Press Release

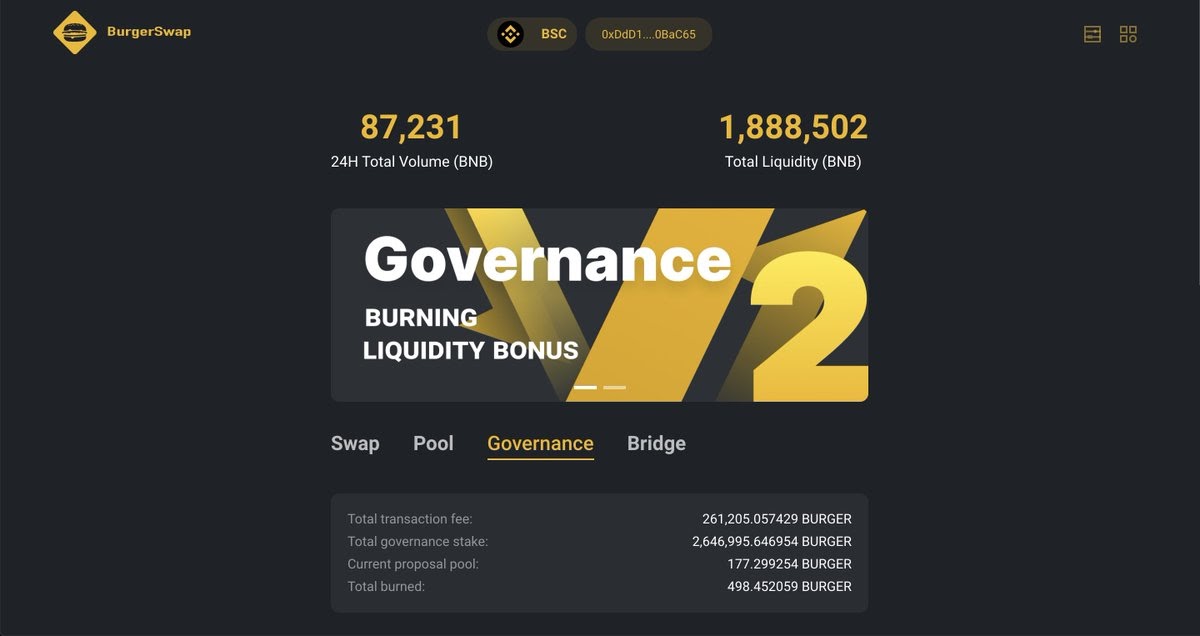

BurgerSwap Introduces V2 Protocol With New Burning Functionality

BurgerSwap is an open-sourced democratized automated market maker (AMM) that focuses on decentralization. The protocol hit the DeFi space by storm, reaching a liquidity of $400M with the staking of 12 million BNB tokens in just one day.

The platform launched on September 10th at 16:00 PM UTC and is already hailed as the very first Uniswap-like application to launch on Binance Smart Chain (BSC). By leveraging BSC, BurgerSwap benefits from faster speeds and lower trading fees compared to similar ETH-based DeFi projects.

The BurgerSwap team sees BSC as having the potential to be one of the top Proof of Stake (PoS) ecosystems. Thus, they have applied for Binance’s $100 million DeFi and CeFi Accelerator Fund to foster the BurgerSwap AMM and ecosystem expansion.

BurgerSwap V2 Can List bTokens

On Sep 22, the Burgerswap team unveiled V2 of its protocol that introduced a Burn Mechanism where a percentage of the BURGER tokens converted from trading fees will be burned forever.

Under BurgerSwap V2, traders will also be able to swap ETH and BSC-based assets via a unique custom built cross-chain BEP20 bridge.

The bridge facilitates the conversion of any ERC20 token to a wrapped bToken issued on BSC. This wrapped token can then be listed on BurgerSwap to trade and provide liquidity.

Burgerswap’s team is currently working on tutorials for how to list bTokens and interact with other important features on the BurgerSwap platform.

LP’s Get More Control Over their Assets

Another hot feature integrated into the V2 protocol is an enhanced ability for LP’s to redeem their rewards at any given time, creating instant liquidity without the need to remove liquidity.

BurgerSwap V2 also offers liquidity providers more control over their assets by allowing them to choose the currency they want to receive their rewards. LP’s can currently receive rewards in BURGER, BNB and USDT.

Since BurgerSwap doesn’t have an LP token, it can implement even more unique elements. For instance, projects on the protocol can opt to reward liquidity providers on their token pairs with their own project token or any other token.

The new BurgerSwap protocol introduces a new default distribution setting for staked rewards. Under V2, 40% of the rewards will be allocated to liquidity providers on the platform, while 30% of the rewards will go to governance/voting participants. The remaining 30% of rewards are burned forever.

User Interface (UI) Improvements

BurgerSwap V2 is built on BSC, and so all tokens will have BNB pairs. Each asset is also required to have a BURGER pair, accounting for a minimum of 1% of the asset’s liquidity to be eligible for mining rewards.

The protocol recently improved the UI around it to empower users to trade BEP20 assets in a decentralized and democratic way.

The platform continues to call on community members interested in joining its UX/UI designers and smart contract dev team to send their applications at twitter.com/burger_swap.

Governance

BurgerSwap V2 emphasizes on community and governance to bring more users, traders, and liquidity to DeFi.

The platform’s BURGER token is the first fully community governed token with no maximum supply. Each block produces 40 Burger tokens, with users getting a share of the rewards relative to the liquidity they provide.

Users can add any pair by providing liquidity, but only BNB and BURGER pairs can mine BURGER tokens.

Unlike SushiSwap, users on BurgerSwap can vote to change the platform’s parameters such as trading fees, staking rewards, and mining speed. Of course, even the reward allocations for LPs and participants in voting can also be changed by voting.

BurgerSawp’s community governance has been a success, with numerous proposals already created and executed since launch. Currently, 2 million staked BURGER tokens are pledged per vote.

The project now seeks to improve its governance system to ensure the model’s sustainability and enhance voting and access to liquidity.

Their dev team is currently working to integrate more DeFi functionalities to the protocol to build a comprehensive DeFi experience on BSC.

Burgerswap is also looking to cap the maximum supply of BURGER tokens to determine the project’s long-term value. Currently, BurgerSwap has an upper limit set at 120 BURGER per block and the lower limit of 1 BURGER.

Users can vote on the number of tokens produced per block, but the amount needs to stay within the set range to maintain a healthy state of the protocol.

Press Release

Qubetics Near Listing, Mantle Dips, Gate Slips: Which Is Among the Top Cryptos to Watch?

The crypto market is evolving fast, but only a few projects are truly aligning with the future of Web3 usability and multichain access. Qubetics is now at the center of that conversation, having just launched its non-custodial multi chain wallet that lets users manage assets across Ethereum, BNB Chain, and Polygon, all without relying on third-party tools. Meanwhile, its ongoing presale reached Stage 37, with only 10 million tokens remaining at $0.3370, signaling urgency and growing market confidence.

In parallel, Mantle (MNT) has seen a minor price dip to $0.6361, offering potential entry for investors looking to accumulate scalable Layer-2 infrastructure while prices are low. Despite the drop, developer activity and upcoming roadmap catalysts keep Mantle relevant in discussions about long-term utility-based altcoins. For those looking for discounted exposure to Ethereum-based scaling, this could be a calculated risk worth considering.

Gate (GT) has declined by 2.13% to $16.95 on the centralized exchange front, raising questions about short-term sentiment around CEX tokens. However, with Gate.io’s expanding ecosystem including new staking features and lending tools, some people still view it as a steady, if slower-growth, asset. With each of these coins representing a different segment of the crypto world, the key question becomes: which one truly belongs among the top cryptos for massive growth right now?

Qubetics ($TICS) Stealing Spotlight with Interoperability

The Qubetics Network is set apart primarily by its strong emphasis on interoperability. Unlike many blockchain networks that operate in silos, Qubetics is designed to be a Web3-aggregated chain.

This means it integrates multiple blockchains, including Bitcoin, into a unified framework. Such architecture allows cross-chain transactions, data sharing, and asset transfers to occur effortlessly and securely.

This interoperability is crucial for expanding decentralized application (DApp) functionality and enhancing user access. Developers gain a cohesive environment where diverse ecosystems collaborate rather than compete. Leveraging cross-chain validation for enterprises and users reduces friction, increases scalability, and boosts the overall security posture.

Qubetics Presale Surge: 10x+ Return Potential in Final Stage

Latest News: Qubetics crypto presale enters its final Stage 37, only 10 million $TICS tokens left at $0.3370, with over 515 million sold and $18 million raised.

Early adopters are positioned for immediate upside as the token is projected to list near $0.40, a committed 20% gain at launch. Bigger buyers have a shot at dramatic upside, $7,000 invested could yield over $300,000 if $TICS rises to $15.

With supply slashed from over 4 billion to 1.36 billion and 38.55% allocated to the public, there’s a scarcity model similar to legacy index strategies—making this presale a leading purpose-fit engine among top cryptos for massive growth.

Qubetics’ mainnet launch in Q2 2025 adds to the credibility, early holders are locking in both future functionality and token price appreciation before full ecosystem rollout.

Qubetics Gears Up for Top Exchange Listing

What truly cements Qubetics’ breakout potential is its imminent listing on a top 10 global crypto exchange. This event alone is projected to increase price by 20%, immediately benefiting presale participants.

Mantle (MNT) Drops to $0.6361: Dip Could Be Entry Point for Growth

Mantle has retraced to $0.6361 with a soft drop of 1.08% on $130 million 24-hour volume. Known for its scalability enhancements and L2 value, Mantle’s dip softens the short-term sentiment—yet many analysts still consider it among the top cryptos for massive growth, citing its performance on network adoption and developer buildout post-Upgrades A and B.

A declining token price increases entry opportunity if its roadmap continues as planned. Investors may get L2 infrastructure exposure at reduced cost before the following catalyst events.

Caution is still warranted—network maintenance and gas dynamics must sustain user growth before declaring this a strong buy among growth leaders.

Gate (GT) Steady Amid Slight Decline

The Gate token dips to $16.95, down 2.13%, with a daily volume of $5.15 million. Gate is used within the Gate.io ecosystem for trading discounts, staking rewards, and governance voting. While usage remains stable, the declining token value reflects user sentiment lag.

Still, Gate.io’s growing user base and new CEX features (like C2C lending and derivatives) suggest a long-term risk-adjusted opportunity, putting GT in contention as a steady top crypto for massive growth based on exchange fundamentals.

But token economies on centralized platforms often underperform compared to utility-driven chains, so GT is best as a complement, not a core growth pick.

Conclusion:

While Mantle and Gate offer entry points based on infrastructure discount and ecosystem familiarity, Qubetics is a top candidate for the top cryptos to watch. With a use-case backed multichain wallet rollout, final presale scarcity, and planned mainnet launch, investors see utility and upside.

Mantle and Gate are viable for lateral infrastructure diversification, but neither offers the multi-dimensional functionality nor growth mechanics that Qubetics does. If you’re building a high-conviction altcoin strategy, Qubetics should be your headline.

For More Information:

Qubetics: https://qubetics.com/

Presale: https://buy.qubetics.com/

Telegram: https://t.me/qubetics/

Twitter: https://x.com/qubetics/

FAQs

1. Why is Qubetics a standout among the top cryptos for massive growth?

Its multichain wallet solves real-world usability and security issues across networks, combining presale scarcity with ecosystem integration.

2. How much ROI could early Qubetics investors expect?

Base presale gains are 20% at launch. If Qubetics hits $5–$15, ROI ranges from 10x to nearly 50x—strong growth target for altcoin investors.

3. Should I buy a Mantle now?

Mantle’s dip enhances value entry on an L2 scaling chain—but confirm upcoming roadmap updates before buying.

4. Is Gate a good investment at $16.95?

Gate token offers are upside linked to its exchange activity but exchange tokens depend heavily on volume and fee structure, limiting explosive growth.

5. Should I invest in all three?

Yes — Qubetics provides multichain utility, Mantle gives L2 scalability exposure, and Gate adds CEX-linked tokens. Diversifying across them balances innovation and stability.

Press Release

Cautious Moves for Ethereum, Rising Pressure on Hedera, and a $10.6M Milestone for Unstaked

In a market where sentiment shifts fast and narratives age even faster, Ethereum and Hedera are walking two very different paths, but both are converging around uncertainty. Ethereum is trading near a critical support level, struggling to maintain bullish momentum despite encouraging network growth and progress on the regulatory front. Meanwhile, Hedera’s price action is tightening, forming a chart pattern that often precedes big moves, yet the direction remains undecided.

During this back-and-forth, Unstaked has raised $10.6 million through its ongoing presale, attracting serious capital without the typical marketing blitz. It’s not trending for hype, it’s trending because early investors see structure, scalability, and a well-incentivized ecosystem.

Ethereum Stalls Near Key Support Despite Network Growth

Ethereum (ETH) is trading around $2,500, supported by a surge in new address creation, which has grown by nearly one-third compared to the same time last year, according to Santiment. This growth aligns with positive momentum surrounding the GENIUS stablecoin bill, which passed the U.S. Senate and is now awaiting House approval. If enacted, it would mark the first major crypto legislation in the U.S., potentially boosting institutional confidence.

President Donald Trump has urged swift passage of the bill, calling it a turning point for U.S. dominance in digital assets. Meanwhile, Ethereum continues to lead with a $126 billion stablecoin market cap on its Layer 1, representing over 50% dominance.

Technically, ETH is holding critical support at $2,450, backed by key moving averages. However, with declining volume and sideways indicators like RSI and Stochastic, momentum is fragile. A breakdown below this level could send ETH toward $2,110, while a move above the 200-day SMA may revive bullish sentiment and target higher channel levels.

Hedera Compresses as Technical Risk Builds

Hedera’s native token HBAR has dropped sharply to $0.1450, its lowest level since April 9 and about 35% below its May peak. This decline coincides with the formation of a death cross pattern on May 30, where the 50-day and 200-day EMAs crossed, a signal often associated with extended bearish trends. Despite the negative price action, Hedera announced a major ecosystem update: AUDC, an Australian company, launched AUDD, the first Australian dollar stablecoin on the Hedera network. AUDD boasts fast settlement and low fees, marking the first commercial use of Hedera Studio.

However, the network’s stablecoin supply has collapsed 82% from $216M to just $40M, raising concerns. Competing chains like Sonic and Unichain now hold over $380M in stablecoins each. Meanwhile, futures open interest in HBAR has dropped to $217M, down from a $308M high. Technical indicators such as RSI and MACD also continue to fall. If the downturn continues, price could slide toward $0.1200, unless it breaks resistance at $0.1855.

Unstaked at $0.012091: Quiet Execution, Real Utility, and $10.6M Raised

While Ethereum flirts with its technical floor and Hedera battles a confidence gap, Unstaked is moving forward with purpose. Priced at $0.012091, and targeting a launch price of $0.1819, Unstaked offers more than just upside, it offers clarity. The project has already raised over $10.6 million and completed 22 presale stages, all without influencer marketing or forced virality. It’s gaining traction because the fundamentals are doing the work.

Unstaked allows users to deploy autonomous AI agents that manage, grow, and engage online communities across platforms like X and Telegram. These agents generate real, on-chain performance data that ties directly to wallet ownership. Unlike passive tokens, Unstaked’s ecosystem is built for active participation, where only effective agents are rewarded through a transparent Proof of Intelligence system.

Adding fuel to its growth, Unstaked has launched a $1,000,000 giveaway, one of the largest presale-based campaigns in the space. 20 winners will each receive $50,000 in $UNSD, rewarded for completing tasks, referring others, engaging on social platforms, and purchasing a minimum of $100 in tokens. This isn’t a hype stunt, it’s a well-designed mechanism to bootstrap community contribution and filter for real users.

With an MVP on the way and multiple CEX listings planned, Unstaked is set to enter the market with strong liquidity and measurable utility. There are no private allocations, no hidden terms, and no speculative promises. For buyers seeking early positioning in something that’s functioning before it’s fashionable, Unstaked checks all the right boxes.

Wrapping Up!

Ethereum is holding the line, Hedera is testing its footing, and Unstaked is simply moving forward. In a market where hesitation can be costly, Unstaked is executing on a roadmap grounded in user mechanics, on-chain performance, and ecosystem incentives. It’s raised $10.6 million not through buzzwords but through visible progress. The contrast is clear. Ethereum and Hedera may both regain momentum in the right conditions, but right now, their paths are uncertain. Unstaked, by comparison, is operating with focus, growing with intention, and offering early participants a quantifiable advantage.

With 28x potential, a $1M reward structure, and functional technology already deployed, this is not just another token, it’s a platform positioning itself to define the next cycle.

Join Unstaked Now:

Presale: https://presale.unstaked.com/

Website: https://unstaked.com/

Telegram: https://t.me/UnstakedTokenOfficial

Press Release

Best Crypto For 2025: A Closer Look at Web3 ai, Cosmos, Chainlink, & Avalanche

The crypto space is constantly evolving, and choosing where to invest can feel like navigating a maze. But when you’re looking ahead to the best crypto for 2025, a few projects are already turning heads with their tech, purpose, and staying power.

In this article, we highlight four standout cryptocurrencies: Web3 ai, Cosmos, Chainlink, and Avalanche. These aren’t just speculative plays. They’re platforms offering real utility, innovative features, and long-term potential. Whether you’re a newcomer or a seasoned trader, these are worth a closer look. Let’s see why they’re gaining attention as the best crypto for 2025.

1. Web3 ai: Using AI to Make Smarter Crypto Moves

Web3 ai is changing the way people approach crypto investing. It’s built around advanced AI tools that aim to make trading simpler and more effective. With real-time insights, portfolio tracking, and smart risk analysis, Web3 ai gives users an edge in a fast-moving market. The platform combines machine learning and natural language processing to help users act faster and with more confidence.

At the heart of it all is the $WAI token presale. It powers access to premium tools, allows staking, and gives holders a say in platform governance. Right now, $WAI is available at $0.000443 in Stage 9 of its presale, with the next price increase set for $0.000465. So far, $8.5 million has been raised.

What makes Web3 ai even more appealing is how easily it integrates with major wallets, DEXs, and multiple blockchains. For investors eyeing the best crypto for 2025, this is one project that combines accessibility with real functionality, making it a strong pick for the long term.

2. Chainlink: The Bridge Between Blockchain & Real-World Data

If you’ve been around crypto long enough, you’ve probably heard of Chainlink. It’s known for providing secure data feeds to smart contracts, which basically means it connects blockchains to real-world information. This is essential for DeFi applications, insurance protocols, and any project that relies on live data like pricing or weather conditions.

Right now, LINK is trading at $12.82. Despite some market fluctuations, the project keeps moving forward. New partnerships and integrations continue to expand Chainlink’s role in the growing DeFi ecosystem. Some experts expect LINK to reach $23.46 by 2026.

Chainlink remains a cornerstone for smart contract development. If you’re building a portfolio around the best crypto for 2025, LINK makes a strong case for inclusion.

3. Cosmos: Making Blockchains Talk to Each Other

Cosmos (ATOM) has been quietly solving a big problem in crypto: interoperability. In simple terms, Cosmos makes it easier for different blockchains to communicate and work together. That’s a huge deal in a landscape filled with siloed networks. Thanks to its design, Cosmos has become a critical player for developers building decentralized apps that need to operate across multiple ecosystems.

At the time of writing, Cosmos is trading at around $3.97. While the price dipped recently, long-term forecasts remain optimistic. Analysts see the token potentially climbing to $6.95 by 2026. ATOM holders also play an active role in network governance, helping shape the future of the protocol.

If cross-chain compatibility continues to rise in importance, Cosmos is well-positioned to meet that demand. It’s definitely one to watch if you’re thinking about the best crypto for 2025.

4. Avalanche: Built for Speed & Efficiency

Avalanche, or AVAX, has quickly gained recognition for its high-speed transactions and scalable infrastructure. Unlike many networks that slow down as activity increases, Avalanche is built to handle thousands of transactions per second. That efficiency makes it attractive to developers building dApps and financial platforms.

Currently priced at $18.34, AVAX has held steady with some expected market swings. But the real story is in its adoption. Avalanche is being used for everything from DeFi platforms to enterprise blockchain solutions. Analysts forecast the price could reach $22.29 by the end of 2025 and possibly hit $36.06 by 2026.

With fast finality, low fees, and a growing ecosystem, Avalanche stands out as one of the best crypto for 2025, especially for investors looking for performance and reliability.

Which Projects Deserve a Spot in Your Portfolio?

When looking at the best crypto for 2025, it’s smart to focus on fundamentals and real use cases. Web3 ai, Cosmos, Chainlink, and Avalanche each bring something unique to the table, from AI automation and cross-chain communication to real-world data delivery and lightning-fast transactions.

These aren’t just hyped coins, they’re foundational projects supporting the future of blockchain. Whether you’re drawn to Web3 ai’s AI engine, Cosmos’ interoperability, Chainlink’s oracles, or Avalanche’s performance, these picks have the potential to play a big role in the next wave of crypto growth.

If you’re building a well-rounded portfolio, keeping an eye on these four could pay off in the long run. They’ve got the tech, the teams, and the traction, and that’s exactly what makes them contenders for the best crypto for 2025.

-

Crypto3 years ago

Crypto3 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release4 years ago

Press Release4 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain5 years ago

Blockchain5 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins