Blockchain

Understanding Bitcoin Market Dominance: A Comprehensive Analysis

Published

1 month agoon

By

Bitcoin Market dominance has surged to a three-year high, sparking excitement in the cryptocurrency market.

This significant shift for Bitcoin (BTC), the undisputed king of crypto, raises questions about the future of altcoins and the overall direction of the crypto landscape.

Let’s dive into what this means and how investors might navigate this changing market dynamic.

Understanding Bitcoin Market Dominance

Bitcoin domination is the proportion of total cryptocurrency market capitalization owned by Bitcoin.

When Bitcoin’s dominance rises, it generally means that BTC is outperforming other cryptocurrencies, attracting increased investment.

A higher Bitcoin dominance percentage suggests that investors have an increased appetite for the established cryptocurrency market leader.

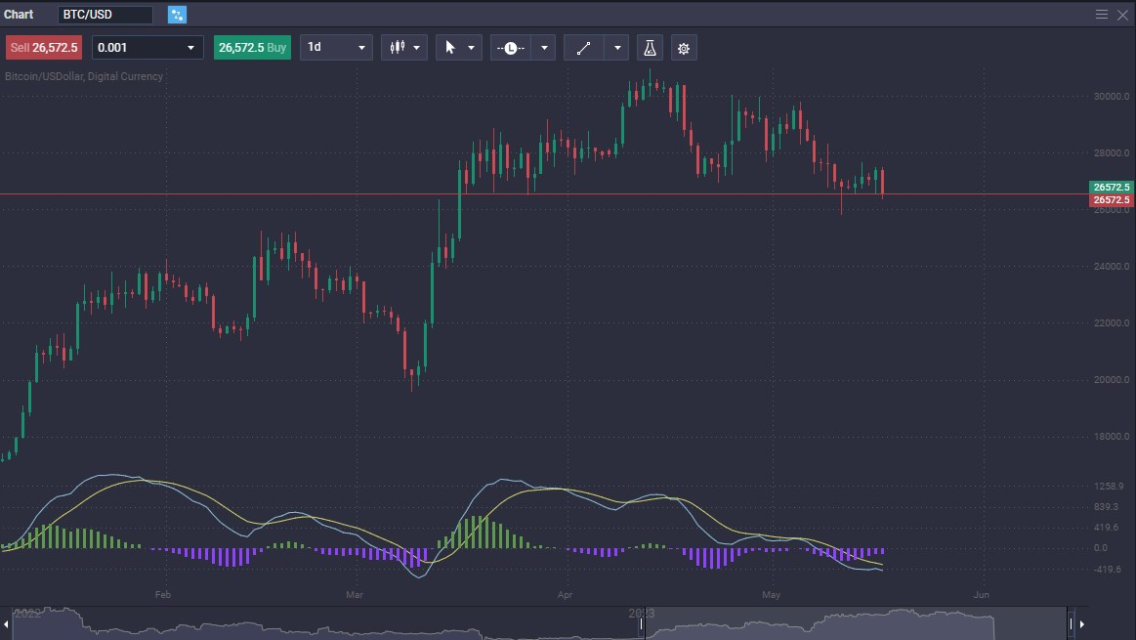

Recent Surge in Bitcoin Dominance

Several factors are contributing to the recent surge in Bitcoin’s dominance, including:

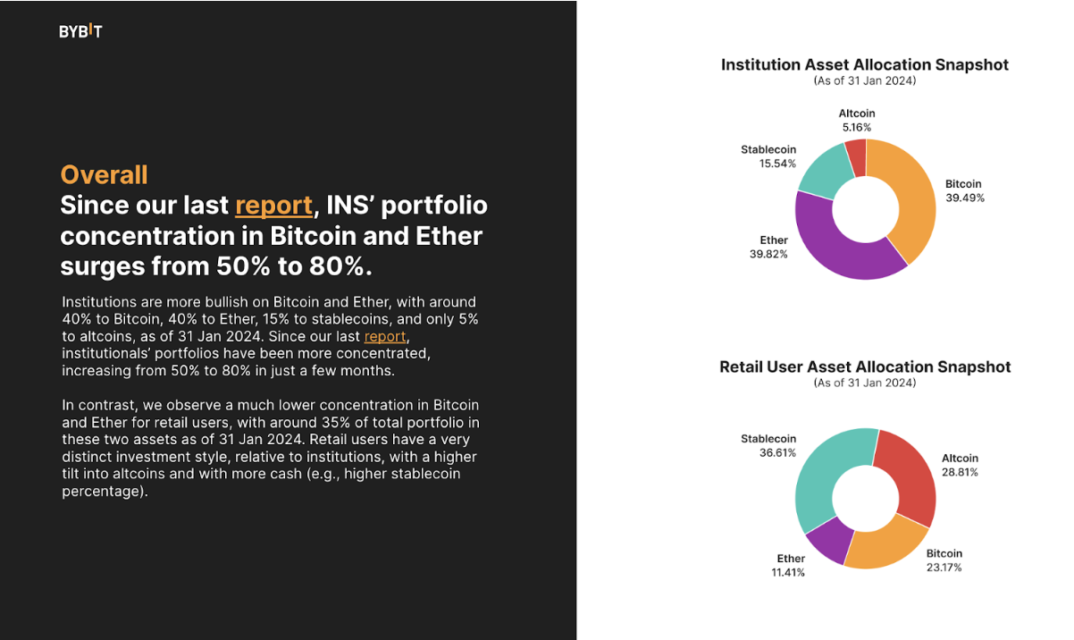

- Increased Institutional Interest: Larger investors often favor Bitcoin due to its established track record and higher perceived stability.

- Regulatory Concerns: Looming regulations within the crypto space may make investors flock towards Bitcoin as a perceived safer haven during uncertainty.

- Altcoin Volatility: Recent fluctuations in altcoin prices may have made the “tried and true” appeal of Bitcoin more enticing.

Market Analyst Opinions: Decoding the Dominance Surge

The recent surge in Bitcoin’s dominance has sparked a lively debate among market analysts, with a range of perspectives emerging:

1. Altcoin Exodus vs. Temporary Trend:

- Bullish on Bitcoin: Some analysts believe this signifies a wider shift away from altcoins. They argue that investors are seeking the perceived safety and stability of Bitcoin, especially with increased institutional interest and regulatory uncertainties. This could lead to a sustained period of Bitcoin dominance.

- Altcoin Resilience Camp: Others see this as a temporary trend. They believe strong altcoins with innovative projects and real-world applications will continue to attract investment in the long run. They point to past instances where altcoin markets have rebounded after periods of Bitcoin dominance.

2. Macroeconomic Factors:

- Flight to Safety: Certain analysts interpret the rise in Bitcoin dominance as a “flight to safety” response to broader economic concerns. Bitcoin, with its limited supply and established presence, might be seen as a hedge against inflation or market volatility.

- Impact of Global Events: Geopolitical tensions or global economic events could be influencing investor behavior, leading them to favor the perceived stability of Bitcoin.

3. The “Maturation” of Crypto:

- Institutional Evolution: Analysts who subscribe to this view suggest that the rise in Bitcoin dominance reflects the maturing crypto market. As institutional investors enter the space, they may favor the established reputation and higher liquidity of Bitcoin, compared to newer altcoins.

4. Divergent Views on Duration:

- Short-Term Dominance: Some analysts believe this is a short-term phenomenon, with altcoins regaining momentum as market dynamics shift.

- Long-Term Restructuring: Others predict a longer-term restructuring of the crypto market, with Bitcoin potentially consolidating its dominance as the primary store-of-value asset within the crypto ecosystem.

Potential Implications for Cryptocurrency Investors

The rise in Bitcoin dominance offers a crucial moment for investors to re-evaluate their crypto strategies.

A focus on diversification is wise, but short-term adjustments to balance a portfolio towards Bitcoin may be beneficial while its dominance holds.

However, it is critical to note that the long-term viability of correctly chosen altcoins, should not be underestimated.

Historical Context of Bitcoin Dominance: Key Takeaways

Bitcoin’s dominance has fluctuated throughout its history due to various factors:

- Early Years (2009-2013): Bitcoin initially held near-total dominance, but the emergence of altcoins began to erode this position.

- Altcoin Explosion (2017): The ICO boom of 2017 saw Bitcoin’s dominance dwindle as investors researched new firms, followed by a market downturn and a partial return to dominance.

- Cycles of Change (2018-Present): Bitcoin dominance has shifted in a cyclical pattern. Periods of Bitcoin outperformance are often followed by “alt seasons” where altcoins experience significant growth.

Important Lessons:

- Market Dynamics: Bitcoin’s dominance is not static; it reflects changing investor preferences and market trends.

- Cyclical Nature: The crypto market operates in cycles. Understanding fluctuations in Bitcoin dominance can aid in future predictions.

- Altcoin Potential: While Bitcoin has a strong track record, some altcoins offer innovation and growth potential, deserving attention from investors.

Studying the past patterns of Bitcoin dominance provides a clearer view of the current market and helps inform smart investment decisions.

Taking Advantage of Bitcoin’s Rise: Strategies for the Current Market

While the future of Bitcoin dominance is uncertain, the current surge offers opportunities for investors to capitalize on this shift. Here are some strategies to consider:

- Dollar-Cost Averaging (DCA) into Bitcoin: DCA involves investing a fixed amount into BTC at regular intervals smoothing out price fluctuations, and potentially reducing risk over time. With Bitcoin’s price on the rise, a consistent DCA strategy could allow for gradual accumulation as dominance remains high.

- Rebalancing Your Portfolio: If Bitcoin’s surge has caused its percentage in your portfolio to grow significantly, consider rebalancing. Sell a portion of the increased BTC holdings and consider redistributing the proceeds into your existing altcoin positions or new, carefully researched projects.

- Exploring Bitcoin-focused Investment Vehicles: The rise in Bitcoin dominance has led to increased access to specialized investment instruments. Consider exchange-traded funds (ETFs) or other products providing indirect exposure to Bitcoin, especially if regulations allow such investments in your region.

- Short-Term Trading: For experienced traders, the current volatility may present short-term opportunities to profit by ‘trading the range’ between Bitcoin and specific altcoins. Use technical analysis cautiously to spot potential entry and exit points.

Important Considerations:

- The Rise of DeFi: The Decentralized Finance (DeFi) sector, built primarily on the Ethereum network, holds immense potential. While Bitcoin dominance is high, strong DeFi projects could still offer significant growth opportunities.

- Staying Informed: The crypto market is highly dynamic. Stay updated on the latest news, regulatory developments, and technological innovations that could impact Bitcoin’s dominance and overall market movement.

Potential Risks of “All In” on Bitcoin

While Bitcoin’s dominance is high, it’s vital to recognize the inherent risks of any investment, even in the most established players. Practicing diversification and risk management will help in maintaining a balanced portfolio.

Is This a “FOMO” Moment? Separating Hype from Rational Investing Ahead of the Bitcoin Halving

The fear of missing out (FOMO) is a powerful emotion that can drive impulsive decisions in any market, especially the volatile world of cryptocurrency. As Bitcoin’s dominance climbs and its next halving approaches, it’s essential to ask whether this is a FOMO-fueled surge or a reflection of rational investor sentiment.

Signs of FOMO Intensified by the Halving:

- Media Frenzy: Sensationalized headlines about Bitcoin’s price gains and the historically positive price impacts of previous halving events may further fuel a sense of urgency in investors.

- Herd Mentality: When investors see others rushing into Bitcoin pre-halving, they may succumb to the fear of being left behind, leading to impulsive buying without thorough consideration.

- Focus Solely on Short-Term Gains: FOMO-driven investors may obsess over the potential for quick profits around the halving, neglecting Bitcoin’s suitability for long-term investment strategies and potentially overpaying for the asset.

Arguments Against Pure FOMO:

- Institutional Interest: Growing investment from large institutions suggests strategic interest in Bitcoin’s scarcity model enforced by the halving, which could support long-term price appreciation.

- Regulatory Environment: Potential regulations can drive investors towards Bitcoin’s relative stability and predictability – particularly important as the halving’s effect on supply becomes tangible.

- Altcoin Innovation: Strong development activity on altcoin projects indicates continued belief in blockchain technology, even while Bitcoin’s halving garners more attention.

Striking a Balance in the Shadow of the Halving

The upcoming Bitcoin halving likely intensifies FOMO-driven behavior. Here’s how investors can navigate this:

- Acknowledge the Power of FOMO: Realize that emotions, heavily influenced by the halving narrative, can impact judgment.

- Focus on Fundamentals: Analyze Bitcoin’s unique supply dynamics, the historical impact of halvings, and how BTC fits into your long-term portfolio.

- Avoid Impulsive Decisions: Don’t let short-term hype overshadow careful research and consideration of your own investment goals and risk tolerance.

Remember, while FOMO might propel short-term market movements around the halving, lasting success in the crypto space often requires research, a calculated approach, and patience, especially in these potentially volatile times.

Bitcoin’s increasing dominance marks a noteworthy change in the cryptocurrency landscape. While its future trajectory is uncertain, this shift underscores the ever-evolving nature of this market. A balanced approach that embraces both the potential of Bitcoin and the long-term promise of select altcoins is likely the most prudent strategy for investors in this dynamic environment.

Disclaimer: Remember, cryptocurrency markets are volatile. Invest only what you can afford to lose, and conduct your research before making any decisions.

You may like

Blockchain

Zeebu’s Remarkable Growth Surpasses $2 Billion in Total Settlement Volume

Published

2 days agoon

May 18, 2024

Zeebu has surpassed $2 billion in total settlement volume, reflecting its remarkable growth and strategic positioning within the blockchain-based payments landscape. This milestone exemplifies Zeebu’s rapid ascent and its crucial role in transforming the financial operations of telecom carriers globally.

In just a few months following the launch of Zeebu’s on-chain settlement platform, the company impressively managed to settle thousands of invoices, rapidly progressing from an initial $1 billion to now surpassing $2 billion in transactions. This growth underscores the platform’s scalability and the robust demand for its services.

Zeebu has become a pivotal player in blockchain-based settlements for the telecom sector, offering an instant payment and settlement solution that significantly reduces transaction times from days to minutes and cuts out intermediaries through the use of smart contract technology.

The core of Zeebu’s innovation is the ZBU Token, which not only facilitates global transactions but also enhances participant engagement through a loyalty and rewards system. This tokenization strategy effectively tackles common financial hurdles like high fees, delays in remittance, and issues with currency exchange, making it an ideal solution for cross-border settlements.

The platform’s usage has expanded substantially, with a growing number of telecom carriers and businesses leveraging Zeebu’s capabilities. As the platform evolves, Zeebu continues to attract new users who recognize its benefits, reinforcing its position as a trusted and leading payment platform in the market.

The data from Zeebu’s dashboard reveals that the overall transaction volume on the platform has already crossed over $2 Billion. At the time of writing, the number of invoices settled stands at 32k+, with total users around 465.

Some of the company’s achievements this year included two massive token burn events and participation in leading telecom and Web3 events across the globe. The first token burn occurred in February 2024, removing over 236 million ZBU tokens from circulation, accounting for more than 4.7% of the total supply.

The second burn took place in May 2024, removing an additional 239 million ZBU tokens, reinforcing Zeebu’s commitment to a sustainable token ecosystem through its Phoenix Protocol, which automates and governs the burn process to ensure a balanced token supply.

In addition to these token burns, Zeebu has actively expanded its presence by participating in and sponsoring major telecom and Web3 events across the Middle East, the Americas, and other regions. This strategic involvement has helped Zeebu establish a strong foothold in these markets and increase its brand visibility.

To further raise awareness about Zeebu, the company partnered with CoinMarketCap and CoinGecko to host several campaigns. These efforts, coupled with listings on prominent exchanges, have significantly enhanced Zeebu’s market presence and credibility.

Moreover, Zeebu released a major update to its Payment Service Provider (PSP) platform, introducing governance features that enable telecom merchants to transition from passive users to active participants in the ecosystem. This update enhances the overall user experience and fosters a more engaged community within the Zeebu platform.

Raj Brahmbhatt, Founder and CEO of Zeebu, added, “This milestone is a significant leap forward in our journey, clearly aligning with our broader strategic goals. As the telecom industry increasingly embraces innovative payment solutions such as blockchain, our extensive experience and proven ability to provide exceptional user experiences and customized financial solutions uniquely position us to meet the growing demands of this dynamic sector.”

Looking ahead, Zeebu is set to further enhance its services, expand its ecosystem, and transition towards a more decentralized and community-driven governance model. To learn more about Zeebu’s innovative platform, click here.

Blockchain

El Salvador Bitcoin Treasury Climbs to Over $350 Million

Published

5 days agoon

May 16, 2024By

El Salvador Bitcoin Treasury climbs over 350 Million as with this bold experiment in national economics and finance, positioning the country at the forefront of cryptocurrency adoption worldwide.

As of 2024, the valuation of El Salvador’s national Bitcoin treasury has impressively surpassed $350 million, reflecting both the growth in Bitcoin’s market value and the country’s aggressive acquisition strategy.

This milestone highlights El Salvador’s commitment to integrating Bitcoin into its economic infrastructure, with significant implications for its financial system and international standing.

Overview of Historical Context and Initial Investments in El Salvador’s Bitcoin Strategy

El Salvador officially adopted Bitcoin as legal tender in September 2021, under the administration of President Nayib Bukele.

The move was groundbreaking, making El Salvador the first country to integrate cryptocurrency into its legal and financial systems. Initially, the government purchased 400 Bitcoins and has since increased its holdings to 5,748.76 BTC.

The strategy aimed to leverage Bitcoin to boost economic growth, attract foreign investment, and increase financial inclusivity among its population.

However, the decision was met with domestic and international skepticism due to concerns about volatility and regulatory challenges.

Current Holdings and Value

As reported by Binance, El Salvador now holds a significant amount of Bitcoin, valued at over $350 million.

The government has established a transparent mechanism to monitor these holdings through a newly introduced website, which provides real-time data on the quantity and value of its Bitcoin assets.

This initiative is part of a broader effort to demonstrate transparency and build trust among citizens and international observers.

El Salvador Bitcoin Treasury Impact on El Salvador’s Economy

Financial Implications

The adoption of Bitcoin has had profound financial implications for El Salvador. It can potentially reduce transaction costs, bypass banking fees, and facilitate remittances, constituting a significant portion of the country’s GDP.

However, the volatility of Bitcoin poses risks to fiscal stability, as fluctuations in its value can dramatically affect the national budget and economic planning.

This aspect of El Salvador’s Bitcoin strategy has attracted considerable attention from global financial analysts and has been the subject of extensive coverage in leading financial news outlets, including Bloomberg.

Public and International Perception

Internationally, El Salvador’s move has been viewed with curiosity and caution.

Financial institutions like the IMF have warned of potential risks associated with adopting a cryptocurrency as legal tender, citing concerns over economic stability and transparency.

Domestically, the public’s response has been mixed, with some expressing pride in their country’s innovative approach. In contrast, others are apprehensive about the potential economic repercussions and the steep learning curve of using digital currencies.

Challenges and Criticisms

Economic Volatility

The intrinsic volatility of Bitcoin is a significant concern. Its price can experience substantial swings based on market dynamics, which can immediately impact the value of El Salvador’s national treasury.

Such fluctuations pose challenges for budgeting and financial forecasting, complicating economic management at a national level.

Political and Regulatory Challenges

El Salvador’s Bitcoin policy has also faced political and regulatory challenges.

Locally, the opposition has criticized the government for lacking a comprehensive strategy to educate the public and mitigate the risks associated with cryptocurrency transactions.

Internationally, the country faces scrutiny from regulatory bodies concerned about the implications for global financial stability and compliance with international financial regulations.

Future Prospects and Government Plans of El Salvador

Government Statements and Actions

In light of these challenges, Salvadoran officials have reiterated their commitment to the Bitcoin strategy, emphasizing potential long-term benefits such as increased financial inclusivity and economic innovation.

The government has announced plans to continue bolstering the infrastructure necessary to support Bitcoin and other digital currencies, aiming to make El Salvador a hub for cryptocurrency innovation and investment.

Potential Expansion and Technological Investments

El Salvador plans to expand its technological framework to better integrate Bitcoin into its economic and financial systems.

Investments in technology that will enable more straightforward and safer transactions are part of this, as they will increase the acceptance of Bitcoin in various economic sectors.

Conclusion

El Salvador’s venture into Bitcoin as a legal tender is an ongoing and evolving experiment, drawing global attention and debate.

This bold initiative’s outcome could influence future cryptocurrency adoption policies in El Salvador and worldwide.

It represents a crucial case study in the intersection of technology, finance, and national governance.

FAQs

What is the current value of El Salvador’s Bitcoin holdings?

El Salvador’s holdings in Bitcoin are valued at over $350 million, reflecting the nation’s substantial investment in this digital asset.

How has the adoption of Bitcoin affected El Salvador’s economy?

Bitcoin adoption has offered opportunities for financial innovation but has also introduced significant volatility and economic risk.

What are the risks of El Salvador’s strategy of holding Bitcoin?

The primary risks involve economic volatility, regulatory challenges, and potential political instability due to the controversial nature of the strategy.

How does the Salvadoran government plan to manage the volatility associated with Bitcoin?

The government is enhancing regulatory frameworks and investing in technological infrastructure to stabilize and secure Bitcoin transactions.

What future plans does El Salvador have regarding its cryptocurrency strategy?

El Salvador aims to expand its technological framework, improve regulatory policies, and maintain its position as a global leader in cryptocurrency adoption.

Deutsche Bank Blockchain Project Guardian is a groundbreaking initiative spearheaded by the Monetary Authority of Singapore (MAS). This project is set to explore the expansive potential of asset tokenization and decentralized finance (DeFi) within the financial sector.

This project is part of a larger effort by MAS to blend traditional financial practices with innovative blockchain technologies, aiming to enhance the efficiency, transparency, and security of financial transactions across various asset classes.

While MAS strongly discourages and seeks to restrict speculation in cryptocurrencies, we see much potential for value creation and efficiency gains in the digital asset ecosystem. This is why we are actively collaborating with the industry to foster a responsible and innovative digital asset ecosystem.

As we enter this new phase of Project Guardian, we look forward to collaborating with fellow policymakers and industry practitioners to jointly develop effective frameworks to guide the sound development of future financial networks.

Leong Sing Chiong, Deputy Managing Director (Markets and Development), MAS

Project Guardian, first introduced by MAS, serves as a collaborative platform that engages multiple top-tier global financial institutions, regulatory authorities, and technology companies.

The initiative focuses on experimenting with and understanding blockchain’s applicability in areas like asset management, fixed income, and foreign exchange.

For Deutsche Bank, this participation signifies a crucial step towards embracing digital transformation and preparing for future financial ecosystems dominated by digital assets and technologies.

Deutsche Bank’s involvement highlights its commitment to innovation and its strategic approach to leveraging new technologies to stay competitive in the rapidly evolving financial landscape.

By participating in Project Guardian, Deutsche Bank aims to explore the practical aspects of blockchain in reducing complexities in asset management, improving transaction speed, and lowering costs, which could revolutionize traditional banking operations and client services.

The bank’s collaboration in this project not only allows it to pilot cutting-edge technologies in a regulatory-compliant environment but also positions it as a forward-thinking leader eager to tap into the emerging market of tokenized assets.

The involvement is expected to yield insights into the scalability and robustness of blockchain applications in real-world financial settings, providing Deutsche Bank with a competitive edge in digital finance.

Deutsche Bank Blockchain Project Guardian Strategic Integration

Deutsche Bank is among the key financial institutions collaborating under the MAS-led Project Guardian, which aims to test the viability and impact of asset tokenization in modernizing financial practices.

This involvement is not merely participatory; Deutsche Bank is actively engaging in pilot projects that test tokenization across several financial sectors, including asset management, fixed income, and foreign exchange, which are crucial to understanding the practical applications and potential disruptions blockchain technology may bring to the financial industry.

Contributing to Project Guardian will bolster our efforts to help shape the new frontier of asset servicing, and strongly position us to contribute to industry progress, and not only anticipate our clients’ needs but exceed their expectations.

Strategic Importance for Deutsche Bank

The strategic importance of Deutsche Bank’s involvement in Project Guardian lies in its potential to redefine financial asset management and transaction processes.

By integrating blockchain technology, Deutsche Bank aims to achieve greater transaction efficiency, enhanced transparency, and improved security measures.

The project allows the bank to explore these technologies in a sandbox environment, mitigating risks while assessing the feasibility of wider implementation across its global operations.

Asset tokenization, as explored in Project Guardian, could significantly lower the barriers to entry for various investment opportunities, allowing for smaller investment denominations and broader investor participation.

The democratization of access to high-value asset markets, which have historically been inaccessible due to their high entry costs and intricate management demands, may result from this development, potentially broadening the clientele of Deutsche Bank.

Expected Benefits and Challenges to Deutsche Bank

The expected benefits for Deutsche Bank include operational efficiencies through streamlined processes and reduced reliance on intermediaries, which can lead to cost savings and faster transaction times.

Moreover, tokenization could enhance liquidity in traditionally illiquid asset classes, a significant advantage in asset and wealth management sectors.

However, the integration of blockchain technology also presents challenges, primarily regulatory and technical. Navigating the complex regulatory landscape, ensuring compliance with international financial regulations, and managing the technical aspects of blockchain integration are critical hurdles that Deutsche Bank will need to overcome.

As Project Guardian progresses, Deutsche Bank is poised to play a pivotal role in shaping the regulatory frameworks and industry standards for blockchain in financial services, contributing not only to its strategic objectives but also to the broader economic ecosystem’s evolution toward digital assets.

Deutsche Bank’s Strategic Journey in Blockchain and Asset Tokenization

Deutsche Bank’s involvement in Project Guardian marks a significant milestone in its digital transformation journey. By actively participating in this pioneering initiative led by the Monetary Authority of Singapore (MAS), Deutsche Bank is positioning itself at the forefront of the financial industry’s shift towards blockchain technology and asset tokenization.

This strategic move is indicative of the bank’s commitment to innovation and its vision to redefine the landscape of financial services.

Key Takeaways:

- Leadership in Innovation: Deutsche Bank’s participation in Project Guardian not only highlights its role as an innovator but also as a leader in shaping the future of financial technologies. The project allows Deutsche Bank to explore and potentially set new standards for the use of blockchain in financial services, ensuring it remains competitive in a rapidly evolving digital economy.

- Enhanced Client Services and Operational Efficiencies: Through blockchain and tokenization, Deutsche Bank can offer its clients more diverse and accessible investment opportunities while also achieving greater operational efficiency and security in its transactions. These advancements could lead to improved customer satisfaction and loyalty, which are crucial in the competitive banking sector.

- Navigating Challenges: The journey has its challenges, including regulatory hurdles, technical integration issues, and the need for substantial cultural shifts within the organization. How Deutsche Bank addresses these challenges will be critical to its success and could provide valuable insights into the resilience and adaptability of large financial institutions embracing new technologies.

Challenges Facing Deutsche Bank

- Regulatory Compliance and Uncertainty: As blockchain and tokenization are relatively new technologies in the financial sector, regulatory frameworks are still developing. Deutsche Bank must navigate these evolving regulations and ensure compliance across different jurisdictions, which can be complex and resource-intensive.

- Technical Integration and Security Concerns: Integrating blockchain technology with existing financial systems poses significant technical challenges. Ensuring the security and robustness of these systems against cyber threats is crucial, as blockchain networks can be susceptible to various security risks.

- Market and Technological Risks: The adoption of blockchain and tokenization involves exposure to market risks related to the volatility of digital assets and technological risks associated with the deployment of new technologies. Managing these risks effectively is essential to prevent potential financial losses and reputational damage.

- Cultural and Organizational Change: Implementing blockchain technology requires significant changes in organizational processes and culture. Deutsche Bank will need to invest in training and development to prepare its workforce for new operational paradigms associated with digital assets and tokenization.

Future Outlook:

As Project Guardian continues to evolve, Deutsche Bank’s ongoing involvement will likely influence not only its operations but also the broader financial industry’s approach to digital assets and blockchain technology. The insights gained from this initiative could lead to more robust, efficient, and inclusive financial systems globally.

Deutsche Bank’s strategic investment in blockchain technology through Project Guardian reflects its proactive approach to adopting next-generation technologies.

This involvement is set to not only transform its internal operations but also to potentially redefine global financial practices, making it a key player in the future of digital finance.

FAQs

1. What is Project Guardian?

Project Guardian is an initiative led by the Monetary Authority of Singapore (MAS) that explores the potential of blockchain technology and asset tokenization in the financial industry. It involves collaboration with global financial institutions to pilot innovative applications in areas such as asset management, fixed income, and foreign exchange.

2. Why is Deutsche Bank participating in Project Guardian?

Deutsche Bank is participating in Project Guardian to leverage blockchain technology to enhance the efficiency, transparency, and security of financial transactions. This involvement aligns with its strategic goals of digital transformation and innovation in financial services.

3. What benefits does blockchain technology offer to Deutsche Bank?

Blockchain technology offers Deutsche Bank multiple benefits, including improved operational efficiencies, enhanced liquidity for illiquid assets, expanded market access, and the ability to provide innovative financial products to a broader range of investors.

4. What are the challenges Deutsche Bank faces with blockchain adoption?

Deutsche Bank faces several challenges with blockchain adoption, including regulatory compliance, technical integration of blockchain with existing systems, security concerns, and the need for organizational adaptation to new technologies.

5. How could asset tokenization change the financial industry?

Asset tokenization could revolutionize the financial industry by making investments more accessible, increasing the liquidity of traditionally illiquid assets, and simplifying complex financial operations through automation and transparency.

6. What is the future outlook for Deutsche Bank’s blockchain initiatives?

The future outlook for Deutsche Bank’s blockchain initiatives is promising, with the potential to influence how financial services are delivered and consumed significantly. Continued participation in projects like Guardian could position Deutsche Bank as a leader in the adoption of digital finance technologies.

Zeebu’s Remarkable Growth Surpasses $2 Billion in Total Settlement Volume

The Scandal of Aiden Pleterski, Canada’s Crypto King

Top Altcoins in 2024 Will Be Dominating Investor Interest

Memecoin Madness: Eddie Seal Team Insults Investors and Returns Money from Presale

El Salvador Bitcoin Treasury Climbs to Over $350 Million

Deutsche Bank Blockchain Project Guardian

Cardalonia Aiming To Become The Biggest Metaverse Project On Cardano

WOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

P2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

ETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

WOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

Project Quantum – Decentralised AAA Gaming

Trending

-

Crypto2 years ago

Crypto2 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Blockchain4 years ago

Blockchain4 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release3 years ago

Press Release3 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Press Release3 years ago

Press Release3 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain4 years ago

Blockchain4 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release3 years ago

Press Release3 years agoProject Quantum – Decentralised AAA Gaming

-

Press Release3 years ago

Press Release3 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain4 years ago

Blockchain4 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins