Blockchain

CVNT: 2021 New Trend in Blockchain Industry

In the blockchain industry, we must see the future before others.

BTC has risen to the highest point in history, and now it is not suitable for us to take a heavy position.

From the perspective of investment, investment based on fundamentals is the kingcraft investment, which is the psychological cornerstone for people to face short-term fluctuations and remain firm, so that the explosive power of BTC, ETH, LTC, dot, uni, etc. in the bull market will not be ignored. The impact of fundamentals on the secondary market price can only be exerted in the bull market stage.

So what are we going to invest next to create more profits for us?

The answer is to refer to what organizations are laying out.

Recently, with the head application RR dVod coming online soon, and the airdrop transformation of the original Internet project, YYeTs has accumulated “capital” in 16 years, including 20 million active users and data pools, tens of thousands of part-time translators from all over the world, and nearly 100000 translation lovers.

The overall development progress of CVNT conscious value network is relatively optimistic, and the future has become more and more clear. Many institutional investors around them regard CVNT as a rare opportunity and focus on the layout.

Blockchain project is the competition of capital in the final analysis. For ordinary people, opportunities will only appear in the earliest stage, only when a large amount of funds do not enter the market in batches. The CVNT storage mining and RR dVod content distribution mining, which will be started soon, are likely to give birth to a number of new rich people in the coin circle.

Opportunities are fleeting. Considering that CVNT is also an old public chain project, I will not elaborate on the background of the project and the whole storage public chain track in the following contents. I will deconstruct the currency price rise and appreciation logic most concerned by everyone from three perspectives: the fundamentals of the project, the head application RR dVod and the value capture of CVNT token.

CVNT: 2021 New Trend in Blockchain Industry

CVNT conscious value network (hereinafter referred to as CVNT) is committed to solving the problems of low performance, poor security, high development difficulty and excessive dependence on service charges of existing blockchain applications, and realizing the performance expansion and decentralized storage of distributed applications. The newly upgraded “VRF consensus main chain + PoST+ double chain structure” runs perfectly in the main network released by CVNT in the middle of last year, establishing a high scalability, high performance and stable underlying storage architecture. Based on the new consensus algorithm, the block speed, success rate, delay, server cost and scalability cost of CVNT’s main network greatly surpass those of the same kind of public chain. In addition, there are many innovations in the way of technology development, which jointly support the positioning of “distributed database cloud + BaaS platform” and the realization of related functions.

Compared with Filecoin, which also uses the consensus of PoST, CVNT main network goes online earlier. At present, the block height is nearly 50 million, TPS / CTPs is more than 50000, and 100 super nodes are supported. On the basis of inheriting the existing mature scheme, all the advantages of PoST are realized by superposition, and the current technical dilemma of Filecoin is broken down one by one. Compared with the long project cycle and huge goal setting of Filecoin, CVNT pays more attention to the large-scale implementation of commercial level decentralized applications, supports the current Internet projects migration and traditional entity enterprise asset digitization, including the integration of baas technology into its own business.

RR dVod is a decentralized and innovative video network system deployed on the CVNT value conscious network, which carries 20 million users of YYeTs to deploy on the chain. The product system covers three functional modules: video content player / distribution / search, high-quality content investment and equity, and distributed DSN.

Because of the extraordinary competitiveness of RR dVod, many people think that CVNT is likely to become a big Mac project in 2021. In addition, from the recent situation, the most difficult part in the development of CVNT is close to completion. In the Q1-Q2 roadmap released in January, we can see the four major update plans of CVNT. Each of these updates points to the huge market of billions of dollars, reflecting the high thinking of the project core team on the implementation and evolution of blockchain technology in the past two years. These include:

(1) Evolving the pest consensus

Build general level decentralized (distributed) storage infrastructure

The essence of blockchain is distributed and decentralized. One of the bottlenecks in the development of blockchain is the distributed storage capacity. Especially for most basic public chains, how to store a large amount of data in their main chain is an urgent problem. The future distributed application (DAPP) wants to become a super application widely used by the public, it must also solve the storage problem. Therefore, the distributed storage of CVNT is likely to become the infrastructure of the future blockchain industry, which brings us huge imagination.

(2) Redefine the operation mode of erc20

IPFS and Filecoin adopt the post storage capacity consensus algorithm to realize the main storage chain, but it is almost impossible to achieve good integration in terms of smart contract and virtual machine. CVNT introduces a multi language supported smart contract virtual machine to realize a function similar to “bridging”, that is, CVNT is allowed to run smart contracts of other blockchain projects, and other blockchains are also allowed to run smart contracts of CVNT.

(3) The next generation of smarter smart contracts

CVNT’s smart contract is an extremely secure and stable next generation smart contract, which extends and supports new business application level functions such as NFT’s registered assets, and fully supports decentralized applications to protect privacy. This will enable CVNT network to support the requirements of many enterprise level blockchain applications, which is an extremely broad blue ocean market.

(4) Improve the scalability of the underlying public chain and avoid hard bifurcation

CVNT VRF consensus main chain relies on the random algorithm with little computation and almost no delay. In terms of scalability, the algorithm can make a great breakthrough. At the same time, only one block with the highest priority is notarized every time, which means that the blockchain will hardly bifurcate. Based on this, if new technology appears in the future, it can be easily added to the CVNT system, which is conducive to the upgrade and iteration of the system.

To enjoy the sweet asset growth brought by high-quality digital assets now is the result of “fundamental investment is kingly investment” and taking investment actions accordingly when there is panic in bear market.

Therefore, from the framework of CVNT and the current operation of the main network, we can see the determination and courage of the team to open up the era of public chain 3.0. Every step is steady, willing to invest resources for the technical vision, and the promised technical milestone never jumps. It is a real basic strong project.

20 million users have joined CVNT. The future is beckoning to you. What are you waiting for?

Blockchain

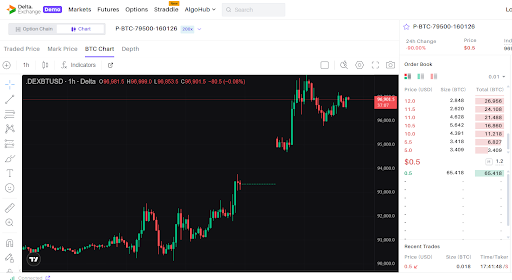

5 Reasons Why Delta Exchange is the Easiest Platform for Crypto Trading Strategies in the Indian Market

Crypto trading in India has grown exponentially in the last few years. In 2025, the market pulled in $258 million in revenue and is on track to hit nearly $732 million by 2033, growing at a 14.3% CAGR from 2026 onwards. That kind of money doesn’t come from people buying Bitcoin on a whim and hoping for a lucky spike. It comes from traders who plan entries, manage exits, build hedges, and run full-blown crypto trading setups.

This shift has created a new problem. Most Indian crypto exchange apps still feel built for basic spot buying without any advanced features to try. You open five tabs, check prices on one app, place orders on another, track risk on a third, and hope nothing slips through.

Delta Exchange transforms the story here. Instead of spots, Delta offers a safe trading platform to explore crypto derivatives (futures and options) across major currencies.

Let’s understand more about Delta Exchange and why so many Indian traders end up sticking with it once they try it.

Why Try Crypto Trading Strategies on Delta Exchange

Ranked among the top Indian crypto exchanges, Delta Exchange offers a range of features and analytics tools to simplify your crypto trading experience.

Here’s why many traders trust Delta Exchange:

- INR trading keeps things simple

If you’ve ever had to convert INR to USDT or USD just to trade Bitcoin, you know the hassle. Delta Exchange lets you deposit and withdraw in INR directly via UPI, IMPS, NEFT, and bank transfer, with your margin and profits shown in INR.

That means no awkward crypto conversions or extra wallets – you fund your account straight from your bank and start crypto trading like it’s normal money.

- Algo trading bots that actually work

Automation can save hours and reduce emotional stress and decisions, especially with fast moves in crypto F&O. Delta Exchange supports algo trading through APIs and bot integrations from platforms like TradingView and Tradetron.

You can link your trading strategy to webhooks or APIs and let bots place trades for Bitcoin futures or other crypto options even when you’re away. If you want systematic, repeatable strategies with fewer missed opportunities, this setup feels practical and real.

And the best part? You don’t need to have any coding knowledge or degree – API Copilot does it all for you.

- Lower trading fees that don’t eat into your wins

Fees matter because every percentage point you pay is one less in your pocket after a winning trade. Delta Exchange offers competitive taker and maker fees, plus a fee cap on options that limits how much you pay on low premium trades.

This helps keep costs predictable, whether you’re trading Bitcoin or ETH futures and options. Traders who place frequent trades or use multi-leg strategies on the Indian crypto exchange can keep more of their gains, rather than having them eaten up by trading fees.

- Strategy Builder for practical trading plans

Strategy planning can get messy if the platform doesn’t help you visualize outcomes. Delta Exchange offers tools that let you craft crypto F&O setups with clear strike choices and expiries, plus daily, weekly, and monthly options for more precise timing. This helps you conveniently plan spreads, straddles, or hedges.

- Compliance and risk measures to know

It’s one thing to trade, another to trust the platform doing it. Delta Exchange is registered with India’s Financial Intelligence Unit (FIU) and follows local KYC and AML rules.

For risk management, the platform supports:

- Margin controls and stop-loss tools that help you manage positions while you trade Bitcoin or other crypto derivatives.

- Demo account to practice trades and understand the market without real money.

- Payoff charts show you how your trade will play out with breakeven points and maximum P&L.

This way, you can study your crypto trading strategy better before finalizing the trade.

Apart from these, Delta also offers leverage up to 200X – a good way to amplify your profits if the market moves in your favor.

The Bottomline

Indian crypto traders have moved far past the buy-and-hold phase. Spot crypto trading still has its place, yet most active users now want faster ways to make money from price swings, not wait months for a rally.

That’s where crypto F&O, spreads, and short-term setups step in. You want tools that let you react within minutes, control risk, and lock gains when the move shows up.

Platforms that only support basic coin buying just can’t keep up with that style of trading. Serious traders want flexibility, speed, and ways to work with volatility, not sit through it – and Delta Exchange caters to such traders well.

Disclaimer: Crypto trading carries inherent risks due to its high volatility. This article is for informational purposes only. Kindly do your own research before making any investment decisions.

Blockchain

MoonExe Aligns With the Next Phase of Stablecoin Payments as Global Regulation Accelerates

MoonExe today reaffirmed its strategic focus on stablecoin-powered payment infrastructure as global regulatory clarity continues to accelerate across major financial jurisdictions.

Regulators worldwide are advancing frameworks that formally recognize stablecoins as legitimate instruments for payment, settlement, and treasury operations. Legislative initiatives in the United States, expanded licensing regimes in Asia, and structured compliance approaches in other regions are collectively signaling a transition from experimental adoption to regulated, real-world deployment.

As stablecoins move deeper into mainstream financial infrastructure, demand is increasing for platforms capable of delivering real-time liquidity, transparent pricing, and verifiable settlement. MoonExe’s Exchange Finance (ExFi) model is designed to address these needs by enabling stablecoin-based currency conversions that operate continuously, without dependence on traditional banking cut-off times or geographic limitations.

The platform focuses on facilitating efficient value movement while maintaining transparency through public blockchain records. Transactions executed within the MoonExe ecosystem can be independently verified via standard blockchain explorers, reinforcing confidence through auditable, immutable data.

In parallel with regulatory progress, market participants are increasingly prioritizing infrastructure reliability over speculative activity. Stablecoins are being evaluated less as alternative assets and more as operational tools capable of supporting cross-border payments, digital commerce, and treasury flows.

MoonExe continues to expand its infrastructure and partnerships to support this evolution, positioning itself as part of the foundational layer required for stablecoins to function at global scale.

For more information about MoonExe and its stablecoin payment infrastructure, visit https://moonexe.com/

Blockchain

Playmaker to Launch in Q2 2026 as Midas Labs Expands Its AI-Powered Game Creation Ecosystem

Midas Labs, a UK-based Web3 technology company, has announced the upcoming launch of Playmaker, an AI-powered game creation and launchpad platform scheduled for Q2 2026. The platform is designed to lower barriers to game development and funding, operating as a core product within the UNIFI-powered Midas ecosystem.

Playmaker will provide creators, indie studios, and early-stage visionaries with an integrated environment to ideate, build, fund, and publish games without the traditional constraints of large teams or complex technical infrastructure. By combining AI-assisted creation tools with a structured launchpad and marketplace, the platform aims to streamline the path from concept to live product.

According to Jonathan Wheatley, Chief Marketing Officer of Midas Labs, Playmaker represents a natural progression of the company’s ecosystem strategy.

“Playmaker is about enabling participation at every level — from creators and developers to early supporters and players,” said Wheatley. “By integrating AI-driven creation with funding and publishing infrastructure, we’re building a system that allows ideas to move efficiently from concept to execution.”

The platform is powered by the $PLAY token, a fixed-supply utility asset used for project participation, creator payments, marketplace transactions, and ecosystem services. $PLAY operates within the broader UNIFI ecosystem, where UNIFI serves as the access and conversion layer, reinforcing liquidity and alignment across Midas Labs’ products.

Midas Labs has structured Playmaker’s token economy around a non-mintable, scarcity-driven model, designed to support long-term sustainability as platform adoption increases.

The Playmaker launch builds on recent Midas Labs milestones, including the expansion of the Midas Play Marketplace, multiple game releases, ecosystem partnerships, and the rollout of UNIFI staking infrastructure. Together, these components form a vertically integrated environment linking creation, funding, distribution, and participation.

Playmaker is scheduled to go live in Q2 2026, with phased ecosystem access beginning with early contributors before expanding globally.

About Midas Labs

Midas Labs is a United Kingdom–based Web3 technology company focused on building scalable digital ecosystems across gaming, AI, and creator-driven platforms. Powered by the UNIFI token, Midas Labs develops infrastructure designed for long-term participation, real utility, and sustainable growth.

-

Crypto4 years ago

Crypto4 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain6 years ago

Blockchain6 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release5 years ago

Press Release5 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain6 years ago

Blockchain6 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain6 years ago

Blockchain6 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins