Blockchain

BlackRock Bitcoin ETF: Propelling Crypto into the Financial Mainstream

The world’s largest asset manager, has caused a stir in the cryptocurrency world with its proposed Blackrock Bitcoin ETF (Exchange-Traded Fund) added five new companies as authorized participants.

The arrival of these new participants in the ETF has been seen as a bullish indicator for the price of Bitcoin. The ETF, which has accumulated over 260,000 BTC since its launch in January 2023, has become a major player in the crypto sector1. The addition of these new participants has also helped the ETF surpass $10 billion in assets faster than any other US ETF in history

A regulated and streamlined way for investors to gain exposure to Bitcoin, this ETF holds the potential to reshape the crypto landscape.

BlackRock Bitcoin ETF: A Shift in Institutional Sentiment

BlackRock’s interest in Bitcoin signals a potential sea change in how traditional financial institutions view cryptocurrencies. Here’s why this matters:

- Validation: BlackRock, a titan of the investment world, pursuing a Bitcoin ETF lends significant credibility to Bitcoin as an asset class. This development could potentially inspire other major organizations to consider investing in cryptocurrency.

- Accessibility: A regulated Bitcoin ETF removes hurdles for institutional investors who may hesitate to navigate the complexities of directly buying and storing cryptocurrency. It paves the way for more extensive capital inflows.

- Evolving Perceptions: BlackRock’s actions challenge the long-held skepticism within traditional finance toward cryptocurrencies. The firm’s evolving stance reflects a growing recognition of Bitcoin’s potential for long-term value and its role in a diversified portfolio.

- Partnership with Coinbase: In 2022, BlackRock’s partnership with Coinbase, a major cryptocurrency exchange, further solidified its commitment to offering Bitcoin exposure to its clients. This strategic move strengthens their position within the emerging crypto investment landscape.

Lingering Considerations

While BlackRock’s Bitcoin ETF represents a significant step, it’s important to remember:

- Regulatory Hurdles: The approval process for a spot Bitcoin ETF in the US remains uncertain, and regulatory challenges may still lie ahead.

- Market Volatility: Bitcoin, like other cryptocurrencies, is known for price volatility. This risk factor remains present despite the potential benefits of a regulated ETF.

The entire repercussions of this move remain to be seen in the future, but it represents an increasing acknowledgment of Bitcoin’s significance in the shifting investment environment.

Pros and Cons of BlackRock’s Bitcoin ETF

Pros:

- Convenient, Regulated Access: BlackRock’s ETF offers a familiar and regulated way to gain exposure to Bitcoin. Investors can trade the ETF on traditional stock exchanges, eliminating the need to set up a cryptocurrency wallet or navigate complex exchanges. This ease of access can attract new investors who might have hesitated to enter the crypto market directly.

- Diversification: Bitcoin can act as a hedge against inflation and traditional market downturns due to its limited supply and lack of correlation with other asset classes. Including a Bitcoin ETF in a portfolio can offer diversification benefits, potentially reducing overall portfolio risk.

- Price Tracking: The ETF allows investors to track the price movements of Bitcoin within the framework of established financial markets, helps to ensure transparency, and eliminates the need to monitor multiple cryptocurrency exchanges separately.

- Potential for Lower Fees: While ETFs typically have management fees, BlackRock’s scale and reputation could lead to a competitively priced ETF compared to other options. Lower fees would improve overall returns for investors.

Cons:

- Management Fees: As mentioned earlier, ETFs have fees that eat into returns. Investors should consider these fees when comparing the ETF’s performance to the underlying asset (Bitcoin).

- Loss of Direct Control: ETF investors don’t directly own Bitcoin but hold shares that represent it. They have no control over Bitcoin and are subject to the custodian’s security measures.

- Centralization Concerns: Some argue that Bitcoin ETFs could contribute to the centralization of the Bitcoin network. If a limited number of large institutions hold a significant portion of the ETF, it could concentrate control and potentially go against the decentralized philosophy behind Bitcoin.

Additional Considerations:

- Tracking Error: A potential drawback of ETFs is tracking error, which occurs when the ETF’s performance deviates from the underlying asset. Investors should understand how BlackRock’s ETF is structured and how closely it tracks the price of Bitcoin.

- Tax Implications: Tax regulations on cryptocurrency can be complex. Investors should research the tax implications of investing in a Bitcoin ETF in their country’s jurisdiction.

- Bitcoin’s Immaturity: The cryptocurrency market is still relatively young, and Bitcoin, like other cryptocurrencies, is a volatile asset, meaning that Investors should be comfortable with a higher degree of risk before considering a Bitcoin ETF.

The Crucial Role of Authorized Participants: Market Makers of the Bitcoin ETF

Authorized Participants (APs) are the backbone of the ETF ecosystem, and their role is particularly vital in a Bitcoin ETF. Essentially, these APs, which are typically large financial institutions, are responsible for:

- Creation and Redemption: APs have an exclusive agreement with BlackRock, allowing them to create new ETF shares when demand is high and redeem existing shares when supply outpaces demand. This mechanism helps maintain the balance between the ETF’s share price and the underlying value of the Bitcoin it represents.

- Liquidity: APs inject liquidity into the market, ensuring smooth trading of the ETF and preventing large price swings due to imbalances in supply and demand.

- Arbitrage Opportunities: APs closely monitor the ETF’s price about the value of its Bitcoin holdings. If discrepancies arise, they can exploit these pricing gaps through arbitrage, ensuring the ETF’s price stays aligned with Bitcoin’s market value.

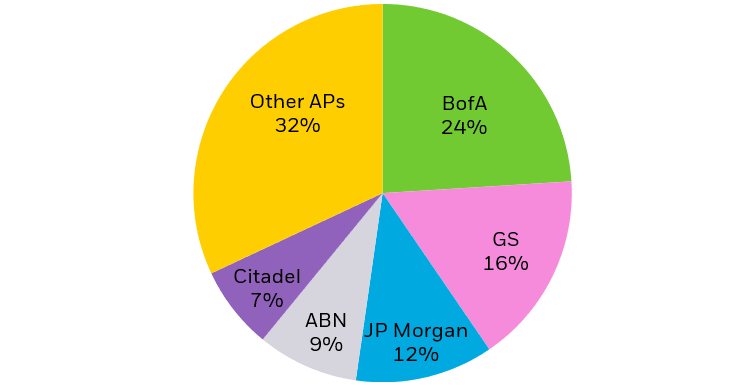

Who’s Involved: BlackRock’s Authorized Participants

BlackRock has enlisted reputable and well-established financial institutions as APs for its Bitcoin ETF. These include:

- Goldman Sachs

- Citigroup

- UBS

- Citadel Securities

- ABN AMRO

- Jane Street Capital

- JPMorgan

- Macquarie

- Virtu Americas

The Significance of BlackRock’s Bitcoin ETF

The involvement of these established financial giants as authorized participants lends credibility and stability to BlackRock’s Bitcoin ETF. It signals institutional confidence in the ETF’s structure and their willingness to participate in the cryptocurrency market in a regulated manner, potentially leading to an increase in the overall investor interest in the ETF.

Potential Impact of BlackRock’s Bitcoin ETF on the Crypto Market

BlackRock’s Bitcoin ETF could have substantial effects on the cryptocurrency market:

- Increased Adoption: Simplifying the investment process might attract new capital and boost Bitcoin’s adoption.

- Enhanced Liquidity: The ETF could improve liquidity within the Bitcoin market.

- Regulatory Scrutiny: An approved ETF might accelerate regulatory oversight of the crypto space.

- Market Volatility: ETF-driven demand could contribute to price fluctuations in the short term.

BlackRock’s Bitcoin ETF: A Catalyst for Change

BlackRock’s proposed Bitcoin ETF signals a potential watershed moment for the cryptocurrency industry.

It could usher in a new era of broader adoption and institutional investment. However, as with any investment, it’s crucial for individuals to carefully assess the potential benefits and risks before making decisions.

The involvement of authorized participants and BlackRock’s entry into the crypto space will significantly impact the market’s evolution.

Whether investing in BlackRock’s Bitcoin ETF aligns with your personal risk tolerance and investment strategy is a decision that requires careful deliberation.

Blockchain

BlockDAG’s $331.5M Presale Steals The Show As TRON Transactions Jump & Dogecoin Eyes Breakout

Technical patterns often reveal more than short-term excitement. TRON has seen its daily transactions jump 80%, showing strong network activity. Dogecoin, on the other hand, is forming a descending triangle pattern that hints at a possible sharp move ahead. Both coins are drawing attention, one for higher usage, the other for possible price action.

But BlockDAG (BDAG) clearly leads with its real-world partnership and forward-thinking presale. With $331.5M raised and over 23.5 billion coins already sold, BlockDAG offers a unique combination of utility and opportunity. The limited-time $0.0016 GLOBAL LAUNCH release price opens the door for greater potential returns. For anyone looking at which crypto to buy today, BlockDAG’s offer stands out with real use and future upside.

TRON Daily Transactions Soar 80% Showing Strength

TRON technical data shows an 80% rise in daily transactions. Activity has grown from about 5 million to nearly 9 million a day since last September. The network’s real use has climbed, and higher fees paid in TRX on-chain point to steady demand beyond short-term moves. However, TRON’s price faces strong resistance at $0.28. Its price has remained between $0.275 and $0.283 where many liquidation points limit upward movement.

The Relative Strength Index is also close to overbought levels, suggesting the chance of a short-term dip unless volume builds to break higher. For TRON to leave the tight range of $0.26 to $0.28, continued buying power will be key. Larger holders adding quietly and increasing social media talk suggest that a breakout could happen if the $0.28 barrier is finally cleared.

Dogecoin Shapes Triangle Pattern Eyes Big Break

Dogecoin is forming a descending triangle pattern where the price keeps bouncing off steady support around $0.1369 while making lower highs. This points to a phase where price action tightens, often before a major move. The repeated tests of support match the classic “1-2-3” pattern often seen before price climbs, showing strong interest from buyers at these levels.

As the pattern narrows, price swings have become smaller, which usually sets up the conditions for a breakout. Many are watching for a push toward $1 if the price can move above the triangle. If momentum holds, the price could go even higher. As price nears the tip of the triangle, the odds of a large move increase, with traders positioning ahead of a possible sharp rise.

BlockDAG Raises $331.5M Presale Selling 23.5B Coins Fast

The Seattle Seawolves have teamed up with BlockDAG to deliver blockchain-driven fan experiences that reach beyond match days. This partnership brings a digital dimension to sports fandom. Fans can collect official digital items like NFTs and tradable digital pieces that mark special moments with the team. This creates a sense of digital ownership in the team’s story.

Through the X1 App, fans can gather memorable moments, earn rewards for engaging with content, and view exclusive videos like behind-the-scenes clips and highlights. This effort builds a stronger bond between the community and the technology shaping future fan experiences.

At the same time, BlockDAG’s presale has surpassed expectations. The project has raised $331.5M so far and sold over 23.5 billion coins. With Batch 29 coins priced at $0.0276, early supporters have already seen a 2,660% return since Batch 1. Thanks to the GLOBAL LAUNCH release, new participants can still access the $0.0016 price for a limited period until August 11. This chance offers clear utility and high potential for returns.

Summing Up!

While Dogecoin watchers focus on chart patterns and TRON followers note stronger network use, BlockDAG is delivering practical results. Its partnership with the Seattle Seawolves brings real value by linking sports fans with digital experiences, while the presale keeps setting new records.

BlockDAG has sold over 23.5 billion coins and provided a 2,660% return since Batch 1. With a special GLOBAL LAUNCH release price of $0.0016 active for a short time, this project offers clear access and potential for growth. For anyone weighing not just hype but real-world use, BlockDAG provides a stronger case for those thinking about which crypto to buy today.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Blockchain

BlockDAG’s GLOBAL LAUNCH Release Edge: Why It Outshines BONK and LINK with $0.0016 Presale Price Lock

Price stability is becoming a rare advantage in crypto, especially as traders weigh shifting momentum signals. LINK is currently holding at a technical crossroads with on-chain data showing a cautious tone among major holders. BONK, on the other hand, is seeing a surge in trading volume and buy-sell delta, pointing to short-term interest, but resistance levels could limit its next move.

BlockDAG, by contrast, is drawing attention for locking its presale price at $0.0016 despite batch 29 being priced at $0.0276. This calculated decision gives BlockDAG (BDAG) an edge by offering a consistent entry point as part of its GLOBAL LAUNCH release.

BONK Price Update: Volume Spike Signals Growing Momentum

The latest BONK price update shows a significant shift in market sentiment, with trading volume rising by 98.33% to $160.5 million. Alongside this surge, there’s a notable buy-sell delta of +127 billion tokens, indicating strong accumulation and bullish interest. After bouncing off the $0.000013 support, BONK briefly touched $0.00001480 before stabilizing around $0.00001446, showing that buyers are actively defending recent gains.

Technically, BONK faces a critical resistance near $0.000015. A break above this level could lead to a stronger rally, but failure to hold may cause a retest of lower support levels. Despite slight overbought conditions, the increase in volume and open interest indicates confidence in the upward trend, making BONK a closely watched asset in this phase of its price cycle.

LINK Price Faces Uncertainty as Traders Watch Key Levels

The LINK price forecast remains uncertain as the asset hovers at a crucial crossroads. Data reveals that investor activity is slowing, with whale wallet interactions dropping and fewer LINK tokens being moved off exchanges. This suggests caution among large holders, with potential overhead pressure. Although LINK is currently holding above a short-term support zone, it shows signs of hesitation that could impact short-term momentum.

Traders are closely watching whether LINK breaks above resistance or falls below the $13.5–$13.9 range, as this could signal the next move. The Relative Strength Index (RSI) is in neutral territory, indicating neither buyers nor sellers have clear control. As LINK stalls near these key levels, the price forecast will depend on whether accumulation picks up or a broader pullback occurs.

BlockDAG Locks In $0.0016 Presale Price with GLOBAL LAUNCH Release

BlockDAG has made a strategic move by freezing its presale price at $0.0016 as part of its highly anticipated GLOBAL LAUNCH release. This decision is designed to protect retail buyers from late-stage price increases, ensuring they get the same early pricing as the initial backers. While the official Batch 29 price is $0.0276, this special offer lowers the barrier to entry, giving participants the chance for a higher ROI.

BlockDAG’s presale has already raised over $329 million, with more than 23.5 billion coins sold, making it one of the most discussed presales of 2025. The ROI since Batch 1 has reached 2,660%, and the locked price of $0.0016 further increases the potential for buyers. This structured presale model sets BlockDAG apart, offering a predictable, user-first approach.

Rather than rushing toward unpredictable surges, BlockDAG’s approach prioritizes stability by locking in the presale price. This eliminates the fear of missing out that often comes with rapid price jumps, allowing buyers to invest with confidence. As the GLOBAL LAUNCH release approaches, BlockDAG offers a unique opportunity, attracting attention from those looking for a long-term, secure entry point.

Conclusion

While BONK’s rising volume and LINK’s indecision at key levels show that volatility still dominates short-term trading, BlockDAG is offering a more stable approach. By freezing its presale price at $0.0016, BlockDAG removes the uncertainty that typically accompanies late-stage investments. This stability has caught the attention of investors seeking a clear, reliable path ahead of major launches.

Unlike other projects that react to market shifts, BlockDAG is taking a proactive approach by focusing on structure and timing. As the GLOBAL LAUNCH release nears, BlockDAG is positioning itself not through speculation but by allowing buyers to participate under clear, predictable terms. This makes BlockDAG stand out as a crypto that’s not relying on hype, but offering real, tangible value for those preparing for long-term gains.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Blockchain

Russian Defense Manufacturer Eyes Stablecoin Launch on Tron Blockchain

A major Russian arms manufacturer is reportedly developing plans to launch its own stablecoin on the Tron blockchain, signaling a growing interest in decentralized finance (DeFi) solutions within state-linked industries.

According to sources close to the matter, the initiative is being explored as a means to bypass traditional financial systems and mitigate the impact of international sanctions. By leveraging blockchain technology—specifically the Tron network known for its low fees and fast transactions—the company aims to facilitate more efficient cross-border transactions and secure trade settlements.

While the identity of the defense contractor has not been officially disclosed, insiders suggest that the stablecoin project is intended for use in settling international arms deals and procuring critical materials. The move would allow the company to conduct business with foreign partners without relying on SWIFT or other Western-controlled financial infrastructures.

The choice of the Tron blockchain is particularly notable. Tron, founded by Justin Sun, has become a popular network for stablecoins like USDT due to its high throughput and low transaction costs. Its growing global user base makes it an attractive option for entities seeking financial flexibility and speed.

The development comes amid Russia’s broader push to integrate digital assets into its economy. The Russian central bank has already launched pilot programs for a digital ruble, while private and state-linked entities are increasingly exploring crypto-based alternatives to facilitate international trade.

If realized, this stablecoin project could set a precedent for other state-affiliated organizations seeking to harness blockchain technology in the face of geopolitical and economic restrictions.

-

Crypto3 years ago

Crypto3 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release4 years ago

Press Release4 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain5 years ago

Blockchain5 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins