Blockchain

Crypto Regulation: SEC Rules & Exchange Battles

The evolving landscape of crypto regulation, particularly the SEC’s recent interactions with major crypto exchanges, signals a pivotal moment for compliance and legal frameworks.

Understanding the Impact of SEC Regulations on Crypto Exchanges

In 2024, the SEC is pushing forward with a rigorous enforcement agenda aimed at crypto exchanges, emphasizing compliance with US securities laws.

This proactive stance includes significant actions against well-known platforms, signaling a pivotal period for the crypto industry’s regulatory landscape.

Further in the article, we will examine the SEC’s intensified scrutiny and its implications for crypto exchanges, investors, and the broader market.

Legal Challenges and Court Battles

Legal disputes between major cryptocurrency platforms and the SEC are defining moments in the crypto industry’s regulatory framework. These battles test the SEC’s authority and shape future governance over digital assets.

Major Cases and Legal Arguments

The SEC has initiated high-profile cases against leading crypto exchanges and platforms, asserting that many digital assets qualify as securities under US law.

Notable cases include actions against Coinbase and Binance, where the SEC argues these platforms operated without proper registrations, dealing in assets that should be classified as securities.

These cases hinge on whether specific tokens sold on these platforms are “investment contracts” and should be regulated as securities.

The legal outcomes could significantly influence how crypto assets are marketed, sold, and managed in the US.

Implications for Crypto Exchanges and Investors

The resolution of these legal challenges carries substantial implications for the operational practices of crypto exchanges.

For investors, the outcomes will likely affect the kinds of assets available on platforms and the level of regulatory protection they can expect when investing in crypto assets.

For crypto exchanges, a ruling against them could mean reevaluating their business models, requiring significant changes to ensure compliance with securities laws.

It may entail stricter AML (anti-money laundering) and KYC (know your customer) policies and fewer tradeable cryptocurrency assets.

Strategic Responses by Crypto Companies

In response to these legal pressures, crypto companies like Coinbase have articulated their stance, challenging the SEC’s claims and arguing that not all digital assets are securities.

This Exchange, for instance, has pushed back against the SEC’s broad application of securities laws, which they argue stifles innovation and harms the US position in the global crypto market.

These companies are also lobbying for more precise rules delineating which digital assets are securities and which are not, advocating for legislation supporting innovation while providing adequate consumer protections.

Future Legal and Crypto Regulation Landscape

The ongoing court cases are likely to prompt legislative changes, with potential new laws that could redefine the regulatory landscape for cryptocurrencies.

The outcomes could lead to more defined roles and responsibilities for regulatory bodies like the SEC and CFTC (Commodity Futures Trading Commission) and more precise guidelines for crypto businesses.

The legal battles and resolutions are poised to establish precedents that will influence future SEC actions and, potentially, the broader legislative environment for the crypto industry.

These developments are critical, as they will help shape the balance between regulatory oversight and innovation within the burgeoning crypto market.

The intricate dynamics of these legal battles reveal the complex interplay between regulation and innovation in the crypto industry.

The outcomes of these cases will not only affect the parties involved but could also set the stage for the future regulatory framework governing digital assets.

Compliance and Operational Adjustments

The intensifying regulatory landscape demands crypto exchanges adapt their operations to align with new compliance requirements.

Adapting to New Regulatory Requirements

Crypto exchanges are increasingly pressured to conform to evolving SEC regulations, which dictate a tighter control environment around trading digital assets considered securities.

Adjustments include enhancing transparency, improving reporting standards, and enforcing stricter due diligence on listings to avoid the inclusion of potential securities without proper oversight.

Technological Solutions for Compliance

Many crypto platforms are turning to advanced technological solutions to tackle the challenges posed by these stringent regulations.

One way to achieve this is by installing advanced compliance software that automatically monitors and reports on transactions that are considered securities.

These systems are designed to flag transactions requiring additional scrutiny or specific compliance procedures, thereby reducing the risk of regulatory breaches.

The SEC acknowledges that it must change to keep up with the markets it oversees:

The SEC must also continue to enhance its expertise in, and devote increased resources to, product markets beyond equities — including crypto assets, derivatives, and fixed income — and maintain a nimble and flexible approach to address market changes expeditiously.

Best Practices for Crypto Exchanges

Best practices in this new regulatory era involve:

- Proactive engagement with regulatory bodies, adopting robust governance frameworks, and continuous education of users about regulatory changes and their impact on trading activities.

- Establish clear communication with crypto exchanges, which are advised to channel with investors, providing regular updates on regulatory developments and how they affect the services offered.

These adjustments are crucial for crypto exchanges to remain compliant and competitive in a rigorous enforcement and oversight landscape.

In this way, the exchange’s dedication to security and transparency is reinforced while helping comply with regulatory requirements and fostering trust with users and investors.

Global Perspectives on Crypto Regulation

As the SEC ramps up its regulatory framework, comparing these developments with global regulatory trends in the crypto sector is insightful.

Comparison with Regulations in Other Countries

Countries worldwide are at various stages of implementing their cryptocurrency regulatory frameworks.

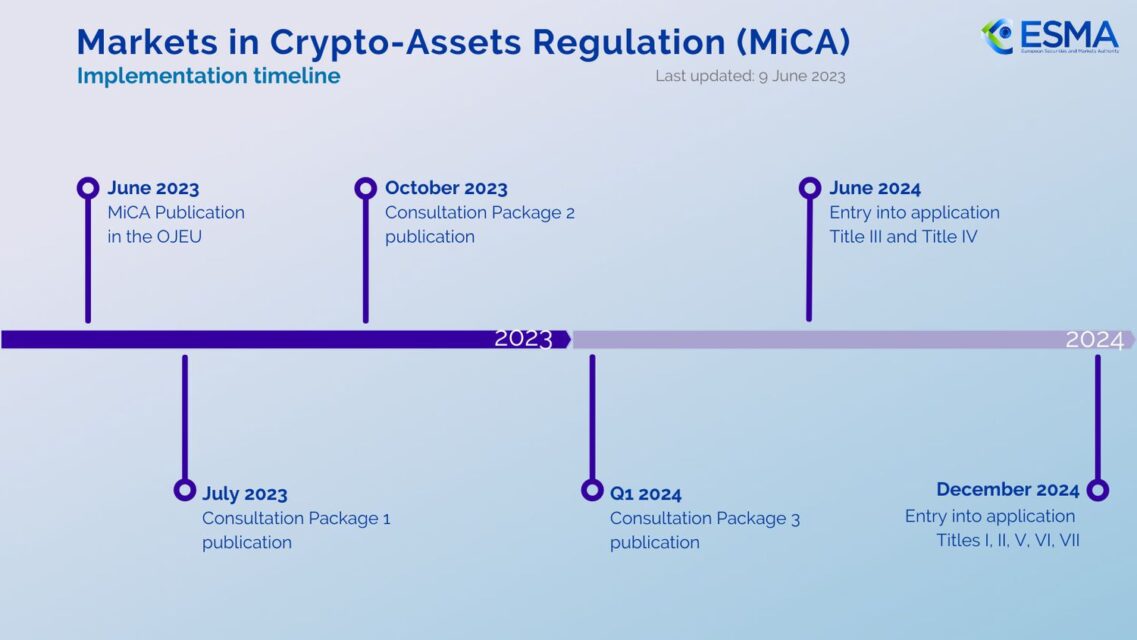

For instance, the Markets in Crypto-Assets (MiCA) framework is a recent development by the European Union that attempts to standardize legislation for cryptocurrency assets among its member states.

In the US, however, there has been more partisanship and fragmentation of regulatory certainty. (CoinDesk).

In Asia, nations like Japan and South Korea have established more stringent regulatory environments, focusing on investor protection and anti-money laundering measures while maintaining a generally supportive stance towards technological innovation in the crypto space.

International Cooperation in Crypto Regulation

There’s a growing trend towards international cooperation among regulatory bodies to tackle the global nature of the cryptocurrency market.

Forums like the G20 increasingly focus on synchronizing regulatory approaches to cryptocurrencies, aiming to combat financial crimes and ensure a stable international monetary system without stifling innovation.

Future Trends in Global Crypto Policies

The global perspective on cryptocurrency regulation is trending towards more stringent frameworks that require greater transparency and compliance from all market participants.

However, there’s also a significant focus on ensuring these regulations do not hinder the crypto industry’s growth.

Future trends may include more standardized international regulations and possibly global frameworks that facilitate easier cross-border operations of crypto businesses.

These contrasts and patterns draw attention to the various methods and intricacies involved in cryptocurrency regulation across the globe.

Such insights are critical for stakeholders in the cryptocurrency market to anticipate changes and adjust their strategies accordingly.

Expert Opinions and Predictions on Crypto Regulation

From business executives to legal specialists, we will now compile their perspectives on the evolution of cryptocurrency laws, including predictions about future modifications and their possible effects on the market.

Views from Industry Leaders

Prominent figures in the crypto industry have expressed mixed feelings about the SEC’s current regulatory approach.

For example, some executives argue that the SEC’s enforcement-first strategy might hinder innovation and drive crypto businesses offshore. They suggest a more balanced approach, encouraging the SEC to provide clear guidelines that support innovation while ensuring market integrity.

Coinbase’s CEO recently highlighted the challenges of navigating unclear and sometimes contradictory regulations, calling for a regulatory framework that is both clear and fair. This sentiment is echoed by others who fear that without regulatory clarity, the US risks falling behind other nations more openly embracing the crypto economy.

Legal Expert Insights on Cryptocurrency Regulatory Trends

Legal experts closely monitor the evolution of crypto regulations, noting that the SEC’s aggressive stance could set important precedents for other regulators globally.

For instance, experts from Norton Rose Fulbright predict that, regardless of the aggressive approach, the necessity for a balanced regulatory regime that accommodates the unique aspects of cryptocurrencies is inevitable.

A prominent attorney specializing in blockchain technology pointed out, “The regulatory landscape needs to evolve with the technology, not against it.

Regulatory agencies should work with industry leaders to craft laws that protect consumers without stifling innovation”.

Predictive Analysis of Upcoming Crypto Regulatory Changes

Predictions for future regulatory changes primarily focus on the potential for more definitive actions from legislative bodies.

Experts predict that significant legislative efforts will be made in the coming years to create more concrete frameworks for cryptocurrency.

For instance, some predict that Congress might step in to provide the necessary clarity that the SEC has been slow to offer, potentially through new legislation that explicitly addresses the classification of digital assets and their regulatory requirements.

These expert opinions and predictions shed light on the ongoing debate and the possible directions for crypto regulation.

As the industry evolves, these insights will be crucial for stakeholders to navigate the changing regulatory landscape effectively.

Managing Cryptocurrency Regulation in the Future

As we’ve explored throughout this article, the landscape of cryptocurrency regulation is undergoing significant transformations, particularly in the United States. The SEC’s intensified scrutiny and legal actions against major crypto platforms mark a critical juncture for the industry, raising questions about the future of digital asset classification and regulatory compliance.

Summary of Key Points:

- Increased Enforcement:

The SEC is stepping up its efforts to regulate the cryptocurrency space, emphasizing compliance and treating many digital assets as securities, leading to high-profile legal challenges testing the limits of the SEC’s regulatory reach. - Legal and Operational Challenges:

Crypto exchanges and other platforms face significant legal and operational hurdles. The outcomes of ongoing legal battles could dictate operational adjustments and compliance strategies for years. - Global Regulatory Environment:

Comparison with other jurisdictions reveals a varied approach to crypto regulation. While some countries offer more clarity and support for innovation, the US remains a complex, somewhat contentious arena for crypto regulation. - Expert Insights and Predictions:

Industry leaders and legal experts advocate for more precise, balanced regulations that support innovation while ensuring market integrity and investor protection. There is a consensus that legislative action is needed to clarify the regulatory framework for cryptocurrencies.

The future of crypto regulation is poised at a crossroads, with the potential for significant legislative and regulatory changes that could reshape the industry. Stakeholders must stay informed and adaptable, ready to navigate the evolving compliance landscape.

Blockchain

Could BlockDAG Reach $1? Whales Move In as 2025’s Top Crypto Presale Breaks Records

BlockDAG is fast becoming one of the standout stories in the crypto space this year. With more than $327 million raised, over 23.5 billion BDAG coins distributed, and an ecosystem already supported by a community of 2 million-plus mobile miners, BlockDAG is proving it’s more than just hype.

It’s now gaining recognition as a Layer 1 platform with actual momentum behind it. The major question many analysts are asking now: Can BDAG hit the $1 mark in the coming years?

With a presale entry price as low as $0.0016 available until the BlockDAG GLOBAL LAUNCH release on August 11, and signs of increasing activity from high-value wallets, BlockDAG’s rapid growth is drawing serious attention. If these early signals prove accurate, BlockDAG could be one of the top crypto presale that transition successfully into long-term market relevance.

Whale Wallets Are Moving, and It’s Creating a Buzz

One of the clearest signs of serious traction in a crypto project is when high-volume wallets begin to act, and that’s exactly what’s happening with BDAG.

Current on-chain data shows several wallets acquiring BDAG in amounts ranging from 7 to 8 figures, all through the limited-time $0.0016 pricing window before August 11. These aren’t casual buys. The scale suggests participation from large holders, potentially including institutional players and crypto whales, who are taking advantage of the pricing before the official launch value of $0.05 kicks in.

Such movements typically happen before major market shifts. These wallets appear to be aligning with the project’s upcoming roadmap, which includes community-run nodes and a full suite of decentralized apps with Ethereum Virtual Machine compatibility.

How BlockDAG Achieved a $327M Raise and Why It’s Significant

Unlike many projects that rely on funding from venture capital, BlockDAG has reached $327 million entirely through public participation. This sets it apart not just for 2025, but across crypto history, putting it ahead of even the most well-known presale successes:

- Filecoin brought in $233 million in 2017

- Polkadot raised $145 million

- Ethereum’s launch in 2014 generated around $18 million

BlockDAG has already outpaced all of these, even before going live.

This level of funding shows two things:

- Widespread belief in the long-term viability of the project

- A strong financial base to support ecosystem development and growth

For those watching this closely, the implications are huge. BlockDAG is stepping into the open market not just with promises but with an active product base. This includes tools like the X1 Miner App, ASIC hardware integration, and a no-code smart contract creator already in use.

Could BDAG Really Hit $1? Here’s What the Numbers Say

Consider these examples: Kaspa crossed $4 billion market cap in 2023. Avalanche exceeded $15 billion during a bullish cycle. Even meme-based coins like PEPE reached multi-billion valuations despite lacking strong utility.

BlockDAG, in contrast, already delivers real substance. It operates a functioning testnet with active smart contract support and runs on a hybrid DAG and Proof-of-Work model capable of handling 15,000 transactions per second. Over 18,250 mining rigs have been sold, reflecting solid hardware demand. Its code is audited, certified, and ready for decentralized app deployment. The roadmap also includes a developer academy, a DeFi launchpad, and a cross-chain bridge, all designed to expand utility and ecosystem depth.

This isn’t about potential; it’s already a working Layer 1 platform. If even a modest share of its 2 million mobile miners begin using the mainnet, the $1 target shifts from speculation to a strategic milestone.

Right now, BlockDAG is offering a limited-time pricing option at $0.0016, even though Batch 29 is at $0.0276. With smart reward structures that encourage long-term holding, the project is building strong liquidity and a self-reinforcing price model as adoption grows.

Ecosystem Strength and Market Visibility Are Driving Growth

BlockDAG’s success isn’t just about the presale. Several key developments are boosting its visibility and utility:

- 20 centralized exchange listings are confirmed

- A 100 million BDAG airdrop tied to presale activity, referrals, testnet usage, and social engagement

- A potential U.S.-based sponsorship to build mainstream awareness

This shows a focus on sustainable growth rather than flash marketing. When branding, liquidity, and user activity align, strong price movement often follows.

Real Utility Meets Real Demand: A Project with Purpose

BlockDAG is not just another promise in a whitepaper. With $327 million raised, strong early participation from large holders, and tools already being used by the public, it has the structure needed to rise fast as one of the top crypto presale projects.

BDAG may well become one of the few coins that bridges true utility with wide-scale community adoption. The push toward a top-50 market position may not be far off if growth continues.

Right now, the special $0.0016 window is still open until August 11. Once it closes, the next price shift may come not from another presale round, but from entry into the open market.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Blockchain

Litecoin Retreats, Pi Coin Sinks After Listing Pushback, But Unstaked Races Forward with Real Utility and $5 Potential!

Litecoin (LTC) is showing signs of fading momentum, with its price dropping under $90 and struggling to stay above $87.5. Market sentiment has clearly turned bearish, and traders are cautious. Meanwhile, Pi Coin has seen a steep decline, falling over 35% as confidence in its progress fades. With both showing weakness, attention is shifting to newer projects like Unstaked.

Unstaked’s $UNSD token does not rely on hope or hype. It is tied directly to actual usage. AI agents use $UNSD to run tasks on platforms like Telegram and Discord. Each action within the network uses tokens. This gives the token true demand. As more users join, the number of tasks increases. That means token usage scales naturally with activity. It’s a simple model with powerful logic, and that’s why experts predict a surge to $3-$5 in the long term.

Litecoin Faces Downtrend with No Major Catalyst in Sight

Litecoin’s (LTC) recent slide below $90 has traders watching closely. The $87.5 level is now the key support zone. Trading volumes are low, and buyers aren’t showing strong interest. Price has stayed in a tight range since early June.

Technical indicators back the bearish outlook. RSI is falling. Short-term moving averages also show weakness. LTC is still used as a low-fee crypto, but its price hasn’t followed other top coins lately.

Without strong news or a major upgrade on the horizon, Litecoin looks stuck in neutral. For swing traders, it offers clear zones to enter and exit. But for those chasing long-term growth from active platforms, LTC lacks fresh drivers compared to newer utility-based projects.

Lack of Clear Roadmap Weighs Heavy on Pi Coin’s Price

Pi Coin’s decline continues after yet another delay in its expected mainnet launch and exchange listing. The team recently cited backend issues, pushing the timeline beyond mid-June 2025. This delay hit user confidence hard. Pi’s price in off-market trades dropped fast, falling from $44 to below $30.

On-chain metrics show limited activity. There is still no fixed date for listings on public exchanges. As the delays pile up, many early users are losing patience. Some are selling off OTC holdings, adding to the pressure.

App engagement is high, but without a working market, token value remains weak. If Pi Coin doesn’t secure a verified listing soon, it risks further downside. Right now, it looks more like a stalled beta project than a crypto ready for mass adoption.

Why AI Utility Sets Unstaked Apart Before Launch!

Unstaked’s $UNSD token is part of a working platform where each use case supports its value. Every AI agent launched in the system will need $UNSD to complete tasks. These range from managing chats to running campaigns. As usage increases, so does token movement.

This structure builds scarcity naturally. $UNSD is not held for speculation; it’s spent across activities in the network. More agents mean more actions, and that means more token use. That’s why many expect the price to reach $3 to $5, not as a guess but as an effect of real adoption.

Unstaked’s presale crypto 2025 is now in Stage 22, with each token priced at $0.01209. Over $10.6 million has been raised so far, and more than 1.2 billion tokens have been sold. No private sales were held. Liquidity will be locked, and the contracts are fully visible to the public.

Importantly, the AI agents will go live only after the presale ends and the project officially launches. This clear roadmap sets expectations right. Many see this as a chance to get in early before network activity picks up. With a utility-based model already in place, $UNSD stands out from projects still chasing hype.

Looking Ahead

Litecoin is under pressure, with prices near $87.5 and no bullish signs ahead. Pi Coin’s crash to $26 has frustrated users as exchange delays stretch on. Both coins face uncertainty, and traders are cautious.

Unstaked, however, is building a network tied to real function. Its $0.01209 token is powering automated tools, and its model rewards actual use. As the launch nears and AI agents go live, demand for $UNSD is expected to rise. For those looking at 2025 prospects, Unstaked’s setup feels more grounded, a system where growth follows real work, not just sentiment.

Join Unstaked Now:

Presale: https://presale.unstaked.com/

Website: https://unstaked.com/

Telegram: https://t.me/UnstakedTokenOfficial

Blockchain

4 Best Crypto Projects Showdown: BlockDAG, LINK, ARB, TAO; Who Will Win The Battle

With so many coins out there, it’s easy to feel lost when trying to pick the best crypto projects. Many people fall for hype, only to see little return. What really matters today is finding coins that reward effort, offer fair systems, and have growing use cases. BlockDAG, Chainlink (LINK), Arbitrum (ARB), and Bittensor (TAO) are gaining attention for these reasons.

They give users chances to take part through tasks, staking, or technical work, instead of simply holding coins. Here, we break down how each of these projects delivers real value and why they deserve a closer look. Keep reading to see how these coins can offer smarter ways to join the crypto world.

1. BlockDAG: Noted For Impressive Growth Potential

BlockDAG is quickly standing out as one of the best crypto projects for those looking to stay active and earn rewards in more than one way. Its task-based airdrop system offers flexibility by letting users choose tasks that match their skills and interests.

Those with a technical background can engage in testing activities on the Beta Testnet and contribute to the development process. People who have a passion for sharing and building communities can invite others or help promote BlockDAG (BDAG) through various platforms.

Even casual users who enjoy spending time on social media can take part by completing small tasks that come with rewards, making BlockDAG appealing to a wide range of participants.

BlockDAG has already raised an impressive $326 million, with 23.4 billion coins sold, showing strong interest and support from the crypto community. There is a fixed price at $0.0016 until 11th August.

BlockDAG’s combination of rewards and appealing presale prices positions BlockDAG as a strong contender among top cryptos for active participants who want more than just passive holding.

2. Chainlink: Delivers Value With Real World Data

With steady updates and wider use across chains, LINK offers long-term strength. It may not have task-based airdrops like BlockDAG, but it remains a trusted choice for real-world crypto use.

Chainlink is among the best crypto projects thanks to its long history of connecting smart contracts to real-world data. LINK helps power DeFi apps, games, and more through its oracle network and Proof of Reserve system. It lets users stake and help secure the network, earning rewards for their part.

3. Arbitrum: Trusted For DeFi App Growth

Arbitrum is considered one of the best crypto projects for those interested in helping Ethereum scale. It cuts fees and boosts transaction speed, which makes it popular with DeFi, NFT, and app builders.

ARB holders can vote on grants, help decide network updates, and take part in governance. DeFi apps on Arbitrum offer ARB-based rewards for liquidity and staking. Its long-term appeal lies in making Ethereum smoother while giving users a say in the future.

4. Bittensor: Drives AI Growth With TAO

Bittensor is a unique entry on the list of the best crypto projects, especially for those excited by AI. TAO lets people join a shared AI network by training models. Contributors earn based on the value of their work, not just for holding coins.

TAO offers developers and researchers a new way to be rewarded for advancing AI, free of large central control. As AI demand grows in 2025, TAO’s blend of crypto and tech keeps gaining attention.

Final Thoughts

The best crypto projects aren’t about hype or fast profits. They focus on fair rewards for real effort. BlockDAG offers early and flexible ways to earn through tasks and smart presale offers. LINK helps secure the core of blockchain with its trusted oracle system.

ARB makes Ethereum more user-friendly while adding governance options. TAO lets users shape AI while earning fairly. Together, these coins show how effort-based rewards are defining the future of crypto.

-

Crypto3 years ago

Crypto3 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release4 years ago

Press Release4 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain5 years ago

Blockchain5 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins