Blockchain

Inside BlockDAG: How Its Mining Network and Mobile App Deliver Real Value

In digital finance, attention is shifting away from projects built on short-term hype and toward platforms offering usable infrastructure. BlockDAG (BDAG) is a case in point. Instead of being just another coin for trading, it functions as the lifeblood of an entire operating environment, one that merges mining, applications, and utility into a single framework. Its recent presale success highlights how much traction this approach is gaining worldwide.

Record-Breaking Presale with Long-Term Intent

BlockDAG’s presale has already crossed $381 million, placing it among the most successful launches in crypto history. The current Batch 29 price is $0.0276, with more than 25 billion BDAG sold. Early participants from Batch 1 are sitting on gains of 2,660%, while even current entrants stand to see 81% upside if BDAG lists at $0.05.

What makes this presale stand out is not just the scale of fundraising but also its structured rollout. Designed across 29 batches, it rewards early adopters with compounding value while steadily increasing the presale floor. This tiered model fosters confidence and keeps engagement high throughout the process.

Unlike campaigns that rely on hype alone, BlockDAG’s success has come from delivering tangible progress, live apps, active mining systems, and a functioning testnet. The presale represents much more than speculation: it provides an entry point into a live ecosystem that already has traction.

“BlockDAG’s presale raised over $376M with a 2,660% ROI, unmatched momentum that reflects strong global participation.” – AInvest, Aug 2025

BDAG as a Multi-Utility Asset

The design of BDAG goes beyond being a simple unit of trade. With a capped supply of 150 billion, its use cases are woven into every corner of the network. The coin supports three primary functions:

- Mining Rewards: Through physical rigs such as the X100, X30, and X10, as well as the X1 Mobile App, participants secure daily BDAG payouts by contributing to network strength.

- Ecosystem Currency: BDAG acts as the default medium for apps, gaming platforms, and payment solutions being developed within the ecosystem.

- Transaction Settlements: Integrated into wallets and future decentralized applications, BDAG facilitates seamless movement across BlockDAG’s infrastructure.

The X1 Mobile Miner, in particular, has become a driver of adoption. With 2.5 million downloads and active daily use, it enables anyone with a smartphone to take part in mining—at no upfront cost. This ensures broad participation and accessibility before the mainnet even launches.

“BDAG is not just a unit of exchange, it is the central fuel for a multi-layered economic system.” – BlockDAG Keynote 3

Real Utility Already in Action

Many presales promise functionality “someday.” BlockDAG, however, is already operating with a range of tools in place. Its testnet supports smart contracts, a live blockchain explorer, and MetaMask integration, giving developers and users an early environment to interact with the ecosystem.

The practical use cases being built around BDAG include:

- Payment gateways designed for fast, low-fee digital transfers

- NFT marketplaces with real-time throughput

- Fan coin platforms supporting entertainment and sports engagement

Unlike speculative projects that delay delivery until mainnet launch, BlockDAG has prioritized showing progress early. Its live systems prove that it isn’t simply a promise on paper, it’s a functioning network already offering real activity and transactions.

Why BlockDAG Stands Out

What sets BlockDAG apart is its ecosystem-first approach. Instead of riding on speculation, it has backed its presale with practical tools, mining infrastructure, and app integrations. This combination of fundraising scale, community participation, and working products positions BDAG as more than a presale coin; it is a framework for long-term adoption.

The X1 miner app, paired with physical rigs and ongoing dApp development, ensures activity across both mobile-first and traditional setups. Meanwhile, the structured presale has created predictable value growth without overreliance on marketing alone.

Looking ahead, the project’s roadmap is equally ambitious: with 1,000 dApps targeted by 2026 and a mainnet scheduled for 2025, BlockDAG is building toward sustained activity rather than short-lived excitement. For those seeking substance rather than speculation, this combination makes BlockDAG a case study in how digital assets can function as complete ecosystems.

Final Thoughts

BlockDAG’s growth story is defined not only by the $381M raised but also by what that capital is enabling, real infrastructure, accessible mining, and live integrations. Its hybrid design blends DAG architecture with Proof-of-Work, offering scalability, security, and speed fit for mainstream applications.

By delivering products ahead of its official launch and structuring BDAG as a multi-utility asset, BlockDAG shows how presales can evolve from fundraising exercises into complete ecosystems. With millions already mining via mobile and testnet features proving functionality, it is no surprise that the presale continues to attract global attention.

As the mainnet approaches and listings draw closer, BlockDAG looks less like a speculative experiment and more like a blueprint for future crypto economies. Instead of simply asking “what coin will rise next,” the better question might be: how soon will BlockDAG redefine the market standard?

Blockchain

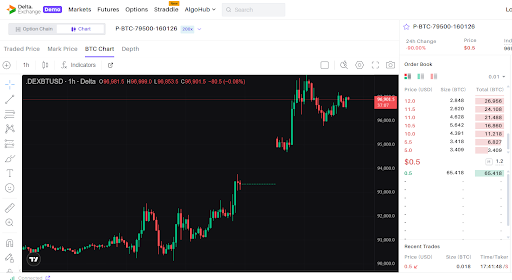

5 Reasons Why Delta Exchange is the Easiest Platform for Crypto Trading Strategies in the Indian Market

Crypto trading in India has grown exponentially in the last few years. In 2025, the market pulled in $258 million in revenue and is on track to hit nearly $732 million by 2033, growing at a 14.3% CAGR from 2026 onwards. That kind of money doesn’t come from people buying Bitcoin on a whim and hoping for a lucky spike. It comes from traders who plan entries, manage exits, build hedges, and run full-blown crypto trading setups.

This shift has created a new problem. Most Indian crypto exchange apps still feel built for basic spot buying without any advanced features to try. You open five tabs, check prices on one app, place orders on another, track risk on a third, and hope nothing slips through.

Delta Exchange transforms the story here. Instead of spots, Delta offers a safe trading platform to explore crypto derivatives (futures and options) across major currencies.

Let’s understand more about Delta Exchange and why so many Indian traders end up sticking with it once they try it.

Why Try Crypto Trading Strategies on Delta Exchange

Ranked among the top Indian crypto exchanges, Delta Exchange offers a range of features and analytics tools to simplify your crypto trading experience.

Here’s why many traders trust Delta Exchange:

- INR trading keeps things simple

If you’ve ever had to convert INR to USDT or USD just to trade Bitcoin, you know the hassle. Delta Exchange lets you deposit and withdraw in INR directly via UPI, IMPS, NEFT, and bank transfer, with your margin and profits shown in INR.

That means no awkward crypto conversions or extra wallets – you fund your account straight from your bank and start crypto trading like it’s normal money.

- Algo trading bots that actually work

Automation can save hours and reduce emotional stress and decisions, especially with fast moves in crypto F&O. Delta Exchange supports algo trading through APIs and bot integrations from platforms like TradingView and Tradetron.

You can link your trading strategy to webhooks or APIs and let bots place trades for Bitcoin futures or other crypto options even when you’re away. If you want systematic, repeatable strategies with fewer missed opportunities, this setup feels practical and real.

And the best part? You don’t need to have any coding knowledge or degree – API Copilot does it all for you.

- Lower trading fees that don’t eat into your wins

Fees matter because every percentage point you pay is one less in your pocket after a winning trade. Delta Exchange offers competitive taker and maker fees, plus a fee cap on options that limits how much you pay on low premium trades.

This helps keep costs predictable, whether you’re trading Bitcoin or ETH futures and options. Traders who place frequent trades or use multi-leg strategies on the Indian crypto exchange can keep more of their gains, rather than having them eaten up by trading fees.

- Strategy Builder for practical trading plans

Strategy planning can get messy if the platform doesn’t help you visualize outcomes. Delta Exchange offers tools that let you craft crypto F&O setups with clear strike choices and expiries, plus daily, weekly, and monthly options for more precise timing. This helps you conveniently plan spreads, straddles, or hedges.

- Compliance and risk measures to know

It’s one thing to trade, another to trust the platform doing it. Delta Exchange is registered with India’s Financial Intelligence Unit (FIU) and follows local KYC and AML rules.

For risk management, the platform supports:

- Margin controls and stop-loss tools that help you manage positions while you trade Bitcoin or other crypto derivatives.

- Demo account to practice trades and understand the market without real money.

- Payoff charts show you how your trade will play out with breakeven points and maximum P&L.

This way, you can study your crypto trading strategy better before finalizing the trade.

Apart from these, Delta also offers leverage up to 200X – a good way to amplify your profits if the market moves in your favor.

The Bottomline

Indian crypto traders have moved far past the buy-and-hold phase. Spot crypto trading still has its place, yet most active users now want faster ways to make money from price swings, not wait months for a rally.

That’s where crypto F&O, spreads, and short-term setups step in. You want tools that let you react within minutes, control risk, and lock gains when the move shows up.

Platforms that only support basic coin buying just can’t keep up with that style of trading. Serious traders want flexibility, speed, and ways to work with volatility, not sit through it – and Delta Exchange caters to such traders well.

Disclaimer: Crypto trading carries inherent risks due to its high volatility. This article is for informational purposes only. Kindly do your own research before making any investment decisions.

Blockchain

MoonExe Aligns With the Next Phase of Stablecoin Payments as Global Regulation Accelerates

MoonExe today reaffirmed its strategic focus on stablecoin-powered payment infrastructure as global regulatory clarity continues to accelerate across major financial jurisdictions.

Regulators worldwide are advancing frameworks that formally recognize stablecoins as legitimate instruments for payment, settlement, and treasury operations. Legislative initiatives in the United States, expanded licensing regimes in Asia, and structured compliance approaches in other regions are collectively signaling a transition from experimental adoption to regulated, real-world deployment.

As stablecoins move deeper into mainstream financial infrastructure, demand is increasing for platforms capable of delivering real-time liquidity, transparent pricing, and verifiable settlement. MoonExe’s Exchange Finance (ExFi) model is designed to address these needs by enabling stablecoin-based currency conversions that operate continuously, without dependence on traditional banking cut-off times or geographic limitations.

The platform focuses on facilitating efficient value movement while maintaining transparency through public blockchain records. Transactions executed within the MoonExe ecosystem can be independently verified via standard blockchain explorers, reinforcing confidence through auditable, immutable data.

In parallel with regulatory progress, market participants are increasingly prioritizing infrastructure reliability over speculative activity. Stablecoins are being evaluated less as alternative assets and more as operational tools capable of supporting cross-border payments, digital commerce, and treasury flows.

MoonExe continues to expand its infrastructure and partnerships to support this evolution, positioning itself as part of the foundational layer required for stablecoins to function at global scale.

For more information about MoonExe and its stablecoin payment infrastructure, visit https://moonexe.com/

Blockchain

Playmaker to Launch in Q2 2026 as Midas Labs Expands Its AI-Powered Game Creation Ecosystem

Midas Labs, a UK-based Web3 technology company, has announced the upcoming launch of Playmaker, an AI-powered game creation and launchpad platform scheduled for Q2 2026. The platform is designed to lower barriers to game development and funding, operating as a core product within the UNIFI-powered Midas ecosystem.

Playmaker will provide creators, indie studios, and early-stage visionaries with an integrated environment to ideate, build, fund, and publish games without the traditional constraints of large teams or complex technical infrastructure. By combining AI-assisted creation tools with a structured launchpad and marketplace, the platform aims to streamline the path from concept to live product.

According to Jonathan Wheatley, Chief Marketing Officer of Midas Labs, Playmaker represents a natural progression of the company’s ecosystem strategy.

“Playmaker is about enabling participation at every level — from creators and developers to early supporters and players,” said Wheatley. “By integrating AI-driven creation with funding and publishing infrastructure, we’re building a system that allows ideas to move efficiently from concept to execution.”

The platform is powered by the $PLAY token, a fixed-supply utility asset used for project participation, creator payments, marketplace transactions, and ecosystem services. $PLAY operates within the broader UNIFI ecosystem, where UNIFI serves as the access and conversion layer, reinforcing liquidity and alignment across Midas Labs’ products.

Midas Labs has structured Playmaker’s token economy around a non-mintable, scarcity-driven model, designed to support long-term sustainability as platform adoption increases.

The Playmaker launch builds on recent Midas Labs milestones, including the expansion of the Midas Play Marketplace, multiple game releases, ecosystem partnerships, and the rollout of UNIFI staking infrastructure. Together, these components form a vertically integrated environment linking creation, funding, distribution, and participation.

Playmaker is scheduled to go live in Q2 2026, with phased ecosystem access beginning with early contributors before expanding globally.

About Midas Labs

Midas Labs is a United Kingdom–based Web3 technology company focused on building scalable digital ecosystems across gaming, AI, and creator-driven platforms. Powered by the UNIFI token, Midas Labs develops infrastructure designed for long-term participation, real utility, and sustainable growth.

-

Crypto4 years ago

Crypto4 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain6 years ago

Blockchain6 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release5 years ago

Press Release5 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain6 years ago

Blockchain6 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain6 years ago

Blockchain6 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins