to be executed directly between participants without central oversight.

This structure enhances efficiency, increases transparency, and reduces costs associated with financial transactions.

Inclusivity and Accessibility:

DeFi democratizes financial services by eliminating barriers like credit checks and extensive documentation.

DeFi ecosystems democratize access to financial products, enabling anyone with an internet connection, mainly the unbanked and underbanked, to participate globally.

This inclusivity bridges significant gaps in traditional banking but also requires basic digital literacy and reliable internet access, highlighting areas for further development and support.

Transparency and Security:

All transactions within DeFi platforms are recorded on a public blockchain, providing an immutable and transparent record.

This transparency is vital for trust and security, allowing anyone to audit all activities.

Additionally, while DeFi offers robust security through blockchain technology, it faces challenges such as smart contract vulnerabilities, which need continuous oversight and improvements.

Innovation and Flexibility:

DeFi is highly innovative, often introducing new financial products and services that challenge traditional models.

Features like yield farming, liquidity mining, and decentralized exchanges (DEXs) represent just a few of the innovations that have emerged from DeFi, offering users new ways to earn returns on investments and engage with financial markets.

Programmability:

Using smart contracts allows for highly programmable and customizable financial services.

Developers can create applications that automatically execute when conditions are met, without manual intervention, which can streamline everything from loans and insurance to asset trading and risk management.

These principles contribute to a financial ecosystem that is not only more open and transparent but also one that is poised to be more adaptive to the needs of a global user base, fostering innovation while challenging existing financial frameworks to evolve.

TradFi and DeFi Integration: Challenges and Opportunities

The integration of traditional finance with decentralized finance (DeFi) presents significant opportunities and formidable challenges, shaping the future landscape of the financial sector.

Opportunities:

- Enhanced Financial Inclusion: DeFi’s ability to operate globally without traditional banking infrastructure makes financial services accessible to those previously excluded due to geographic or economic barriers.

- Reduced Transaction Costs: By eliminating intermediaries, DeFi can significantly lower the fees associated with financial transactions, making operations more cost-effective for users across the board .

- Increased Transparency and Efficiency: By ensuring that every transaction is documented on a public ledger, blockchain technology improves the financial activity’s transparency and auditability.

- Automation of Financial Services: Smart contracts automate many financial processes, such as lending, borrowing, and asset management, which reduces administrative overhead and speeds up transactions.

Challenges:

- Regulatory compliance: Integrating DeFi into traditional finance necessitates navigating complex regulatory frameworks that differ by authority. Compliance is crucial for legitimacy and financial crime prevention.

- Interoperability Issues: There is a current lack of interoperability between traditional financial systems and blockchain technologies, which complicates the seamless transfer of assets across these platforms.

- Security Concerns: While blockchain adds a layer of security, DeFi is vulnerable to clever contract exploits and other cybersecurity threats that could undermine user trust and system stability.

- Market and Operational Risks: The decentralized nature of DeFi could lead to market manipulation, and the pseudonymous design poses challenges for enforcing laws like anti-money laundering

(You can read the full overview of cryptocurrencies and decentralized finance PDF document at NBER).

As DeFi continues to evolve, these challenges are expected to be addressed through technological advancements and more robust regulatory frameworks.

The future of finance depends on how effectively the financial sector can integrate DeFi’s agility with the stability of traditional monetary systems.

Future Outlook and Predictions for TradFi and DeFi Integration

The integration of traditional finance (TradFi) and decentralized finance (DeFi) is set to redefine the financial landscape in 2024 and beyond, with trends calling for a transformative phase for both sectors.

Tokenization and Real-World Assets (RWA):

The tokenization of assets, including bonds, stocks, treasuries, real estate, and even carbon credits, is expected to be a significant trend. This move is expected to enhance liquidity, reduce transaction costs, and open new opportunities for DeFi protocol designs, making financial systems more inclusive and efficient.

Regulatory Developments:

Regulatory frameworks are expected to evolve significantly, with experiments in places like the European Union and the United Kingdom shaping the regulatory landscape. These changes are crucial for addressing compliance and fraud issues within DeFi, ensuring the sector’s growth is sustainable and integrated seamlessly with existing financial systems (Geek Metaverse News).

Cross-Chain and Layer 2 Solutions:

Improvements in cross-chain interoperability and adoption of Layer 2 scaling solutions are set to address critical technical challenges such as transaction speeds and cost. These technologies will enable smoother transitions and interactions between different blockchain networks and traditional financial systems, broadening the scope and efficiency of DeFi.

Increased Institutional Adoption:

There is an expectation of increased institutional engagement, with traditional financial entities exploring DeFi to offer more innovative services. Validating the DeFi space and bringing in more advanced financial products and money would close the gap between traditional finance and decentralized finance.

Focus on Sustainability:

Blockchain technology, particularly the adoption of energy-efficient consensus mechanisms such as Proof of Stake, is consistent with global sustainability goals. This shift is expected to enhance the appeal of blockchain and DeFi for environmentally conscious investors and stakeholders.

Technological advancements in blockchain and AI, alongside significant regulatory changes, emphasize sustainability and efficiency in the financial sector.

As we approach 2024, these developments are poised to blur the traditional boundaries between centralized and decentralized finance, marking it a pivotal year in the industry.

These developments are expected to expand financial inclusion and transform how financial services are accessed and delivered globally.

Conclusion

As we look toward 2024, the convergence of traditional finance (TradFi) and decentralized finance (DeFi) undeniably shape a new financial paradigm.

The future of finance hinges on the successful integration of TradFi’s robustness and DeFi’s innovative mechanisms.

This melding promises enhanced liquidity, reduced transaction costs, and broader financial inclusion, eased by technological breakthroughs such as tokenizing real-world assets and advanced blockchain solutions.

Regulatory advancements are predicted to play a pivotal role in ensuring that DeFi’s growth is sustainable and compliant with global financial regulations.

Moreover, adopting energy-efficient blockchain technologies aligns with a more environmentally conscious approach, making DeFi appealing to a broader spectrum of investors.

The ongoing evolution within these sectors suggests a move towards a more interconnected and efficient global financial system, heralding a future where finance is more obtainable, open, and accommodating to the requirements of a diverse global populace.

FAQs

1. What is the significance of tokenization in integrating TradFi and DeFi?

Tokenization plays a crucial role in converting real-world assets into digital tokens. This process enhances liquidity and makes these assets more accessible to investors globally, thereby bridging the gap between traditional and decentralized finance.

2. How will regulatory changes affect the DeFi landscape in 2024?

Regulatory changes are expected to provide a more transparent framework for DeFi operations, addressing compliance, security, and fraud issues and promoting increased institutional adoption.

3. What technological advancements are pivotal for DeFi’s future?

Technological advancements such as cross-chain interoperability, Layer 2 scaling solutions, and energy-efficient consensus mechanisms are pivotal. They enhance transaction speeds, reduce costs, and ensure that DeFi platforms are sustainable and efficient.

4. What role does institutional adoption play in the growth of DeFi?

Institutional adoption is critical for the growth of DeFi, as it brings in significant capital and legitimacy. Financial institutions exploring DeFi could lead to the development of new financial products and greater integration with traditional monetary systems.

5. How does the focus on sustainability influence the blockchain and DeFi sectors?

The focus on sustainability drives the adoption of greener blockchain technologies and practices, aligning DeFi with global sustainability goals. As a result, DeFi and blockchain have become increasingly appealing to investors who care about the environment and support larger ecological projects.

In July 2023, the Curve Finance reentrancy attack posed a significant security challenge for the leading decentralized finance (DeFi) platform, Curve Finance.

A reentrancy vulnerability within its system was exploited, leading to substantial financial losses across multiple DeFi projects.

We will now explore the vulnerability’s origins, its discovery, and the subsequent steps taken by Curve Finance and the broader DeFi community to address the security lapse.

What is Reentrancy?

On DeFi platforms, reentrancy attacks are malicious vulnerabilities in which a function is indirectly executed by itself before the initial execution is complete.

Such recursion may result in unwanted transactions that exploit smart contract flaws.

In the context of blockchain and Ethereum, in which Curve Finance operates, these flaws can cause significant financial damage due to the irreversible nature of transactions.

Reentrancy occurs when functions call other, untrusted contracts before resolving their effects (such as updating balances), allowing the external contract to re-enter the original function and causing logical disruptions.

For instance, this can lead to several withdrawals from the same deposit, depleting money that ought to be safeguarded.

Historical Context and Previous Incidents

The infamous DAO attack in 2016 was a landmark incident involving a reentrancy exploit, where an attacker drained around a third of the DAO’s funds by repeatedly recalling a function to withdraw Ether.

This event not only led to a significant financial loss but also prompted a hard fork in Ethereum, highlighting the critical importance of secure smart contract design.

Since then, the Ethereum community has prioritized enhancing security measures, yet reentrancy remains a daunting challenge. Various other incidents across the DeFi landscape have echoed the persistent vulnerability to such attacks, underscoring an ongoing battle against exploits in complex smart contract interactions.

This context sets the stage for understanding the recent incident with Curve Finance, in which similar vulnerabilities were exploited due to outdated compiler versions in their smart contracts.

To protect against changing threats in the DeFi sector, the incident serves as a clear reminder of the need for strict security protocols as well as ongoing updates and audits of the smart contract codebase.

Discovery and Response to the Curve Finance Vulnerability

The reentrancy vulnerability in Curve Finance was identified during a routine security audit by an independent developer who was examining the code for potential flaws.

Initial Discovery of the Bug

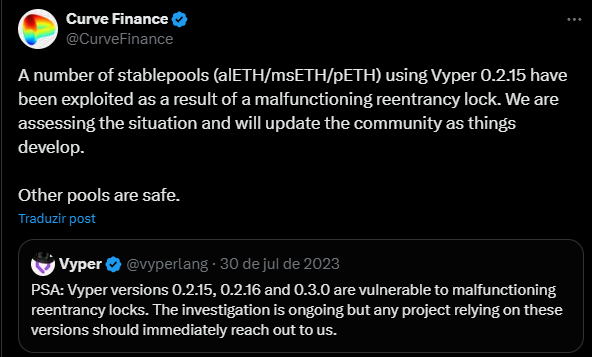

The vulnerability stemmed from the use of outdated versions of the Vyper compiler, versions 0.2.15, 0.2.16, and 0.3.0, which failed to implement effective reentrancy guards.

This oversight left certain smart contracts open to exploitation, particularly those involving transactions linked to native ETH or tokens adhering to the ERC-777 standard.

Curve Finance and Vyper posted on the social platform X stating:

Technical Analysis of the Vulnerability

The specific flaw allowed attackers to manipulate the contract’s functions to withdraw funds repeatedly before the contract state could be updated to reflect each transaction.

This type of attack exploits the gap between the initiation of a contract call and the state update, a critical period during which the contract is vulnerable.

The Vyper programming language, known for its Python-like syntax and targeted at Ethereum’s virtual machine, was central to the issue.

The language’s updates had not adequately addressed the reentrancy guard, which should prevent multiple entries into vulnerable functions during a single transaction.

Curve Finance’s Immediate Actions

Upon discovery, Curve Finance swiftly responded by halting affected transactions and patching the vulnerability. They updated the compiler and adjusted the smart contracts to include enhanced security checks.

Additionally, the platform launched a white-hat program, encouraging ethical hackers to find and report vulnerabilities in return for bounties. This initiative not only helped fix the immediate issue but also bolstered the platform’s defenses against future attacks.

The response was part of a broader effort to reinforce trust and security within the Curve Finance ecosystem and the DeFi community at large.

Implications for the DeFi Ecosystem

The revelation of the reentrancy vulnerability in Curve Finance triggered a swift and coordinated response across the DeFi community. Various platforms initiated reviews of their protocols, especially those written in Vyper or similar languages prone to similar issues.

Immediate Community Reaction and Long-term Impact on DeFi Security

The incident fueled a widespread reassessment of security strategies within the DeFi space, with many platforms accelerating their security audits and patch implementations to fortify their systems against similar vulnerabilities.

The incident involving Curve Finance is an important reminder of the security risks that are part and parcel of the DeFi industry.

It emphasized the need for continuous improvement in smart contract design and validation techniques. As a result, there has been a significant increase in the adoption of more rigorous testing environments and security frameworks, which are critical for maintaining trust and stability in DeFi.

The incident has also underscored the necessity of community vigilance and the role of white-hat hackers in detecting and mitigating possible dangers before they can cause widespread damage.

Strengthening DeFi Security

To mitigate risks such as reentrancy attacks, developers must implement best practices in smart contract design, such as the checks-effects-interactions pattern, which organizes code to make unexpected reentries difficult.

Regular security audits and the integration of security tools that automate the detection of common vulnerabilities are crucial.

Developers are also encouraged to use updated and secure compilers to avoid introducing flaws that can be exploited.

Strategic Recommendations for DeFi Platforms

DeFi platforms should establish robust security frameworks that include continuous monitoring and rapid response systems.

Encouraging a culture of security within the development community and incentivizing the disclosure of potential vulnerabilities through bug bounty programs are effective strategies.

These efforts enhance not only the security of individual platforms but also contribute to the resilience and trustworthiness of the entire DeFi ecosystem.

Enhancing DeFi Security Post-Curve Finance Reentrancy Attack

The reentrancy vulnerability exposed in Curve Finance served as a critical wake-up call for the DeFi sector.

It underscored the perpetual need for vigilance, robust security protocols, and the proactive involvement of the community in safeguarding digital assets.

The occurrence sparked a round of security reassessments across several DeFi platforms, emphasizing the significance of ongoing development in smart contract design and implementation.

DeFi platforms must adopt secure coding practices, prioritize thorough and frequent audits, and keep up with the most recent advancements in smart contract security if they are to improve security measures.

The implementation of automated vulnerability detection tools and the promotion of a security-first approach among developers will be pivotal in averting such incidents.

Final thoughts and FAQ:

The incident highlights the effectiveness of community-driven security enhancements, such as bug bounty programs and white-hat initiatives, which not only help in identifying vulnerabilities but also foster a collaborative approach to security.

As DeFi continues to evolve, the commitment to implementing these best practices will be pivotal in shaping its resilience and ensuring the trust of users and investors in this dynamic and promising sector of the financial industry.

- What is a reentrancy attack in DeFi?

When a malicious actor takes advantage of a smart contract vulnerability that allows a function to be called more than once before its initial invocation is finished, it can result in unauthorized actions like multiple withdrawals. This type of attack is known as a reentrancy attack in the context of decentralized finance (DeFi). - How was the Curve Finance reentrancy vulnerability discovered?

When an independent developer conducted a routine audit, they discovered the Curve Finance reentrancy vulnerability. Outdated versions of the Vyper compiler did not properly implement reentrancy guards, leaving smart contracts vulnerable to attacks. - What steps did Curve Finance take in response to the vulnerability?

The affected smart contracts were updated, security measures were strengthened, and Curve Finance introduced a bug bounty program to incentivize the community to report possible security flaws. Curve Finance swiftly addressed the vulnerability. - What are the best practices to prevent reentrancy attacks in DeFi?

Best practices include using the checks-effects-interactions pattern in smart contract development, conducting regular and comprehensive security audits, and employing up-to-date and secure compilers to minimize risks. - What impact did the reentrancy exploit have on the DeFi ecosystem?

The exploit led to significant financial losses and prompted a broader reassessment of security protocols across multiple DeFi platforms. It highlighted the need for continuous improvement in security practices and community engagement in the security process.

Financial

Solana Surge: Institutional and Jupiter DEX Wins

Published

3 months agoon

April 24, 2024By

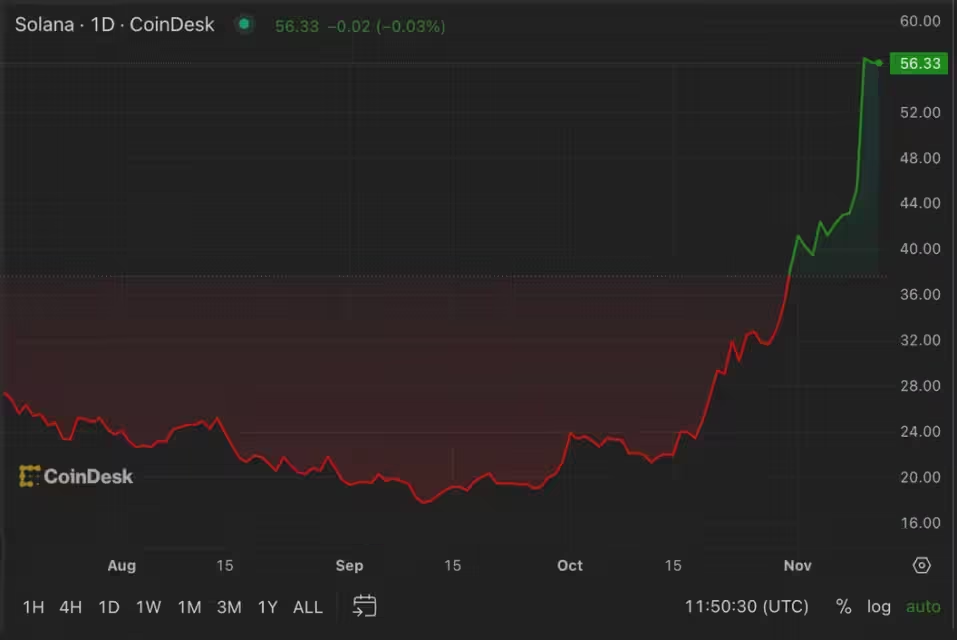

The Solana surge is evident as it has recently seen a significant boost in market presence and price. This uptick is primarily driven by growing institutional investments and the successful performance of its decentralized exchange, Jupiter.

The focus will be on the factors driving this growth and the expectations surrounding its price potentially exceeding $200.

Solana Surge: Institutional Investments and DEX Prowess

Solana has garnered significant attention from institutional investors, with substantial inflows marking its ascent as a preferred asset in the crypto space. Particularly, investment products related to Solana have attracted remarkable interest, with investment flows increasing notably over recent months.

Grayscale Solana Trust, for instance, trades at a significant premium, indicating high demand among institutional players. Additionally, the launch of a dedicated Solana fund by major financial players like Galaxy and Bloomberg further underscores the institutional commitment to Solana.

Now, let us dig deeper into how these factors contribute to Solana’s market dynamics and, at the same time, what future trends we can expect as Solana evolves in the competitive cryptocurrency landscape.

Yesterday Grayscale’s $GSOL product traded at a 869% premium to the underlying $SOL https://t.co/pPQuEdakbY pic.twitter.com/Mk2w0dW2uI

— BitMEX Research (@BitMEXResearch) November 11, 2023

Analyzing the Impact of Institutional Investments on Solana

Solana (DEX), Jupiter exchange, plays a critical role the ecosystem, contributing to the overall trading volume and enhancing token utility in the crypto market.

The combination of robust institutional support and success-driven decentralized finance (DeFi) applications establishes Solana as a prominent player in the cryptocurrency realm.

Solana Surge: Key Institutional Players and Their Influence

Significant investment flows into various blockchain-focused funds and trusts have demonstrated institutional interest in Solana.

Grayscale Solana Trust, in particular, has seen a staggering 869% premium, indicating strong demand among institutional investors.

Also, new funds facilitated by major financial players like Galaxy and Bloomberg have further boosted Solana’s visibility and attractiveness in the institutional arena.

Investment Trends and Future Outlook

The consistent inflows into Solana-related investment products underscore a growing trend of institutional confidence.

With Solana leading altcoin investments and capturing significant portions of the institutional inflows, it is positioned as a top contender in the crypto market for long-term growth.

The increasing openness of institutional investors to altcoins, especially Solana, suggests a broader acceptance of its underlying technology and potential for high returns.

The Role of Institutional Confidence in Crypto Valuations

Institutional investments are not just about capital inflows; they also bring credibility and stability to the market.

The enhanced institutional confidence has led to reduced volatility and a steadier price trajectory.

The institution’s requirement to retain underlying assets to hedge against their positions in derivatives markets, such as futures and options, is primarily to blame for this shift.

Comparisons with Other Cryptocurrencies

While Bitcoin and Ethereum have traditionally dominated institutional attention, Solana’s unique offerings, like lower transaction fees and faster speeds, have carved out a significant niche for them.

Its capability to handle complex decentralized applications efficiently makes it an attractive alternative to Ethereum for some investors.

Jupiter DEX: A Catalyst for Solana Price Surge

How Jupiter is Redefining DEX Operations

Jupiter DEX, has significantly impacted its ecosystem by boosting its transaction volumes and liquidity.

This DEX facilitates a large volume of transactions and enhances the user experience with its innovative features and high transaction speeds, which are crucial for DeFi operations.

Technological Innovations and User Experience

Jupiter’s success can be attributed to its seamless integration within the Solana ecosystem, providing users with efficient and cost-effective trading solutions.

Its ability to handle large volumes without compromising on speed or security makes it a standout platform, fostering a more robust DeFi environment on Solana.

Jupiter Market Performance and Volume Analysis

Jupiter has rapidly climbed the ranks to become one of the top players by volume among decentralized exchanges.

In addition to demonstrating its operational success, this surge in activity shows how the cryptocurrency community is becoming more engaged and trusting of Solana DeFi capabilities.

Metrics and Growth Indicators

The increase in trading volumes and user engagement on Jupiter underscores the DEX vital role in propelling Solana market cap and investor interest.

As Jupiter continues to expand its offerings and improve its technology, it is expected to play a central role in shaping the future trajectory of Solana in the crypto market.

Future Projections: Can Solana Exceed $200 again?

Market Sentiment and Technical Analysis on Solana

The bullish sentiment surrounding Solana is palpable, with experts and analysts citing its robust technological framework and growing institutional interest as key drivers.

Technical analysis of Solana price trends suggests a potential breakout above the $200 mark, especially considering its recent performance and increased market participation.

The growing volume of DEXs like Jupiter and persistent institutional investments, which offer a solid foundation for price stability and growth, support this theory.

Expert Predictions and Chart Trends

Financial analysts and crypto experts have noted token resilience and innovative capabilities, positioning it as a strong contender in the cryptocurrency market.

Chart trends show a consistent upward trajectory in trading volumes and market capitalization, hinting at a possible surge past the $200 threshold if current market conditions persist.

The Role of External Market Factors

External factors such as global economic conditions, regulatory changes, and technological advancements play a significant role in the cryptocurrency market.

Solana’s flexibility in responding to these changes and its ability to take advantage of emerging technology trends may play a role in its potential to surpass $200.

Regulatory Environment and Competitor Movements

The regulatory landscape for cryptocurrencies is an important factor. Positive developments, such as the approval of crypto products and the institutionalization of crypto investments, can benefit Solana.

Conversely, stringent regulations could pose challenges. Additionally, movements by competitors, especially Ethereum and its ongoing upgrades, could impact Solana’s market positioning and price dynamics.

Additional Thoughts

Jupiter, Solana’s decentralized exchange, has been a huge success and has contributed significantly to the company’s market surge.

The combined effect of these factors not only enhances Solana’s market credibility but also boosts its price stability and growth potential.

With expectations high and market sentiment bullish, Solana is poised to potentially exceed the $200 mark, contingent on sustaining its current momentum and navigating the broader external factors effectively.

FAQs on Solana Intitutional Investments and DEXs

- What are the main factors driving institutional investments into Solana?

Institutional investments in Solana are primarily driven by its technological advancements, high transaction speeds, and low fees, which offer significant efficiency for decentralized applications. Additionally, the successful performance of its decentralized exchange, Jupiter, and the increasing adoption of Solana in various crypto financial products have bolstered investor confidence. Recent launches of Solana investment funds by major entities like Galaxy and Bloomberg have further signaled strong institutional support. - How does Jupiter DEX compare with other top decentralized exchanges in terms of volume and technology?

Jupiter DEX stands out due to its integration with the Solana blockchain, known for high-speed transactions and low costs, which are critical in high-frequency trading environments typical of decentralized exchanges. It competes closely with other top DEXs by offering superior transaction speeds and lower fees, which have attracted a significant user base and increased its trading volumes, thus enhancing its market position compared to other DEX platforms. - What are the potential risks and rewards of investing in Solana at its current price point?

The rewards of investing in Solana include potential high returns due to its innovative technology, growing institutional interest, and robust ecosystem developments like its DeFi applications. However, risks involve market volatility, regulatory changes, and competition from other blockchains like Ethereum. Investors must also consider the technology’s nascent stage, which could be susceptible to technical challenges or security vulnerabilities (Blockworks). - How might regulatory changes impact Solana market position and price?

Regulatory developments can significantly impact Solana’s market position. Positive regulations that support the growth of cryptocurrencies and blockchain technology could enhance Solana’s adoption and increase its price. Conversely, stringent regulations or negative legal attention could restrict its growth or lead to decreased market confidence, adversely affecting its price. - Can Solana maintain its growth trajectory in the highly competitive DEX market?

Solana’s ability to maintain its growth trajectory in the competitive DEX market depends on its ongoing innovation, scalability, and ability to attract and retain users. Its current technological edge, particularly its high transaction speeds and low fees, provides a strong foundation. However, continuous improvements and adaptations to emerging market needs and technological trends will be crucial for maintaining its competitive advantage.

Introducing the Plena App: A Revolutionary Crypto Super App

How Bitcoin Lotteries Work and Differ from Conventional Lotteries

Introducing Grok-1.5V: Revolutionizing Multimodal AI

Gam3: Revolutionizing Blockchain Gaming with Layer 3 Technology on Arbitrum

Ethora: The Degen Binary Options Trading Platform powered by AI, on Base Network

WEMIX Unveils Groundbreaking Updates for a Sustainable Blockchain Gaming Future

Cardalonia Aiming To Become The Biggest Metaverse Project On Cardano

WOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

P2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

ETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

WOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

Project Quantum – Decentralised AAA Gaming

Trending

-

Crypto2 years ago

Crypto2 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Blockchain4 years ago

Blockchain4 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release4 years ago

Press Release4 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Press Release4 years ago

Press Release4 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain4 years ago

Blockchain4 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release3 years ago

Press Release3 years agoProject Quantum – Decentralised AAA Gaming

-

Press Release4 years ago

Press Release4 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain4 years ago

Blockchain4 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins