Recent Updates

Bitcoin Price Fall: What Means For The Future of Crypto?

Published

2 years agoon

By

sky0x.ethIn recent news, the Bitcoin price has plummeted. Many people are wondering what this means for the future of crypto and whether or not it is a sign of things to come.

Most people are not sure what caused the sudden decline in Bitcoin prices. It was exciting for most investors as the value of Bitcoin shot up to $69,000 in November 2021. However, this joy was short-lived as the prices dropped in June 2022 to about $20,000.

What Caused Bitcoin Price Falls?

There are a few factors that could have contributed to the decline. Firstly, there is the US Securities and Exchange Commission’s (SEC) legal battle with Ripple Labs, Inc., which is one of the largest companies in the crypto space. The SEC has charged Ripple with conducting an unregistered security sale. This has caused uncertainty in the market and could have contributed to investors’ hesitancy.

Secondly, there has been increasing regulatory pressure on the cryptocurrency industry. Governments around the world are starting to take a closer look at cryptocurrencies and how they are used. This is causing additional uncertainty in the markets and could be another factorcontributing to the dip in Bitcoin prices.

Lastly, there has been a surge in the number of institutional investors entering the cryptocurrency markets. These large, institutional investors often behave differently than smaller individual investors and can cause large swings in prices.

What Affects Bitcoin Value

As you may have realized, the value of Bitcoin is quite volatile. This is due to its decentralized nature and the fact that it is not backed by any government or central bank. As a result, the supply and demand for Bitcoin can have a huge impact on its price.

When there is more demand for Bitcoin, prices tend to rise; conversely, when there is less demand, prices tend to fall. This is why it’s important to pay attention to news and events that can affect the demand for Bitcoin.

It’s also important to keep in mind that the price of Bitcoin can be affected by other factors as well, such as market speculations, trading activity and even political developments.

Recently, there have been quite a number of global events including:

- War in Ukraine

- High-interest rates

- Fears of inflation

These factors have had a serious impact on the global stock markets and it’s likely that they could be contributing to the current dip in Bitcoin prices as well. However, there are others options for trading while waiting for crypto markets to regain momentum. You can use the various bet365 deposit methods to play other games and explore other trading options.

Negative News Affected Crypto Markets

Besides the common factors mentioned above, the media has also been playing a significant role in affecting Bitcoin prices. There have been reports of fraud and theft within the crypto world that have caused investors to be hesitant about investing in cryptocurrency. This negative news coverage has definitely had an impact on the demand for Bitcoin and other cryptocurrencies as well.

In June 2021, China stopped banks and financial institutions from offering crypto services. This news caused a lot of fear and FUD in the markets, resulting in a huge drop in prices across the board.

Recently, in November 2022, FTX, one of the main crypto exchanges, went bust. This caused a lot of concern in the markets, resulting in another big drop in prices.

What Is the Future of Cryptocurrency?

Generally, Bitcoin is known to be volatile and as such, it could gain momentum and rise in price again. However, it is difficult to predict what will happen in the future as there are many external factors that can influence its value.

Nevertheless, most experts agree that cryptocurrency still has a lot of potentials and could be an important part of our financial system in the years to come. As more countries start to recognize crypto as legal tender, the demand for them could increase and this could eventually lead to a rise in prices.

Therefore, it is important to keep an eye on events that could affect the crypto markets and make informed decisions when investing in cryptocurrency.

Conclusion

The recent slump in Bitcoin prices can be attributed to various factors such as increasing regulation, institutional investors entering the market, and negative news coverage.

The dip in Bitcoin prices has caused some cryptocurrency experts to be concerned about the future of digital currency. There are several factors that could be contributing to this decline, including regulatory uncertainty, however, it is important to remember that price fluctuations are normal and to take the long term view when investing in digital currencies. With this in mind, you can expect anything to happen, including a sharp rise in the value of Bitcoin price.

It is also important to stay informed on the latest developments and news in order to make better-informed decisions when it comes to investing. Ultimately, only time will tell what the future holds for cryptocurrency markets.

You may like

Recent Updates

Bitcoin Surpasses $1 Trillion Market Cap

Published

3 months agoon

April 27, 2024By

Ryan Halley

Bitcoin has reached a significant milestone, surpassing a $1 trillion Market Cap and attaining a two-year high price.

This surge reflects a growing FOMO among investors, along with optimistic predictions spurred by upcoming influential events.

The Rise to a $1 Trillion Market Cap

Bitcoin’s recent price surge has catapulted its market cap over the $1 trillion mark, signaling a major shift in investor confidence and market dynamics.

This leap to over $63,000 per Bitcoin comes amid high expectations surrounding new financial products and major events in the crypto world.

Factors Driving Bitcoin Price Surge

The significant surge in Bitcoin’s value, propelling its market cap beyond $1 trillion, can be attributed to a confluence of impactful developments and market dynamics.

The Impact of Investor FOMO

Investor FOMO (“Fear of Missing Out”) has played a pivotal role in the recent price increases.

As Bitcoin’s price began to climb, more investors, afraid of missing out on potential gains, began pouring into the market, further fueling the price surge.

Anticipated US Election Outcomes

The anticipation surrounding the upcoming US elections has also stirred the market.

Investors often speculate on how different election outcomes might affect regulatory frameworks and economic policies related to cryptocurrencies, influencing Bitcoin’s price.

The Bitcoin Halving Event

The impending Bitcoin halving event scheduled for April, which has been in effect since Friday, April 19, is one of the main factors driving the recent surge in the price of Bitcoin.

In the past, halving—which reduces the reward for mining new blocks by half—has raised the price of Bitcoin and decreased its supply.

Investor interest has grown in anticipation of this upcoming event, as lower mining rewards are expected to result in a smaller supply of new Bitcoin, potentially raising prices due to scarcity.

Historical Context and Future Expectations

Exploring Bitcoin’s historical price trends provides context for its recent surge and insight into what to expect in the future.

Historical Price Movements

Bitcoin has seen a pattern of dramatic rises and sharp corrections over its history.

Following each significant increase, the cryptocurrency market experienced regulatory changes, technological advancements, or macroeconomic factors that attracted more institutional investors.

Expert Predictions for Bitcoin’s Future – The 1 Trillion Market Cap Trend!

Experts are increasingly optimistic about Bitcoin’s future price trajectory. Analysts from major financial institutions suggest that the $1 trillion market cap could be just the beginning if current trends continue.

For instance, a senior analyst at JPMorgan has hinted at a potential rise to $75,000 by the end of the year, citing increased institutional investment and limited supply as key drivers.

Another expert from Bloomberg expects that the post-halving scarcity and ongoing financial product innovations like ETFs could push prices even higher.

Recent market trends and upcoming events have reignited the optimism of Bitcoin experts who are convinced of the cryptocurrency’s bright future.

Notably, financial analysts have offered several forecasts:

- Goldman Sachs has predicted that Bitcoin could reach as high as $100,000, citing its growing acceptance as a ‘digital gold’ and a hedge against inflation.

- Michael Novogratz, a well-known crypto fan and investor, suggests that Bitcoin might stabilize around $60,000–70,000 before attempting new highs, especially if the crypto continues the combination with traditional financial systems.

- Cathie Wood of Ark Invest projects even more dramatic growth, predicting that Bitcoin could exceed $500,000 by 2025 if more companies continue to convert their cash reserves to Bitcoin as Tesla did.

- Bloomberg Intelligence has projected a price target of $80,000 for Bitcoin by the end of the year, emphasizing the role of quantitative easing and extensive fiscal stimuli as catalysts.

These forecasts underscore a consensus among many experts that, while volatile, Bitcoin’s trajectory might continue upward, especially with structural changes like halving and increased institutional adoption.

If you’re looking to invest in a promising asset that has the potential to deliver sizable returns, Bitcoin’s upward momentum is a strong indicator that it’s worth considering.

Bitcoin Investment Strategies for Current and New Investors

Navigating investment strategies in the volatile landscape of Bitcoin requires both caution and insight.

Here’s how both seasoned and new investors can approach their investments:

Strategies for Veteran Investors

For veterans in the Bitcoin market, diversification within the crypto sector can help manage risk. Investing in other blockchain technologies or sectors, such as DeFi (decentralized finance) and NFTs (non-fungible tokens), which may benefit from Bitcoin’s rise, is advisable.

Additionally, using advanced trading techniques like algorithmic trading or futures contracts can enhance returns while managing exposure.

Tips for New Bitcoin Investors

New investors should start by educating themselves on the basics of blockchain and Bitcoin.

Given the price volatility of Bitcoin, it is essential to only invest what one can afford to lose.

Starting with small, regular investments—a strategy known as dollar-cost averaging—can reduce the risk of market timing.

Furthermore, choosing reputable exchanges and wallets for purchasing and storing Bitcoin is essential for security.

Both groups should stay updated with market trends and regulatory changes, as these can significantly impact Bitcoin’s market dynamics.

Final Conclusion and FAQ

The significant rise in Bitcoin’s market cap to over $1 trillion showcases its increasing acceptance and potential as a mainstream financial asset.

Investors are paying close attention to the market for new opportunities with the upcoming US election and halving event.

The current climate offers challenges and opportunities, urging seasoned and new investors to adapt their strategies accordingly.

FAQ

- What does a $1 trillion market cap signify for Bitcoin?

- It signifies increased investor confidence and mainstream acceptance of Bitcoin as a viable investment.

- How does the US election affect Bitcoin’s price?

- Election outcomes can influence regulatory and economic policies impacting Bitcoin and the broader crypto market.

- What is a Bitcoin-halving event?

- A halving event reduces the reward for mining new Bitcoin blocks, historically leading to decreased supply and increased prices.

- What investment strategies should new Bitcoin investors consider?

- New investors should educate themselves, use dollar-cost averaging, and keep a careful eye on using reputable platforms.

- Can Bitcoin’s price volatility be managed?

- Yes, through strategies like diversification, using futures contracts, and staying informed about market trends.

Recent Updates

Finland Bitcoin Mining, Boosts District Heating

Published

3 months agoon

April 25, 2024By

Ryan Halley

Finland Bitcoin Mining, boosts district heating integration, proves to be an innovative synergy between bitcoin mining operations and district heating systems, and can serve as a precedent for sustainable energy solutions.

This method maximizes energy use and represents an important step toward environmentally friendly technology applications in the crypto-mining sector.

The integration harnesses excess heat from Bitcoin mining to boost the efficiency of district heating networks, offering a model that could inspire similar initiatives globally.

Exploring Finland’s Bitcoin Mining and Heating Integration

The Bitcoin mining integration with district heating in Finland represents a ground-breaking approach to sustainable energy use, fostering synergy that could set a precedent for future projects worldwide.

Understanding District Heating and Bitcoin Mining

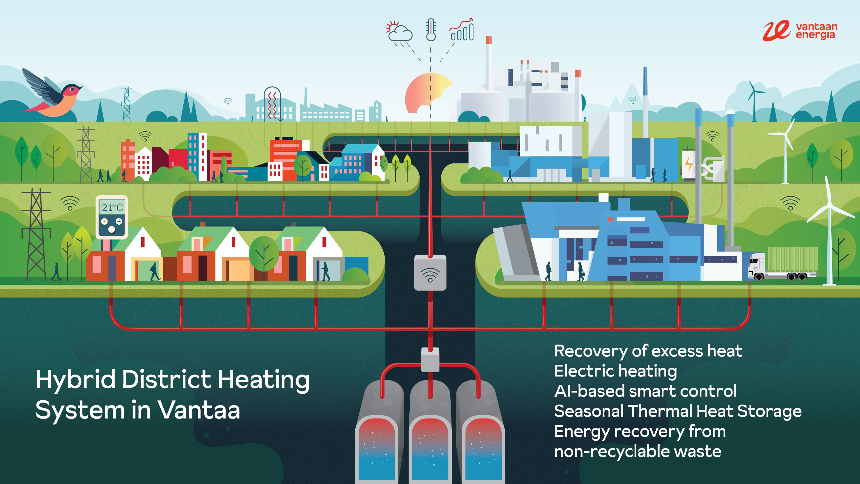

District heating, a prevalent method in Finland’s urban infrastructure, involves centrally producing and distributing heat via a network of pipes to multiple buildings.

District Heating Overview

The system and the idea of district heating can be highly efficient in densely populated areas, which is part of Finland’s commitment to sustainable energy practices.

Over 90% of residents in larger Finnish cities benefit from this system, which is now evolving to incorporate more renewable energy sources and innovative technologies like heat recovery from various processes.

Bitcoin Mining Basics

Bitcoin mining involves the validation of transactions and the creation of new coins through complex computational processes. This operation is energy-intensive, owing primarily to the computational power required.

District heating systems in Finland can become more efficient by utilizing surplus heat from mining operations in combination with district heating.

Integration Mechanics

The synergy between Bitcoin mining and district heating in Finland exemplifies a pioneering approach to sustainable energy use.

Miners benefit from an additional revenue stream by selling excess heat to district heating providers, which contributes to a reduction in their operational and environmental costs.

This model provides economic benefits and positions Finland as a leader in using blockchain technology for sustainable practices.

Benefits of Merging Bitcoin Mining with Heating Homes

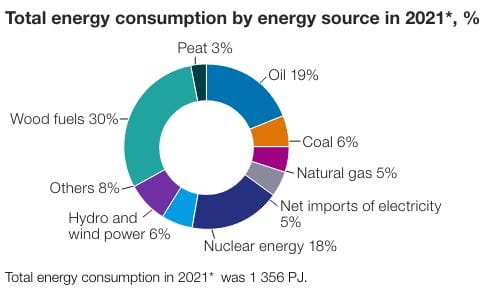

According to Statistics Finland, as of 2021, nonrenewable energy sources account for 69% of total consumption.

These sources included wood (30%), oil (19%), coal (6%), natural gas (5%), and peat (3%).

The integration of Bitcoin mining with district heating significantly reduces environmental impact.

Some of the benefits are:

Environmental Impact Reduction

This model reduces reliance on fossil fuels while also helping to reduce greenhouse gas emissions by utilizing excess heat generated by mining operations for heating.

The advanced heat recovery systems ensure that the heat produced during mining does not go to waste but instead supports the heating needs of local communities.

Economic Advantages for Local Communities in Finland

Economically, this integration offers substantial benefits.

District heating systems can be more cost-effective by using waste heat from Bitcoin mining, resulting in lower heating bills for customers.

Additionally, Bitcoin miners gain a stable income from selling the excess heat, enhancing the financial viability of mining operations in regions with high energy costs.

Cases of Success in using Cryptocurrency Mining as a renewable energy technology in Finland

Finland’s advancement in renewable energy technologies, including significant increases in nuclear and wind power capacities, supports the viability of such integrations.

These developments ensure a stable and abundant energy supply, making the region particularly attractive for energy-intensive operations like Bitcoin mining.

This synergy between renewable energy advancements and Bitcoin mining is helping to establish a precedent for other regions to follow, potentially transforming energy use in industries worldwide.

These examples provide a blueprint for replication in other regions, showcasing the potential for scalable and sustainable energy solutions worldwide.

Challenges and Solutions for Finland Bitcoin Mining and District Heating Integration

Integrating Bitcoin mining with district heating systems poses several technical challenges, primarily related to the efficient transfer and utilization of heat.

Advanced engineering solutions are required to capture and transport the heat produced during cryptocurrency mining.

Robust system controls and monitoring are also necessary to ensure constant operational standards to manage the varied heat output from mining activities.

Innovative Solutions Implemented

Finland has implemented innovative solutions that enhance energy efficiency and system reliability.

These include advanced thermal storage technologies, which allow heat to be stored and used during peak demand, and smart grid technologies, for more flexible and efficient energy distribution.

The integration of renewable energy sources like wind and solar has been optimized to complement the heat generated from mining, stabilize the energy supply, and reduce carbon emissions.

These solutions can help mitigate the technical hurdles but also, pave the way for expanding this model to other regions, potentially transforming how cities worldwide approach energy production and consumption in a blockchain-enabled world.

Future Outlook and Potential Replications

Finland’s model of integrating Bitcoin mining with district heating holds significant potential for scalability.

Scalability of the Model

Thanks to the country’s advancements in renewable energy and district heating technologies, this model can be replicated in colder regions with substantial heating demands.

The success of these initiatives in Finland serves as a promising blueprint for other nations looking to enhance their energy efficiency and sustainability.

Potential Global Impact and Adoption

The global impact of such integrations could be profound, reducing carbon footprints and operational costs across multiple sectors.

As more countries adopt this innovative approach, it could lead to widespread changes in how energy-intensive industries, like cryptocurrency mining, are perceived and utilized in the context of national energy strategies.

This forward-thinking approach promises not only environmental and economic benefits but also positions Finland as a leader in the innovative use of technology for sustainable development.

FAQs

1. How does the integration of Bitcoin mining with district heating work? The process involves capturing the excess heat generated from Bitcoin mining operations and redirecting it into the district heating system. This heat, otherwise wasted, is used to warm residential and commercial buildings, enhancing energy efficiency and sustainability.

2. What are the environmental benefits of integrating Bitcoin mining with district heating?

This integration significantly reduces the environmental impact by lowering the reliance on fossil fuels for heating, thus decreasing greenhouse gas emissions. It leverages renewable energy sources and heat recovery systems to provide a more sustainable heating solution.

3. Can this integrated model be applied in other countries?

Yes, the model has potential for global replication, particularly in colder regions where district heating is essential. Its scalability depends on local energy infrastructure and the availability of renewable energy sources.

4. What economic impacts does this integration have on local communities?

Local communities benefit economically from reduced heating costs and additional revenue streams for Bitcoin miners through the sale of excess heat. This model also promotes local technological and energy sector growth.

5. What are the main challenges in implementing this integrated system, and how are they addressed?

Key challenges include managing the variable heat output from mining operations and integrating it effectively into the heating system. Solutions involve advanced engineering, thermal storage technologies, and smart grid systems to enhance energy distribution and system efficiency.

Recent Updates

Bitcoin High Volatility Day as Halving Approaches

Published

3 months agoon

April 20, 2024By

Ryan Halley

As the Bitcoin community edges closer to the anticipated halving event on April 19, 2024, market dynamics are exhibiting notable fluctuations, with Bitcoin High Volatility.

This event, which will halve the reward for mining new blocks from 6.25 BTC to 3.125 BTC, not only underscores Bitcoin’s designed scarcity but also significantly influences its market volatility.

Understanding Bitcoin’s Halving

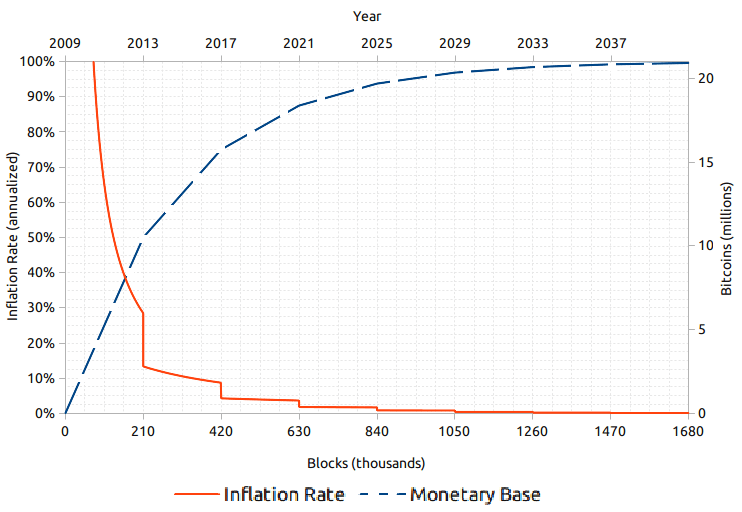

Bitcoin halving is a pivotal event that occurs approximately every four years, cutting the reward for mining new blocks by half.

This deflationary mechanism is crucial for controlling inflation and ensuring a gradual decrease in the distribution of new bitcoins, intending to reach a maximum supply cap of 21 million.

The next halving will reduce the mining reward to just 3.125 BTC per block, a change that underscores the scarcity of Bitcoin and is watched closely by investors and enthusiasts alike.

The Impact of Halving on Bitcoin High Volatility

Historical Volatility Trends Around Halving Events

Bitcoin’s price history around halving events reveals a pattern of increased volatility and significant price surges. The 2020 halving, for example, saw a considerable increase in Bitcoin’s value within months following the event.

These price swings are caused by speculative expectations of lower supply leading to price rises.

However, the magnitude of these surges has decreased with each subsequent halving, suggesting a maturing market that may react differently over time.

Predictions for This Halving’s Market Impact

With the 2024 halving approaching, analysts are predicting potential bullish movements in Bitcoin’s price, with some estimates suggesting a rise to $150,000 by the end of 2025. However, it’s important to manage expectations as Bitcoin’s growing mainstream adoption could lead to more stabilized price movements compared to past cycles. The market’s maturity and the broader economic environment will play critical roles in shaping the outcome of this halving event.

Market Reactions to Impending Halving

Investor Sentiment and Market Dynamics

The anticipation of the halving has led to a varied response from the market, with noticeable increases in trading volumes and strategic holding patterns among large-scale miners. This period is marked by heightened activity and speculation, reflecting the significant interest and potential financial implications of the halving. Google search trends for Bitcoin halving have spiked, indicating widespread public and investor interest.

Strategic Moves by Bitcoin Traders

In preparation for the halving, traders and investors are adjusting their strategies to either capitalize on potential price increases or to hedge against possible volatility. These strategies include accumulating Bitcoin in anticipation of reduced supply post-halving and adjusting portfolio allocations to manage risk during expected high volatility periods.

Technical Perspective on Bitcoin Mining

Changes in Mining Difficulty and Profitability

The halving will directly impact mining profitability by slashing the reward, making it essential for miners to enhance operational efficiency. This necessity drives the adoption of more advanced mining technologies and could potentially increase the consolidation of mining operations, as smaller players may find it difficult to compete.

Innovations in Mining Technology

The reduction in block rewards makes efficient mining operations crucial. Miners are increasingly investing in renewable energy sources and exploring technological innovations such as improved ASIC miners and liquid cooling technologies to reduce costs and improve efficiency. These advancements are crucial for sustaining profitable mining operations in a less rewarding post-halving environment.

Final Thoughts

The upcoming 2024 Bitcoin halving is a crucial event that will not only affect the mining community but also the broader cryptocurrency market. The interaction between reduced supply and ongoing demand could significantly influence Bitcoin’s price and its role in the financial ecosystem. As such, the halving is a focal point for discussions about Bitcoin’s future and its potential long-term stability and growth.

FAQs on Bitcoin Halving:

- What is Bitcoin halving and why does it occur?

- Bitcoin halving is a built-in feature of its blockchain protocol, intended to control inflation by reducing the block reward given to miners, thus slowing down the production of new bitcoins.

- How has Bitcoin’s price historically reacted to halving events?

- Bitcoin has typically seen significant price increases following halving events, although the size of these increases has tended to diminish with each event.

- What strategies might traders consider in the lead-up to a halving?

- Traders may consider buying Bitcoin before a halving to capitalize on the expected increase in price post-event or may engage in short-term trading strategies to exploit the increased volatility.

- How does halving impact the profitability of Bitcoin mining?

- Halving reduces the income miners receive for verifying transactions, which can impact their profitability unless offset by higher Bitcoin prices or improvements in mining efficiency.

- Can halving make Bitcoin a more sustainable cryptocurrency in the long term?

- By decreasing the rate of new Bitcoin creation, halving contributes to the long-term sustainability of the cryptocurrency by promoting scarcity, which could lead to increased value over time.

Introducing the Plena App: A Revolutionary Crypto Super App

How Bitcoin Lotteries Work and Differ from Conventional Lotteries

Introducing Grok-1.5V: Revolutionizing Multimodal AI

Gam3: Revolutionizing Blockchain Gaming with Layer 3 Technology on Arbitrum

Ethora: The Degen Binary Options Trading Platform powered by AI, on Base Network

WEMIX Unveils Groundbreaking Updates for a Sustainable Blockchain Gaming Future

Cardalonia Aiming To Become The Biggest Metaverse Project On Cardano

WOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

P2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

ETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

WOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

Project Quantum – Decentralised AAA Gaming

Trending

-

Crypto2 years ago

Crypto2 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Blockchain4 years ago

Blockchain4 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release4 years ago

Press Release4 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Press Release4 years ago

Press Release4 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain4 years ago

Blockchain4 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release3 years ago

Press Release3 years agoProject Quantum – Decentralised AAA Gaming

-

Press Release4 years ago

Press Release4 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain4 years ago

Blockchain4 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins