Press Release

What Does the future hold for MDEX after the Halving?

On June 5, MDEX officially started its first halving. What changes will the halving bring? And what does it mean for MDX holders?

Before answering these questions, we can take a look at a typical example of cryptocurrency halving.

In 2012, Bitcoin halved for the first time, and its price skyrocketed over 84 times afterward; in 2016, Bitcoin halved for the second time, and rose 29 times afterward; Bitcoin’s most recent halving occurred in 2020, and the price peaked near $65,000 after that, which was also over 7 times higher than the $8,700 at the time of the halving. Investors have reached the consensus that havling means skyrocketing prices. Based on bitcoin’s halving history, we can try to predict how MDX will perform after halving.

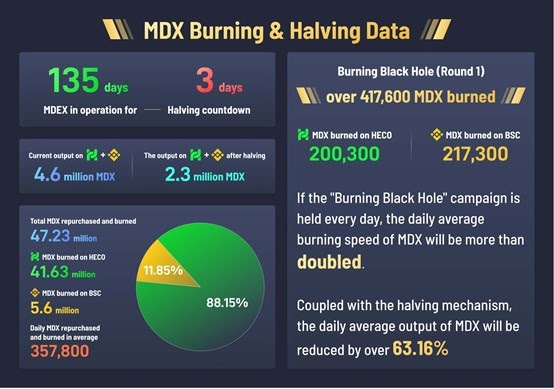

MDEX currently produces 80 MDX per block, and each three seconds a new block is generated, which makes MDX’s daily output is 4.6 million (including both BSC and HECO chains). After the first halving, the output per block is reduced to 40 MDX, making MDX’s daily output reduced to 2.3 million.

MDEX adopts a “double mining mechanism” that combines liquidity mining and transaction mining. The advantage of this approach is that it can attract users to actively participate in transactions at the early stage of the project launch and thereby empower the platform with funds and traffic. However, there is also this problem that its token MDX has been facing increasing selling pressure in the secondary market, which is one of the reasons why the price of MDX’s tokens has been sluggish. The most direct effect of this halving is to reduce the selling pressure, making it easier to push up prices. In addition, it will also stimulate demand for MDX purchases.

Similarly, in the early days, Bitcoin production was high and mining difficulty was low, so users could easily obtain a large amount of Bitcoin, resulting in low purchase demand and low price. However, with the halving of Bitcoin, its production decreased, and the rising hash kept pushing up the mining difficulty, making it difficult for users to obtain more Bitcoin from mining. Users then started to choose to buy directly from the secondary market, thus driving up the price of bitcoin.

By the same token, on the one hand, with the halving of MDX, when the accelerated release period of MDX is over, it will become more and more difficult for users to obtain MDX through mining. While on the other hand, the IMO and community governance scenarios of MDEX will continue to expand the application scenarios of MDX. Users will have to buy MDX from the secondary market if they want to participate in MDEX activities, which also gives MDX another potential upward momentum.

The halving of MDX is based on the same logic as Bitcoin, but with a higher frequency– once every six months. Its daily production is reduced by half after each halving. In this way, in the first quarter of 2023 year, basically 80% of MDX will be mined out; with the reduction of production, the growth rate of MDX circulation will further decrease. The official MDEX repurchase and burn mechanism as well as the enhancement of community consensus, MDX will enter a new round of upward price change.

Intrinsic Mechanism Drives Up MDX’s Value

In addition to the halving, MDEX also uses other intrinsic mechanisms to drive up the value of MDX.

According to relevant rules, MDEX injects 30% of the daily platform revenue into the pending repurchase pool and automatically executes repurchase and burn when the smart contract is triggered by the repurchase price (72-hour MDX average price). From MDEX’s official website, MDEX has burned more than 6.4 million MDX on BSC and more than 42 million MDX on HECO, and the total repurchase amount is over $115 million according to the latest price of MDX.

MDEX’s “Burning Black Hole” campaign is another supplementary mechanism to accelerate the MDX deflation and further empower the value of MDX. In the Burning Black Hole campaign, MDEX will set aside 300,000 USDT per round to build a burning prize pool, and the rest pool is investments from MDEX users. There are three prizes set up in the campaign, the first prize Jupiler rewards users with 10% MDX from the prize pool; the second prize Saturn rewards users with 100,000 USDT, and the remaining users will share the 200,000 USDT remaining MDX in the prize pool. 90% of the MDX invested by users in the campaign will be burned.

As there are more transactions on MDEX, the transaction fee may also continue to increase, which means an increased number of MDXs will be burned; according to the data on MDEX’s official website, the first round of the Burning Black Hole capaign has burned a total of over 400,000 MDXs. If the campagin took place on a daily basis, the average daily MDX burn would be doubled. Along with the regular repurchase and burn mechanism. it will enable MDX to enter the deflationary stage in advance. That is, the daily MDX output wil be less than the daily MDX burned. This deflation will in turn increase the speed of MDX appreciation.

A horizontal comparison with DEXs

Let us now horizontally compare MDEX with other mainstream DEX:

| Project | lock-up volume | daily transaction volume | Total market value |

| Uniswap | 6.6B | 1.12B | 27B |

| Sushiswap | 3.9B | 0.56B | 3.02B |

| Pancake | 8.1B | 0.75B | 5.61B |

| MDEX | 4.01B | 2.50B | 2.46B |

Data source: DeBank

From the table, it can be seen that, at present, the lock-up volume of MDEX is about 1/2 of Pancake, 2/3 of Uniswap, and basically at the same level as Sushiswap. But its average daily transaction volume of $2.5 billion is far ahead of the other three DEXs, and even higher than their sum. However, in terms of the market cap of MDX in circulation, it is only 1/11 of UNI and less than 1/2 of CAKE. Therefore, if the valuation logic is similar, then MDEX is just beginning to discover its value.

The above comparison of mainstream DEX shows that, in terms of total liquidity, MDEX is still somewhat lagging behind the current DEX leaders. But considering that MDEX has been online for the shortest time, its growth history is not comparable to Uniswap that has been in the DEX mark for years, or to Sushiswap and Pancake that have experienced DeFi hot and a bull market. In this sense, MDEX’s achievements in lockup volume and market capitalization are worth celebrating.

The highlight of MDEX is its transaction volume. With the support of transaction mining, its daily transaction volume has been far ahead of other head DEXs, and its growth is even more breathtaking. With the help of the upcoming halving, MDEX will give full play to the virtuous cycle of the repurchase and burn mechanism and dual-mining mechanism, which will bring MDEX a much broader future.

From the development history of DEX, it took Uniswap 840 days to increase the cumulative transaction volume from 0 to 100 billion, while MDEX accomplished the same result in just 50 days. If MDEX continues its current momentum, it will maintain a steady growth in locked positions with the development of the DeFi market, and enhance its transaction volume with the help of the dual-mining mechanism. The existence of repurchase and burn mechanism and the forthcoming having will further empower MDEX to secure a unique place in leading exchanges. Correspondingly, the value of its token MDX is still estimated to have the potential of more than several times of growth.

Official website: Click Here

Discord: Click Here

Twitter: Click Here

Medium: Click Here

Global Telegram: Click Here

Official Channels: Click Here

Press Release

Digital Reserve成为2026香港Web3嘉年华二级展位赞助商

Digital Reserve已确认加入2026香港Web3嘉年华,将作为二级展位赞助商为大会提供支持

Digital Reserve 是一家澳洲持牌的加密货币出入金与交易平台,深耕行业多年、穿越多轮牛熊周期,凭借对华人市场的深刻理解、完善的银行通道与高质量服务,持续为专业客户提供稳定、顺畅的数字资产流动解决方案。更多信息: https://digitalreserve.net/

香港Web3嘉年华是由万向区块链实验室与HashKey Group联合推出的Web3活动品牌,由W3ME承办,自2023年起于每年4月在香港会议展览中心举办,聚焦行业热点话题与政策趋势,是亚洲规模最大、最受关注的Web3行业盛会之一。

2026香港Web3嘉年华将于4月20日-23日在香港会议展览中心盛大举行。自2023年首届举办以来,香港Web3嘉年华已飞速成长为全球最具影响力的加密峰会之一,为全球东西方交流构建了一个高规格、高质量、高纵深的平台。过往三届盛会累计吸引超10万名现场参会者,汇聚超350个前沿项目参加,邀请超1200位演讲嘉宾分享,并衍生超400场周边活动,成功构建了一个以大会为核心、辐射全港的活力生态圈。

目前,香港特别行政区财政司司长陈茂波,香港证监会中介机构部执行董事叶志衡,万向区块链董事长、Hashkey Group董事长兼CEO肖风,香港特别行政区立法会议员(科技创新界)邱达根,Solana Foundation总裁Lily Liu,MatrixPort创始合伙人及首席商务官Cynthia Wu,Animoca Brands联合创始人兼董事长Yat Siu,全球金融科技学院院长及新加坡社科大学教授李国权,Pantera Capital合伙人Franklin Bi,汇丰银行数字资产与货币总监Bugra Celik(嘉宾排名不分先后)等重磅嘉宾已确认出席。

此外,本届嘉年华已吸引近千位来自传统金融、科技创新及实体产业的高净值人士与企业核心决策者报名参会。这里不仅是行业盛会,更是跨越边界、融合认知的高价值连接平台。了解更多: https://www.web3festival.org/hongkong2026/#/zh

成为合作伙伴:https://tally.so/r/w5YEbP

Press Release

Digital Reserve Joins the Hong Kong Web3 Festival 2026 as a Secondary Exhibition Sponsor

Hong Kong, 26th February 2026, Another week, another exciting addition to the Hong Kong Web3 Festival 2026 lineup. The festival has just announced that Digital Reserve is coming on board as a Secondary Exhibition Sponsor — and if you know anything about the Chinese-speaking crypto community, you’ll understand why this one feels like a particularly good fit.

Let’s talk about Digital Reserve for a moment, because they’re worth understanding properly. On paper, they’re an Australia-licensed crypto on/off-ramp and trading platform. In practice, they’re something a lot more specific and a lot more valuable than that description suggests. Digital Reserve has spent years building a platform and a reputation with Chinese-speaking clients around the world — people who want to move between fiat and crypto without the usual headaches, who need a platform that actually understands their language and their needs, and who want to trust that the service they’re getting today will still be there and still be solid six months from now when the market looks completely different.

That last part is important. The crypto space has a habit of churning out platforms that shine in good conditions and quietly fall apart when things get difficult. Digital Reserve has been through enough market cycles to have proven itself when it counts. They’ve kept their banking access intact, maintained their service quality, and continued showing up for their clients regardless of what the charts were doing. In an industry where trust is genuinely hard to earn, that kind of consistency means something. Take a closer look at what they’re building at digitalreserve.net.

This Festival Has Been Earning Its Reputation for Three Years

If you haven’t been following Hong Kong Web3 Festival since the beginning, here’s the short version: it launched in April 2023, and every year since then it has gotten bigger, better, and more relevant. Co-hosted by Wanxiang Blockchain Labs and HashKey Group — two organizations that carry serious credibility in the blockchain world — and organized by W3ME, the festival has grown into the kind of event that serious people in Web3 and crypto genuinely make time for.

This year’s edition runs from April 20 to 23 at the Hong Kong Convention and Exhibition Centre. Four days, one of the world’s great cities for finance and innovation, and a program that is shaping up to be the most compelling the festival has ever put together.

The Track Record Makes a Strong Case

Look at what the previous three editions of Web3 Festival have actually delivered and the picture becomes pretty clear. Over 350 exhibitors. More than 1,200 speakers. A total of 100,000 visitors across all three editions. And over 400 side events that kept the energy alive well beyond the main stage. These numbers didn’t happen by accident — they’re the result of an event that consistently delivers on its promise and keeps people coming back.

For 2026, the festival is bringing together up to 300 speakers from across every dimension of the Web3 and crypto world. But here’s the detail that really tells you something about where this event has arrived: over 500 executives and decision-makers from traditional finance and the real economy have already signed up to attend. That’s not just the crypto faithful gathering to talk to each other. That’s the old financial world and the new one sitting in the same space, having conversations that actually lead somewhere. Deals get made at events like this. Partnerships form. Strategies shift. The right conversation with the right person can change the direction of a business, and Web3 Festival has become one of the most reliable places to have those conversations.

Hong Kong Is Doing a Lot of Heavy Lifting Here

It’s worth saying out loud: Hong Kong is not just a backdrop for this event. It’s genuinely part of what makes it work. There isn’t another city in the world that sits quite where Hong Kong sits — deep roots in global finance, a natural gateway to Mainland China’s market, and an environment that has shown a real willingness to take Web3 seriously rather than treating it as something to be managed from a distance. For an industry that is still figuring out how to grow up without losing what makes it interesting, that kind of environment matters enormously.

For Digital Reserve specifically, Hong Kong makes perfect sense. Their clients are spread across the Chinese-speaking world, and Hong Kong Web3 Festival pulls in exactly the kind of international, finance-literate, crypto-engaged audience that Digital Reserve has been building for. Being present in that room — not just as a name in the program but as an actual exhibitor that attendees can walk up to and talk with — is a genuinely valuable thing.

That’s the kind of sponsorship that works both ways. The festival gets a partner that brings real credibility and a loyal community behind it. Digital Reserve gets access to an audience that gets it. Everyone in the room benefits from the connection.

Come and Be Part of It

If you’re thinking about attending, exhibiting, speaking, or exploring a partnership with the festival, this is your signal to stop thinking and start moving. Everything you need to know about Hong Kong Web3 Festival 2026 is waiting for you at https://www.web3festival.org/hongkong2026/#/en. If a partnership is what you have in mind, the conversation starts at https://tally.so/r/w5YEbP.

Digital Reserve joining the 2026 roster is another reminder that the people who are serious about where this industry is going are choosing to show up at this festival. It’s worth being one of them.

Press Release

卓锐证券成为2026香港Web3嘉年华白金赞助商

Hong Kong, 5th March 2026, 卓锐证券已确认加入2026香港Web3嘉年华,将作为白金赞助商为大会提供支持。

卓锐证券(香港)有限公司(中央编号:BRE865)是香港证监会认可持牌法团,持有第1、2、4、5、9类牌照。作为全港增速TOP1的持牌虚拟资产券商*,卓锐证券专注构建合规安全的交易生态,实现传统资产与加密货币的无缝流动。通过自主研发的一站式交易平台“ZR”,投资者只需一个账户,即可借助AI赋能的机构级视野,灵活配置股票、ETF及加密货币。了解更多:https://www.zr.hk/

香港Web3嘉年华是由万向区块链实验室与HashKey Group联合推出的Web3活动品牌,由W3ME承办,自2023年起于每年4月在香港会议展览中心举办,聚焦行业热点话题与政策趋势,是亚洲规模最大、最受关注的Web3行业盛会之一。

2026香港Web3嘉年华将于4月20日-23日在香港会议展览中心盛大举行。自2023年首届举办以来,香港Web3嘉年华已飞速成长为全球最具影响力的加密峰会之一,为全球东西方交流构建了一个高规格、高质量、高纵深的平台。过往三届盛会累计吸引超10万名现场参会者,汇聚超350个前沿项目参加,邀请超1200位演讲嘉宾分享,并衍生超400场周边活动,成功构建了一个以大会为核心、辐射全港的活力生态圈。

目前,香港特别行政区财政司司长陈茂波,香港证监会中介机构部执行董事叶志衡,万向区块链董事长、Hashkey Group董事长兼CEO肖风,香港特别行政区立法会议员(科技创新界)邱达根,Solana Foundation总裁Lily Liu,MatrixPort创始合伙人及首席商务官Cynthia Wu,Animoca Brands联合创始人兼董事长Yat Siu,全球金融科技学院院长及新加坡社科大学教授李国权,Pantera Capital合伙人Franklin Bi,汇丰银行数字资产与货币总监Bugra Celik(嘉宾排名不分先后)等重磅嘉宾已确认出席。

此外,本届嘉年华已吸引近千位来自传统金融、科技创新及实体产业的高净值人士与企业核心决策者报名参会。这里不仅是行业盛会,更是跨越边界、融合认知的高价值连接平台。了解更多: https://www.web3festival.org/hongkong2026/#/zh

成为合作伙伴:https://tally.so/r/w5YEbP

-

Crypto4 years ago

Crypto4 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain6 years ago

Blockchain6 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release5 years ago

Press Release5 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain6 years ago

Blockchain6 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain6 years ago

Blockchain6 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins