Recent Updates

Russian President favors cryptocurrencies, urging all parties to discuss

The Russian President, Vladimir Putin, favors cryptocurrencies and urges the Russian Central Bank to discuss the matter, not rejecting cryptocurrencies right away.

Russian Authorities’ have strong disagreements on dealing with Bitcoin and other cryptocurrencies, and the issue reached Russian President Vladimir Putin’s ears.

The Russian President wants to hear all parties involved; however, it is a divisive proposal that originated within the Russian Central Bank.

Chebeskov, the Director of Russian Financial Politics, contends that outlawing cryptocurrencies in Russia risks trailing behind other “high-tech” countries.

According to the Russian President, the authorities’ attitude is motivated by the fact that the growth of this type of financial system may pose risks to Russians, given the volatility of cryptocurrencies.

He also mentioned that Russia provides a large field for cryptocurrency growth and a location where the country’s various advantages may aid in the development of the overall industry.

Putin backed the banking institution’s stance on continuing the discussions, not discarding cryptocurrencies right away.

The risks of forbidding Cryptocurrencies in Russia.

In recent days, the world has focused on Russia because of a policy that might jeopardize Bitcoin trading, use, and mining in that nation.

It is a contentious proposition that arose within the Russian Central Bank. Due to its volatility and usage in “criminal operations,” the body says that bitcoin “poses serious dangers to the wellbeing of Russian residents and the stability of the financial system.”

The Russian Ministry of Finance was not pleased with the banking institution’s proposal.

According to a local media source, Ivan Chebeskov, head of that ministry’s Financial Policy Department, claimed that the minister of that portfolio favored regulation but did not support a ban on cryptocurrencies. “We need to regulate rather than prohibit. Citizens would be protected by regulation, “said the official.

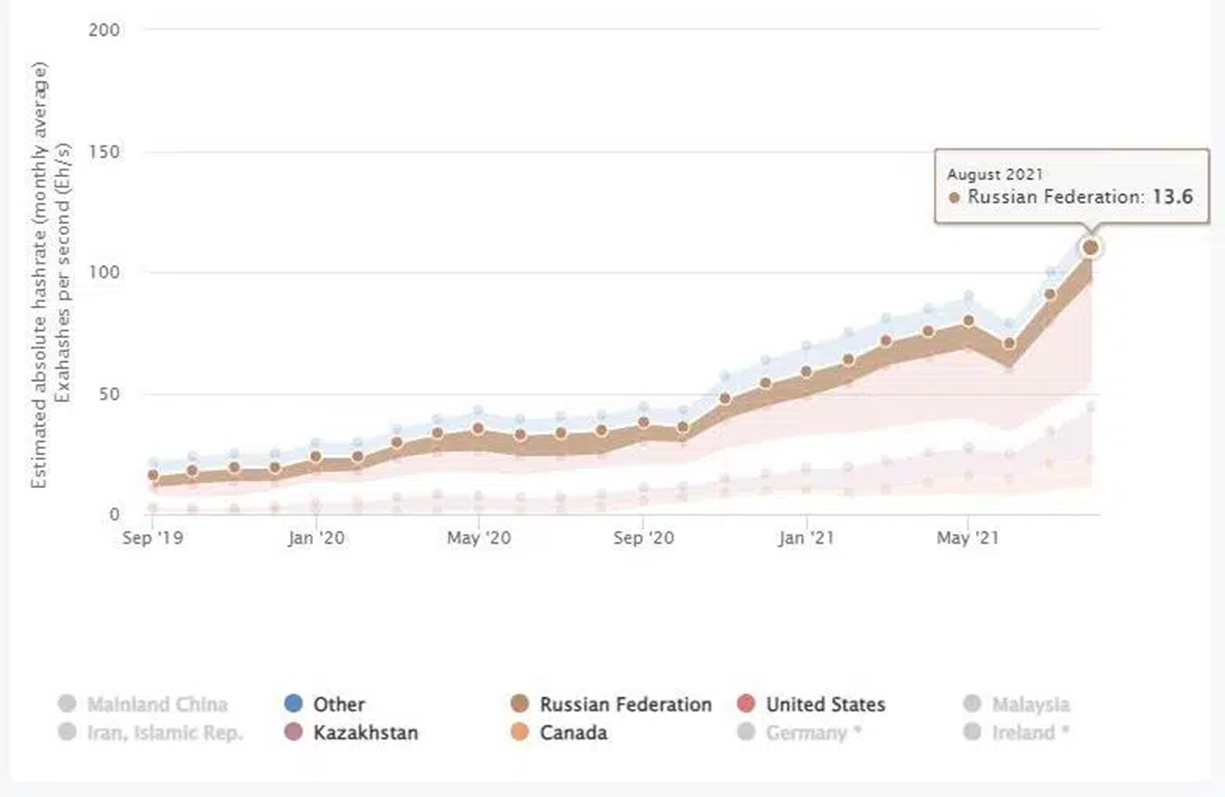

Chebeskov argues that prohibiting cryptocurrency in Russia risks lagging behind other countries in the “high-tech” sector. One such country is the United States, with whom ties have recently heated up and presently hosts 42 percent of the worldwide Bitcoin hashrate, while Russia has just 13 percent.

He also emphasized the need to allow technology to evolve, which is why they are working on “legislative measures in terms of regulation.”

Disagreements among authorities on dealing with bitcoin reached Russian President Vladimir Putin’s ears.

Putin calls for consensus though all parties involved.

Putin addressed discussions on whether or not to accommodate bitcoin in Russia during a virtual conference he held with his ministerial cabinet on January 26, 2022.

The bitcoin issue seemed to be of importance to the Russian President since, before starting the schedule, he wanted to make his position on the matter clear:

I am familiar with the ongoing discussion on this issue. These issues are dealt with and regulated by the Central Bank of Russia. The Central Bank does not stand in the way of our technical progress and is making the necessary efforts to introduce the latest technologies in this area of activity.

Vladimir Putin, President of Russia.

Putin defended the position of the financial body on the point of bitcoin volatility because “it carries certain risks, first of all to citizens,” the President said.

According to Russia’s President, the authorities’ stance is driven by the fact that the proliferation of this sort of finance may pose dangers to Russians, given the volatility of cryptocurrencies.

However, He also brought up the point that Russia offers a wide field for cryptocurrencies growth and even a place where it can help the development of the entire sector with the many advantages that the country offers.

Putin also acknowledged that Russia manages “certain competitive advantages, especially in mining” and referred “to the surplus of electricity and well-trained personnel available in the country,.”

Finally, Putin called for the issue to remain under discussion and for a unanimous decision to be reached among all parties involved.

Crypto

Do Kwon Faces 12-Year Sentence as Prosecutors Call Terra Collapse “Massive Fraud”

U.S. prosecutors are seeking a 12-year prison sentence for Terraform Labs founder Do Kwon, arguing that the collapse of Terra and Luna amounted to one of the largest frauds in crypto history. The request, filed in the Southern District of New York, highlights the scale of losses tied to TerraUSD (UST) and Luna’s algorithmic failure—an implosion that erased more than $40 billion and triggered widespread contagion across the digital asset sector.

In their filing, prosecutors said Kwon spent years misleading investors about TerraUSD’s stability, artificially inflating its perceived safety and contributing to the system’s eventual collapse. They argued that the fallout extended far beyond market volatility, calling Terra’s unraveling “a defining moment” that reshaped global regulatory scrutiny of crypto markets.

Kwon’s defense team has pushed for a significantly lighter sentence—up to five years—claiming that coordinated trading activity from third parties and broader market stress helped accelerate TerraUSD’s depeg. They cited research, including Chainalysis data, suggesting that external actors exploited structural weaknesses rather than Kwon deliberately engineering the collapse.

Kwon pleaded guilty in August to wire fraud and conspiracy charges. His criminal case stems from a March 2023 indictment that included commodities fraud, securities fraud, wire fraud and market manipulation allegations. The core of the case centers on TerraUSD, the algorithmic stablecoin designed to maintain a $1 peg through a balancing mechanism with its sister token, Luna. When that mechanism failed in May 2022, both assets collapsed rapidly, wiping out tens of billions in value and triggering insolvencies across multiple crypto firms.

Prosecutors are not seeking restitution, citing the complexity of calculating losses across global bankruptcy cases already underway. Instead, they requested forfeiture of roughly $19 million, noting that compensation efforts for victims will primarily be handled through restructuring processes tied to firms affected by Terra’s collapse.

Kwon’s legal challenges span multiple countries. After being arrested in Montenegro in March 2023 for attempting to travel on forged documents, he was extradited to the United States in December 2024 following competing requests by both the U.S. and South Korea. He also previously lost a civil case brought by the U.S. Securities and Exchange Commission, where a jury found that Terraform Labs and Kwon misled investors about TerraUSD’s mechanics and backing.

Sentencing is scheduled for December 11, marking a key moment in one of crypto’s most consequential legal sagas. While the ruling will conclude Kwon’s federal criminal case, numerous bankruptcy, civil and creditor proceedings tied to Terra’s collapse remain ongoing.

Crypto Currency

Celo Foundation and Opera Deepen Partnership to Accelerate MiniPay’s Global Stablecoin Expansion

MiniPay’s explosive growth continues as the Celo Foundation and Opera strengthen their partnership to scale real-time stablecoin payments worldwide. With more than 11 million activated wallets and Celo now leading Ethereum Layer-2 networks in daily stablecoin activity, the collaboration marks a major step toward making mobile-first digital money accessible across emerging and global markets.

MiniPay, built exclusively on Celo’s low-cost EVM chain, has surpassed 300 million transactions since launching in 2023. As adoption accelerates, Celo’s network now serves over 700,000 daily active users, including more than 3 million weekly users of USD₮, solidifying its position as a leading payments-focused blockchain. Integrations with Binance, Transak, Transfi and others have further strengthened MiniPay’s cross-market reach.

The partnership is expanding even more through early integrations with Mercado Pago in Argentina and PIX in Brazil. These features introduce direct stablecoin-to-fiat conversions, reducing the friction typically associated with off-ramping and setting the stage for broader international expansion over the coming year.

Celo Foundation President Rene Reinsberg called MiniPay “crypto’s killer use case,” emphasizing how Celo’s infrastructure enables everyday, real-world stablecoin utility. The collaboration between Opera and Celo has evolved far beyond a browser integration and is now one of the fastest-growing Web3 financial applications globally.

Looking ahead to 2026, MiniPay is preparing to roll out a number of major upgrades. One key enhancement includes deeper integration of real-world assets such as Tether Gold (XAUt0), which has already attracted nearly 30,000 users seeking inflation-resistant savings options. Plans are also underway for stablecoin-backed cards and enhanced payment tools, positioning MiniPay as a unified gateway to both traditional finance and on-chain utilities.

To support its growing ecosystem, Celo and Opera will launch a global Mini App Roadshow across Asia and South America in early 2026. This initiative aims to onboard more developers in markets with rapidly expanding Web3 adoption. Opera EVP Mobile Jørgen Arnesen highlighted that MiniPay’s mission is to offer a stablecoin wallet that works reliably “no matter where people are,” and the expanded partnership gives builders new opportunities to innovate on top of MiniPay’s infrastructure.

As Celo and Opera continue to broaden access to stablecoin payments, MiniPay is quickly emerging as a critical tool for global users seeking fast, affordable, and reliable digital finance.

Crypto

Binance Faces Renewed Legal Battle Over Alleged $80M BTC Theft

A Florida scam victim will get a second chance to pursue legal action against Binance Holdings Inc. after a state appeals court ruled that a lawsuit over the alleged theft of $80 million worth of Bitcoin can move forward. The Florida Third District Court of Appeals determined on Wednesday that a lower court improperly dismissed the case for lack of personal jurisdiction, stating the plaintiff presented a plausible argument that Binance conducts business activities connected to Florida users.

The lawsuit, originally filed in state court, claims scammers gained access to the victim’s Binance account and transferred roughly $80 million in Bitcoin off the exchange. According to the plaintiff, Binance was notified immediately and provided with transaction details but did not freeze the stolen assets in time, allowing the funds to vanish permanently. The defendant argues it has no direct operational presence in Florida, but the appeals court disagreed, reviving the case and sending it back to the trial court for further proceedings.

The decision does not determine whether Binance is liable, but it opens the door for discovery, hearings, and evidence collection. Legal analysts say the ruling could have wider implications for global crypto exchanges that serve U.S. users while attempting to avoid state-level jurisdiction.

This lawsuit adds to Binance’s broader legal challenges over the past two years, including federal scrutiny regarding compliance and operational practices. As the case progresses, the Florida court will assess whether Binance can be held responsible for failing to safeguard customer assets amid an alleged sophisticated crypto theft.

-

Crypto4 years ago

Crypto4 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain6 years ago

Blockchain6 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release5 years ago

Press Release5 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain6 years ago

Blockchain6 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain6 years ago

Blockchain6 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins