Blockchain

Bitcoin Halving: Ultimate Guide For Investors And Crypto Enthusiasts

Published

2 months agoon

By

Bitcoin halving is a significant event within the cryptocurrency ecosystem, which has profound implications for Bitcoin’s economic framework and market dynamics.

If you’re interested in delving deeper into the concept of Bitcoin halving, this all-inclusive guide is perfect for you.

It delves into the intricate details of how Bitcoin halving functions, its significance for both miners and investors and its effect on the wider cryptocurrency ecosystem.

Furthermore, this guide explores the fundamental concepts that underpin Bitcoin halving, including why it is essential to control inflation and limit the total supply of Bitcoin which is great for crypto enthusiasts and a fantastic guide for Investors.

It delves into the relationship between Bitcoin halving events and market sentiment, examining historical trends and potential future ramifications.

Apart from Bitcoin halving, this guide also aims to provide readers with a comprehensive understanding of Bitcoin mining, which is the backbone of the cryptocurrency ecosystem.

Bitcoin mining is a decentralized mechanism that verifies transactions and creates new bitcoins. This section elucidates the intricate process of Bitcoin mining, including the technical nuances of mining algorithms, hardware requirements, and the competitive dynamics of the mining ecosystem.

By exploring the challenges and opportunities inherent in Bitcoin mining, this guide highlights its significance in facilitating secure and decentralized transactions within the digital realm.

Overall, this guide is an excellent resource for anyone looking to gain a deeper understanding of Bitcoin halving and mining.

Bitcoin Halving: A Catalyst for Market Dynamics and Investor

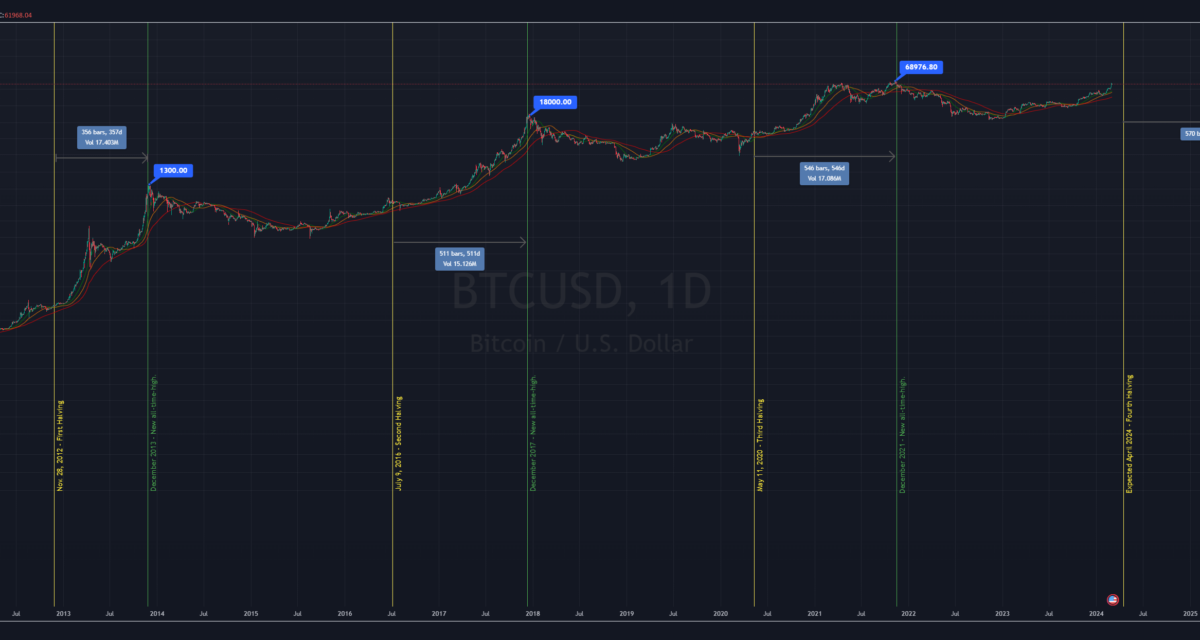

SentimentThe Bitcoin halving event on May 11, 2020, marked a pivotal moment in the cryptocurrency’s history, reducing the block reward from 12.5 bitcoins to 6.25 bitcoins and curbing the rate of new supply issuance.

This deflationary monetary policy showcased Bitcoin’s resilience amidst economic uncertainty, garnering attention from stakeholders worldwide.

Post-halving, Bitcoin witnessed heightened volatility and speculation as traders eagerly awaited its impact on price dynamics. The event reignited interest in Bitcoin as a store of value and inflation hedge, driving demand and subsequent price appreciation.

Media coverage and investor speculation surged, highlighting the halving’s influence on market sentiment and price trends.

The next halving of Bitcoin is expected in 2024, which will further the cryptocurrency’s goal of reaching a maximum supply of 21 million coins. This upcoming event holds significant importance for miners, investors, and the crypto community.

Market participants are already anticipating the upcoming bitcoin halving and its effects on supply dynamics, price volatility, and investor sentiment. Miners are reevaluating their operational strategies as they navigate the diminishing block rewards.

Factors like energy efficiency, hardware optimization, and operational scalability are crucial for maintaining profitability in a reduced reward environment. Investors are analyzing market dynamics and historical trends to anticipate price movements and assess Bitcoin’s deflationary model’s long-term value preservation.

The lead-up to the next halving sees intense discourse within the cryptocurrency community on supply dynamics, market psychology, and macroeconomic trends.

The countdown to the event serves as a focal point for speculation, anticipation, and reflection, underscoring the enduring impact of Bitcoin’s halving mechanism on shaping the digital asset landscape.

Miners’ Reward Mechanism: Incentivizing Network Security and Participation

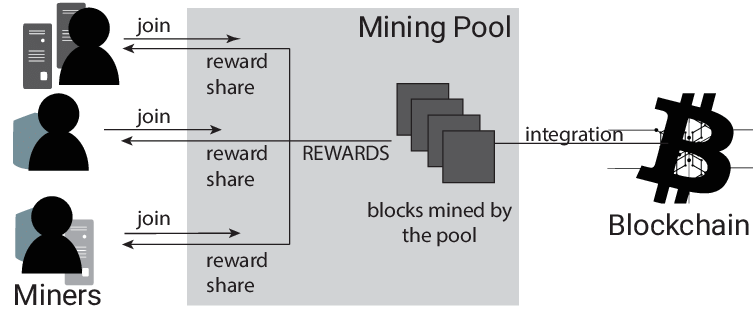

Central to the operation of the Bitcoin network is the reward mechanism designed to incentivize miners to dedicate computational resources towards securing and validating transactions.

This section elucidates the intricate interplay between miners, block rewards, and the foundational principles underpinning Bitcoin’s decentralized consensus protocol.

At the heart of the mining process lies the pursuit of block rewards, wherein miners compete to solve complex cryptographic puzzles and append new blocks to the blockchain. Initially set at 50 bitcoins per block upon Bitcoin’s inception in 2009, the block reward undergoes periodic reductions, halving approximately every four years by the protocol.

This reduction is a deliberate mechanism to constrain the issuance of new bitcoins, gradually tapering the inflation rate and imbuing the cryptocurrency with scarcity akin to precious metals like gold.

Beyond the allure of newly minted bitcoins, miners are further

incentivized by transaction fees, which constitute an additional source of revenue accrued from including transactions within the blocks they mine.

As the Bitcoin network matures and transaction volumes increase, transaction fees assume greater prominence in the overall reward structure, supplementing block rewards and serving as a tangible indicator of network activity and utility.

The close alignment of block rewards and transaction fees highlights the mutually beneficial association between miners and Bitcoin network users. Miners have a crucial responsibility in ensuring the smooth functioning of the Bitcoin network, and they receive rewards proportional to their computational efforts.

This reward mechanism fosters competition among miners, incentivizing them to invest in state-of-the-art hardware, optimize energy efficiency, and strategically position themselves within the mining ecosystem to maximize profitability.

The Bitcoin ecosystem maintains a consistent block production rate by adjusting mining difficulty, which balances mining rewards and network participation.

This adaptive mechanism ensures the resilience and robustness of the Bitcoin network, safeguarding against external threats and preserving the integrity of the decentralized ledger.

The miners’ reward mechanism embodies the foundational principles of decentralization, security, and economic incentivization that underpin the Bitcoin protocol.

Miners’ interests are aligned with those of network participants in this system, which results in a self-sustaining ecosystem.

As a result, individual incentives merge to maintain the collective integrity and security of the Bitcoin network.

The miners’ reward mechanism is a crucial element in the resilience and longevity of Bitcoin as it continues to develop and expand in the rapidly changing world of digital finance.

Relation to Bitcoin Price and Post-Halving Effects: Unraveling Market Dynamics and Economic Implications

The correlation between Bitcoin halving events and the fluctuations in the value of the cryptocurrency market is a topic that attracts a lot of attention and conjecture from analysts, investors, and enthusiasts alike.

Historically, Bitcoin halving events have served as catalysts for price volatility and speculative fervor, eliciting fervent anticipation and market speculation leading up to the event.

Investors often become bullish in anticipation of a reduction in block rewards as they perceive it as an omen of scarcity and upward price movement. As a result, Bitcoin’s price trajectory leading up to and after halving events typically displays marked fluctuations, characterized by spikes in buying activity and frenzied market speculation.

However, the relationship between Bitcoin halving events and price dynamics extends beyond mere speculative fervor, encompassing broader macroeconomic factors and market sentiment.

Bitcoin’s scarcity narrative, finite supply cap of 21 million coins, and its ability to act as a store of value protected against inflationary pressures and sovereign manipulation make it comparable to digital gold.

Halving events serve as a means to strengthen this story, highlighting Bitcoin’s position as a safeguard against the decline of fiat currency and political instability.

The cryptocurrency ecosystem goes through significant changes in mining dynamics, investor sentiment, and market psychology.

The decrease in block rewards compels miners to reassess their strategies, prompting the consolidation of inefficient mining operations.

The combination of this change and the decrease in the creation of new Bitcoins can cause a shortage in supply that drives the value of Bitcoin higher and sparks excitement in the market.

After the halving event, there is usually a rise in media attention, an increase in investor interest, and a surge in institutional investments in the cryptocurrency industry.

Several factors support the positive outlook on Bitcoin’s enduring value proposition.

As institutional adoption gains traction and retail participation proliferates, Bitcoin’s price trajectory may exhibit sustained upward momentum, underpinned by fundamental demand drivers and scarcity-induced price discovery mechanisms.

Historically, there has been a connection between Bitcoin halving events and bullish price surges. Nonetheless, the interplay between halving and price dynamics is complex and uncertain.

Several factors, including regulatory developments, technological advancements, macroeconomic trends, and market sentiment, can affect the outcome of future halvings.

The Impact of Bitcoin Halving Events Goes Beyond Mere Price Speculation

Bitcoin halving events, price dynamics, and post-halving effects actively demonstrate the intricate relationship between supply-side economics, market psychology, and broader macroeconomic forces that shape the trajectory of the cryptocurrency market.

These pivotal milestones in the evolution of the cryptocurrency ecosystem go beyond mere price speculation, impacting monetary policy, financial innovation, and the democratization of global finance.

Bitcoin’s ongoing redefinition of the digital economy extends beyond the cryptocurrency realm, with halving events signaling a paradigm shift in how we perceive and engage with money in the digital age.

You may like

In a significant move, Hong Kong authorities have cracked down on a fake crypto exchange, Quantum AI, allegedly linked to Elon Musk.

The scam, leveraging Musk’s identity and reputation, has duped unsuspecting investors into losing significant sums.

Overview of the Crackdown on the Fake Crypto Exchange

The Hong Kong Securities and Futures Commission (SFC) swiftly responded to reports of a fake cryptocurrency exchange allegedly linked to Elon Musk.

Hong Kong Securities and Futures Commission (SFC) Action:

The SFC warned investors and decided to shut down the fraudulent platform. By leveraging its regulatory authority, the SFC aimed to protect investors from falling victim to the elaborate scam and uphold the integrity of Hong Kong’s financial markets.

According to the report, Quantum AI utilized deepfake videos and images on its website and social media platforms to falsely suggest an association with Elon Musk. This deceptive tactic misled investors into believing that the platform had Musk’s endorsement or involvement.

Discovery of the Fake Exchange:

The fake exchange was discovered following multiple investor complaints and the SFC’s diligent monitoring of suspicious activity. The fraudulent platform impersonated Musk through fake social media profiles and a website designed to mimic genuine exchanges.

The SFC worked closely with international law enforcement agencies to uncover the scam’s masterminds and prevent further victimization.

Importance of Investor Protection:

The crackdown underscores the significance of protecting investors in the ever-evolving world of cryptocurrency trading. The SFC’s proactive measures demonstrate the importance of regulatory oversight in ensuring that crypto platforms operate transparently and ethically.

Modus Operandi of the Fake Exchange

Impersonation of Elon Musk:

Scammers took advantage of Elon Musk’s enormous popularity and influence in cryptocurrency by creating fake social media profiles and websites that impersonated him.

These platforms featured doctored images, counterfeit endorsements, and fabricated quotes, all giving the impression that Musk was endorsing and supporting the fraudulent exchange. The scammers designed their website to mimic genuine cryptocurrency exchanges with realistic dashboards and transaction fees.

Exploitation of Popular Crypto Trends:

In addition to leveraging Musk’s name, the scammers capitalized on the rising popularity of cryptocurrencies like Bitcoin, Ethereum, and Dogecoin.

They promoted deceptive investment schemes promising extraordinary returns, appealing to crypto enthusiasts’ fear of missing out (FOMO). Buzzwords like “blockchain,” “decentralization,” and “DeFi” were used strategically to attract novice investors.

Deceptive Promotions and Marketing Tactics:

The fraudulent exchange lured investors with enticing promotions such as “limited-time offers” and “exclusive investment opportunities.” Victims were urged to deposit their cryptocurrencies quickly to secure their spots.

Once investors transferred their assets, the scammers either disappeared or fabricated technical issues to prevent withdrawals.

Impact on Victims

The widespread impact of this scam underscores the importance of thorough due diligence and regulatory oversight in the volatile world of cryptocurrency trading.

Financial Losses:

Victims of the fake exchange experienced significant financial losses. The scammers successfully defrauded unsuspecting investors of over $165,000 worth of cryptocurrency.

Many investors, drawn in by the promise of high returns and the false endorsement by Elon Musk, invested their life savings or substantial amounts, only to find themselves unable to withdraw their funds.

Psychological and Emotional Impact:

Beyond financial losses, the scam inflicted psychological and emotional distress on the victims. Many investors felt betrayed and humiliated for falling prey to the scheme.

The scammers exploited common psychological tactics such as the fear of missing out (FOMO) and urgency, leaving victims feeling manipulated and devastated. Some investors reported sleepless nights and anxiety over their lost investments.

Broader Implications for Crypto Regulation

Regulatory Challenges in the Crypto Space:

The crackdown on the fake exchange highlights the difficulties regulators face in policing decentralized and pseudonymous cryptocurrency transactions. The rapidly evolving nature of crypto scams demands international cooperation and constant vigilance.

Investor Education and Awareness:

Investor education plays a crucial role in preventing similar scams. Authorities emphasize the importance of verifying exchange licenses, checking URLs, and recognizing red flags in marketing promotions. Stricter regulations and enhanced international collaboration are necessary to safeguard investors and maintain market integrity.

Response from Elon Musk and the Crypto Community

Elon Musk’s Response:

Elon Musk and his representatives swiftly distanced themselves from the scam, emphasizing that neither Musk nor his companies had any connection to the fraudulent exchange.

Musk has previously expressed concerns over misusing his image and reputation for deceptive crypto schemes. He also advocated for increased vigilance among investors and stricter enforcement against scams impersonating public figures.

Crypto Community Reactions:

The broader cryptocurrency community, including major exchanges like Binance, quickly rallied to denounce the scam and raise awareness. Binance published warnings and educational content to help investors spot fake exchanges and urged them to conduct thorough research before investing.

Calls for Greater Regulatory Oversight:

The incident sparked renewed calls for stricter regulations on crypto exchanges and greater international cooperation. Industry leaders emphasized the need for self-regulation within the crypto community to identify and flag suspicious activity.

Summary of Key Points: Conclusion and FAQ

The crackdown on the fake cryptocurrency exchange allegedly linked to Elon Musk underscores the importance of vigilance in the rapidly evolving crypto space.

The Hong Kong Securities and Futures Commission (SFC) acted swiftly to shut down the scam and protect investors.

The scam exploited Musk’s reputation, leveraging fake social media profiles and deceptive promotions to steal over $165,000 worth of cryptocurrency.

Future of Crypto Regulation in Hong Kong and Beyond:

This incident highlights the need for stricter regulations and international collaboration to combat similar schemes.

Investor education is crucial for identifying red flags and conducting due diligence before investing.

In the future, regulatory bodies and industry leaders must work together to create a safer and more transparent environment for crypto trading.

FAQs

Q: What was the nature of the fake cryptocurrency exchange linked to Elon Musk?

A: The fake cryptocurrency exchange impersonated Elon Musk using doctored images, fake social media profiles, and a website that mimics legitimate exchanges. It falsely claimed to have Musk’s endorsement to lure investors into fraudulent investment schemes.

Q: How did Hong Kong authorities discover the fraudulent exchange?

A: The Hong Kong Securities and Futures Commission (SFC) discovered the scam through investor complaints and suspicious activity monitoring. They collaborated with international law enforcement agencies to uncover the scam’s masterminds.

Q: What are the financial losses attributed to this scam?

A: The scammers defrauded investors of over $165,000 worth of cryptocurrency. Victims were unable to withdraw their funds, leaving them devastated and financially impacted.

Q: How can investors identify a fraudulent crypto exchange?

A: Investors can identify fraudulent exchanges by verifying licenses, double-checking URLs, and recognizing red flags like unsolicited promotions and high-return promises. They should also consult official resources and trusted crypto news outlets.

Q: What regulatory measures are being proposed to prevent such scams?

A: Regulators emphasize the need for international collaboration and stricter oversight of cryptocurrency exchanges. Investor education and self-regulation within the crypto community are crucial in identifying and flagging suspicious activities.

Blockchain

Monero P2P Trading Platform Closes and Raises Concerns

Published

13 hours agoon

May 9, 2024By

Monero P2P trading platform closes and raises concerns within the community of cryptocurrency users who value privacy.

The closure of this significant platform, which had long been a hub for Monero enthusiasts, underscores the challenges and risks facing decentralized exchanges in today’s evolving regulatory landscape.

Monero has gained popularity as a privacy-focused cryptocurrency due to its ability to provide secure and anonymous transactions, making it a preferred choice for users prioritizing privacy.

However, the platform’s closure was attributed to a mix of factors, including increased regulatory pressures, operational challenges, and security vulnerabilities.

This development impacts Monero’s market liquidity and raises questions about the future of decentralized platforms.

We will look into the reasons behind the shutdown, its effect on the Monero community, and the potential future of decentralized cryptocurrency trading platforms in an ever-changing environment.

Understanding Monero and P2P Trading Platforms

Monero (XMR) is a privacy-centric cryptocurrency that aims to provide secure, untraceable, and fungible transactions.

Monero (XMR):

Unlike Bitcoin, which offers pseudo-anonymity, Monero employs advanced cryptographic techniques like Ring Signatures, Ring Confidential Transactions (RingCT), and stealth addresses to ensure transaction privacy. These features make Monero a popular choice among individuals prioritizing financial privacy and anonymity.

P2P Trading Platforms:

Peer-to-peer (P2P) trading platforms enable direct transactions between buyers and sellers without intermediaries, providing a decentralized alternative to traditional exchanges. For privacy-focused cryptocurrencies like Monero, P2P platforms create an environment aligned with users’ desire for anonymity, often offering secure escrow systems, reputation-based trading, and end-to-end encrypted communication.

The Platform’s History:

The platform emerged as a significant player in Monero trading, providing a space where like-minded users could trade directly and securely. Its ease of use and privacy-centric features quickly attracted a loyal user base, making it a critical node in the Monero trading ecosystem. However, its recent closure has left a noticeable gap, compelling traders to seek alternative venues.

Monero P2P Trading Platform Closes Because of Presure Regarding privacy focused trading.

Increased regulatory scrutiny on cryptocurrencies has created a challenging environment for decentralized platforms. Many governments are pushing for tighter controls on crypto exchanges to curb illicit activities.

Regulatory Pressures:

The P2P Monero platform was under immense pressure due to its association with privacy-focused trading. Compliance requirements, such as know-your-customer (KYC) regulations and anti-money laundering (AML) policies, posed significant challenges, prompting the platform’s operators to shut down rather than compromise their values or face legal consequences.

Operational Challenges:

Decentralized platforms require robust infrastructure to handle transactions securely and efficiently. However, maintaining such infrastructure has significant operational challenges, including server management, user support, and technical updates. The Monero P2P platform struggled to keep up with increasing operational demands, particularly as its user base grew. Technical glitches, insufficient resources, and increasing server costs further strained the platform’s sustainability.

Security Concerns:

Security is paramount in any trading platform, but decentralized exchanges face unique challenges. The Monero platform had to combat various security threats, including scams, hacks, and fraudulent listings. Despite employing security measures like escrow systems and reputation-based trading, malicious actors still exploited vulnerabilities. Rising security issues compromised user funds and eroded trust in the platform, accelerating its decline.

Impact on the Monero Community

Liquidity Challenges:

The closure of the P2P trading platform has affected Monero’s liquidity, particularly in the P2P market segment. With fewer active marketplaces supporting Monero, traders have experienced challenges finding reliable platforms, which has reduced trading activity and liquidity. This decline makes it harder for buyers and sellers to conduct transactions quickly and at favourable prices.

Alternative Trading Solutions:

Despite the closure, Monero trading continues through various other avenues. Decentralized exchanges (DEXs) like Bisq and open-source platforms like LocalMonero offer alternative trading solutions. Centralized exchanges (CEXs) like Kraken and Binance also facilitate Monero trading, albeit with varying degrees of privacy. OTC (over-the-counter) markets and private trading networks also provide options for traders seeking more personalized trading experiences.

User Trust and Confidence:

The sudden shutdown has shaken user confidence in decentralized platforms, particularly those prioritizing privacy over compliance. Many users have expressed concerns about the reliability and security of P2P platforms, prompting a shift towards more regulated exchanges or private trading networks. Restoring user trust will require significant improvements in platform security, transparency, and regulatory compliance.

Parrot Bamboo said at Binance Square:

📣 LocalMonero, the largest peer-to-peer Monero trading platform, announced that it is closing after approximately 7 years of operation. $XMR

The Future of Decentralized Cryptocurrency Platforms

Regulatory Compliance:

For decentralized platforms, regulatory compliance is still a major obstacle. A careful balance must be struck between navigating changing international rules and protecting user privacy.

Platforms must adopt innovative compliance strategies, such as decentralized KYC protocols or community-driven governance models, to remain operational without compromising their core values.

Security Innovations:

Security innovations must be prioritized on decentralized platforms to avert security breaches and restore confidence.

Implementing advanced encryption, multi-signature wallets, and decentralized identity verification can enhance platform security.

Additionally, community-based security audits and bug bounty programs can help identify and address vulnerabilities proactively.

Decentralized Exchange Development:

The growth of decentralized exchanges (DEXs) signifies shifting towards a more secure and user-centric trading model. DEXs like Uniswap and Bisq are gaining traction due to their non-custodial nature and robust security features. However, challenges such as low liquidity, user experience issues, and regulatory uncertainty still hinder their widespread adoption.

Improving cross-chain interoperability, incentivizing liquidity providers, and simplifying user interfaces could accelerate DEX development.

Final Thoughts and FAQ:

The closure of a prominent Monero P2P trading platform has highlighted the complexities and challenges of operating in a rapidly changing regulatory environment. While privacy-centric cryptocurrencies like Monero appeal to users seeking anonymity, platforms supporting these currencies must navigate a delicate balance between compliance and user privacy. The shutdown has affected Monero’s liquidity and raised concerns within the community, but alternatives such as decentralized exchanges and private trading networks still offer viable trading solutions. Moving forward, decentralized platforms must prioritize security, compliance, and innovation to regain user trust and continue providing safe, reliable environments for peer-to-peer trading. The future of decentralized trading depends on striking the right balance between privacy, security, and adaptability to an evolving regulatory landscape.

FAQs

Q.: Why did the Monero P2P trading platform close?

A.: The platform cited regulatory pressures, security concerns, and operational challenges as primary reasons.

Q.: What alternatives exist for Monero P2P trading?

A.: Decentralized exchanges (DEXs) like Bisq and other P2P platforms still support Monero trading.

Q.: How does this closure affect Monero trading?

A.: It may reduce liquidity and impact confidence in P2P platforms.

Q.: What makes Monero unique among cryptocurrencies?

A.:Monero is known for its strong privacy features, such as RingCT and stealth addresses.

Q.: Is Monero still safe to trade?

A.: Yes, trading Monero remains safe, provided users utilize trusted platforms with robust security features.

Find out the latest Cryptocurrency news today top stories development, including significant updates on the Ripple v. SEC litigation, Apple’s creative collaboration with Render Network, significant market trends, and regulatory measures.

Stay informed with today’s most impactful crypto news and analysis.

Cryptocurrency News Today: Ripple vs. SEC, Apple-Render Partnership, Bitcoin Trends, and other Top Stories

Cryptocurrency continues to make headlines, reflecting its increasing impact on finance and technology globally.

As the digital currency landscape evolves, it’s shaped by significant developments, including regulatory battles, groundbreaking partnerships, and shifts in market dynamics.

We will now bring you the latest pivotal events in the cryptocurrency world as of May 7, 2024, focusing on the ongoing Ripple vs. SEC lawsuit, public skepticism about crypto in the US, strategic partnerships like that of Apple and Render Network, and fundamental market movements.

Ripple vs. SEC Lawsuit Intensifies

The Ripple vs. SEC lawsuit has reached a crucial point as the US Securities and Exchange Commission (SEC) filed its final response in the ongoing legal battle with Ripple.

The SEC argued that Ripple’s claims do not eliminate the necessity for injunctions to prevent potential future violations.

This legal conflict, which began in December 2020 when the SEC filed a lawsuit against Ripple Labs for conducting unregistered securities sales via its XRP token, has now escalated with this latest filing.

Background of the Lawsuit

The lawsuit centers around the SEC’s assertion that Ripple raised over $1.3 billion through an unregistered securities offering. Ripple maintains that XRP is a digital currency, not a security, and therefore not subject to SEC regulations.

The outcome of this case is poised to set a precedent for how digital assets are classified and regulated in the US.

The initial ruling in favor of Ripple sparked optimism in the crypto community, but the SEC’s recent filing intensified regulatory scrutiny.

SEC’s Final Response and Ripple’s Defense

In its latest response, the SEC urged the court to issue injunctions despite Ripple’s assurances of compliance, emphasizing the importance of deterring future violations.

Ripple argues that the lawsuit is unfounded and that the XRP Ledger’s decentralization minimizes the potential for securities fraud.

The SEC’s response highlighted the need to protect investors and maintain the integrity of financial markets, pointing to Ripple’s past behavior as a basis for future risks.

Potential Impact on the Market

The lawsuit has affected XRP’s price and market sentiment, with the token experiencing significant volatility.

Despite falling over 14% year-to-date due to legal uncertainties, analysts believe XRP could rebound if Ripple secures a favorable outcome. Moreover, this lawsuit has implications beyond Ripple, potentially shaping future regulatory approaches to the broader cryptocurrency market.

Majority of Americans Skeptical About Crypto Despite Financial System Concerns

According to a recent survey by The Harris Group and the Digital Currency Group (DCG), 70% of voters in swing states think that considerable changes are needed to the current financial system since it is antiquated.

However, despite these concerns, most participants remain skeptical about cryptocurrencies as a viable solution due to issues like security, regulation, and market volatility.

Survey Findings and Public Perception

The survey highlighted the divide in public perception. While the majority agreed on the need for reform in traditional finance, only a minority viewed cryptocurrencies as the answer. Factors contributing to this skepticism include the perceived association of cryptocurrencies with speculative trading, regulatory uncertainty, and the prevalence of scams. Many respondents were particularly wary of decentralized finance (DeFi) and its potential risks.

Regulatory Concerns

Participants expressed concerns about regulatory oversight, highlighting the importance of government involvement in ensuring investor protection.

Recent events such as the Ripple vs. SEC lawsuit and the collapse of FTX have further fueled doubts about the industry’s integrity.

This survey underscores the challenges that cryptocurrency faces in gaining mainstream acceptance, even as it continues to grow in technological innovation and market impact.

Apple Partners with Render Network for Decentralized Computing

Apple’s keynote on May 7, 2024, spotlighted a groundbreaking partnership with the Render Network via OctaneX, a decentralized GPU platform.

This collaboration aims to harness Apple’s advanced hardware capabilities alongside the Render Network’s decentralized computing power, creating a seamless and powerful computing platform.

Partnership Overview

OctaneX is designed to leverage the decentralized GPU resources of the Render Network, offering a nearly unlimited pool of high-performance computing power.

By integrating Apple’s cutting-edge hardware, such as the M-series chips, with Render’s decentralized architecture, the partnership is set to redefine how decentralized computing resources can be accessed and utilized.

Impact on Decentralized Computing

This collaboration could significantly impact the decentralized computing landscape, offering content creators, developers, and researchers access to scalable GPU resources.

It also demonstrates how blockchain-based networks like Render can partner with tech giants to provide decentralized solutions for demanding computing tasks like rendering, machine learning, and data analysis.

Furthermore, this partnership aligns with Apple’s broader strategy of promoting innovation and integration within its ecosystem, signaling a growing interest in decentralized technologies and their potential applications.

Wintermute Provides Liquidity for Hong Kong Crypto ETFs

Wintermute, a leading market maker in the cryptocurrency industry, has committed to providing liquidity for Hong Kong-listed crypto exchange-traded funds (ETFs).

This calculated strategy comes at the same time as Asian venture capital firms open a $1 billion liquidity fund to help the expansion and uptake of cryptocurrency exchange-traded funds (ETFs) in the area.

Hong Kong’s Growing Crypto Market

The move reflects Hong Kong’s ambition to position itself as a global hub for cryptocurrency trading and innovation.

Recent regulatory changes have made the region increasingly attractive to institutional investors seeking exposure to digital assets through regulated financial products like ETFs.

Wintermute’s Role and Significance

Wintermute’s involvement as a liquidity provider ensures tighter spreads and higher trading volumes for the new ETFs, improving investor confidence and signaling the growing maturity of the cryptocurrency market in Asia.

The initiative aims to bridge the gap between traditional finance and digital assets, fostering institutional adoption of crypto products.

Bitcoin and Ethereum Market Trends

Bitcoin continues to capture investor attention as market sentiment shifts positively.

Bitcoin’s Bullish Momentum

The world’s largest cryptocurrency recently surpassed the $69,000 level before slightly retreating to $67,857.52, reflecting a 3.45% gain.

Fidelity Investments predicts a potential surge to $100,000 as institutional interest grows and more traditional finance firms offer Bitcoin exposure.

This bullish sentiment is supported by recent on-chain data, indicating that Bitcoin might be preparing for a significant upward movement.

Bitcoin adds 4.5% even as stocks reverse lower following hawkish Fed commentary.

Stephen Alpher, CoinDesk

Indicators and Trends

- Funding Rate and Basis Rate: Both indicators have cooled off, signaling a “calm before the storm,” according to Ciaran Lyons of Cointelegraph. This cooling-off often precedes a bullish breakout.

- Market Analysis: Bitcoin’s recent dip hasn’t dented the optimism of traders, as it remains on an upward trajectory.

Data suggests the crypto market remains in the early stages of a macro uptrend.”

Nancy Lubale, to Cointelegraph

Ethereum’s Underperformance

While Bitcoin is gearing up for a bull run, Ethereum (ETH) has been underperforming due to weaker capital rotation.

Despite rising 0.61% to $3,297.90, it has lagged behind Bitcoin’s gains, attributed to a lack of institutional momentum and uncertainty around the SEC’s approval of a spot Ethereum ETF.

Indicators and Trends

- On-Chain Data and Glassnode Analysis: Glassnode analysts report that Ethereum price lags due to “weaker capital rotation” but remains in a macro uptrend alongside Bitcoin.

- Market Analysis: Ethereum is still expected to benefit from the crypto market’s overall macro uptrend.

Broader Market Trends

- Altcoin Performance: Other prominent cryptocurrencies, such as Binance Coin (BNB), Cardano (ADA), and Toncoin (TON), have seen modest gains in recent days.

- Crypto Rebound Expectations: Investors are closely watching presales of promising projects like Raboo, which has attracted significant investment amid Bitcoin and Ethereum price recovery.

Australian Tax Office Seeks Crypto Data from 1.2 Million Users

The Australian Tax Office (ATO) has requested personal and transaction data from 1.2 million cryptocurrency users to identify those who still need to fulfill their tax obligations.

The agency acknowledged that some users might unknowingly fail to comply but emphasized the need to enforce regulations consistently. This move underscores the growing scrutiny of crypto transactions by tax authorities globally.

Complexity of Compliance

Crypto tax compliance remains challenging due to the intricacies of tracking transactions across multiple exchanges and platforms, making it crucial for users to stay informed on evolving guidelines.

The landscape of cryptocurrencies is still changing as a result of market trends, creative collaborations, and regulatory scrutiny.

The Ripple vs. SEC lawsuit highlights the industry’s regulatory challenges and the need for more precise guidelines.

Meanwhile, public skepticism about crypto remains high despite dissatisfaction with the current financial system, emphasizing the importance of security and compliance.

On the innovation front, Apple’s partnership with the Render Network exemplifies the potential for decentralized computing.

At the same time, Wintermute’s involvement in Hong Kong crypto ETFs showcases the growing institutional interest in digital assets in Asia.

Market trends indicate that Bitcoin remains bullish, with predictions pointing to a surge beyond $100,000, while Ethereum, despite its underperformance, is expected to benefit from a macro uptrend alongside other altcoins.

The Australian Tax Office’s move to enforce crypto compliance further underscores the importance of regulatory adherence.

Conclusion

Bitcoin and Ethereum continue to shape the cryptocurrency market’s outlook.

While Bitcoin shows bullish potential, Ethereum’s macro trends and growing institutional interest hint at a promising future despite recent underperformance.

It will be crucial for stakeholders and investors alike to keep up with new developments and stay aware of developing trends as the cryptocurrency business continues to drive changes in the markets, regulations, and technology.

FAQs

- What is the current status of the Ripple vs. SEC lawsuit?

- The SEC has filed its final response, calling for injunctions against Ripple despite its arguments.

- Why are Americans skeptical about crypto despite dissatisfaction with the financial system?

- Concerns about security, regulation, and market volatility contribute to skepticism.

- How does Apple’s partnership with the Render Network impact decentralized computing?

- This collaboration integrates Apple’s advanced hardware with decentralized GPU resources, potentially redefining decentralized computing.

- What does Wintermute’s involvement in Hong Kong crypto ETFs signify?

- It reflects growing interest and strategic importance in the Asian crypto market.

- What market trends are currently affecting Bitcoin and Ethereum?

- Bitcoin shows signs of a bullish movement, while Ethereum lags due to weaker capital rotation.

Hong Kong Cracks Down on Fake Crypto Exchange

Monero P2P Trading Platform Closes and Raises Concerns

WEMADE and WEMIX Win “Best Web3 Gaming” at MENA Games Industry Awards 2024

Cryptocurrency News Today Top Stories May 7, 2024

Unlock Long-Term Benefits with SportsMint’s Presale

TradFi and DeFi Integration Fundamentals

Cardalonia Aiming To Become The Biggest Metaverse Project On Cardano

WOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

P2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

ETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

WOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

Project Quantum – Decentralised AAA Gaming

Trending

-

Crypto2 years ago

Crypto2 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Blockchain4 years ago

Blockchain4 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release3 years ago

Press Release3 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Press Release3 years ago

Press Release3 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain4 years ago

Blockchain4 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release3 years ago

Press Release3 years agoProject Quantum – Decentralised AAA Gaming

-

Press Release3 years ago

Press Release3 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain4 years ago

Blockchain4 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins