Blockchain

BNB Reaches $882, OKB Supply Cut, BlockDAG Ships 19,400 Miners: Which Has the Strongest Signal?

Speculation can drive short bursts, but real traction shows through delivery. The Binance coin BNB price hit $882, fueled by active addresses climbing past 3 million. OKB jumped 152% in just a week after a major token burn and deeper integration with its new Layer-1 chain.

Both show strong interest, but they rely on upgrades to existing ecosystems. BlockDAG (BDAG) is taking a different approach by executing first, shipping 19,400 miners, locking in exchange listings, and paying users directly through mobile mining and referrals. With $383 million raised and 25.5 billion coins sold, it is proving its model even before the mainnet launches.

BlockDAG Is Already Delivering Value

In a market filled with presales that promise utility later, BlockDAG is already delivering results. Over 19,400 X Series miners have been shipped, proving hardware delivery is more than talk. At the same time, leading exchanges like MEXC and BitMart are already confirmed for post-launch listings, giving the project a strong entry into the market.

What makes it stand out further is the ecosystem rewarding users now. Through the X1 mobile miner, users can earn daily via Proof-of-Engagement. Add a 25% referral bonus system, and participants are already benefiting from live rewards rather than waiting on speculation.

The presale figures back this momentum. BlockDAG has raised $383 million, selling more than 25.5 billion coins. It is currently in batch 29, representing a 2,660% ROI compared to batch 1 at $0.001. With a $600 million hard cap, there is still room for growth.

For those considering the best crypto to buy right now, BlockDAG offers something most projects cannot: delivery before launch. While many demand trust, BlockDAG flips the model by giving users real products and payouts first.

Binance Coin Price Eyes the $1,000 Mark

The Binance coin (BNB) price reached $882.60, setting a new high on the back of increased user activity. Daily active addresses surged past 3 million, the most since June, showing that demand on the network is reinforcing momentum.

With this backdrop, analysts are now watching the $900 level, with $1,000 appearing possible if current growth continues. Support remains between $740 and $820, creating a strong base for recent buyers. The steady rise in address activity suggests this move is backed by more than speculation.

OKB Price Analysis Shows 152% Jump

The latest OKB price analysis points to a 152% surge in just seven days. A major driver was OKX’s burn of 65 million OKB, worth about $7.3 billion, cutting supply sharply and boosting scarcity.

Another key factor was the rollout of X Layer, OKX’s Layer-1 chain built with Polygon’s zkEVM. OKB is now the exclusive gas token across the OKX ecosystem, from exchange functions to wallets and payments, creating added demand pressure.

Trading volume jumped 72% and market cap grew 24% during the rally. With a capped supply of 21 million and deeper integration across products, OKB’s latest move reflects action-backed growth rather than hype.

Key Insights

BNB’s climb and OKB’s surge highlight how upgrades and supply cuts can drive short-term performance. But BlockDAG is setting a higher standard by delivering first. Miners are shipped, listings on major exchanges are confirmed, and users are earning live rewards through mobile mining and referrals.

With $383 million raised and more than 25.5 billion coins sold, BlockDAG is proving itself before the mainnet even goes live. For those asking what is the best crypto to buy right now, its approach of delivering products and payouts before launch makes the choice clearer.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Blockchain

5 Reasons Why Delta Exchange is the Easiest Platform for Crypto Trading Strategies in the Indian Market

Crypto trading in India has grown exponentially in the last few years. In 2025, the market pulled in $258 million in revenue and is on track to hit nearly $732 million by 2033, growing at a 14.3% CAGR from 2026 onwards. That kind of money doesn’t come from people buying Bitcoin on a whim and hoping for a lucky spike. It comes from traders who plan entries, manage exits, build hedges, and run full-blown crypto trading setups.

This shift has created a new problem. Most Indian crypto exchange apps still feel built for basic spot buying without any advanced features to try. You open five tabs, check prices on one app, place orders on another, track risk on a third, and hope nothing slips through.

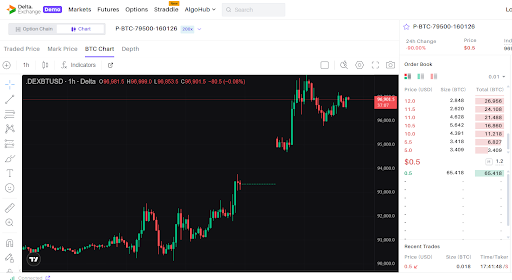

Delta Exchange transforms the story here. Instead of spots, Delta offers a safe trading platform to explore crypto derivatives (futures and options) across major currencies.

Let’s understand more about Delta Exchange and why so many Indian traders end up sticking with it once they try it.

Why Try Crypto Trading Strategies on Delta Exchange

Ranked among the top Indian crypto exchanges, Delta Exchange offers a range of features and analytics tools to simplify your crypto trading experience.

Here’s why many traders trust Delta Exchange:

- INR trading keeps things simple

If you’ve ever had to convert INR to USDT or USD just to trade Bitcoin, you know the hassle. Delta Exchange lets you deposit and withdraw in INR directly via UPI, IMPS, NEFT, and bank transfer, with your margin and profits shown in INR.

That means no awkward crypto conversions or extra wallets – you fund your account straight from your bank and start crypto trading like it’s normal money.

- Algo trading bots that actually work

Automation can save hours and reduce emotional stress and decisions, especially with fast moves in crypto F&O. Delta Exchange supports algo trading through APIs and bot integrations from platforms like TradingView and Tradetron.

You can link your trading strategy to webhooks or APIs and let bots place trades for Bitcoin futures or other crypto options even when you’re away. If you want systematic, repeatable strategies with fewer missed opportunities, this setup feels practical and real.

And the best part? You don’t need to have any coding knowledge or degree – API Copilot does it all for you.

- Lower trading fees that don’t eat into your wins

Fees matter because every percentage point you pay is one less in your pocket after a winning trade. Delta Exchange offers competitive taker and maker fees, plus a fee cap on options that limits how much you pay on low premium trades.

This helps keep costs predictable, whether you’re trading Bitcoin or ETH futures and options. Traders who place frequent trades or use multi-leg strategies on the Indian crypto exchange can keep more of their gains, rather than having them eaten up by trading fees.

- Strategy Builder for practical trading plans

Strategy planning can get messy if the platform doesn’t help you visualize outcomes. Delta Exchange offers tools that let you craft crypto F&O setups with clear strike choices and expiries, plus daily, weekly, and monthly options for more precise timing. This helps you conveniently plan spreads, straddles, or hedges.

- Compliance and risk measures to know

It’s one thing to trade, another to trust the platform doing it. Delta Exchange is registered with India’s Financial Intelligence Unit (FIU) and follows local KYC and AML rules.

For risk management, the platform supports:

- Margin controls and stop-loss tools that help you manage positions while you trade Bitcoin or other crypto derivatives.

- Demo account to practice trades and understand the market without real money.

- Payoff charts show you how your trade will play out with breakeven points and maximum P&L.

This way, you can study your crypto trading strategy better before finalizing the trade.

Apart from these, Delta also offers leverage up to 200X – a good way to amplify your profits if the market moves in your favor.

The Bottomline

Indian crypto traders have moved far past the buy-and-hold phase. Spot crypto trading still has its place, yet most active users now want faster ways to make money from price swings, not wait months for a rally.

That’s where crypto F&O, spreads, and short-term setups step in. You want tools that let you react within minutes, control risk, and lock gains when the move shows up.

Platforms that only support basic coin buying just can’t keep up with that style of trading. Serious traders want flexibility, speed, and ways to work with volatility, not sit through it – and Delta Exchange caters to such traders well.

Disclaimer: Crypto trading carries inherent risks due to its high volatility. This article is for informational purposes only. Kindly do your own research before making any investment decisions.

Blockchain

MoonExe Aligns With the Next Phase of Stablecoin Payments as Global Regulation Accelerates

MoonExe today reaffirmed its strategic focus on stablecoin-powered payment infrastructure as global regulatory clarity continues to accelerate across major financial jurisdictions.

Regulators worldwide are advancing frameworks that formally recognize stablecoins as legitimate instruments for payment, settlement, and treasury operations. Legislative initiatives in the United States, expanded licensing regimes in Asia, and structured compliance approaches in other regions are collectively signaling a transition from experimental adoption to regulated, real-world deployment.

As stablecoins move deeper into mainstream financial infrastructure, demand is increasing for platforms capable of delivering real-time liquidity, transparent pricing, and verifiable settlement. MoonExe’s Exchange Finance (ExFi) model is designed to address these needs by enabling stablecoin-based currency conversions that operate continuously, without dependence on traditional banking cut-off times or geographic limitations.

The platform focuses on facilitating efficient value movement while maintaining transparency through public blockchain records. Transactions executed within the MoonExe ecosystem can be independently verified via standard blockchain explorers, reinforcing confidence through auditable, immutable data.

In parallel with regulatory progress, market participants are increasingly prioritizing infrastructure reliability over speculative activity. Stablecoins are being evaluated less as alternative assets and more as operational tools capable of supporting cross-border payments, digital commerce, and treasury flows.

MoonExe continues to expand its infrastructure and partnerships to support this evolution, positioning itself as part of the foundational layer required for stablecoins to function at global scale.

For more information about MoonExe and its stablecoin payment infrastructure, visit https://moonexe.com/

Blockchain

Playmaker to Launch in Q2 2026 as Midas Labs Expands Its AI-Powered Game Creation Ecosystem

Midas Labs, a UK-based Web3 technology company, has announced the upcoming launch of Playmaker, an AI-powered game creation and launchpad platform scheduled for Q2 2026. The platform is designed to lower barriers to game development and funding, operating as a core product within the UNIFI-powered Midas ecosystem.

Playmaker will provide creators, indie studios, and early-stage visionaries with an integrated environment to ideate, build, fund, and publish games without the traditional constraints of large teams or complex technical infrastructure. By combining AI-assisted creation tools with a structured launchpad and marketplace, the platform aims to streamline the path from concept to live product.

According to Jonathan Wheatley, Chief Marketing Officer of Midas Labs, Playmaker represents a natural progression of the company’s ecosystem strategy.

“Playmaker is about enabling participation at every level — from creators and developers to early supporters and players,” said Wheatley. “By integrating AI-driven creation with funding and publishing infrastructure, we’re building a system that allows ideas to move efficiently from concept to execution.”

The platform is powered by the $PLAY token, a fixed-supply utility asset used for project participation, creator payments, marketplace transactions, and ecosystem services. $PLAY operates within the broader UNIFI ecosystem, where UNIFI serves as the access and conversion layer, reinforcing liquidity and alignment across Midas Labs’ products.

Midas Labs has structured Playmaker’s token economy around a non-mintable, scarcity-driven model, designed to support long-term sustainability as platform adoption increases.

The Playmaker launch builds on recent Midas Labs milestones, including the expansion of the Midas Play Marketplace, multiple game releases, ecosystem partnerships, and the rollout of UNIFI staking infrastructure. Together, these components form a vertically integrated environment linking creation, funding, distribution, and participation.

Playmaker is scheduled to go live in Q2 2026, with phased ecosystem access beginning with early contributors before expanding globally.

About Midas Labs

Midas Labs is a United Kingdom–based Web3 technology company focused on building scalable digital ecosystems across gaming, AI, and creator-driven platforms. Powered by the UNIFI token, Midas Labs develops infrastructure designed for long-term participation, real utility, and sustainable growth.

-

Crypto4 years ago

Crypto4 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release5 years ago

Press Release5 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain6 years ago

Blockchain6 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins