Crypto

Bitcoin price drops more than 20% to $42,000. What’s going on?

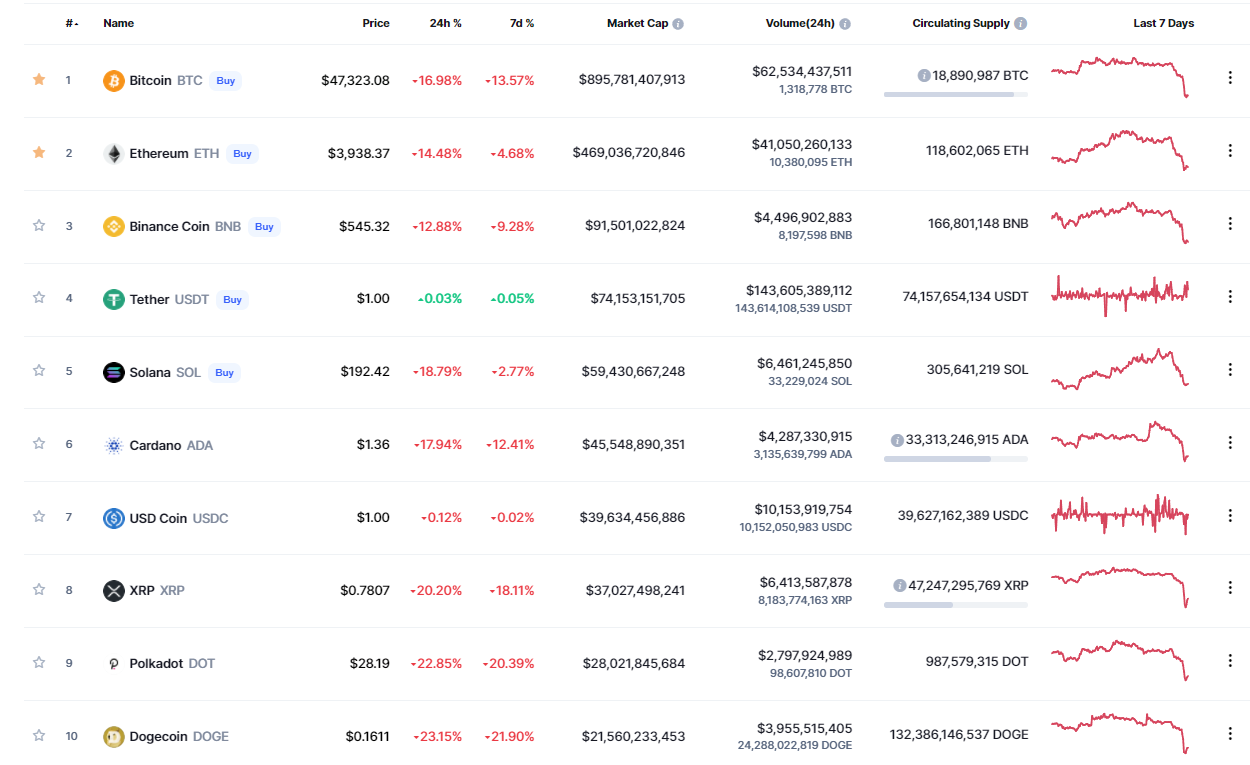

With the new Covid Omicron variant, the bitcoin price drops more than 20%. Bitcoin, Ethereum, and several other cryptocurrencies face a storm of bearish catalysts. Cryptocurrency prohibitions might also be the cause.

Bitcoin price dropped drastically in the early hours of this Saturday, November 4th, falling more than 20%, coming to trade at US$ 42,000.

The price of Ethereum plummeted, dropping more than 25%, to around $3,400, and other known cryptocurrencies have also seen their market prices going down. The total market capitalization dropped 16% to $2.2 trillion.

On a side note, in early November, the total market capitalization of cryptocurrencies reached $3 trillion for the first time in history.

Cryptocurrencies have been in chaos since the appearance of the Omicron form of the coronavirus.

The Bitcoin price drops more than 20% What could be the cause?

On November 26th, bitcoin dropped to a seven-week low to trade at $54,000, entering the falling territory, when in October, it passed the $68000 barrier. At the time of the writing of this article, the price recovered, and it’s trading at $47205,98.

Tech stocks also had a bad week, with the Nasdaq index closing the week down about 2.5%. Cryptocurrency and stock prices are typically not closely correlated, however, large stock sales may be causing investors to become more aware of the overall risk and exit cryptocurrency positions.

The World Health Organization (WHO) said on past Friday, November 3rd, that the variant was detected in 38 countries, compared to 23 two days ago, with initial data suggesting that the strain is more contagious than others.

In addition to fears over the omicron variant, rising yields on US Treasuries may be prompting investors to abandon riskier investments in search of safer returns.

The index fell to its lowest level in over seven weeks. The return of the “red tide” to the markets harmed the most cyclical industries, such as retail and tourism. The energy industry was also among those that suffered the most losses as a result of the reduction in the price of an oil barrel.

Fed Chairman Jerome Powell stated on Tuesday that “it is time to remove the temporary end of inflation,” bolstering the notion that interest rates may increase sooner than expected, which penalized equities on both sides of the Atlantic.

Jerome Powell further warned that this new coronavirus variant offers possible economic hazards at a time when US inflation is at its highest level since 1990.

And this could be leading the investors to liquidate their Cryptocurrency positions.

Cryptocurrency prohibitions and regulatory restrictions across the world

Other causes could be the potential for further regulatory restrictions to be weighing on cryptocurrency valuations.

China has effectively banned cryptocurrency and mining transactions. The conflict between Chinese officials and miners lasted for more than six months.

China prohibited mining activities in May of this year, forcing these business people to shift their equipment to other countries such as the United States, Kazakhstan, and Russia.

On November 16th, China resumed its war on miners, declaring that Chinese officials would work more to penalize unlawful miners.

“Virtual currency mining is high energy consumption and carbon emissions, and does not play a positive role in industrial development and technological progress.”

Said the Chinese Government.

Despite portraying itself as an ecologically correct and environmentally conscious country, China’s primary energy source is coal combustion, as seen in the quotation below.

Following the departure of miners to other nations such as the United States, bitcoin mining is already proving to be more environmentally friendly.

“The risks arising from the production and trading of virtual currency are becoming increasingly prominent. Its blind and disorderly development has a severe adverse impact on promoting high quality economic and social development, energy conservation and emission reduction.”

said Meng Wei, a spokesperson for National Development and Reform Commission in China.

India is about to introduce legislation, not to ban, but to regulate all cryptocurrencies. According to the government announcement, the new law will allow for “limited exclusions to promote the underlying cryptocurrency technology and its purposes.”

The Indian Central Bank further stated that they raised “severe concerns regarding macroeconomic and financial stability.”

The regulation is meant to safeguard Indian consumers when a rising number of individuals, many of whom lack financial expertise or information, are making these sorts of transactions and risk losing their entire investment, treating cryptocurrencies as assets.

The United States has recently signed the US spending bill included new taxes for cryptocurrency brokers.

Among these various factors, Bitcoin, Ethereum, and several other cryptocurrencies faced a storm of bearish catalysts.

Do you the Biswap DEX? If not, you should. Check here and benefit from high APY and low to non-existent fees.

Crypto

Shaping The Crypto Futures and Options (F&O) Landscape With Delta Exchange in India

Did you know that India is on track to become a global leader in crypto adoption by the end of 2024? With the rise in crypto users and investments, crypto derivatives—futures and options (F&O)—also play a crucial role in the market. Delta Exchange is emerging as one of the key players in crypto derivatives trading, offering multiple tools and features for Indian traders.

According to a report by the Financial Mirror, the country will surpass 270 million crypto users by the end of 2024. This data highlights India’s growing enthusiasm for digital assets, and it exceeds the total number of crypto users in Europe and the US combined.

In another report by TechSci Research, the Indian crypto market was valued at $221.5 million last year and is projected to grow with a CAGR of 6.75% by 2029.

Source | Projected growth of the Indian crypto market

In this blog, we will discuss the country’s increasing involvement in crypto markets, especially the crypto F&O segment, and how investors are driving tremendous growth in the sector.

The Rise of Crypto F&O in India

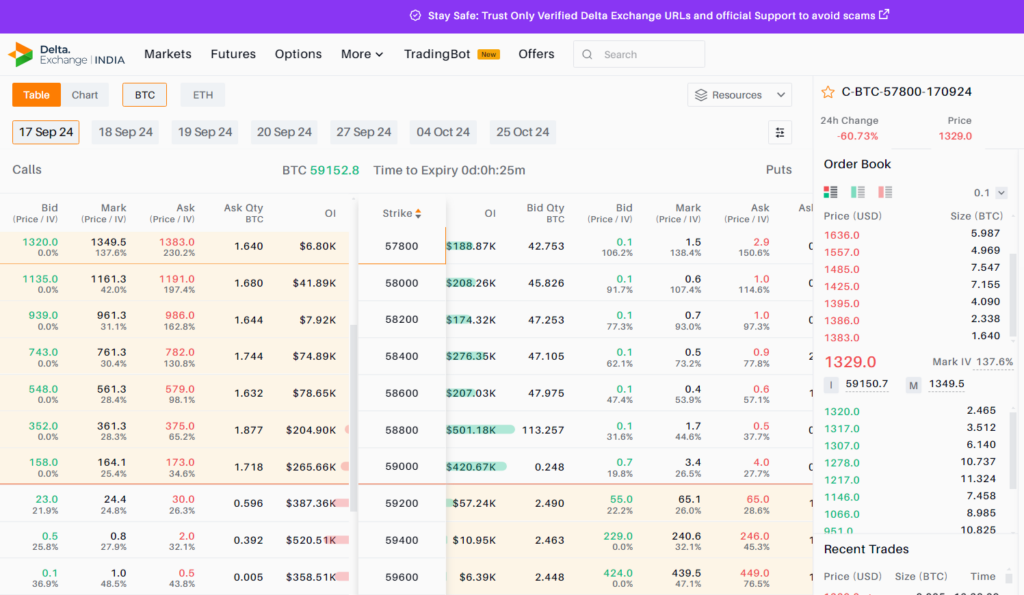

The global rise of crypto trading has opened up new opportunities in the financial market, with crypto futures and options (F&O) being the key drivers of its growth. Unlike traditional crypto trading, where investors buy and hold assets, F&O trading allows traders to speculate on crypto price movements without directly owning them. With its vast tech-savvy population and enthusiasts alike, Indian traders are playing a crucial role in shaping the F&O landscape.

Traders are usually drawn to the high–reward potential of crypto markets, and they use crypto derivatives to hedge their digital assets. What sets Indian traders apart is their ability to adopt new financial tools in the growing tech era and their curiosity about trying out advanced trading strategies like crypto F&O.

As the crypto market matures, Delta Exchange continues to play a critical role, offering features tailored to the unique needs of the Indian market.

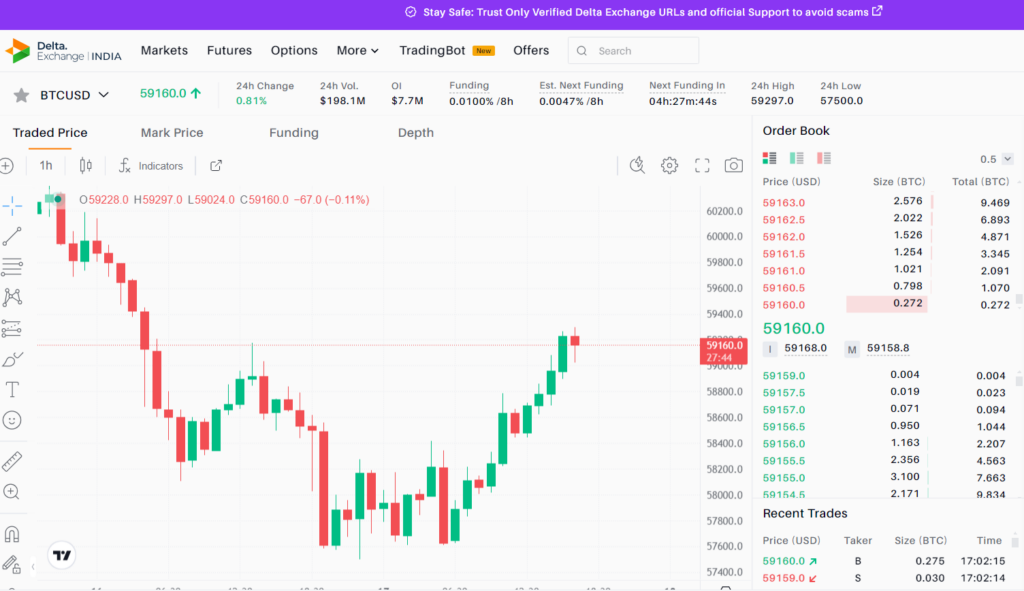

Delta Exchange: The Fastest-Growing Crypto F&O Platform

Among the growing crypto exchange platforms, Delta Exchange is one of the leading crypto F&O trading platforms in India today. Recently, in a single day, they recorded the highest trading volume of $2 billion in Bitcoin (BTC) and Ethereum (ETH) derivatives. This is a clear indication that Indian traders are actively participating in crypto F&O trading.

Source | Futures trading on Delta Exchange

Source | Options trading on Delta Exchange

Delta Exchange caters to crypto investors and traders who want to diversify their crypto F&O trading with advanced tech, liquidity, insurance, and risk management to protect the trader’s interest. With Financial Intelligence Unit (FIU) registration, Delta Exchange has become a trusted and reliable platform for growing crypto F&O trading.

The platform offers traders:

- User-friendly platform

- Multiple expiry options (daily, weekly, and monthly)

- Advanced risk management tools

- INR settlements

- 24/7/365 open market and customer support

Here’s how traders can deposit and withdraw money on the platform:

For deposits:

- Log in to your Delta Exchange account

- Go to the ‘Add funds’ section

- Add accurate bank account details

- Once whitelisted by the team, traders can transfer funds to their accounts.

For withdrawals:

- Log in to your Delta Exchange account

- Go to the ‘Withdrawal’ section

- Specify withdrawal amount

- Add proper bank account details

- Confirm withdrawal by transferring the selected amount.

Traders and investors can easily manage funds on Delta Exchange in an efficient and hassle-free manner by following the above steps.

You can download the Delta Exchange app from the Play Store or App Store.

WEEKLY SNAPSHOT ON STRADDLE PREMIUM – DELTA EXCHANGE

| Weekly Returns (20 Dec – 26 Dec) | |||||

| Underlying | Weekly High ($) | Weekly Low ($) | Last Price($) | % Change since Last Week | Intraday ATM Straddle Premium for Friday (24 hr to Expiry) |

| BTCUSD | 99949 | 92485 | 95750 | -1.73% | 2320 |

| ETHUSD | 3553 | 3100 | 3333 | -2.44% | 117 |

Note: Last Price mentioned as on 26 Dec, 11:59 PM

| Straddle Premium Comparison | ||

| Underlying | Previous Week(Exp 27-12-2024) | Upcoming Week(Exp 03-01-2025) |

| BTCUSD | 6100 | 6160 |

| ETHUSD | 310 | 280 |

| Altcoins Futures Watch Past Week (20 Dec – 26 Dec) – Delta Exchange | ||||

| Alt Coins | Weekly High | Weekly Low | Last Price | % Change |

| FTMUSD | 1.09900 | 0.84440 | 0.87180 | -12.53% |

| AAVEUSD | 390.068 | 271.450 | 337.544 | 7.25% |

| BNBUSD | 720.020 | 618.000 | 688.880 | 3.42% |

Note: Last Price mentioned as on 26 Dec, 11:59 PM

Key Factors Driving the Growth of Crypto F&O

Here are some primary factors that influence the growth of crypto F&O in India:

Growing market interest & adoption

The digital landscape in India creates a nurturing environment for crypto F&O adoption. With the global awareness of cryptocurrency, both experienced and new traders find access to digital assets via online platforms, exchanges, mobile applications, and other web platforms.

Regulatory clarity

Regulatory developments have led to significant growth in the crypto F&O sector. The Reserve Bank of India (RBI) lifted the banking ban, providing consumer protection and tax relief that provided traders with the legal clarity needed for crypto transactions.

Risk Management via hedging

Crypto F&O is used as a hedging tool. Holding crypto F&O contracts allows traders to minimize their losses if the market or prices shift against their original position.

The Bottomline

India is a home for many tech enthusiasts and financial experts. Over the past few years, the growth in the crypto futures and options domain has been obvious due to the rapid adoption of cryptocurrencies and emerging technologies. With a wider audience open to such new, advanced trading strategies, India is poised to play a bigger and more significant role in the global crypto market. All thanks to the curious traders who are driving the growth of the crypto F&O market due to clear-cut regulations in place, hedging, regulated platforms like Delta Exchange, and a chance of gaining higher returns on investments.

Visit the website www.delta.exchange for more updates or connect on X. For more details and information about crypto F&O, visit the YouTube channel.

Disclaimer: Cryptocurrencies are inherently volatile, and investments in the asset class can carry significant risks. The information presented in this article is not intended to be financial advice, and we strongly recommend conducting your due diligence before investing in crypto.

Crypto

CVTrade Review 2024: Uncover the Best in Cryptocurrency Trading

CVTrade is an emerging cryptocurrency exchange known for its user-friendly interface, competitive trading fees, and diverse range of digital assets. This CVTrade review covers everything you need to know about CVTrade in 2024, including its advantages, disadvantages, services, trading platform, security features, and more.

CVTrade Featured Partner Offer

CVTrade often collaborates with various financial and technology firms to provide exclusive promotions and discounts. These may include reduced trading fees, early access to new cryptocurrencies, and additional benefits. For the latest offers, it’s best to check CVTrade’s official website or trading platform.

Pros

- User-Friendly Interface

- Competitive Trading Fees

- Wide Range of Cryptocurrencies

- Strong Security Measures

- Advanced Trading Features

- Support for Multiple Fiat Currencies

Cons

- Limited Educational Resources

- Customer Support Response Times

- Regulatory Compliance Issues

- Availability in Some Regions

- Margin Trading Risks

Who Is CVTrade Good For?

CVTrade is suitable for both new and experienced cryptocurrency traders. The platform offers advanced trading tools for professional traders while maintaining a straightforward interface for beginners. Its strong security features make it a great choice for those prioritizing safety.

What Makes CVTrade a Good Choice?

CVTrade stands out due to its competitive fees, extensive cryptocurrency offerings, and user-friendly design. The platform’s robust security measures and advanced trading features attract a wide range of traders looking for reliable and versatile trading options.

CVTrade Security

CVTrade prioritizes security with measures like two-factor authentication (2FA), cold storage for the majority of funds, and regular security audits. These practices help ensure the protection of users’ assets from potential threats.

CVTrade Disadvantages

Despite its strengths, CVTrade has some challenges, including a limited range of educational resources and occasional delays in customer support responses. Regulatory compliance issues may also affect its availability in certain regions.

CVTrade Services

CVTrade offers a variety of services designed for cryptocurrency traders, including:

- Spot Trading: Buy and sell cryptocurrencies immediately.

- Futures Trading: Contracts to buy or sell assets at a set price and date.

- Options Trading: Contracts providing the right to buy or sell assets at a specified price.

- Margin Trading: Amplify potential returns (and losses) using borrowed funds.

CVTrade Trading Platform

The CVTrade trading platform is designed to cater to a range of trading needs. It features advanced charting tools, various order types (market, limit, stop), and a user-friendly interface for executing trades. Additionally, CVTrade provides a professional trading interface for experienced users.

CVTrade Margin Trading

CVTrade offers margin trading with leverage options, allowing traders to increase their market exposure. This feature is ideal for experienced traders familiar with the risks of leveraged trading.

Top Cryptocurrencies Available on CVTrade

| 1 | BTC/USDT |

| 2 | ETH/USDT |

| 3 | BNB/USDT |

| 4 | XRP/USDT |

| 5 | ADA/USDT |

| 6 | DOGE/USDT |

| 7 | TRX/USDT |

| 8 | SOL/USDT |

| 9 | AVAX/USDT |

| 10 | CVT/USDT |

CVTrade Trading Fees

CVTrade’s fee structure varies depending on the type of transaction and the trader’s trading volume. For detailed fee information, visit CVTrade’s official website.

CVTrade Account Verification

CVTrade requires users to complete account verification to comply with regulatory standards. This involves submitting personal information and documentation to unlock advanced features and higher transaction limits.

CVTrade Regulation

CVTrade operates under regulatory frameworks in various jurisdictions, ensuring compliance with legal standards for cryptocurrency exchanges. Users should review CVTrade’s terms of service for region-specific information.

CVTrade Supported Countries

CVTrade serves users in multiple countries worldwide, though service availability may vary due to regulatory constraints. Check CVTrade’s official website for the most current information on supported regions.

CVTrade Support and Reviews

CVTrade offers customer support through multiple channels, including an online help center and email. While the platform is generally well-regarded for its features and security, users have noted occasional delays in customer service responses.

Areas for CVTrade Improvement

CVTrade could improve by:

- Enhancing User Education: Providing more resources for new users.

- Improving Customer Support: Reducing response times.

- Expanding Regional Availability: Increasing service access in more areas.

Conclusion

CVTrade is a noteworthy cryptocurrency exchange praised for its user-friendly interface, competitive fees, and diverse digital asset offerings. Despite some limitations, such as the need for improved educational resources and customer support, CVTrade remains a solid choice for traders seeking a reliable platform in the digital asset space. Share your thoughts or questions below!

Follow CVTrade.io on Social Media: Facebook | Instagram | LinkedIn | Twitter | Medium

FAQ

Is CVTrade safe?

Yes, CVTrade prioritizes security with features like two-factor authentication (2FA), cold storage for most funds, and regular security audits to ensure user protection.

What are CVTrade’s trading fees?

CVTrade’s trading fees generally range from 0.1% to 0.2%, depending on the type of trade and 30-day trading volume. Higher trading volumes often qualify for reduced fees.

Does CVTrade support fiat currencies?

Yes, CVTrade supports a variety of fiat currencies, including USD, EUR, and GBP, for both deposits and withdrawals, providing flexibility for international users.

How do I contact CVTrade customer support?

You can reach CVTrade customer support through their online help center, email, or live chat options available on their website.

Is CVTrade available in my country?

CVTrade is accessible in many countries around the world. However, service availability and features may vary based on regional regulations and local laws.

Crypto

MFEV Announces Investment-Based Referral Program with No Lock-In Period: 3.8 Million Coins Available

MFEV, a leading innovator in the blockchain and cryptocurrency space, is excited to unveil its latest initiative: an investment-based referral program designed to reward participants with MFEV coins. With a total of 3.8 million MFEV coins allocated for this program, the company aims to incentivize and reward both new and existing investors as they participate in the ongoing Initial Coin Offering (ICO) rounds.

Investment-Based Referral Program: A Unique Opportunity for Investors

This referral program is investment-based, offering a unique and lucrative opportunity for potential investors to earn additional rewards. Designed to immediately capture attention and foster a sense of opportunity, the program allows participants to benefit directly from their investments in MFEV.

Eligibility Criteria: How to Earn Rewards

To participate, investors need to join the MFEV pre-sale or public round of funding. As part of the rewards program, referrers will earn 2% of the total investment made by the individuals they refer. Both investors and referrers must refer new investors to qualify for the rewards.

The more your referred investors contribute, the greater the number of MFEV coins you will earn from a designated pool of 3.5 million coins. This clear and rewarding structure encourages broader participation, making it easy for participants to see the tangible benefits tied to their referrals and investments.

No Lock-In Period: Flexibility for Investors

A key feature of the program is the absence of a lock-in period for referral rewards. This flexibility is designed to appeal to a wide range of participants, particularly those who may be cautious about long-term commitments. By eliminating any lock-in requirements, MFEV is making it easier for investors to engage with the program without the burden of extended time constraints.

Who Can Participate? Inclusive Eligibility for Maximum Appeal

The program is open to everyone: individuals who have already invested in MFEV, as well as those planning to invest in upcoming rounds. This inclusive approach ensures that a broad spectrum of investors can benefit, expanding the program’s appeal and accessibility.

Disclaimer: First-Come, First-Served Basis

To maintain the program’s integrity and incentivize quick participation, the investment-based reward plan operates on a first-come, first-served basis. Potential investors are encouraged to act swiftly to secure their share of the 3.8 million MFEV coins available as part of the referral reward.

Looking Ahead: Future Promotional-Based Referral Program

While this PR focuses on the investment-based referral program with 3.5 million MFEV coins, MFEV also has plans to introduce a promotional-based referral program in the near future, which will allocate an additional 343,000 MFEV coins. More details on this exciting development will be released soon.

About MFEV

MFEV continues to set the standard in blockchain innovation, with a commitment to empowering investors and expanding access to the benefits of cryptocurrency. Through its strategic initiatives and investor-friendly programs, MFEV is building a more inclusive and rewarding financial ecosystem for all participants.

Website: https://www.mfev.io/

-

Crypto3 years ago

Crypto3 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release4 years ago

Press Release4 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release4 years ago

Press Release4 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release4 years ago

Press Release4 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release4 years ago

Press Release4 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain5 years ago

Blockchain5 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins