Crypto

Bitcoin price drops more than 20% to $42,000. What’s going on?

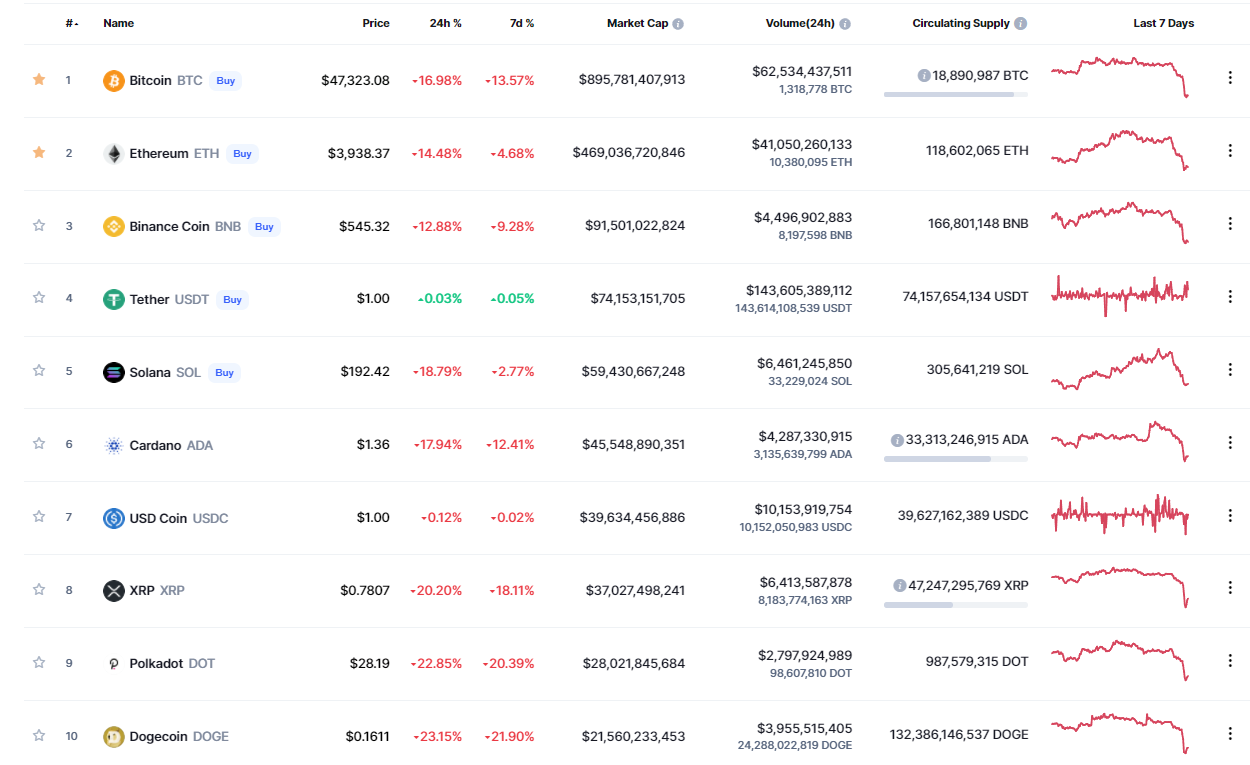

With the new Covid Omicron variant, the bitcoin price drops more than 20%. Bitcoin, Ethereum, and several other cryptocurrencies face a storm of bearish catalysts. Cryptocurrency prohibitions might also be the cause.

Bitcoin price dropped drastically in the early hours of this Saturday, November 4th, falling more than 20%, coming to trade at US$ 42,000.

The price of Ethereum plummeted, dropping more than 25%, to around $3,400, and other known cryptocurrencies have also seen their market prices going down. The total market capitalization dropped 16% to $2.2 trillion.

On a side note, in early November, the total market capitalization of cryptocurrencies reached $3 trillion for the first time in history.

Cryptocurrencies have been in chaos since the appearance of the Omicron form of the coronavirus.

The Bitcoin price drops more than 20% What could be the cause?

On November 26th, bitcoin dropped to a seven-week low to trade at $54,000, entering the falling territory, when in October, it passed the $68000 barrier. At the time of the writing of this article, the price recovered, and it’s trading at $47205,98.

Tech stocks also had a bad week, with the Nasdaq index closing the week down about 2.5%. Cryptocurrency and stock prices are typically not closely correlated, however, large stock sales may be causing investors to become more aware of the overall risk and exit cryptocurrency positions.

The World Health Organization (WHO) said on past Friday, November 3rd, that the variant was detected in 38 countries, compared to 23 two days ago, with initial data suggesting that the strain is more contagious than others.

In addition to fears over the omicron variant, rising yields on US Treasuries may be prompting investors to abandon riskier investments in search of safer returns.

The index fell to its lowest level in over seven weeks. The return of the “red tide” to the markets harmed the most cyclical industries, such as retail and tourism. The energy industry was also among those that suffered the most losses as a result of the reduction in the price of an oil barrel.

Fed Chairman Jerome Powell stated on Tuesday that “it is time to remove the temporary end of inflation,” bolstering the notion that interest rates may increase sooner than expected, which penalized equities on both sides of the Atlantic.

Jerome Powell further warned that this new coronavirus variant offers possible economic hazards at a time when US inflation is at its highest level since 1990.

And this could be leading the investors to liquidate their Cryptocurrency positions.

Cryptocurrency prohibitions and regulatory restrictions across the world

Other causes could be the potential for further regulatory restrictions to be weighing on cryptocurrency valuations.

China has effectively banned cryptocurrency and mining transactions. The conflict between Chinese officials and miners lasted for more than six months.

China prohibited mining activities in May of this year, forcing these business people to shift their equipment to other countries such as the United States, Kazakhstan, and Russia.

On November 16th, China resumed its war on miners, declaring that Chinese officials would work more to penalize unlawful miners.

“Virtual currency mining is high energy consumption and carbon emissions, and does not play a positive role in industrial development and technological progress.”

Said the Chinese Government.

Despite portraying itself as an ecologically correct and environmentally conscious country, China’s primary energy source is coal combustion, as seen in the quotation below.

Following the departure of miners to other nations such as the United States, bitcoin mining is already proving to be more environmentally friendly.

“The risks arising from the production and trading of virtual currency are becoming increasingly prominent. Its blind and disorderly development has a severe adverse impact on promoting high quality economic and social development, energy conservation and emission reduction.”

said Meng Wei, a spokesperson for National Development and Reform Commission in China.

India is about to introduce legislation, not to ban, but to regulate all cryptocurrencies. According to the government announcement, the new law will allow for “limited exclusions to promote the underlying cryptocurrency technology and its purposes.”

The Indian Central Bank further stated that they raised “severe concerns regarding macroeconomic and financial stability.”

The regulation is meant to safeguard Indian consumers when a rising number of individuals, many of whom lack financial expertise or information, are making these sorts of transactions and risk losing their entire investment, treating cryptocurrencies as assets.

The United States has recently signed the US spending bill included new taxes for cryptocurrency brokers.

Among these various factors, Bitcoin, Ethereum, and several other cryptocurrencies faced a storm of bearish catalysts.

Do you the Biswap DEX? If not, you should. Check here and benefit from high APY and low to non-existent fees.

Crypto

Best Altcoins to Buy: BlockDAG, Solana, Cardano, and HBAR Offer Practical Entry Points

When looking for the best altcoins to buy, it helps to focus on projects with clear use cases, steady development, and chances to join early. BlockDAG is gaining attention through its GLOBAL LAUNCH release, rare price level, and a 100M BDAG airdrop that rewards those who take part early.

For those drawn to fast activity and high usage, Solana stands out with strong performance in DeFi and speed. Cardano appeals to those who value a research-first method and long-term planning. Meanwhile, HBAR provides a low-energy option supported by major firms through its hashgraph system.

1. BlockDAG: Price Advantage and Community-Based Tasks

BlockDAG is currently moving fast, with strong backing seen in the $326 million raised during its presale. At the moment, BDAG is available for $0.0016 until August 11. This is one of the lowest prices since its first batch, offering a low-cost entry point ahead of the $0.05 launch price.

More than 23.4 billion coins have already been sold, along with 18,250 mining units. These numbers show that the project is seeing real use. The gap between the current and launch price offers room for a 2,841% gain.

The 100M BDAG Airdrop is now live and set up in two three-month seasons, giving users six months to take part. People can complete simple tasks such as joining Telegram, following on X, posting updates, or inviting friends. These actions help expand the community and earn free BDAG.

Between its smart price model, active campaign, and growing support, BlockDAG (BDAG) is one of the best altcoins to buy for those looking to engage early.

2. Solana: Fast Blockchain with Growing Ecosystem

Solana is known for its fast and scalable blockchain. Using both Proof of History and Proof of Stake, it handles thousands of transactions per second. This setup supports DeFi, NFTs, and gaming. Many consider Solana one of the best altcoins to buy due to its speed, low costs, and strong uptime.

Currently priced around $145, Solana shows solid recovery this year. More developers and partners are joining its ecosystem and launching new dApps. With working technology and practical use, Solana continues to be a choice for those exploring coins with active growth paths.

3. Cardano: Research-Based Blockchain with Real Value

Cardano is known for its secure and energy-efficient approach. It was one of the first to use a proof-of-stake system, helping reduce energy use while keeping transactions secure. A recent upgrade called Mithril improved transaction speed and made it easier for new apps to launch.

ADA is trading near $0.39, showing a steady presence in today’s market. Backed by peer-reviewed research and a focused development team, Cardano keeps working on real-world use. Its careful planning makes it appealing for those looking at long-term projects among the best altcoins to buy.

4. Hedera: Green Payments Backed by Strong Network

Hedera Hashgraph offers a different path with its fast and secure hashgraph system. This approach gives it low fees and quick transaction times. Unlike regular blockchains, Hedera’s setup is designed to be efficient and highly scalable.

HBAR is currently trading at around $0.086, maintaining interest as more businesses try out its features. With enterprise partnerships and a focus on energy use, Hedera fits those looking at cleaner, faster systems in the search for the best altcoins to buy.

How BlockDAG Compares with These Leading Projects

When looking at the best altcoins to buy, early access and practical use both matter. BlockDAG stands out with its current price of $0.0016 and the chance for early gains up to 2,841% before launch. The project’s 100M BDAG airdrop and community-focused setup make it worth watching.

Solana brings speed and wide usage in areas like gaming and DeFi. Cardano builds slowly with solid research and reliable progress. HBAR focuses on speed and energy savings with business adoption. All four offer something unique, but the BlockDAG GLOBAL LAUNCH release timing gives it a different kind of edge before prices move higher.

Crypto

While Hedera Stalls and PI Lags, Web3 ai’s Presale Crosses $8.65M — Best Time to Buy May Be Now!

The crypto markets are moving unevenly heading into the second half of 2025. While some legacy projects are stalling, investor focus is shifting toward innovative presale opportunities that offer stronger upside. Hedera (HBAR) and PI Network have both lost momentum, with analysts flagging a lack of near-term catalysts. In contrast, Web3 ai has surged past $8.65 million, and 21.72 billion tokens sold, still priced at just $0.000443.

This growing AI-focused platform is drawing investors away from slower-moving projects with its promise of real utility and smarter risk management. As volatility grows and narratives shift, the case for Web3 ai as the best time to buy crypto becomes harder to ignore.

Hedera Price Forecast: Analysts Expect Rebound, But Timing Is Unclear

Hedera’s recent 11% drop has put investors on edge. While long-term fundamentals remain intact, short-term traders are cautious. The latest Hedera price forecast points to a possible recovery, but it hinges on whether support near $0.08 can hold. According to analysts, the network’s enterprise partnerships and strong throughput could eventually push prices higher, possibly toward $0.12 or more, but this scenario is far from guaranteed.

Traders watching Hedera are still dealing with bearish technical setups. The lack of strong bullish confirmation on the daily chart keeps sentiment muted, even as some accumulation appears to be taking place. That makes HBAR a candidate for rebound, but not necessarily one of the best crypto investments today.

In this environment, even optimistic Hedera price forecasts are being viewed through a cautious lens. The hesitation among short-term traders is a reminder that legacy projects without immediate catalysts may continue to underperform against new market entrants.

PI Network Price Prediction: Community Hype Meets Harsh Reality

The PI Network has long been a controversial project due to its closed ecosystem and lack of exchange listings. Current PI Network price predictions are reflecting that skepticism. Analysts suggest the token may never reach the $10 mark unless there’s a drastic change in accessibility and utility. Despite having one of the largest communities in the space, PI has yet to deliver on its promise of decentralized mobile mining at scale.

The biggest concern around PI isn’t user engagement but rather token liquidity and real-world usage. The lack of exchange listings continues to stifle price discovery, and recent sentiment indicates that many in the market are losing patience. PI Network price prediction models have adjusted downward, now targeting sub-$5 ranges for the foreseeable future.

For investors looking at the best time to buy crypto, PI’s limitations make it a speculative bet rather than a calculated long-term investment. Without more transparency or token access, it risks falling behind as more structured, utility-driven projects gain traction.

Web3 ai: AI-Powered Risk Management Tool for Real-Time Protection

As legacy coins wobble, Web3 ai is quickly defining itself as a smarter, safer choice for crypto investors. The project’s AI-Powered Risk Management Tool will be a major feature, offering real-time protection in volatile conditions. Using models like Value at Risk (VaR) and Monte Carlo simulations, this tool will allow investors to dynamically assess and manage risk across their portfolios.

Web3 ai’s system goes beyond analytics, it can actively simulate market crashes and flag when users are overexposed to correlated assets. The built-in automation will even allow for setting AI-triggered stop-losses, ensuring quick response times in high-volatility events. This kind of protection has never been more necessary as uncertainty remains a major theme in the crypto space.

At the heart of the Web3 ai ecosystem is the $WAI token, which gives holders access to the platform’s full suite of AI tools. From trading assistants and portfolio optimizers to this risk management layer, $WAI is more than a token, it’s a utility key. Holding the token also offers benefits like staking rewards, governance access, and discounts across the platform.

Currently in Stage 09 of its AI token presale, Web3 ai has already raised over $8.65 million, with more than 21.72 billion tokens sold. With a listing price of $0.005242, early participants at the current $0.000443 price point stand to gain a 1,747% ROI if projections hold. This blend of real utility, strong upside, and presale momentum is turning heads among investors who believe this could be the best time to buy crypto.

The Final Verdict

The crypto market in 2025 is seeing clear shifts in investor preference. Hedera’s potential rebound and the uncertain PI Network price prediction show how older projects can get stuck in limbo. While HBAR may recover and PI might eventually deliver, neither offers the immediate combination of utility and upside that Web3 ai brings.

With over $8.65 million raised and a 1,747% ROI forecast, Web3 ai is more than just another presale, it’s a serious contender for the best crypto investment in the second half of the year. As smart money looks for safer, smarter entries, the momentum behind Web3 ai is accelerating, and the current presale price may not last much longer.

Join Web3 ai Now:

Website: http://web3ai.com/

Telegram: https://t.me/Web3Ai_Token

X: https://x.com/Web3Ai_Token

Instagram: https://www.instagram.com/web3ai_token

Crypto

India’s Most Compliant Crypto Exchange Has Arrived — Welcome to eXchange1

In a space often defined by uncertainty, opacity, and regulatory gaps, eXchange1 is charting a different course. With its official launch in India, the European-regulated crypto platform brings something rare to the digital asset ecosystem: clarity, credibility, and compliance by design.

As crypto markets evolve, regulation has become the single most critical factor for mainstream adoption. India’s policymakers, like their global counterparts, are increasingly prioritizing investor protection, risk mitigation, and oversight. Yet, many exchanges continue to operate in regulatory grey zones—leading to user mistrust, security concerns, and market instability.

eXchange1 was built to address exactly this.

A Fully Regulated Global Exchange

Unlike platforms that try to retrofit regulation after launching, eXchange1 was designed from the ground up to meet the highest standards of global compliance. It is licensed under the MiCA (Markets in Crypto-Assets Regulation) framework by the Financial Crime Investigation Service (FCIS) of Lithuania, and also registered with India’s Financial Intelligence Unit (FIU).

The MiCA regulation, enforced by the European Securities and Markets Authority (ESMA), sets a unified, pan-European legal standard for crypto businesses, focusing on:

- Consumer protection

- Market integrity

- Financial stability

- Transparent disclosures

Being licensed under MiCA not only reflects eXchange1’s operational maturity but also signals a deep commitment to the future of regulated crypto finance.

A Platform Regulators Can Work With

eXchange1 isn’t just compliant—it’s collaborative. Its leadership has experience navigating complex international frameworks, and its systems are engineered to integrate with compliance regimes across multiple jurisdictions. From real-time AML monitoring to KYC onboarding protocols and custodial transparency, the platform is purpose-built to meet the expectations of financial authorities.

“Too often, regulation is treated like a barrier,” says CEO Ms. Sandoval Mera. “At eXchange1, we see it as the bridge between innovation and trust. We’re working with regulators, not around them.”

Ms. Mera, who brings more than 30 years of experience in global policy and institutional frameworks through her work with the United Nations, believes that responsible growth in crypto is not possible without structural accountability.

Local Compliance, Global Strength

India’s Financial Intelligence Unit (FIU) has become increasingly active in holding exchanges accountable. eXchange1 has ensured its full FIU registration to operate in alignment with local laws and enforcement agencies.

By being compliant both globally and locally, the platform is equipped to operate at scale while meeting region-specific standards. This makes eXchange1 one of the few crypto platforms in India that ticks both boxes—global credibility and domestic legitimacy.

This dual-compliance positioning is more important than ever as India continues to lead global crypto adoption, yet remains cautious about unregulated platforms and the risk they pose to users and capital flow.

Bridging the Trust Gap

The global crypto sector has long struggled with reputational risks—from high-profile exchange collapses to poor governance and opaque operations. For Indian users, this has translated into understandable caution, especially among first-time investors and institutions.

eXchange1 addresses this head-on by providing a secure, transparent, and fully regulated ecosystem without sacrificing user experience or performance. The platform offers:

- Enterprise-grade security protocols

- Institutional custody standards

- Real-time risk management systems

- High-liquidity architecture for scalable performance

All of this is designed to offer peace of mind to users, financial institutions, and regulators.

The Case for Regulation-First Crypto

While the early years of crypto were defined by decentralization and borderless innovation, today’s users demand accountability. Government agencies, investors, and the general public want to know: Who’s running this? What laws do they follow? How is my money protected?

eXchange1 provides those answers. The platform’s design integrates compliance into every step of the user journey, from onboarding to trading and withdrawals. Internal audits, risk models, and user protections aren’t add-ons—they are defaults.

Chairman Dr. James Newsome, a former Chairman of the U.S. Commodity Futures Trading Commission (CFTC) and past President & CEO of NYMEX, brings decades of regulatory experience to the table. “Trust is the real currency in crypto,” he says. “Our systems, governance, and approach reflect that understanding.”

More Than Just a License

While many platforms acquire regulatory registration as a checkbox, eXchange1 treats compliance as an operating principle. Its legal teams, risk officers, and product leads work in sync to ensure that every new feature meets evolving policy frameworks—whether in Europe, India, or any future market.

This makes eXchange1 not just compliant, but regulation-forward—ready to help shape the global narrative for crypto governance.

A Step Toward a Safer Crypto Future

As India embraces digital finance, platforms like eXchange1 become critical enablers. By choosing to enter the market only after securing all necessary approvals, eXchange1 sets a powerful precedent: that global crypto growth can be responsible, inclusive, and aligned with law.

For investors, this means access to cutting-edge financial tools with institutional-level safeguards. For regulators, it means a reliable partner in enforcing standards. And for the industry as a whole, it means progress without compromise.

Final Word

India’s crypto future depends not just on innovation, but on infrastructure that regulators, users, and institutions can trust. eXchange1’s commitment to regulation isn’t a strategic advantage—it’s the foundation of its identity.

Media Contact:

media@exchange1.com

-

Crypto3 years ago

Crypto3 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release4 years ago

Press Release4 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain5 years ago

Blockchain5 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins