Crypto

Which Are the 10 Hottest NFT Projects on the Market This Year? Here Is a Complete List

Non-fungible tokens, or NFTs, are causing a paradigm shift in nearly every economic sector.

Whether it’s in economics or the arts, they will have an impact on almost every aspect of society. Here are some of the fascinating initiatives currently underway in this sector.

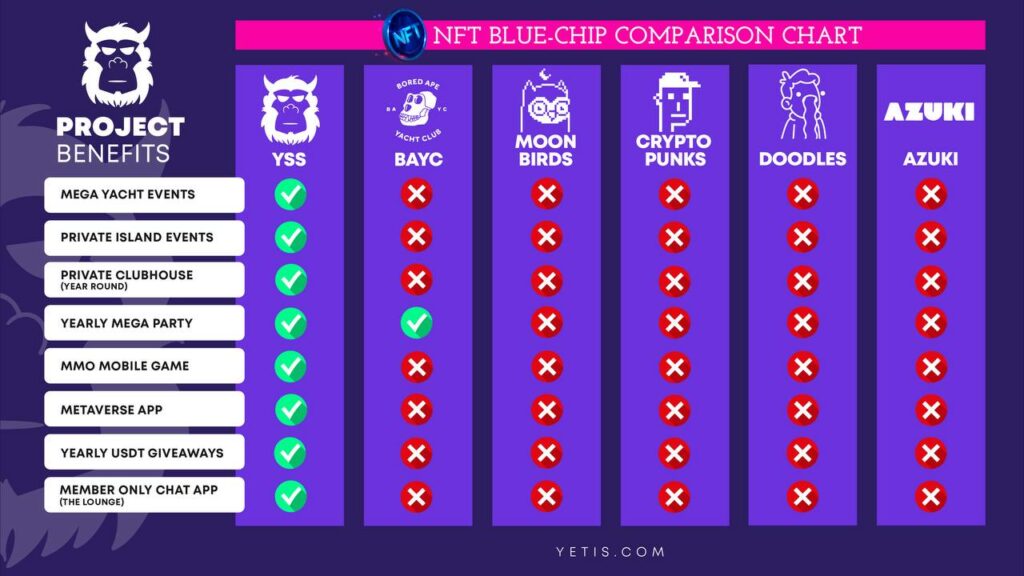

Yeti Secret Society

You must be a member of the Yeti Secret Society‘s investment community in order to join this project’s exclusive club. Yeti Secret Society sees exclusivity as a long-term strategy. Twitter and Discord are the team’s primary social media platforms.

Investors frequently consider the rarity of an NFT while conducting their due diligence. Even in the current market, Yeti Secret Society’s popularity is expected to increase because of its producers’ emphasis on distinctiveness and rarity.

Yeti Secret Society is no exception when it comes to the importance of clubs and communities in a crypto team’s purpose. All Yeti NFT owners will be able to utilize this feature and enjoy its perks.

A 600-person boat journey to Monaco will be included as part of the project’s expansion. Members of the team and celebrities alike are welcome to attend parties on the team’s island. This project will let you meet VIPs, as the founders announced.

The Yeti Secret Society and the MMO game production firm Sapphire Studios have teamed together. MMO game and Metaverse framework will be created as a result of this collaboration.

When it comes to web development, the people behind the Yeti Secret Society have extensive experience. Prior to the broader public, pre-mint users will be able to acquire these new NFTs.

Property’s VR

In the NFT and metaverse, you may find Property’s Virtual Reality, a revolutionary real estate collecting game.

The team’s goal is to develop something that has never been seen before, both within and outside of the metaverse. The team’s objective is to include gameplay elements from famous games throughout the world.

Unique real estate that is related to a specific cultural or economic system is depicted in these NFTs.

The team has been working hard to secure agreements with a variety of different companies and NFT groups ahead of their public launch.

There will be Crypto Baristas-themed coffee shops and carts thanks to the Property’s engagement with the initiative. Investors are keeping an eye on this project since it is part of the user-generated universe.

Invisible Friends

Five thousand animated figures were produced by Markus Magnusson for the Invisible Friends NFT collection. As part of a larger project, the Random Character Collective created this NFT.

It was revealed in an interview with Magnusson, the project’s designer, that this project was intended for those who are still youthful at heart but have a keen eye for art.

Strong demand and high prices were generated when this NFT project was originally offered due to the scarcity of supply. Invisible Friends was out of stock within a day of its release. Their prices rose to 12 ETH at the time of their introduction.

Prior to the mint’s official launch, Invisible Friends created a special golden NFT dubbed Golden Friend. Due to its scarcity, it sold at auction for $1.32 million in ETH. The RCC Charity Fund was the sole beneficiary of the Invisible Friends founders’ generous auction donations.

Token holders will be rewarded, according to the initiative’s creators. Invisible Friends is expected to develop in the future, according to the team’s plans.

LetsWalk

The animator DeeKay was born in Seoul, South Korea, but he now considers the Bay Area to be his permanent residence. The realm of art has always held a great deal of interest for him, going back as far as he can remember.

In addition to being famous for his one-of-a-kind artworks, he is the creator of the LetsWalk line of NFTs. A well-known NFT trader by the name of Cozomo De Medici just purchased his “Destiny” NFT for 225 ETH.

This NFT collection features a variety of “walks,” each of which is remarkable in its own right due to its individuality. DeeKay places the emphasis entirely on the work of art itself, as opposed to depending on “traits,” as is customary in NFTs.

LetsWalk allows spectators to form their own opinions about the artwork that they are watching rather than relying on a conventional ranking system, which was utilized in the majority of the previous NFT initiatives.

Azuki

Azuki presents itself as a project that is “skating” over the unclear boundaries that exist between the digital and real worlds as they continue to converge.

Participants in the Azuki project are granted access to “The Garden,” which is a collection of 10,000 NFTs. This perk comes as part of the whole package. Azuki has high expectations that the project would begin to blur the lines between the digital and real worlds if it is successful in building this “Garden.”

This initiative incorporates streetwear, NFT goods, and live events, as well as personalities and collaborations associated with Azuki.

Ingenious tricks created by Azuki, such as Bobu the Bean Farmer, have also been recognized for breaking new ground in their respective categories.

Bobu, the Bean Farmer, was tasked with the responsibility of chopping up the artwork into more manageable sections and designing a Bobu Token.

Using this token, all owners in the community will have the ability to administer the Bobu character that exists in the Azuki universe. In this one-of-a-kind web3 experiment, token holders will have a voice in determining what will happen to Bobu.

Moonbirds

On April 16, 2022, the ERC-721 Moonbirds NFTs were released into circulation on the Ethereum network. Moonbird NFTs, which are essentially utility-enabled profile photos, have a number of different components, all of which utilize rarity as their primary distinguishing characteristic.

Mooonbirds is one of the most well-known companies in the picture-for-proof startup space, and there is a good reason for this. Members of each Moonbird, which provides access to a private club, have access to additional privileges during the course of their membership.

Moonbirds have access to the Discord servers that are gated by NFTs. Information on forthcoming drops, community activities, and nesting will be available to those who have access to private Moonbirds channels.

Moonbird NFT holders who nest or lock their tokens will be eligible for further incentives for their efforts. Once the process of nesting has been finished, a Moonbird’s NFT will move on to the next part of its life cycle, which consists of several stages.

The owner of the NFT has the opportunity to win other rewards and incentives as well.

Women Rise

For the Women Rise initiative that Maliha Abidi worked on, the market saw 10,000 one-of-a-kind NFT artworks. Abidi is an artist that works in the realm of visual art and has garnered recognition on a global scale.

The series showcases a diverse group of women from all over the world. Each of them possesses a unique set of characteristics.

Making the world a better place is a mission that a diverse group of women from all walks of life is embracing. People in these fields include scientists, artists, campaigners, and computer programmers, among others.

Women Rise provides the opportunity for art lovers to acquire a one-of-a-kind piece of artwork while also expanding the NFT’s capacity for inclusion and diversity.

If you are a collector, you can take pleasure in any of these NFTs. Remember that some of them are significantly more valuable than others. More than 453 distinct kinds of hand-drawn features were utilized in the construction of the NFTs.

What motivates the makers of Women Rise is their firm conviction that the world needs more diversity, more accurate representation, and more art that is not only aesthetically pleasing but also honors women from all over the world.

Treeverse

The NFT collection “NFTrees” that was released by Loopify in February 2021 served as the inspiration for Treeverse. The massively multiplayer online game Treeverse was always intended to be a social experience.

The group has issued a total of 10,420 Founders’ Private Plot (FPP) NFTs, all of which were purchased during the first hour of trading.

Players may anticipate an action-packed MOBA-style game when the MMORPG makeover has been completed. Outside of the city, there is a wide variety of content for players to engage in, including the exploration of dungeons, the completion of quests, and the acquisition of experience points.

This MMORPG, like all others, places a significant emphasis on the players’ individual abilities. In order for players to advance in the game, they will need to enhance their talents in areas such as mining, crafting, and combat.

IdeoCo Labs, Animoca Brands, and Skyvision Capital each contributed $5 million to Treeverse’s round of fundraising totaling $25 million. After the company received its initial round of investment, investors are obviously keeping a close eye on this venture.

Doodles

Burnt Toast in Doodles is responsible for the generation of ten thousand non-fungible tokens (NFT), each of which is comprised of hundreds of distinct aesthetic characteristics. Doodles have been used to depict a diverse cast of characters, ranging from Skellys to cats, aliens to apes, and everything in between.

The artifacts owned by Doodles also contain hundreds of bizarre heads, outfits, and colors from the artist’s palette.

You are able to have your opinion heard on developing features, upcoming goods, and community-organized events when you use a Doodle. The architects and designers are working on the Doodles project, and they work together during every stage of the process.

The name of the bank account that the project uses to fund new community activities is “Doodlebank.”

Since they began their Space Doodles campaign, Doodles has experienced a great year, and it’s possible that this upward trajectory may go on into 2022 as well.

In addition to more than 200 audio-visual features, which together illustrate how well your Space Doodle is operating, numbers are also included with each Space Doodle.

The measurements of Space Doodles will be used by the project to construct new Doodles experiences that will surprise and amaze the whole NFT ecosystem.

Kibatsu Mecha

Artist Jerry Liu is responsible for the creation of Kibatsu Mecha, a collection and tale that features 2,222 individual figures that were hand-generated and are completely animated.

Any combination of seven individual characteristics can be given to a Kibatsu Mecha. Each and every one of the “very unusual” Kibatsu Mecha possesses one-of-a-kind qualities that are not present in any other NFT.

Megacity Kibatsu and the lands around it are populated by Kibatsu Mecha and the pilots who control them. Every day, fights take place in the Ataki Arena, which is known as one of the most exciting and risky combat arenas in the city.

People engage in a fight for a variety of reasons, including the pursuit of notoriety and wealth, the rush that comes with competition, and other factors. The individuals responsible for organizing this initiative will continue to disseminate information on it as time goes on.

Crypto

Best Altcoins to Buy: BlockDAG, Solana, Cardano, and HBAR Offer Practical Entry Points

When looking for the best altcoins to buy, it helps to focus on projects with clear use cases, steady development, and chances to join early. BlockDAG is gaining attention through its GLOBAL LAUNCH release, rare price level, and a 100M BDAG airdrop that rewards those who take part early.

For those drawn to fast activity and high usage, Solana stands out with strong performance in DeFi and speed. Cardano appeals to those who value a research-first method and long-term planning. Meanwhile, HBAR provides a low-energy option supported by major firms through its hashgraph system.

1. BlockDAG: Price Advantage and Community-Based Tasks

BlockDAG is currently moving fast, with strong backing seen in the $326 million raised during its presale. At the moment, BDAG is available for $0.0016 until August 11. This is one of the lowest prices since its first batch, offering a low-cost entry point ahead of the $0.05 launch price.

More than 23.4 billion coins have already been sold, along with 18,250 mining units. These numbers show that the project is seeing real use. The gap between the current and launch price offers room for a 2,841% gain.

The 100M BDAG Airdrop is now live and set up in two three-month seasons, giving users six months to take part. People can complete simple tasks such as joining Telegram, following on X, posting updates, or inviting friends. These actions help expand the community and earn free BDAG.

Between its smart price model, active campaign, and growing support, BlockDAG (BDAG) is one of the best altcoins to buy for those looking to engage early.

2. Solana: Fast Blockchain with Growing Ecosystem

Solana is known for its fast and scalable blockchain. Using both Proof of History and Proof of Stake, it handles thousands of transactions per second. This setup supports DeFi, NFTs, and gaming. Many consider Solana one of the best altcoins to buy due to its speed, low costs, and strong uptime.

Currently priced around $145, Solana shows solid recovery this year. More developers and partners are joining its ecosystem and launching new dApps. With working technology and practical use, Solana continues to be a choice for those exploring coins with active growth paths.

3. Cardano: Research-Based Blockchain with Real Value

Cardano is known for its secure and energy-efficient approach. It was one of the first to use a proof-of-stake system, helping reduce energy use while keeping transactions secure. A recent upgrade called Mithril improved transaction speed and made it easier for new apps to launch.

ADA is trading near $0.39, showing a steady presence in today’s market. Backed by peer-reviewed research and a focused development team, Cardano keeps working on real-world use. Its careful planning makes it appealing for those looking at long-term projects among the best altcoins to buy.

4. Hedera: Green Payments Backed by Strong Network

Hedera Hashgraph offers a different path with its fast and secure hashgraph system. This approach gives it low fees and quick transaction times. Unlike regular blockchains, Hedera’s setup is designed to be efficient and highly scalable.

HBAR is currently trading at around $0.086, maintaining interest as more businesses try out its features. With enterprise partnerships and a focus on energy use, Hedera fits those looking at cleaner, faster systems in the search for the best altcoins to buy.

How BlockDAG Compares with These Leading Projects

When looking at the best altcoins to buy, early access and practical use both matter. BlockDAG stands out with its current price of $0.0016 and the chance for early gains up to 2,841% before launch. The project’s 100M BDAG airdrop and community-focused setup make it worth watching.

Solana brings speed and wide usage in areas like gaming and DeFi. Cardano builds slowly with solid research and reliable progress. HBAR focuses on speed and energy savings with business adoption. All four offer something unique, but the BlockDAG GLOBAL LAUNCH release timing gives it a different kind of edge before prices move higher.

Crypto

While Hedera Stalls and PI Lags, Web3 ai’s Presale Crosses $8.65M — Best Time to Buy May Be Now!

The crypto markets are moving unevenly heading into the second half of 2025. While some legacy projects are stalling, investor focus is shifting toward innovative presale opportunities that offer stronger upside. Hedera (HBAR) and PI Network have both lost momentum, with analysts flagging a lack of near-term catalysts. In contrast, Web3 ai has surged past $8.65 million, and 21.72 billion tokens sold, still priced at just $0.000443.

This growing AI-focused platform is drawing investors away from slower-moving projects with its promise of real utility and smarter risk management. As volatility grows and narratives shift, the case for Web3 ai as the best time to buy crypto becomes harder to ignore.

Hedera Price Forecast: Analysts Expect Rebound, But Timing Is Unclear

Hedera’s recent 11% drop has put investors on edge. While long-term fundamentals remain intact, short-term traders are cautious. The latest Hedera price forecast points to a possible recovery, but it hinges on whether support near $0.08 can hold. According to analysts, the network’s enterprise partnerships and strong throughput could eventually push prices higher, possibly toward $0.12 or more, but this scenario is far from guaranteed.

Traders watching Hedera are still dealing with bearish technical setups. The lack of strong bullish confirmation on the daily chart keeps sentiment muted, even as some accumulation appears to be taking place. That makes HBAR a candidate for rebound, but not necessarily one of the best crypto investments today.

In this environment, even optimistic Hedera price forecasts are being viewed through a cautious lens. The hesitation among short-term traders is a reminder that legacy projects without immediate catalysts may continue to underperform against new market entrants.

PI Network Price Prediction: Community Hype Meets Harsh Reality

The PI Network has long been a controversial project due to its closed ecosystem and lack of exchange listings. Current PI Network price predictions are reflecting that skepticism. Analysts suggest the token may never reach the $10 mark unless there’s a drastic change in accessibility and utility. Despite having one of the largest communities in the space, PI has yet to deliver on its promise of decentralized mobile mining at scale.

The biggest concern around PI isn’t user engagement but rather token liquidity and real-world usage. The lack of exchange listings continues to stifle price discovery, and recent sentiment indicates that many in the market are losing patience. PI Network price prediction models have adjusted downward, now targeting sub-$5 ranges for the foreseeable future.

For investors looking at the best time to buy crypto, PI’s limitations make it a speculative bet rather than a calculated long-term investment. Without more transparency or token access, it risks falling behind as more structured, utility-driven projects gain traction.

Web3 ai: AI-Powered Risk Management Tool for Real-Time Protection

As legacy coins wobble, Web3 ai is quickly defining itself as a smarter, safer choice for crypto investors. The project’s AI-Powered Risk Management Tool will be a major feature, offering real-time protection in volatile conditions. Using models like Value at Risk (VaR) and Monte Carlo simulations, this tool will allow investors to dynamically assess and manage risk across their portfolios.

Web3 ai’s system goes beyond analytics, it can actively simulate market crashes and flag when users are overexposed to correlated assets. The built-in automation will even allow for setting AI-triggered stop-losses, ensuring quick response times in high-volatility events. This kind of protection has never been more necessary as uncertainty remains a major theme in the crypto space.

At the heart of the Web3 ai ecosystem is the $WAI token, which gives holders access to the platform’s full suite of AI tools. From trading assistants and portfolio optimizers to this risk management layer, $WAI is more than a token, it’s a utility key. Holding the token also offers benefits like staking rewards, governance access, and discounts across the platform.

Currently in Stage 09 of its AI token presale, Web3 ai has already raised over $8.65 million, with more than 21.72 billion tokens sold. With a listing price of $0.005242, early participants at the current $0.000443 price point stand to gain a 1,747% ROI if projections hold. This blend of real utility, strong upside, and presale momentum is turning heads among investors who believe this could be the best time to buy crypto.

The Final Verdict

The crypto market in 2025 is seeing clear shifts in investor preference. Hedera’s potential rebound and the uncertain PI Network price prediction show how older projects can get stuck in limbo. While HBAR may recover and PI might eventually deliver, neither offers the immediate combination of utility and upside that Web3 ai brings.

With over $8.65 million raised and a 1,747% ROI forecast, Web3 ai is more than just another presale, it’s a serious contender for the best crypto investment in the second half of the year. As smart money looks for safer, smarter entries, the momentum behind Web3 ai is accelerating, and the current presale price may not last much longer.

Join Web3 ai Now:

Website: http://web3ai.com/

Telegram: https://t.me/Web3Ai_Token

X: https://x.com/Web3Ai_Token

Instagram: https://www.instagram.com/web3ai_token

Crypto

India’s Most Compliant Crypto Exchange Has Arrived — Welcome to eXchange1

In a space often defined by uncertainty, opacity, and regulatory gaps, eXchange1 is charting a different course. With its official launch in India, the European-regulated crypto platform brings something rare to the digital asset ecosystem: clarity, credibility, and compliance by design.

As crypto markets evolve, regulation has become the single most critical factor for mainstream adoption. India’s policymakers, like their global counterparts, are increasingly prioritizing investor protection, risk mitigation, and oversight. Yet, many exchanges continue to operate in regulatory grey zones—leading to user mistrust, security concerns, and market instability.

eXchange1 was built to address exactly this.

A Fully Regulated Global Exchange

Unlike platforms that try to retrofit regulation after launching, eXchange1 was designed from the ground up to meet the highest standards of global compliance. It is licensed under the MiCA (Markets in Crypto-Assets Regulation) framework by the Financial Crime Investigation Service (FCIS) of Lithuania, and also registered with India’s Financial Intelligence Unit (FIU).

The MiCA regulation, enforced by the European Securities and Markets Authority (ESMA), sets a unified, pan-European legal standard for crypto businesses, focusing on:

- Consumer protection

- Market integrity

- Financial stability

- Transparent disclosures

Being licensed under MiCA not only reflects eXchange1’s operational maturity but also signals a deep commitment to the future of regulated crypto finance.

A Platform Regulators Can Work With

eXchange1 isn’t just compliant—it’s collaborative. Its leadership has experience navigating complex international frameworks, and its systems are engineered to integrate with compliance regimes across multiple jurisdictions. From real-time AML monitoring to KYC onboarding protocols and custodial transparency, the platform is purpose-built to meet the expectations of financial authorities.

“Too often, regulation is treated like a barrier,” says CEO Ms. Sandoval Mera. “At eXchange1, we see it as the bridge between innovation and trust. We’re working with regulators, not around them.”

Ms. Mera, who brings more than 30 years of experience in global policy and institutional frameworks through her work with the United Nations, believes that responsible growth in crypto is not possible without structural accountability.

Local Compliance, Global Strength

India’s Financial Intelligence Unit (FIU) has become increasingly active in holding exchanges accountable. eXchange1 has ensured its full FIU registration to operate in alignment with local laws and enforcement agencies.

By being compliant both globally and locally, the platform is equipped to operate at scale while meeting region-specific standards. This makes eXchange1 one of the few crypto platforms in India that ticks both boxes—global credibility and domestic legitimacy.

This dual-compliance positioning is more important than ever as India continues to lead global crypto adoption, yet remains cautious about unregulated platforms and the risk they pose to users and capital flow.

Bridging the Trust Gap

The global crypto sector has long struggled with reputational risks—from high-profile exchange collapses to poor governance and opaque operations. For Indian users, this has translated into understandable caution, especially among first-time investors and institutions.

eXchange1 addresses this head-on by providing a secure, transparent, and fully regulated ecosystem without sacrificing user experience or performance. The platform offers:

- Enterprise-grade security protocols

- Institutional custody standards

- Real-time risk management systems

- High-liquidity architecture for scalable performance

All of this is designed to offer peace of mind to users, financial institutions, and regulators.

The Case for Regulation-First Crypto

While the early years of crypto were defined by decentralization and borderless innovation, today’s users demand accountability. Government agencies, investors, and the general public want to know: Who’s running this? What laws do they follow? How is my money protected?

eXchange1 provides those answers. The platform’s design integrates compliance into every step of the user journey, from onboarding to trading and withdrawals. Internal audits, risk models, and user protections aren’t add-ons—they are defaults.

Chairman Dr. James Newsome, a former Chairman of the U.S. Commodity Futures Trading Commission (CFTC) and past President & CEO of NYMEX, brings decades of regulatory experience to the table. “Trust is the real currency in crypto,” he says. “Our systems, governance, and approach reflect that understanding.”

More Than Just a License

While many platforms acquire regulatory registration as a checkbox, eXchange1 treats compliance as an operating principle. Its legal teams, risk officers, and product leads work in sync to ensure that every new feature meets evolving policy frameworks—whether in Europe, India, or any future market.

This makes eXchange1 not just compliant, but regulation-forward—ready to help shape the global narrative for crypto governance.

A Step Toward a Safer Crypto Future

As India embraces digital finance, platforms like eXchange1 become critical enablers. By choosing to enter the market only after securing all necessary approvals, eXchange1 sets a powerful precedent: that global crypto growth can be responsible, inclusive, and aligned with law.

For investors, this means access to cutting-edge financial tools with institutional-level safeguards. For regulators, it means a reliable partner in enforcing standards. And for the industry as a whole, it means progress without compromise.

Final Word

India’s crypto future depends not just on innovation, but on infrastructure that regulators, users, and institutions can trust. eXchange1’s commitment to regulation isn’t a strategic advantage—it’s the foundation of its identity.

Media Contact:

media@exchange1.com

-

Crypto3 years ago

Crypto3 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release4 years ago

Press Release4 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain5 years ago

Blockchain5 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins