Blockchain

Bitcoin Halving: Ultimate Guide For Investors And Crypto Enthusiasts

Published

2 months agoon

By

Bitcoin halving is a significant event within the cryptocurrency ecosystem, which has profound implications for Bitcoin’s economic framework and market dynamics.

If you’re interested in delving deeper into the concept of Bitcoin halving, this all-inclusive guide is perfect for you.

It delves into the intricate details of how Bitcoin halving functions, its significance for both miners and investors and its effect on the wider cryptocurrency ecosystem.

Furthermore, this guide explores the fundamental concepts that underpin Bitcoin halving, including why it is essential to control inflation and limit the total supply of Bitcoin which is great for crypto enthusiasts and a fantastic guide for Investors.

It delves into the relationship between Bitcoin halving events and market sentiment, examining historical trends and potential future ramifications.

Apart from Bitcoin halving, this guide also aims to provide readers with a comprehensive understanding of Bitcoin mining, which is the backbone of the cryptocurrency ecosystem.

Bitcoin mining is a decentralized mechanism that verifies transactions and creates new bitcoins. This section elucidates the intricate process of Bitcoin mining, including the technical nuances of mining algorithms, hardware requirements, and the competitive dynamics of the mining ecosystem.

By exploring the challenges and opportunities inherent in Bitcoin mining, this guide highlights its significance in facilitating secure and decentralized transactions within the digital realm.

Overall, this guide is an excellent resource for anyone looking to gain a deeper understanding of Bitcoin halving and mining.

Bitcoin Halving: A Catalyst for Market Dynamics and Investor

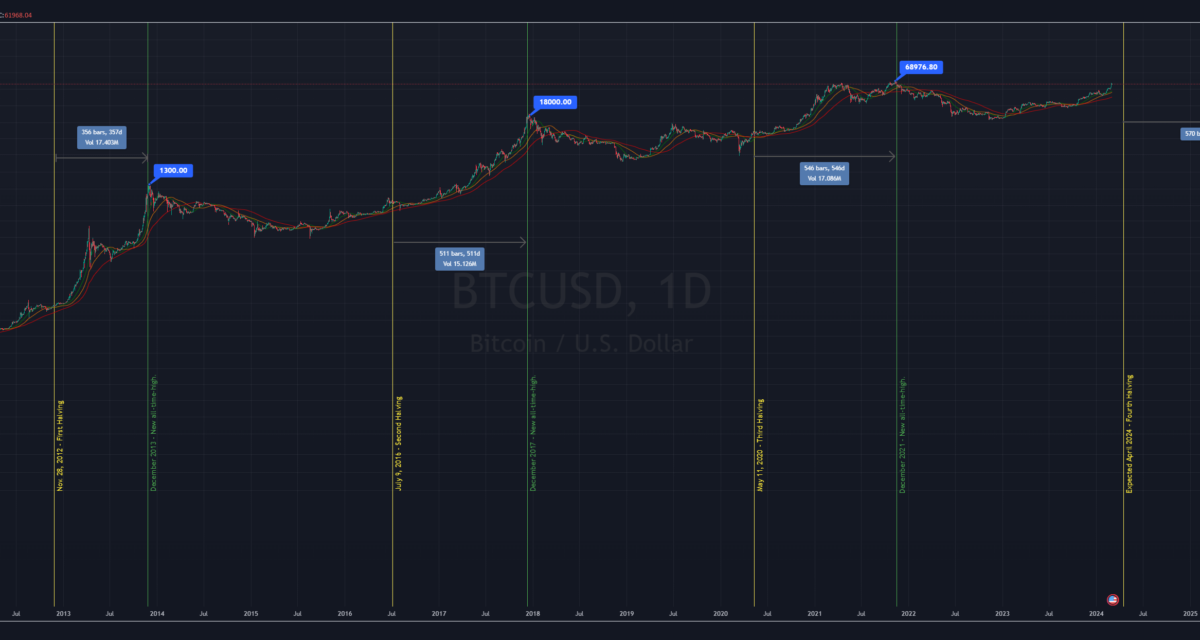

SentimentThe Bitcoin halving event on May 11, 2020, marked a pivotal moment in the cryptocurrency’s history, reducing the block reward from 12.5 bitcoins to 6.25 bitcoins and curbing the rate of new supply issuance.

This deflationary monetary policy showcased Bitcoin’s resilience amidst economic uncertainty, garnering attention from stakeholders worldwide.

Post-halving, Bitcoin witnessed heightened volatility and speculation as traders eagerly awaited its impact on price dynamics. The event reignited interest in Bitcoin as a store of value and inflation hedge, driving demand and subsequent price appreciation.

Media coverage and investor speculation surged, highlighting the halving’s influence on market sentiment and price trends.

The next halving of Bitcoin is expected in 2024, which will further the cryptocurrency’s goal of reaching a maximum supply of 21 million coins. This upcoming event holds significant importance for miners, investors, and the crypto community.

Market participants are already anticipating the upcoming bitcoin halving and its effects on supply dynamics, price volatility, and investor sentiment. Miners are reevaluating their operational strategies as they navigate the diminishing block rewards.

Factors like energy efficiency, hardware optimization, and operational scalability are crucial for maintaining profitability in a reduced reward environment. Investors are analyzing market dynamics and historical trends to anticipate price movements and assess Bitcoin’s deflationary model’s long-term value preservation.

The lead-up to the next halving sees intense discourse within the cryptocurrency community on supply dynamics, market psychology, and macroeconomic trends.

The countdown to the event serves as a focal point for speculation, anticipation, and reflection, underscoring the enduring impact of Bitcoin’s halving mechanism on shaping the digital asset landscape.

Miners’ Reward Mechanism: Incentivizing Network Security and Participation

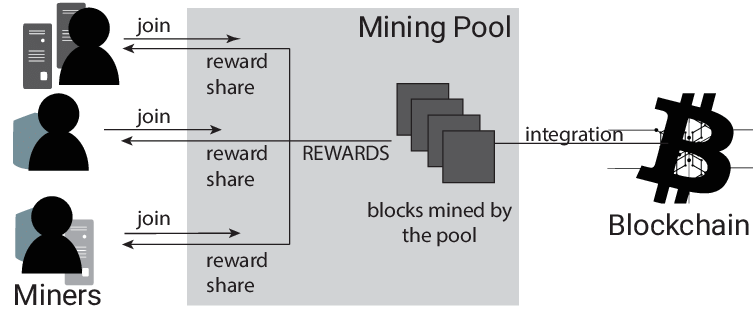

Central to the operation of the Bitcoin network is the reward mechanism designed to incentivize miners to dedicate computational resources towards securing and validating transactions.

This section elucidates the intricate interplay between miners, block rewards, and the foundational principles underpinning Bitcoin’s decentralized consensus protocol.

At the heart of the mining process lies the pursuit of block rewards, wherein miners compete to solve complex cryptographic puzzles and append new blocks to the blockchain. Initially set at 50 bitcoins per block upon Bitcoin’s inception in 2009, the block reward undergoes periodic reductions, halving approximately every four years by the protocol.

This reduction is a deliberate mechanism to constrain the issuance of new bitcoins, gradually tapering the inflation rate and imbuing the cryptocurrency with scarcity akin to precious metals like gold.

Beyond the allure of newly minted bitcoins, miners are further

incentivized by transaction fees, which constitute an additional source of revenue accrued from including transactions within the blocks they mine.

As the Bitcoin network matures and transaction volumes increase, transaction fees assume greater prominence in the overall reward structure, supplementing block rewards and serving as a tangible indicator of network activity and utility.

The close alignment of block rewards and transaction fees highlights the mutually beneficial association between miners and Bitcoin network users. Miners have a crucial responsibility in ensuring the smooth functioning of the Bitcoin network, and they receive rewards proportional to their computational efforts.

This reward mechanism fosters competition among miners, incentivizing them to invest in state-of-the-art hardware, optimize energy efficiency, and strategically position themselves within the mining ecosystem to maximize profitability.

The Bitcoin ecosystem maintains a consistent block production rate by adjusting mining difficulty, which balances mining rewards and network participation.

This adaptive mechanism ensures the resilience and robustness of the Bitcoin network, safeguarding against external threats and preserving the integrity of the decentralized ledger.

The miners’ reward mechanism embodies the foundational principles of decentralization, security, and economic incentivization that underpin the Bitcoin protocol.

Miners’ interests are aligned with those of network participants in this system, which results in a self-sustaining ecosystem.

As a result, individual incentives merge to maintain the collective integrity and security of the Bitcoin network.

The miners’ reward mechanism is a crucial element in the resilience and longevity of Bitcoin as it continues to develop and expand in the rapidly changing world of digital finance.

Relation to Bitcoin Price and Post-Halving Effects: Unraveling Market Dynamics and Economic Implications

The correlation between Bitcoin halving events and the fluctuations in the value of the cryptocurrency market is a topic that attracts a lot of attention and conjecture from analysts, investors, and enthusiasts alike.

Historically, Bitcoin halving events have served as catalysts for price volatility and speculative fervor, eliciting fervent anticipation and market speculation leading up to the event.

Investors often become bullish in anticipation of a reduction in block rewards as they perceive it as an omen of scarcity and upward price movement. As a result, Bitcoin’s price trajectory leading up to and after halving events typically displays marked fluctuations, characterized by spikes in buying activity and frenzied market speculation.

However, the relationship between Bitcoin halving events and price dynamics extends beyond mere speculative fervor, encompassing broader macroeconomic factors and market sentiment.

Bitcoin’s scarcity narrative, finite supply cap of 21 million coins, and its ability to act as a store of value protected against inflationary pressures and sovereign manipulation make it comparable to digital gold.

Halving events serve as a means to strengthen this story, highlighting Bitcoin’s position as a safeguard against the decline of fiat currency and political instability.

The cryptocurrency ecosystem goes through significant changes in mining dynamics, investor sentiment, and market psychology.

The decrease in block rewards compels miners to reassess their strategies, prompting the consolidation of inefficient mining operations.

The combination of this change and the decrease in the creation of new Bitcoins can cause a shortage in supply that drives the value of Bitcoin higher and sparks excitement in the market.

After the halving event, there is usually a rise in media attention, an increase in investor interest, and a surge in institutional investments in the cryptocurrency industry.

Several factors support the positive outlook on Bitcoin’s enduring value proposition.

As institutional adoption gains traction and retail participation proliferates, Bitcoin’s price trajectory may exhibit sustained upward momentum, underpinned by fundamental demand drivers and scarcity-induced price discovery mechanisms.

Historically, there has been a connection between Bitcoin halving events and bullish price surges. Nonetheless, the interplay between halving and price dynamics is complex and uncertain.

Several factors, including regulatory developments, technological advancements, macroeconomic trends, and market sentiment, can affect the outcome of future halvings.

The Impact of Bitcoin Halving Events Goes Beyond Mere Price Speculation

Bitcoin halving events, price dynamics, and post-halving effects actively demonstrate the intricate relationship between supply-side economics, market psychology, and broader macroeconomic forces that shape the trajectory of the cryptocurrency market.

These pivotal milestones in the evolution of the cryptocurrency ecosystem go beyond mere price speculation, impacting monetary policy, financial innovation, and the democratization of global finance.

Bitcoin’s ongoing redefinition of the digital economy extends beyond the cryptocurrency realm, with halving events signaling a paradigm shift in how we perceive and engage with money in the digital age.

You may like

Blockchain

Zeebu’s Remarkable Growth Surpasses $2 Billion in Total Settlement Volume

Published

2 days agoon

May 18, 2024

Zeebu has surpassed $2 billion in total settlement volume, reflecting its remarkable growth and strategic positioning within the blockchain-based payments landscape. This milestone exemplifies Zeebu’s rapid ascent and its crucial role in transforming the financial operations of telecom carriers globally.

In just a few months following the launch of Zeebu’s on-chain settlement platform, the company impressively managed to settle thousands of invoices, rapidly progressing from an initial $1 billion to now surpassing $2 billion in transactions. This growth underscores the platform’s scalability and the robust demand for its services.

Zeebu has become a pivotal player in blockchain-based settlements for the telecom sector, offering an instant payment and settlement solution that significantly reduces transaction times from days to minutes and cuts out intermediaries through the use of smart contract technology.

The core of Zeebu’s innovation is the ZBU Token, which not only facilitates global transactions but also enhances participant engagement through a loyalty and rewards system. This tokenization strategy effectively tackles common financial hurdles like high fees, delays in remittance, and issues with currency exchange, making it an ideal solution for cross-border settlements.

The platform’s usage has expanded substantially, with a growing number of telecom carriers and businesses leveraging Zeebu’s capabilities. As the platform evolves, Zeebu continues to attract new users who recognize its benefits, reinforcing its position as a trusted and leading payment platform in the market.

The data from Zeebu’s dashboard reveals that the overall transaction volume on the platform has already crossed over $2 Billion. At the time of writing, the number of invoices settled stands at 32k+, with total users around 465.

Some of the company’s achievements this year included two massive token burn events and participation in leading telecom and Web3 events across the globe. The first token burn occurred in February 2024, removing over 236 million ZBU tokens from circulation, accounting for more than 4.7% of the total supply.

The second burn took place in May 2024, removing an additional 239 million ZBU tokens, reinforcing Zeebu’s commitment to a sustainable token ecosystem through its Phoenix Protocol, which automates and governs the burn process to ensure a balanced token supply.

In addition to these token burns, Zeebu has actively expanded its presence by participating in and sponsoring major telecom and Web3 events across the Middle East, the Americas, and other regions. This strategic involvement has helped Zeebu establish a strong foothold in these markets and increase its brand visibility.

To further raise awareness about Zeebu, the company partnered with CoinMarketCap and CoinGecko to host several campaigns. These efforts, coupled with listings on prominent exchanges, have significantly enhanced Zeebu’s market presence and credibility.

Moreover, Zeebu released a major update to its Payment Service Provider (PSP) platform, introducing governance features that enable telecom merchants to transition from passive users to active participants in the ecosystem. This update enhances the overall user experience and fosters a more engaged community within the Zeebu platform.

Raj Brahmbhatt, Founder and CEO of Zeebu, added, “This milestone is a significant leap forward in our journey, clearly aligning with our broader strategic goals. As the telecom industry increasingly embraces innovative payment solutions such as blockchain, our extensive experience and proven ability to provide exceptional user experiences and customized financial solutions uniquely position us to meet the growing demands of this dynamic sector.”

Looking ahead, Zeebu is set to further enhance its services, expand its ecosystem, and transition towards a more decentralized and community-driven governance model. To learn more about Zeebu’s innovative platform, click here.

Blockchain

El Salvador Bitcoin Treasury Climbs to Over $350 Million

Published

4 days agoon

May 16, 2024By

El Salvador Bitcoin Treasury climbs over 350 Million as with this bold experiment in national economics and finance, positioning the country at the forefront of cryptocurrency adoption worldwide.

As of 2024, the valuation of El Salvador’s national Bitcoin treasury has impressively surpassed $350 million, reflecting both the growth in Bitcoin’s market value and the country’s aggressive acquisition strategy.

This milestone highlights El Salvador’s commitment to integrating Bitcoin into its economic infrastructure, with significant implications for its financial system and international standing.

Overview of Historical Context and Initial Investments in El Salvador’s Bitcoin Strategy

El Salvador officially adopted Bitcoin as legal tender in September 2021, under the administration of President Nayib Bukele.

The move was groundbreaking, making El Salvador the first country to integrate cryptocurrency into its legal and financial systems. Initially, the government purchased 400 Bitcoins and has since increased its holdings to 5,748.76 BTC.

The strategy aimed to leverage Bitcoin to boost economic growth, attract foreign investment, and increase financial inclusivity among its population.

However, the decision was met with domestic and international skepticism due to concerns about volatility and regulatory challenges.

Current Holdings and Value

As reported by Binance, El Salvador now holds a significant amount of Bitcoin, valued at over $350 million.

The government has established a transparent mechanism to monitor these holdings through a newly introduced website, which provides real-time data on the quantity and value of its Bitcoin assets.

This initiative is part of a broader effort to demonstrate transparency and build trust among citizens and international observers.

El Salvador Bitcoin Treasury Impact on El Salvador’s Economy

Financial Implications

The adoption of Bitcoin has had profound financial implications for El Salvador. It can potentially reduce transaction costs, bypass banking fees, and facilitate remittances, constituting a significant portion of the country’s GDP.

However, the volatility of Bitcoin poses risks to fiscal stability, as fluctuations in its value can dramatically affect the national budget and economic planning.

This aspect of El Salvador’s Bitcoin strategy has attracted considerable attention from global financial analysts and has been the subject of extensive coverage in leading financial news outlets, including Bloomberg.

Public and International Perception

Internationally, El Salvador’s move has been viewed with curiosity and caution.

Financial institutions like the IMF have warned of potential risks associated with adopting a cryptocurrency as legal tender, citing concerns over economic stability and transparency.

Domestically, the public’s response has been mixed, with some expressing pride in their country’s innovative approach. In contrast, others are apprehensive about the potential economic repercussions and the steep learning curve of using digital currencies.

Challenges and Criticisms

Economic Volatility

The intrinsic volatility of Bitcoin is a significant concern. Its price can experience substantial swings based on market dynamics, which can immediately impact the value of El Salvador’s national treasury.

Such fluctuations pose challenges for budgeting and financial forecasting, complicating economic management at a national level.

Political and Regulatory Challenges

El Salvador’s Bitcoin policy has also faced political and regulatory challenges.

Locally, the opposition has criticized the government for lacking a comprehensive strategy to educate the public and mitigate the risks associated with cryptocurrency transactions.

Internationally, the country faces scrutiny from regulatory bodies concerned about the implications for global financial stability and compliance with international financial regulations.

Future Prospects and Government Plans of El Salvador

Government Statements and Actions

In light of these challenges, Salvadoran officials have reiterated their commitment to the Bitcoin strategy, emphasizing potential long-term benefits such as increased financial inclusivity and economic innovation.

The government has announced plans to continue bolstering the infrastructure necessary to support Bitcoin and other digital currencies, aiming to make El Salvador a hub for cryptocurrency innovation and investment.

Potential Expansion and Technological Investments

El Salvador plans to expand its technological framework to better integrate Bitcoin into its economic and financial systems.

Investments in technology that will enable more straightforward and safer transactions are part of this, as they will increase the acceptance of Bitcoin in various economic sectors.

Conclusion

El Salvador’s venture into Bitcoin as a legal tender is an ongoing and evolving experiment, drawing global attention and debate.

This bold initiative’s outcome could influence future cryptocurrency adoption policies in El Salvador and worldwide.

It represents a crucial case study in the intersection of technology, finance, and national governance.

FAQs

What is the current value of El Salvador’s Bitcoin holdings?

El Salvador’s holdings in Bitcoin are valued at over $350 million, reflecting the nation’s substantial investment in this digital asset.

How has the adoption of Bitcoin affected El Salvador’s economy?

Bitcoin adoption has offered opportunities for financial innovation but has also introduced significant volatility and economic risk.

What are the risks of El Salvador’s strategy of holding Bitcoin?

The primary risks involve economic volatility, regulatory challenges, and potential political instability due to the controversial nature of the strategy.

How does the Salvadoran government plan to manage the volatility associated with Bitcoin?

The government is enhancing regulatory frameworks and investing in technological infrastructure to stabilize and secure Bitcoin transactions.

What future plans does El Salvador have regarding its cryptocurrency strategy?

El Salvador aims to expand its technological framework, improve regulatory policies, and maintain its position as a global leader in cryptocurrency adoption.

Deutsche Bank Blockchain Project Guardian is a groundbreaking initiative spearheaded by the Monetary Authority of Singapore (MAS). This project is set to explore the expansive potential of asset tokenization and decentralized finance (DeFi) within the financial sector.

This project is part of a larger effort by MAS to blend traditional financial practices with innovative blockchain technologies, aiming to enhance the efficiency, transparency, and security of financial transactions across various asset classes.

While MAS strongly discourages and seeks to restrict speculation in cryptocurrencies, we see much potential for value creation and efficiency gains in the digital asset ecosystem. This is why we are actively collaborating with the industry to foster a responsible and innovative digital asset ecosystem.

As we enter this new phase of Project Guardian, we look forward to collaborating with fellow policymakers and industry practitioners to jointly develop effective frameworks to guide the sound development of future financial networks.

Leong Sing Chiong, Deputy Managing Director (Markets and Development), MAS

Project Guardian, first introduced by MAS, serves as a collaborative platform that engages multiple top-tier global financial institutions, regulatory authorities, and technology companies.

The initiative focuses on experimenting with and understanding blockchain’s applicability in areas like asset management, fixed income, and foreign exchange.

For Deutsche Bank, this participation signifies a crucial step towards embracing digital transformation and preparing for future financial ecosystems dominated by digital assets and technologies.

Deutsche Bank’s involvement highlights its commitment to innovation and its strategic approach to leveraging new technologies to stay competitive in the rapidly evolving financial landscape.

By participating in Project Guardian, Deutsche Bank aims to explore the practical aspects of blockchain in reducing complexities in asset management, improving transaction speed, and lowering costs, which could revolutionize traditional banking operations and client services.

The bank’s collaboration in this project not only allows it to pilot cutting-edge technologies in a regulatory-compliant environment but also positions it as a forward-thinking leader eager to tap into the emerging market of tokenized assets.

The involvement is expected to yield insights into the scalability and robustness of blockchain applications in real-world financial settings, providing Deutsche Bank with a competitive edge in digital finance.

Deutsche Bank Blockchain Project Guardian Strategic Integration

Deutsche Bank is among the key financial institutions collaborating under the MAS-led Project Guardian, which aims to test the viability and impact of asset tokenization in modernizing financial practices.

This involvement is not merely participatory; Deutsche Bank is actively engaging in pilot projects that test tokenization across several financial sectors, including asset management, fixed income, and foreign exchange, which are crucial to understanding the practical applications and potential disruptions blockchain technology may bring to the financial industry.

Contributing to Project Guardian will bolster our efforts to help shape the new frontier of asset servicing, and strongly position us to contribute to industry progress, and not only anticipate our clients’ needs but exceed their expectations.

Strategic Importance for Deutsche Bank

The strategic importance of Deutsche Bank’s involvement in Project Guardian lies in its potential to redefine financial asset management and transaction processes.

By integrating blockchain technology, Deutsche Bank aims to achieve greater transaction efficiency, enhanced transparency, and improved security measures.

The project allows the bank to explore these technologies in a sandbox environment, mitigating risks while assessing the feasibility of wider implementation across its global operations.

Asset tokenization, as explored in Project Guardian, could significantly lower the barriers to entry for various investment opportunities, allowing for smaller investment denominations and broader investor participation.

The democratization of access to high-value asset markets, which have historically been inaccessible due to their high entry costs and intricate management demands, may result from this development, potentially broadening the clientele of Deutsche Bank.

Expected Benefits and Challenges to Deutsche Bank

The expected benefits for Deutsche Bank include operational efficiencies through streamlined processes and reduced reliance on intermediaries, which can lead to cost savings and faster transaction times.

Moreover, tokenization could enhance liquidity in traditionally illiquid asset classes, a significant advantage in asset and wealth management sectors.

However, the integration of blockchain technology also presents challenges, primarily regulatory and technical. Navigating the complex regulatory landscape, ensuring compliance with international financial regulations, and managing the technical aspects of blockchain integration are critical hurdles that Deutsche Bank will need to overcome.

As Project Guardian progresses, Deutsche Bank is poised to play a pivotal role in shaping the regulatory frameworks and industry standards for blockchain in financial services, contributing not only to its strategic objectives but also to the broader economic ecosystem’s evolution toward digital assets.

Deutsche Bank’s Strategic Journey in Blockchain and Asset Tokenization

Deutsche Bank’s involvement in Project Guardian marks a significant milestone in its digital transformation journey. By actively participating in this pioneering initiative led by the Monetary Authority of Singapore (MAS), Deutsche Bank is positioning itself at the forefront of the financial industry’s shift towards blockchain technology and asset tokenization.

This strategic move is indicative of the bank’s commitment to innovation and its vision to redefine the landscape of financial services.

Key Takeaways:

- Leadership in Innovation: Deutsche Bank’s participation in Project Guardian not only highlights its role as an innovator but also as a leader in shaping the future of financial technologies. The project allows Deutsche Bank to explore and potentially set new standards for the use of blockchain in financial services, ensuring it remains competitive in a rapidly evolving digital economy.

- Enhanced Client Services and Operational Efficiencies: Through blockchain and tokenization, Deutsche Bank can offer its clients more diverse and accessible investment opportunities while also achieving greater operational efficiency and security in its transactions. These advancements could lead to improved customer satisfaction and loyalty, which are crucial in the competitive banking sector.

- Navigating Challenges: The journey has its challenges, including regulatory hurdles, technical integration issues, and the need for substantial cultural shifts within the organization. How Deutsche Bank addresses these challenges will be critical to its success and could provide valuable insights into the resilience and adaptability of large financial institutions embracing new technologies.

Challenges Facing Deutsche Bank

- Regulatory Compliance and Uncertainty: As blockchain and tokenization are relatively new technologies in the financial sector, regulatory frameworks are still developing. Deutsche Bank must navigate these evolving regulations and ensure compliance across different jurisdictions, which can be complex and resource-intensive.

- Technical Integration and Security Concerns: Integrating blockchain technology with existing financial systems poses significant technical challenges. Ensuring the security and robustness of these systems against cyber threats is crucial, as blockchain networks can be susceptible to various security risks.

- Market and Technological Risks: The adoption of blockchain and tokenization involves exposure to market risks related to the volatility of digital assets and technological risks associated with the deployment of new technologies. Managing these risks effectively is essential to prevent potential financial losses and reputational damage.

- Cultural and Organizational Change: Implementing blockchain technology requires significant changes in organizational processes and culture. Deutsche Bank will need to invest in training and development to prepare its workforce for new operational paradigms associated with digital assets and tokenization.

Future Outlook:

As Project Guardian continues to evolve, Deutsche Bank’s ongoing involvement will likely influence not only its operations but also the broader financial industry’s approach to digital assets and blockchain technology. The insights gained from this initiative could lead to more robust, efficient, and inclusive financial systems globally.

Deutsche Bank’s strategic investment in blockchain technology through Project Guardian reflects its proactive approach to adopting next-generation technologies.

This involvement is set to not only transform its internal operations but also to potentially redefine global financial practices, making it a key player in the future of digital finance.

FAQs

1. What is Project Guardian?

Project Guardian is an initiative led by the Monetary Authority of Singapore (MAS) that explores the potential of blockchain technology and asset tokenization in the financial industry. It involves collaboration with global financial institutions to pilot innovative applications in areas such as asset management, fixed income, and foreign exchange.

2. Why is Deutsche Bank participating in Project Guardian?

Deutsche Bank is participating in Project Guardian to leverage blockchain technology to enhance the efficiency, transparency, and security of financial transactions. This involvement aligns with its strategic goals of digital transformation and innovation in financial services.

3. What benefits does blockchain technology offer to Deutsche Bank?

Blockchain technology offers Deutsche Bank multiple benefits, including improved operational efficiencies, enhanced liquidity for illiquid assets, expanded market access, and the ability to provide innovative financial products to a broader range of investors.

4. What are the challenges Deutsche Bank faces with blockchain adoption?

Deutsche Bank faces several challenges with blockchain adoption, including regulatory compliance, technical integration of blockchain with existing systems, security concerns, and the need for organizational adaptation to new technologies.

5. How could asset tokenization change the financial industry?

Asset tokenization could revolutionize the financial industry by making investments more accessible, increasing the liquidity of traditionally illiquid assets, and simplifying complex financial operations through automation and transparency.

6. What is the future outlook for Deutsche Bank’s blockchain initiatives?

The future outlook for Deutsche Bank’s blockchain initiatives is promising, with the potential to influence how financial services are delivered and consumed significantly. Continued participation in projects like Guardian could position Deutsche Bank as a leader in the adoption of digital finance technologies.

Zeebu’s Remarkable Growth Surpasses $2 Billion in Total Settlement Volume

The Scandal of Aiden Pleterski, Canada’s Crypto King

Top Altcoins in 2024 Will Be Dominating Investor Interest

Memecoin Madness: Eddie Seal Team Insults Investors and Returns Money from Presale

El Salvador Bitcoin Treasury Climbs to Over $350 Million

Deutsche Bank Blockchain Project Guardian

Cardalonia Aiming To Become The Biggest Metaverse Project On Cardano

WOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

P2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

ETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

WOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

Project Quantum – Decentralised AAA Gaming

Trending

-

Crypto2 years ago

Crypto2 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Blockchain4 years ago

Blockchain4 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release3 years ago

Press Release3 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Press Release3 years ago

Press Release3 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain4 years ago

Blockchain4 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release3 years ago

Press Release3 years agoProject Quantum – Decentralised AAA Gaming

-

Press Release3 years ago

Press Release3 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain4 years ago

Blockchain4 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins