Crypto

Which Are the 10 Hottest NFT Projects on the Market This Year? Here Is a Complete List

Published

2 years agoon

By

redfly.eth

Non-fungible tokens, or NFTs, are causing a paradigm shift in nearly every economic sector.

Whether it’s in economics or the arts, they will have an impact on almost every aspect of society. Here are some of the fascinating initiatives currently underway in this sector.

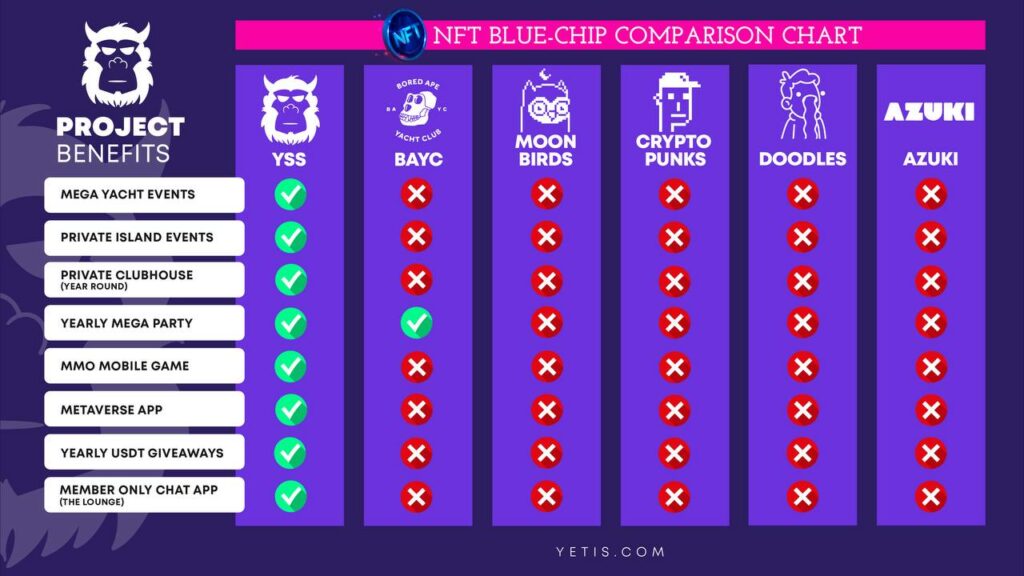

Yeti Secret Society

You must be a member of the Yeti Secret Society‘s investment community in order to join this project’s exclusive club. Yeti Secret Society sees exclusivity as a long-term strategy. Twitter and Discord are the team’s primary social media platforms.

Investors frequently consider the rarity of an NFT while conducting their due diligence. Even in the current market, Yeti Secret Society’s popularity is expected to increase because of its producers’ emphasis on distinctiveness and rarity.

Yeti Secret Society is no exception when it comes to the importance of clubs and communities in a crypto team’s purpose. All Yeti NFT owners will be able to utilize this feature and enjoy its perks.

A 600-person boat journey to Monaco will be included as part of the project’s expansion. Members of the team and celebrities alike are welcome to attend parties on the team’s island. This project will let you meet VIPs, as the founders announced.

The Yeti Secret Society and the MMO game production firm Sapphire Studios have teamed together. MMO game and Metaverse framework will be created as a result of this collaboration.

When it comes to web development, the people behind the Yeti Secret Society have extensive experience. Prior to the broader public, pre-mint users will be able to acquire these new NFTs.

Property’s VR

In the NFT and metaverse, you may find Property’s Virtual Reality, a revolutionary real estate collecting game.

The team’s goal is to develop something that has never been seen before, both within and outside of the metaverse. The team’s objective is to include gameplay elements from famous games throughout the world.

Unique real estate that is related to a specific cultural or economic system is depicted in these NFTs.

The team has been working hard to secure agreements with a variety of different companies and NFT groups ahead of their public launch.

There will be Crypto Baristas-themed coffee shops and carts thanks to the Property’s engagement with the initiative. Investors are keeping an eye on this project since it is part of the user-generated universe.

Invisible Friends

Five thousand animated figures were produced by Markus Magnusson for the Invisible Friends NFT collection. As part of a larger project, the Random Character Collective created this NFT.

It was revealed in an interview with Magnusson, the project’s designer, that this project was intended for those who are still youthful at heart but have a keen eye for art.

Strong demand and high prices were generated when this NFT project was originally offered due to the scarcity of supply. Invisible Friends was out of stock within a day of its release. Their prices rose to 12 ETH at the time of their introduction.

Prior to the mint’s official launch, Invisible Friends created a special golden NFT dubbed Golden Friend. Due to its scarcity, it sold at auction for $1.32 million in ETH. The RCC Charity Fund was the sole beneficiary of the Invisible Friends founders’ generous auction donations.

Token holders will be rewarded, according to the initiative’s creators. Invisible Friends is expected to develop in the future, according to the team’s plans.

LetsWalk

The animator DeeKay was born in Seoul, South Korea, but he now considers the Bay Area to be his permanent residence. The realm of art has always held a great deal of interest for him, going back as far as he can remember.

In addition to being famous for his one-of-a-kind artworks, he is the creator of the LetsWalk line of NFTs. A well-known NFT trader by the name of Cozomo De Medici just purchased his “Destiny” NFT for 225 ETH.

This NFT collection features a variety of “walks,” each of which is remarkable in its own right due to its individuality. DeeKay places the emphasis entirely on the work of art itself, as opposed to depending on “traits,” as is customary in NFTs.

LetsWalk allows spectators to form their own opinions about the artwork that they are watching rather than relying on a conventional ranking system, which was utilized in the majority of the previous NFT initiatives.

Azuki

Azuki presents itself as a project that is “skating” over the unclear boundaries that exist between the digital and real worlds as they continue to converge.

Participants in the Azuki project are granted access to “The Garden,” which is a collection of 10,000 NFTs. This perk comes as part of the whole package. Azuki has high expectations that the project would begin to blur the lines between the digital and real worlds if it is successful in building this “Garden.”

This initiative incorporates streetwear, NFT goods, and live events, as well as personalities and collaborations associated with Azuki.

Ingenious tricks created by Azuki, such as Bobu the Bean Farmer, have also been recognized for breaking new ground in their respective categories.

Bobu, the Bean Farmer, was tasked with the responsibility of chopping up the artwork into more manageable sections and designing a Bobu Token.

Using this token, all owners in the community will have the ability to administer the Bobu character that exists in the Azuki universe. In this one-of-a-kind web3 experiment, token holders will have a voice in determining what will happen to Bobu.

Moonbirds

On April 16, 2022, the ERC-721 Moonbirds NFTs were released into circulation on the Ethereum network. Moonbird NFTs, which are essentially utility-enabled profile photos, have a number of different components, all of which utilize rarity as their primary distinguishing characteristic.

Mooonbirds is one of the most well-known companies in the picture-for-proof startup space, and there is a good reason for this. Members of each Moonbird, which provides access to a private club, have access to additional privileges during the course of their membership.

Moonbirds have access to the Discord servers that are gated by NFTs. Information on forthcoming drops, community activities, and nesting will be available to those who have access to private Moonbirds channels.

Moonbird NFT holders who nest or lock their tokens will be eligible for further incentives for their efforts. Once the process of nesting has been finished, a Moonbird’s NFT will move on to the next part of its life cycle, which consists of several stages.

The owner of the NFT has the opportunity to win other rewards and incentives as well.

Women Rise

For the Women Rise initiative that Maliha Abidi worked on, the market saw 10,000 one-of-a-kind NFT artworks. Abidi is an artist that works in the realm of visual art and has garnered recognition on a global scale.

The series showcases a diverse group of women from all over the world. Each of them possesses a unique set of characteristics.

Making the world a better place is a mission that a diverse group of women from all walks of life is embracing. People in these fields include scientists, artists, campaigners, and computer programmers, among others.

Women Rise provides the opportunity for art lovers to acquire a one-of-a-kind piece of artwork while also expanding the NFT’s capacity for inclusion and diversity.

If you are a collector, you can take pleasure in any of these NFTs. Remember that some of them are significantly more valuable than others. More than 453 distinct kinds of hand-drawn features were utilized in the construction of the NFTs.

What motivates the makers of Women Rise is their firm conviction that the world needs more diversity, more accurate representation, and more art that is not only aesthetically pleasing but also honors women from all over the world.

Treeverse

The NFT collection “NFTrees” that was released by Loopify in February 2021 served as the inspiration for Treeverse. The massively multiplayer online game Treeverse was always intended to be a social experience.

The group has issued a total of 10,420 Founders’ Private Plot (FPP) NFTs, all of which were purchased during the first hour of trading.

Players may anticipate an action-packed MOBA-style game when the MMORPG makeover has been completed. Outside of the city, there is a wide variety of content for players to engage in, including the exploration of dungeons, the completion of quests, and the acquisition of experience points.

This MMORPG, like all others, places a significant emphasis on the players’ individual abilities. In order for players to advance in the game, they will need to enhance their talents in areas such as mining, crafting, and combat.

IdeoCo Labs, Animoca Brands, and Skyvision Capital each contributed $5 million to Treeverse’s round of fundraising totaling $25 million. After the company received its initial round of investment, investors are obviously keeping a close eye on this venture.

Doodles

Burnt Toast in Doodles is responsible for the generation of ten thousand non-fungible tokens (NFT), each of which is comprised of hundreds of distinct aesthetic characteristics. Doodles have been used to depict a diverse cast of characters, ranging from Skellys to cats, aliens to apes, and everything in between.

The artifacts owned by Doodles also contain hundreds of bizarre heads, outfits, and colors from the artist’s palette.

You are able to have your opinion heard on developing features, upcoming goods, and community-organized events when you use a Doodle. The architects and designers are working on the Doodles project, and they work together during every stage of the process.

The name of the bank account that the project uses to fund new community activities is “Doodlebank.”

Since they began their Space Doodles campaign, Doodles has experienced a great year, and it’s possible that this upward trajectory may go on into 2022 as well.

In addition to more than 200 audio-visual features, which together illustrate how well your Space Doodle is operating, numbers are also included with each Space Doodle.

The measurements of Space Doodles will be used by the project to construct new Doodles experiences that will surprise and amaze the whole NFT ecosystem.

Kibatsu Mecha

Artist Jerry Liu is responsible for the creation of Kibatsu Mecha, a collection and tale that features 2,222 individual figures that were hand-generated and are completely animated.

Any combination of seven individual characteristics can be given to a Kibatsu Mecha. Each and every one of the “very unusual” Kibatsu Mecha possesses one-of-a-kind qualities that are not present in any other NFT.

Megacity Kibatsu and the lands around it are populated by Kibatsu Mecha and the pilots who control them. Every day, fights take place in the Ataki Arena, which is known as one of the most exciting and risky combat arenas in the city.

People engage in a fight for a variety of reasons, including the pursuit of notoriety and wealth, the rush that comes with competition, and other factors. The individuals responsible for organizing this initiative will continue to disseminate information on it as time goes on.

You may like

Crypto

The Scandal of Aiden Pleterski, Canada’s Crypto King

Published

15 hours agoon

May 18, 2024By

Ryan Halley

Aiden Pleterski, once hailed as Canada’s ‘Crypto King,’ rose to fame with his successful cryptocurrency ventures. However, his reign was short-lived, as allegations of fraud and mismanagement led to his downfall.

In this article, we will explore Pleterski’s meteoric rise, the controversies surrounding his empire, and the consequences of his actions.

The Scandal of Aiden Pleterski, Canada’s Crypto King

Aiden Pleterski: The Emergence of a Crypto Prodigy

Early Life and Background of Pleterski

Aiden Pleterski’s journey into the world of cryptocurrency began in his early twenties. Born and raised in Ontario, Canada, Pleterski exhibited an early interest in finance and technology.

His fascination with the emerging field of cryptocurrency led him to invest in Bitcoin and other digital assets, marking the beginning of his career as a crypto entrepreneur.

Building the Crypto Empire

Pleterski’s strategic investments and sharp business acumen quickly paid off. By capitalizing on the volatility and growth of the cryptocurrency market, he amassed significant wealth.

Pleterski founded several companies, each aimed at leveraging the potential of blockchain technology and digital currencies. His ventures attracted substantial investments, earning him the moniker of Canada’s ‘Crypto King’.

The Pinnacle of Success

Aiden Pleterski’s rapid success in the cryptocurrency market did not go unnoticed.

Achievements and Recognition

Pleterski achieved significant milestones, including the successful launch of multiple crypto-related businesses and securing high-profile investments.

His creative handling of digital assets and his adeptness at navigating the unstable cryptocurrency market won him praise in the financial media, where he was regularly featured.

His businesses reportedly managed millions of dollars in assets, and he became a prominent figure in the Canadian cryptocurrency community. Pleterski’s achievements were often highlighted in interviews and articles, where he was portrayed as a trailblazer in the crypto world.

Lifestyle and Public Image

With his newfound wealth, Pleterski adopted a lavish lifestyle that further solidified his public image as a successful entrepreneur.

He was known for his extravagant spending on luxury cars, high-end real estate, and opulent parties. His social media profiles showcased this glamorous life, attracting a large following and boosting his reputation.

Pleterski’s public persona was meticulously crafted to exude confidence and success. This image not only appealed to potential investors but also positioned him as a role model for aspiring crypto enthusiasts.

However, this high-profile lifestyle would later come under scrutiny as allegations against him emerged.

The Downfall: Fraud Allegations and Legal Troubles

Aiden Pleterski’s promising career in cryptocurrency took a dramatic turn as allegations of fraud and financial mismanagement surfaced.

Investigations and the Arrest of the Crypto King

Investigations revealed that Pleterski had been operating what authorities described as a Ponzi scheme, using new investors’ money to pay returns to earlier investors instead of generating legitimate profits.

Pleterski struggled to keep up the appearance of large returns as the scheme fell apart due to a decline in cryptocurrency prices.

In late 2022, Pleterski was arrested on charges of fraud after it was discovered that he had taken in over $40 million from investors, of which less than two percent were actually invested in cryptocurrencies.

The majority of the funds were allegedly used to finance his luxurious lifestyle and personal expenses.

“I guess you could say greed took over, and I was taking very aggressive positions, and I was trying to make returns that obviously weren’t feasible or weren’t necessarily possible at the time, and it just caused more losses,”

Pleterski Lawyer, Norman Groot said to CNBC.

Pleterski was also kidnapped and beaten for his actions. One of the alleged kidnappers invested and lost $740,000.

On the same day that reporters learned five men are facing charges for allegedly kidnapping Aiden Pleterski last December, CBC Toronto obtained an edited video of him being visibly beaten.

Legal Proceedings and Charges

Following his arrest, Pleterski faced multiple legal challenges. He was charged with several counts of fraud and misrepresentation. Court documents detailed how Pleterski had misled investors by promising exorbitant returns and presenting falsified investment reports.

The bankruptcy proceedings exposed the extent of his fraudulent activities, with creditors seeking to recover millions of dollars.

During the legal proceedings, Pleterski admitted to making aggressive and unrealistic investments, driven by a combination of greed and the pressure to deliver on his promises.

His admission did little to mitigate the damage, as investors and authorities alike sought justice for the significant financial losses incurred.

Lessons Learned and the Impact on the Crypto Community

The fallout from Aiden Pleterski’s fraudulent activities had significant repercussions for his investors. Many individuals and entities who had entrusted Pleterski with their money found themselves facing substantial financial losses.

Repercussions for Investors

The total amount lost was estimated to exceed $25 million, with some investors losing their life savings.

Personal stories emerged of economic ruin and the emotional toll on those who were affected by Pleterski’s deception.

Investors whom the promise of high returns had drawn in were left to navigate the lengthy and complex process of bankruptcy proceedings in an attempt to recoup their funds. Unfortunately, the recovery of lost investments was limited, with much of the money already spent on Pleterski’s extravagant lifestyle.

Reflections on Crypto Regulations

Pleterski’s case has sparked a broader conversation about the need for stricter regulations in the cryptocurrency industry. The lack of oversight and regulatory frameworks allowed Pleterski to operate his scheme relatively unchecked, highlighting vulnerabilities in the current system.

Industry experts and regulators have called for enhanced measures to protect investors and prevent similar occurrences in the future.

Discussions have centred around implementing more rigorous vetting processes for crypto investment firms, increasing transparency requirements, and establishing clear guidelines for crypto asset management.

These changes are seen as essential steps to restore trust in the cryptocurrency market and safeguard against fraudulent activities.

FAQs

What were the key factors in Aiden Pleterski’s rise to prominence?

Aiden Pleterski rose to prominence due to his early investments in Bitcoin and other cryptocurrencies, which yielded significant returns. His strategic business moves and ventures in the crypto space further established his reputation as a successful entrepreneur. Pleterski’s high-profile lifestyle and media presence also played a crucial role in his rise to fame.

What led to the downfall of Aiden Pleterski?

Pleterski’s downfall began when investigations revealed that he had been operating a Ponzi scheme, using funds from new investors to pay returns to earlier investors. As cryptocurrency prices fell, the scheme collapsed, exposing his fraudulent activities. His arrest on multiple fraud charges marked the end of his career as a ‘Crypto King’.

How did Pleterski’s actions affect his investors?

Investors suffered significant financial losses, with many losing their life savings. The total amount lost was estimated to exceed $25 million. The bankruptcy proceedings have been lengthy, and recovery of the lost funds has been limited. Personal stories of financial and emotional hardship have highlighted the severe impact of Pleterski’s actions on his investors.

What legal charges were brought against Aiden Pleterski?

Aiden Pleterski was charged with multiple counts of fraud and misrepresentation. He was accused of running a Ponzi scheme and misleading investors about the returns and safety of their investments. The legal proceedings revealed extensive financial mismanagement and deceit, leading to significant legal consequences for Pleterski.

What can be learned from Pleterski’s story about cryptocurrency investments?

Pleterski’s story underscores the importance of conducting thorough due diligence before investing in cryptocurrency. Investors should be wary of promises of high returns with little risk and should verify the credentials and legitimacy of investment opportunities. The case also highlights the need for stricter regulations and oversight in the crypto industry to protect investors and prevent fraud.

Crypto

Top Altcoins in 2024 Will Be Dominating Investor Interest

Published

1 day agoon

May 17, 2024By

Ryan Halley

The cryptocurrency landscape will see top altcoins in 2024, leading the charge, evolving rapidly with groundbreaking technological advancements and an influx of sophisticated crypto investment strategies.

Amidst this dynamic backdrop, four altcoins have emerged as particularly compelling for investors: Solana (SOL), Toncoin (TON), Borroe Finance ($ROE), and Filecoin (FIL).

These cryptocurrencies have demonstrated resilience and remarkable growth potential, underpinned by robust technologies and significant market interest.

Solana (SOL): Leading the Charge with Technological Innovations

Overview of Solana

Solana’s architecture is built for speed and efficiency, allowing thousands of transactions per second while maintaining decentralization.

This capability is thanks to its innovative Proof of History (PoH) consensus and the underlying Proof of Stake (PoS) mechanism.

Market Performance and Future Prospects

As of mid-2024, Solana has been trading around $145, with analysts predicting a potential rise to $160 or higher.

A growing dApp ecosystem and a consistent increase in network transaction volume support this forecast.

The price target aligns with the 50-day Exponential Moving Average (EMA), suggesting a solid bullish momentum if it breaks this resistance level.

Toncoin (TON): Gaining Momentum with Market Recovery

Understanding Toncoin

Toncoin supports The Open Network, a decentralized internet platform that prioritizes user privacy and scalability.

It is an appealing option for developers and users seeking secure and efficient digital interactions.

Investment Surge and Price Predictions

Toncoin recently marked a price increase to $7.00, following a robust 17% gain amid a broader market recovery.

The market sentiment remains strongly positive, with future price estimates suggesting a climb to $8.00 as the network continues to expand its functionalities and user base.

Borrow Finance ($ROE): Emerging Leader in DeFi.

The Rise of Borroe Finance

This innovative DeFi platform addresses liquidity issues for Web3 businesses by offering a marketplace for trading invoices, royalties, and subscriptions.

Its approach has resonated with a wide range of investors, particularly those interested in the intersection of Finance and technology.

Future Growth and ROI Potential

Following its successful presale, which raised $4.5 million, Borroe Finance’s token ($ROE) is currently priced at around $0.50 in early trading sessions post-listing.

Market analysts are optimistic, forecasting a potential increase to $25 in the medium term, reflecting a possible 50x gain based on its innovative business model and growing adoption in the DeFi space.

Filecoin (FIL): Securing Data with Promising Returns

Filecoin at a Glance

Filecoin provides a decentralized storage solution that challenges traditional cloud services, offering improved security and lower costs.

Participants are encouraged to participate by receiving FIL tokens in exchange for licensing unused storage space.

Recovery Rally and Market Trajectory

Filecoin is trading around $5.66 but has shown signs of a promising rally, with projections indicating a rise to $6.50.

This anticipated growth is due to higher on-chain activity and a surge in demand for decentralized storage solutions.

The expected price movement represents a solid opportunity for investors looking for assets with recovery potential and long-term growth.

Investment Strategies for Top Altcoins in 2024

Analyzing Market Trends

Investors are encouraged to closely monitor adoption rates, technological updates, and regulatory developments, as these factors significantly influence altcoin prices and market dynamics.

Risk Management and Portfolio Diversification

A diversified investment portfolio with a mix of established and emerging altcoins can help manage risk and capitalize on different growth phases within the crypto sector.

Conclusion

The highlighted altcoins represent the forefront of the 2024 cryptocurrency bull run, driven by innovation, robust market performances, and strong investor interest.

As the digital finance landscape evolves, these cryptocurrencies stand out as key players poised to shape the industry’s future.

FAQs

What makes these altcoins stand out among other cryptocurrencies in 2024?

Their innovative technology, strong market adoption, and community support differentiate them from the many options available in the crypto market.

How can investors assess the potential of new altcoins entering the market?

Evaluating the technological foundation, development team, and strategic market positioning can provide valuable insights into an altcoin’s potential.

What are the key technological advancements driving the growth of these selected altcoins?

Advances in blockchain scalability, efficiency in transaction processing, and novel consensus mechanisms are pivotal to their success and attractiveness to investors.

Crypto

XRP Market Surge: The End of 7-Year Accumulation

Published

3 days agoon

May 15, 2024By

Ryan Halley

As the XRP market surge gains momentum, XRP’s prolonged seven-year accumulation phase reaches its finale, positioning the cryptocurrency community on the cusp of significant price movements.

This phase, marked by sustained buying activity at relatively low prices, sets the stage for what could be a dramatic shift in market dynamics.

In this analysis, we’ll delve into the factors that have characterised this period and discuss the possible outcomes for XRP’s market value as it transitions into a new phase.

Understanding XRP Market Surge and Accumulation Phases in Cryptocurrency

Accumulation phases in cryptocurrency are periods when XRP is predominantly bought by long-term holders at low prices, indicating undervaluation.

The Concept of Accumulation in Crypto Markets

Accumulation phases in the cryptocurrency world refer to extended periods during which XRP sets are bought predominantly by long-term holders, often at low prices, indicating a collective assessment of undervaluation.

Such phases are crucial for the eventual upward price movement, as they represent a buildup of value that can catalyze future market rallies.

XRP’s Accumulation Timeline: A Retrospective

XRP’s accumulation phase began shortly after its market entry, characterized by intermittent peaks and troughs that signified gradual interest from investors.

Throughout this period, significant XRP sentiments, such as regulatory scrutiny and marXRP side fluctuations, played a pivotal role in shaping investor perceptions and actions.

Analysis of XRP’s Market Behavior and Investor Sentiments

Technical indicators, such as increased trading volume, price stability at a higher base, and crossing the central moving average, signal the end of XRP’s long accumulation phase.

Key Indicators Used to Identify the End of Accumulation

Technical indicators such as increased trading volume, price stability at a higher base level, and crossing the central moving average pointed to the end of XRP long accumulation phase.

In a note at Binance Square, Mr_ghawsi have highlighted these patterns, suggesting a readiness for the next phase of price action.

Investor Sentiments Around XRP’s Long Accumulation

The length of XRP accumulation period has instilled a mixed sense of caution and anticipation among investors.

While some worry about the prolonged nature of this phase, indicating stagnation, others see it as a foXRP’sion for future solid performance, as detailed in analyses like those found on Bitcoinist.

Predictive Insights: What Comes After Accumulation for XRP?

Historical trends and data can provide valuable insights into what might occur after a prolonged accumulation phase.

A breakout is typically expected for cryptocurrencies similar to XRP that have undergone extended accumulations.

This breakout often results in significant price increases as market sentiment shifts and trading volumes rise. These trends suggest a bullish outlook for XRP as it transitions from accumulation.

Expert Predictions and Market Analysts’ Outlook

Drawing on data from sources like Binance and insights shared in various financial media, including CryptoDeFinance, market analysts have started to forecast a positive trajectory for XRP.

This optimism is based on several factors, including market maturity, investor interest, and evolving regulatory environments that might favor cryptocurrencies like XRP.

Potential Impact of Market and Regulatory Factors

Historical trends show that cryptocurrencies like XRP often see significant price increases following prolonged accumulation phases.

Influence of Global Crypto Market Trends on XRP

The global cryptocurrency market’s current trends play a significant role in influencing individual asset prices.

With increasing adoption and recognition of digital assets, coupled with substantial institutional investments, the broader market’s bullish trends are affecting XRP.

Comparisons to market movements of major players like Bitcoin and Ethereum indicate that ripple effects from their gains often benefit similar digital assets.

Regulatory Changes and Their Impact on XRP

Regulation remains a critical factor for all cryptocurrencies, including XRP.

Recent developments discussed on platforms like Binance indicate a possible easing of stringent regulations, leading to enhanced market participation and higher prices.

However, potential clampdowns or restrictive policies in major markets, like the USA, could pose risks, tempering overly optimistic forecasts.

Predictive Insights: What Comes After Accumulation for XRP?

The end of XRP’s long accumulation phase suggests potential volatility and significant price movements as market dynamics shift.

Here’s a detailed look at the price predictions and factors that could influence XRP’s market value in the coming years. Price Predictions for 2024 and Beyond

- Short-Term Predictions (2024):

- The XRP price forecast for 2024 indicates a bullish trajectory, with peak values of $1.019 anticipated by the year’s conclusion. This observation denotes a substantial increase in worth compared to its present cost, indicative of an expanding assurance of market efficacy after the accumulation phase.

- Mid-Term Predictions (2025 – 2027):

- By 2025, XRP is forecasted to continue its upward trajectory, potentially reaching $1.81 by the end of 2026 and $2.27 by early 2027. These predictions indicate a substantial percentage increase, driven by favorable market conditions and increased adoption.

- Long-Term Outlook (2030):

- Looking further ahead, XRP could see prices climbing to $3.62 by 2030. This surge is a significant increase compared to its current price, indicating growing confidence in its market performance beyond the accumulation phase.

Factors Influencing Future Price Movements

- Market Trends: XRP’s price positively correlates with several other major cryptocurrencies, suggesting that broader market trends will significantly influence its price movements. A bullish trend among significant market players like Bitcoin and Ethereum is XRP’s ability to impact XRP positively.

- Regulatory Environment: The future of cryptocurrency will depend heavily on regulatory decisions. Positive regulatory developments could lead to increased institutional adoption and higher prices. In contrast, unfavorable regulations might pose significant risks.

- Cryptocurrency’s ecological developments: Innovations and enhancements within the XRP Ledger and broader Ripple network could enhance XRP’s utility and appeal, potentially driving its price.

Conclusion

As XRP moves out of a long accumulation period, its future price potential appears robust, supported by optimistic expert analyses and favorable conditions.

However, investors should remain cautious and consider the impact of external factors, such as market trends and regulatory changes, on their investment decisions.

The end of an accumulation phase indicates a possible price increase due to higher demand and limited supply, signaling a potential bullish trend.

FAQs:

How reliable are historical patterns for predicting future price movements in crypto?

Historical patterns provide insights but are not always reliable due to the volatile and unpredictable nature of the cryptocurrency market.

What should investors watch for in the regulatory environment affecting XRP?

Investors should monitor legal developments and regulatory changes that could impact XRP, as these can significantly affect its price and market acceptance.

How can investors prepare for potential market shifts in XRP?

Investors should stay informed about market trends and regulatory news, diversify their investments, and consider using stop-loss orders to manage risks.

The Scandal of Aiden Pleterski, Canada’s Crypto King

Top Altcoins in 2024 Will Be Dominating Investor Interest

Memecoin Madness: Eddie Seal Team Insults Investors and Returns Money from Presale

El Salvador Bitcoin Treasury Climbs to Over $350 Million

Deutsche Bank Blockchain Project Guardian

XRP Market Surge: The End of 7-Year Accumulation

Cardalonia Aiming To Become The Biggest Metaverse Project On Cardano

WOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

P2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

ETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

WOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

Project Quantum – Decentralised AAA Gaming

Trending

-

Crypto2 years ago

Crypto2 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Blockchain4 years ago

Blockchain4 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release3 years ago

Press Release3 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Press Release3 years ago

Press Release3 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain4 years ago

Blockchain4 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release3 years ago

Press Release3 years agoProject Quantum – Decentralised AAA Gaming

-

Press Release3 years ago

Press Release3 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain4 years ago

Blockchain4 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins