Financial

Solana Surge: Institutional and Jupiter DEX Wins

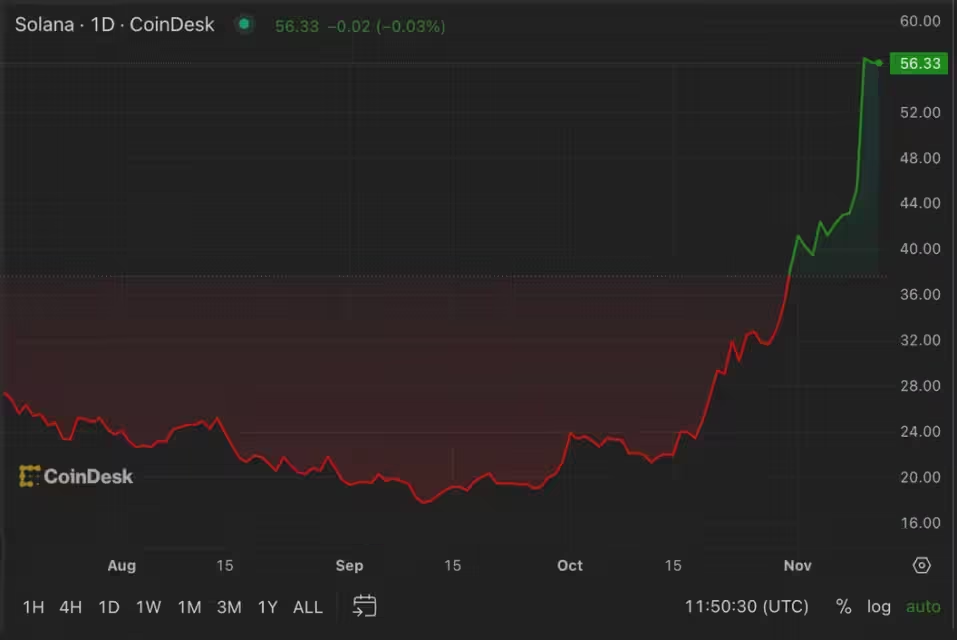

The Solana surge is evident as it has recently seen a significant boost in market presence and price. This uptick is primarily driven by growing institutional investments and the successful performance of its decentralized exchange, Jupiter.

The focus will be on the factors driving this growth and the expectations surrounding its price potentially exceeding $200.

Solana Surge: Institutional Investments and DEX Prowess

Solana has garnered significant attention from institutional investors, with substantial inflows marking its ascent as a preferred asset in the crypto space. Particularly, investment products related to Solana have attracted remarkable interest, with investment flows increasing notably over recent months.

Grayscale Solana Trust, for instance, trades at a significant premium, indicating high demand among institutional players. Additionally, the launch of a dedicated Solana fund by major financial players like Galaxy and Bloomberg further underscores the institutional commitment to Solana.

Now, let us dig deeper into how these factors contribute to Solana’s market dynamics and, at the same time, what future trends we can expect as Solana evolves in the competitive cryptocurrency landscape.

Analyzing the Impact of Institutional Investments on Solana

Solana (DEX), Jupiter exchange, plays a critical role the ecosystem, contributing to the overall trading volume and enhancing token utility in the crypto market.

The combination of robust institutional support and success-driven decentralized finance (DeFi) applications establishes Solana as a prominent player in the cryptocurrency realm.

Solana Surge: Key Institutional Players and Their Influence

Significant investment flows into various blockchain-focused funds and trusts have demonstrated institutional interest in Solana.

Grayscale Solana Trust, in particular, has seen a staggering 869% premium, indicating strong demand among institutional investors.

Also, new funds facilitated by major financial players like Galaxy and Bloomberg have further boosted Solana’s visibility and attractiveness in the institutional arena.

Investment Trends and Future Outlook

The consistent inflows into Solana-related investment products underscore a growing trend of institutional confidence.

With Solana leading altcoin investments and capturing significant portions of the institutional inflows, it is positioned as a top contender in the crypto market for long-term growth.

The increasing openness of institutional investors to altcoins, especially Solana, suggests a broader acceptance of its underlying technology and potential for high returns.

The Role of Institutional Confidence in Crypto Valuations

Institutional investments are not just about capital inflows; they also bring credibility and stability to the market.

The enhanced institutional confidence has led to reduced volatility and a steadier price trajectory.

The institution’s requirement to retain underlying assets to hedge against their positions in derivatives markets, such as futures and options, is primarily to blame for this shift.

Comparisons with Other Cryptocurrencies

While Bitcoin and Ethereum have traditionally dominated institutional attention, Solana’s unique offerings, like lower transaction fees and faster speeds, have carved out a significant niche for them.

Its capability to handle complex decentralized applications efficiently makes it an attractive alternative to Ethereum for some investors.

Jupiter DEX: A Catalyst for Solana Price Surge

How Jupiter is Redefining DEX Operations

Jupiter DEX, has significantly impacted its ecosystem by boosting its transaction volumes and liquidity.

This DEX facilitates a large volume of transactions and enhances the user experience with its innovative features and high transaction speeds, which are crucial for DeFi operations.

Technological Innovations and User Experience

Jupiter’s success can be attributed to its seamless integration within the Solana ecosystem, providing users with efficient and cost-effective trading solutions.

Its ability to handle large volumes without compromising on speed or security makes it a standout platform, fostering a more robust DeFi environment on Solana.

Jupiter Market Performance and Volume Analysis

Jupiter has rapidly climbed the ranks to become one of the top players by volume among decentralized exchanges.

In addition to demonstrating its operational success, this surge in activity shows how the cryptocurrency community is becoming more engaged and trusting of Solana DeFi capabilities.

Metrics and Growth Indicators

The increase in trading volumes and user engagement on Jupiter underscores the DEX vital role in propelling Solana market cap and investor interest.

As Jupiter continues to expand its offerings and improve its technology, it is expected to play a central role in shaping the future trajectory of Solana in the crypto market.

Future Projections: Can Solana Exceed $200 again?

Market Sentiment and Technical Analysis on Solana

The bullish sentiment surrounding Solana is palpable, with experts and analysts citing its robust technological framework and growing institutional interest as key drivers.

Technical analysis of Solana price trends suggests a potential breakout above the $200 mark, especially considering its recent performance and increased market participation.

The growing volume of DEXs like Jupiter and persistent institutional investments, which offer a solid foundation for price stability and growth, support this theory.

Expert Predictions and Chart Trends

Financial analysts and crypto experts have noted token resilience and innovative capabilities, positioning it as a strong contender in the cryptocurrency market.

Chart trends show a consistent upward trajectory in trading volumes and market capitalization, hinting at a possible surge past the $200 threshold if current market conditions persist.

The Role of External Market Factors

External factors such as global economic conditions, regulatory changes, and technological advancements play a significant role in the cryptocurrency market.

Solana’s flexibility in responding to these changes and its ability to take advantage of emerging technology trends may play a role in its potential to surpass $200.

Regulatory Environment and Competitor Movements

The regulatory landscape for cryptocurrencies is an important factor. Positive developments, such as the approval of crypto products and the institutionalization of crypto investments, can benefit Solana.

Conversely, stringent regulations could pose challenges. Additionally, movements by competitors, especially Ethereum and its ongoing upgrades, could impact Solana’s market positioning and price dynamics.

Additional Thoughts

Jupiter, Solana’s decentralized exchange, has been a huge success and has contributed significantly to the company’s market surge.

The combined effect of these factors not only enhances Solana’s market credibility but also boosts its price stability and growth potential.

With expectations high and market sentiment bullish, Solana is poised to potentially exceed the $200 mark, contingent on sustaining its current momentum and navigating the broader external factors effectively.

FAQs on Solana Intitutional Investments and DEXs

- What are the main factors driving institutional investments into Solana?

Institutional investments in Solana are primarily driven by its technological advancements, high transaction speeds, and low fees, which offer significant efficiency for decentralized applications. Additionally, the successful performance of its decentralized exchange, Jupiter, and the increasing adoption of Solana in various crypto financial products have bolstered investor confidence. Recent launches of Solana investment funds by major entities like Galaxy and Bloomberg have further signaled strong institutional support. - How does Jupiter DEX compare with other top decentralized exchanges in terms of volume and technology?

Jupiter DEX stands out due to its integration with the Solana blockchain, known for high-speed transactions and low costs, which are critical in high-frequency trading environments typical of decentralized exchanges. It competes closely with other top DEXs by offering superior transaction speeds and lower fees, which have attracted a significant user base and increased its trading volumes, thus enhancing its market position compared to other DEX platforms. - What are the potential risks and rewards of investing in Solana at its current price point?

The rewards of investing in Solana include potential high returns due to its innovative technology, growing institutional interest, and robust ecosystem developments like its DeFi applications. However, risks involve market volatility, regulatory changes, and competition from other blockchains like Ethereum. Investors must also consider the technology’s nascent stage, which could be susceptible to technical challenges or security vulnerabilities (Blockworks). - How might regulatory changes impact Solana market position and price?

Regulatory developments can significantly impact Solana’s market position. Positive regulations that support the growth of cryptocurrencies and blockchain technology could enhance Solana’s adoption and increase its price. Conversely, stringent regulations or negative legal attention could restrict its growth or lead to decreased market confidence, adversely affecting its price. - Can Solana maintain its growth trajectory in the highly competitive DEX market?

Solana’s ability to maintain its growth trajectory in the competitive DEX market depends on its ongoing innovation, scalability, and ability to attract and retain users. Its current technological edge, particularly its high transaction speeds and low fees, provides a strong foundation. However, continuous improvements and adaptations to emerging market needs and technological trends will be crucial for maintaining its competitive advantage.

Financial

BlockDAG’s GLOBAL LAUNCH Release Coming Soon: Is it the Best Crypto to Buy Now in July?

The third quarter of 2025 is bringing a clear turnaround in crypto sentiment. Many altcoins are beginning to show renewed strength, social discussions are increasing, and capital is flowing back into the market.

Amid this revival, BlockDAG (BDAG) continues to lead conversations as the best crypto to buy now in July. Having raised over $329 million and sold more than 23.6 billion BDAG coins, BlockDAG has secured its position firmly, with this month possibly being the final chance to enter at $0.0016 before its price sees a change.

Unlike other altcoins waiting for market momentum, BlockDAG is progressing strongly in its goals. Its entire ecosystem is already operating, covering testnet functions, active communities, mining options, and strong partnerships. People are rushing to buy BDAG while the price remains fixed at $0.0016 until the GLOBAL LAUNCH release on 11th August.

Why BlockDAG Tops July Rankings

BlockDAG is built as a unique Layer 1 blockchain combining Directed Acyclic Graph (DAG) scalability with Proof-of-Work security and decentralisation. This combination enables thousands of transactions per second with very low delays, setting it ahead of Bitcoin and Ethereum on performance.

However, it’s not just its speed that sets it apart. The actual turning point is BlockDAG’s full ecosystem, which is already live and expanding. Its features include:

- A running testnet for developers to deploy smart contracts and dApps

- A no-code dApp builder for quick launch of on-chain tools without coding

- The X1 Miner App is used by over 2 million people for gamified mobile mining rewards

- An expanding ASIC mining ecosystem with 18,000+ units sold

- Developer academy resources for growing technical talent

- Buyer Battles offering 150 million BDAG daily as rewards in app competitions

All these achievements highlight one truth: BlockDAG is not in preparation; it is fully operational. With the current price at $0.0016, it is widely considered a short window before mainstream listings push its value up further.

Strong Partnerships Prove Real-Use Expansion

BlockDAG gained attention this July by revealing two major US-based sponsorships. The project has secured deals, positioning it as a blockchain leader with broad user engagement opportunities.

These deals go beyond branding. They include fan tokens, NFTs, co-branded social media campaigns, and exclusive behind-the-scenes storytelling with key figures. For BlockDAG, these are powerful gateways bringing millions of people into Web3 easily.

Additionally, BlockDAG confirmed a huge US-based sponsorship deal is locked, only awaiting regulatory approval. Though details remain private, the expected scale is predicted to be one of crypto’s biggest. With billions of potential users from these partnerships, the timing is set perfectly.

$0.0016 Available Until August 11: What’s Next?

Right now, the crypto presale price remains fixed at $0.0016 until August 11. After this date, the offer will close, and new pricing will be rolled out. Whether someone is casually entering crypto or buying with larger funds, this remains one of the last chances to secure entry before its GLOBAL LAUNCH progresses further.

BlockDAG’s careful updates and compliance-focused communication show the team’s dedication to strong market standards. Even so, looking at similar events in crypto history, many expect huge changes in utility, access, and visibility to follow.

The presale is now among the largest ever in crypto, surpassing early launches of Filecoin, Tezos, and Polkadot. With over 200,000 BDAG holders to date, it reflects rising confidence and natural growth. Engagement across Telegram, Twitter, and community forums continues to rise, showing the increasing FOMO around its locked price and rollout.

Having raised over $329 million so far and with its goal set at $600 million, BlockDAG is shaping up to be one of this decade’s strongest Layer 1 projects.

Final Takeaway!

When choosing the best crypto to buy now in July, it’s no longer about hype alone but about genuine progress. BlockDAG is not just gathering pace; it is turning that into real growth, user onboarding, and fully live products.

With its $0.0016 price locked until August 11, many see this as the last major entry point before its next growth phase. Early buyers have already seen 2,660% growth in their funds since batch 1. With a $600 million target, 2 million+ X1 app users, 18,000 ASIC units sold, and its US-based sponsorships, BlockDAG is building infrastructure that most projects can only promise.

This is not just another quick listing. It is a complete working ecosystem that continues to expand and has already entered its GLOBAL LAUNCH release. July could well be the final window to secure BDAG before its next chapter unfolds.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Financial

BlockDAG’s 100M BDAG Airdrop Turns Heads as AAVE Price Chart Weakens & Aptos Price Target Slips

Crypto’s constant shake-ups keep even seasoned traders on edge. The AAVE price chart continues to swing as DeFi lending adapts to market shifts and regulatory moves, while the Aptos (APT) price target attracts fresh speculation thanks to its speed-focused Layer-1 upgrades. But as these familiar names test new highs and lows, BlockDAG (BDAG) is taking a bolder route that demands real buyer attention; its massive 100M BDAG Airdrop Campaign is now live.

Early users can claim a share of 100 million BDAG by completing simple quests, adding extra upside beyond its already impressive presale. With over $329 million raised, 23.6 billion coins, and nearly 18,300 miners sold, BlockDAG’s growing network and $0.0016 entry window until August 11 signal why it’s being called the best crypto right now. This comparison breaks down how AAVE price chart trends, the Aptos (APT) price target, and BlockDAG’s airdrop opportunity stack up.

AAVE Price Chart Trends Reveal Hidden Upside in DeFi Shakeups

AAVE remains one of the most recognised DeFi protocols, standing tall for its open-source liquidity market that allows users to lend and borrow crypto with variable or stable interest rates. Recent trends show that the AAVE price chart has seen significant swings, reflecting both market uncertainty and the community’s active governance decisions.

AAVE’s strengths lie in its flexibility, multi-chain expansion, and security measures, which have helped it maintain its standing as a top DeFi project. However, it faces challenges too. The DeFi space is fiercely competitive, and regulatory scrutiny on lending protocols has made some investors cautious. Still, with constant upgrades and a proactive approach to risk management, AAVE stays relevant for traders scanning the AAVE price chart for possible entry points in this fast-paced market.

Aptos Price Target Pushes Higher as Layer-1 Race Heats Up

Aptos (APT) keeps catching the eye of Layer-1 watchers as developers push its scalability and security benefits. Designed with the Move programming language and promising thousands of transactions per second, Aptos aims to solve long-standing blockchain bottlenecks. The current Aptos (APT) price target remains optimistic, especially as more partnerships and ecosystem tools roll out.

With a growing number of dApps and a strong developer community, Aptos holds its position as a future-ready network that prioritises speed and low fees. Yet, there are concerns about whether it can keep up with larger competitors like Ethereum or Solana, which already have deeply established communities. For now, the Aptos (APT) price target keeps climbing as more eyes look for new Layer-1 solutions that deliver real-world utility and next-level performance.

BlockDAG 100M BDAG Airdrop: A Big Win for Early Supporters

BlockDAG isn’t just another presale; it’s carving out an identity with aggressive network growth and real user incentives. One of BlockDAG’s most compelling moves right now is the 100M BDAG Airdrop Campaign, allowing early buyers to claim 100 million BDAG by completing four simple quests.

This campaign is designed to reward early supporters while building a broader community base. But the numbers behind BlockDAG speak even louder: it has already raised over $329 million in its presale, sold 23.6 billion coins, and 18,284 miners.

Though it’s currently in batch 29 at $0.0276, the BlockDAG opens a limited-time window, allowing buyers to secure BDAG at just $0.0016 until August 11, one of the lowest prices since its earliest batches, offering a potential 3,025% profit.

Together, the rare entry window and the 100M BDAG Airdrop are turning BlockDAG into one of the most watched presale projects this season. On the security front, BlockDAG has been Halborn and CertiK approved, strengthening confidence in its infrastructure and resilience against threats.

Combined with ongoing developments, an expanding mining community, and clear audit transparency, BlockDAG proves it’s more than just a presale. It’s a network that’s live, growing, and built on trust. For anyone eyeing the crypto market closely, this window is a rare chance to get in before momentum accelerates.

In Summary

AAVE’s proven DeFi model keeps it a magnet for traders tracking the AAVE price chart, while Aptos leverages its robust Layer-1 foundation and developer community to aim for a higher Aptos (APT) price target. Both projects showcase strong market positions and evolving roadmaps. Yet BlockDAG’s approach hits differently. Its presale dominance, the huge 100M BDAG Airdrop Campaign, deep community mining, and high-profile audits give it a real edge in scalability and trust.

Add in the current price window of $0.0016, and it’s clear why BlockDAG is being called the best crypto right now for buyers seeking strong upside potential. As always, research and timing are key, but with its track record and community focus, BlockDAG is shaping up to be one to watch closely this year.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Financial

BlockDAG GLOBAL LAUNCH Release Brings $0.0016 Unlock Deal Until August 11 While Bitcoin Solaris Targets $9 Phase 9

Bitcoin Solaris has caught people’s attention with its phase 9 sale at $9. So far, it has pulled in over $5 million and grown its holder base to more than 11,500. What adds an interesting angle is the Nova App, which allows mobile mining, plus the built-in on-chain casino that keeps traders engaged. The confirmed Bitcoin Solaris listing on LBank has made many hopeful, with a $20 launch price already forecast. For those chasing quick wins and stories that drive early interest, Bitcoin Solaris’ phase 9 looks attractive right now.

But compare that to what BlockDAG is doing, and the gap is obvious. BlockDAG presale has already raised over $326 million. Its tools are live, its roadmap is unfolding, and it’s not just hoping for a breakout. It’s focused on real delivery and staying power. From simple DApp kits to actual grants for devs, BlockDAG is rolling out the kind of ecosystem that most coins only talk about.

Bitcoin Solaris Gathers Heat, But Can It Keep It Going?

Bitcoin Solaris’ phase 9 has pulled plenty of eyes to its side. Over 4.2 million coins have sold so far, and its confirmed LBank listing keeps the spotlight on. Traders expect Bitcoin Solaris trading volume to get a strong boost once the $20 launch happens, giving more reason for people to jump in early.

The Nova App’s mobile mining plus the casino experience make it stand out. But there’s still a technical gap. There’s no live testnet yet, no solid dApp launch layer, and very little around an active ecosystem that builders can plug into. So while the Bitcoin Solaris phase 9 push feels promising now, it’s still uncertain if Bitcoin Solaris trading interest can last after its listing. It has to prove it’s more than a short-term play and turn that hype into a solid, lasting project.

BlockDAG Delivers the Infrastructure Bitcoin Solaris Still Lacks

BlockDAG is already showing real progress with 23.4B coins and 18,250 miners already sold. The X1 miner app has over 2 million users tapping away, generating up to 20 BDAG daily. This is real usage, not just a concept.

Its structure relies on DAG technology for fast and efficient transactions. Developers can already use low-code and no-code DApp tools to launch apps quickly. BlockDAG’s security is covered with thorough audits from both CertiK and Halborn

BlockDAG is planning for the long term, too. It’s driving developer engagement with hackathons, grants, and the BlockDAG Academy. Exchange listings are moving forward, and the community keeps growing.

As part of BlockDAG GLOBAL LAUNCH release, BDAG coins are now available at a lower price of $0.0016 until August 11. This brings back one of the lowest prices since batch 1, giving early buyers a shot at up to 3,025% profit when the final $0.05 launch price goes live.

While Bitcoin Solaris works to prove itself, BlockDAG is already running, scaling, and giving back real performance. It’s the difference between big talk and a real network you can use today.

Bitcoin Solaris or BlockDAG: What Really Stands the Test of Time?

If you want to see what separates Bitcoin Solaris from BlockDAG, you have to look deeper than today’s hype. Bitcoin Solaris phase 9 has sparked momentum at $9 with its LBank listing, an increase in trading volume, mobile mining, and its gamified casino. It’s getting strong attention because it fits the fast-move narrative that some traders enjoy.

BlockDAG, on the other hand, is not chasing headlines. It’s building layer by layer. Its $326 million raise fuels a working testnet, advanced DAG architecture, solid audits, and a mobile miner app already serving 2 million users. Developers have access to live tools now, not just promises.

In the end, Bitcoin Solaris might run on short-term energy. BlockDAG is setting itself up for the long game with real systems and an active, growing base. One is about quick moves; the other is about proven scale and staying power.

Final Thoughts

Bitcoin Solaris has created a spark in the market. Its phase 9 sale sits at $9, with a $20 launch on LBank around the corner. Traders expect Bitcoin Solaris trading volume to climb after the listing. For some, this could mean big moves in the short run.

But BlockDAG is in a different league. With $326 million presale, 23.4 billion coins sold, and a testnet already live, it’s doing what many projects only promise. The limited time entry price of $0.0016 until August 11 just sweetens the deal for those looking to get in before the final $0.05 price. It’s not just hype, it’s a working setup, a real community, and clear growth.

For anyone who wants more than just the next jump, BlockDAG stands out as the clear pick for true scale, real delivery, and lasting potential.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

-

Crypto3 years ago

Crypto3 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release4 years ago

Press Release4 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain5 years ago

Blockchain5 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins