Blockchain

Bitcoin Halving: Ultimate Guide For Investors And Crypto Enthusiasts

Bitcoin halving is a significant event within the cryptocurrency ecosystem, which has profound implications for Bitcoin’s economic framework and market dynamics.

If you’re interested in delving deeper into the concept of Bitcoin halving, this all-inclusive guide is perfect for you.

It delves into the intricate details of how Bitcoin halving functions, its significance for both miners and investors and its effect on the wider cryptocurrency ecosystem.

Furthermore, this guide explores the fundamental concepts that underpin Bitcoin halving, including why it is essential to control inflation and limit the total supply of Bitcoin which is great for crypto enthusiasts and a fantastic guide for Investors.

It delves into the relationship between Bitcoin halving events and market sentiment, examining historical trends and potential future ramifications.

Apart from Bitcoin halving, this guide also aims to provide readers with a comprehensive understanding of Bitcoin mining, which is the backbone of the cryptocurrency ecosystem.

Bitcoin mining is a decentralized mechanism that verifies transactions and creates new bitcoins. This section elucidates the intricate process of Bitcoin mining, including the technical nuances of mining algorithms, hardware requirements, and the competitive dynamics of the mining ecosystem.

By exploring the challenges and opportunities inherent in Bitcoin mining, this guide highlights its significance in facilitating secure and decentralized transactions within the digital realm.

Overall, this guide is an excellent resource for anyone looking to gain a deeper understanding of Bitcoin halving and mining.

Bitcoin Halving: A Catalyst for Market Dynamics and Investor

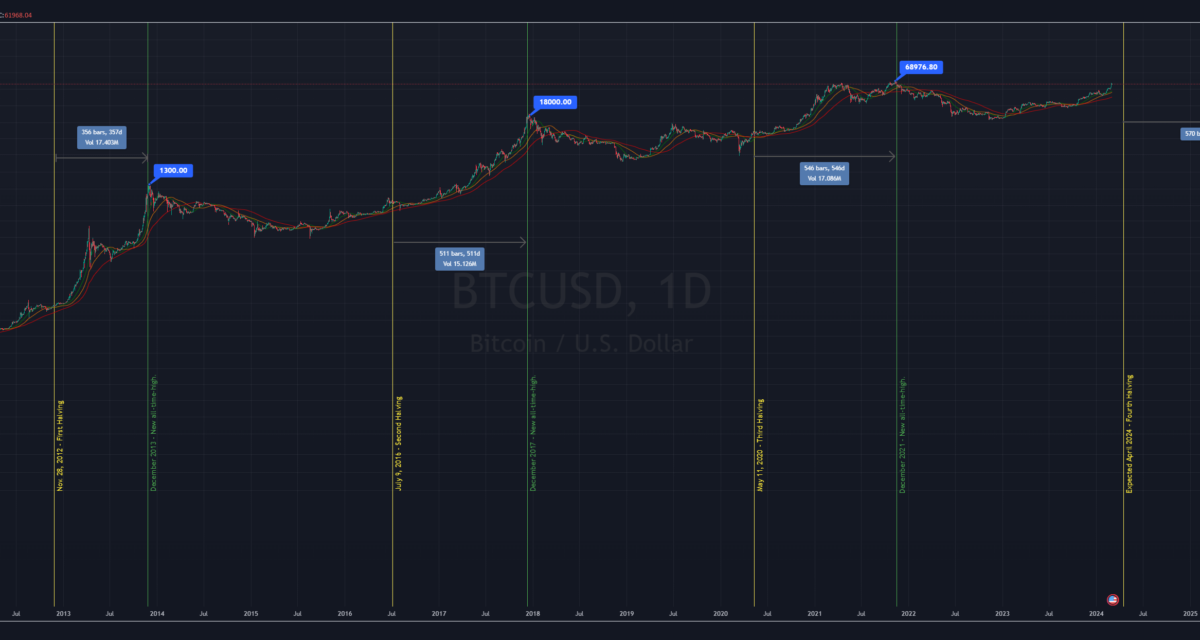

SentimentThe Bitcoin halving event on May 11, 2020, marked a pivotal moment in the cryptocurrency’s history, reducing the block reward from 12.5 bitcoins to 6.25 bitcoins and curbing the rate of new supply issuance.

This deflationary monetary policy showcased Bitcoin’s resilience amidst economic uncertainty, garnering attention from stakeholders worldwide.

Post-halving, Bitcoin witnessed heightened volatility and speculation as traders eagerly awaited its impact on price dynamics. The event reignited interest in Bitcoin as a store of value and inflation hedge, driving demand and subsequent price appreciation.

Media coverage and investor speculation surged, highlighting the halving’s influence on market sentiment and price trends.

The next halving of Bitcoin is expected in 2024, which will further the cryptocurrency’s goal of reaching a maximum supply of 21 million coins. This upcoming event holds significant importance for miners, investors, and the crypto community.

Market participants are already anticipating the upcoming bitcoin halving and its effects on supply dynamics, price volatility, and investor sentiment. Miners are reevaluating their operational strategies as they navigate the diminishing block rewards.

Factors like energy efficiency, hardware optimization, and operational scalability are crucial for maintaining profitability in a reduced reward environment. Investors are analyzing market dynamics and historical trends to anticipate price movements and assess Bitcoin’s deflationary model’s long-term value preservation.

The lead-up to the next halving sees intense discourse within the cryptocurrency community on supply dynamics, market psychology, and macroeconomic trends.

The countdown to the event serves as a focal point for speculation, anticipation, and reflection, underscoring the enduring impact of Bitcoin’s halving mechanism on shaping the digital asset landscape.

Miners’ Reward Mechanism: Incentivizing Network Security and Participation

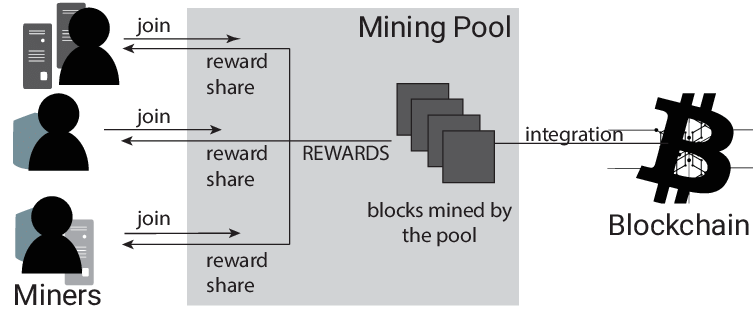

Central to the operation of the Bitcoin network is the reward mechanism designed to incentivize miners to dedicate computational resources towards securing and validating transactions.

This section elucidates the intricate interplay between miners, block rewards, and the foundational principles underpinning Bitcoin’s decentralized consensus protocol.

At the heart of the mining process lies the pursuit of block rewards, wherein miners compete to solve complex cryptographic puzzles and append new blocks to the blockchain. Initially set at 50 bitcoins per block upon Bitcoin’s inception in 2009, the block reward undergoes periodic reductions, halving approximately every four years by the protocol.

This reduction is a deliberate mechanism to constrain the issuance of new bitcoins, gradually tapering the inflation rate and imbuing the cryptocurrency with scarcity akin to precious metals like gold.

Beyond the allure of newly minted bitcoins, miners are further

incentivized by transaction fees, which constitute an additional source of revenue accrued from including transactions within the blocks they mine.

As the Bitcoin network matures and transaction volumes increase, transaction fees assume greater prominence in the overall reward structure, supplementing block rewards and serving as a tangible indicator of network activity and utility.

The close alignment of block rewards and transaction fees highlights the mutually beneficial association between miners and Bitcoin network users. Miners have a crucial responsibility in ensuring the smooth functioning of the Bitcoin network, and they receive rewards proportional to their computational efforts.

This reward mechanism fosters competition among miners, incentivizing them to invest in state-of-the-art hardware, optimize energy efficiency, and strategically position themselves within the mining ecosystem to maximize profitability.

The Bitcoin ecosystem maintains a consistent block production rate by adjusting mining difficulty, which balances mining rewards and network participation.

This adaptive mechanism ensures the resilience and robustness of the Bitcoin network, safeguarding against external threats and preserving the integrity of the decentralized ledger.

The miners’ reward mechanism embodies the foundational principles of decentralization, security, and economic incentivization that underpin the Bitcoin protocol.

Miners’ interests are aligned with those of network participants in this system, which results in a self-sustaining ecosystem.

As a result, individual incentives merge to maintain the collective integrity and security of the Bitcoin network.

The miners’ reward mechanism is a crucial element in the resilience and longevity of Bitcoin as it continues to develop and expand in the rapidly changing world of digital finance.

Relation to Bitcoin Price and Post-Halving Effects: Unraveling Market Dynamics and Economic Implications

The correlation between Bitcoin halving events and the fluctuations in the value of the cryptocurrency market is a topic that attracts a lot of attention and conjecture from analysts, investors, and enthusiasts alike.

Historically, Bitcoin halving events have served as catalysts for price volatility and speculative fervor, eliciting fervent anticipation and market speculation leading up to the event.

Investors often become bullish in anticipation of a reduction in block rewards as they perceive it as an omen of scarcity and upward price movement. As a result, Bitcoin’s price trajectory leading up to and after halving events typically displays marked fluctuations, characterized by spikes in buying activity and frenzied market speculation.

However, the relationship between Bitcoin halving events and price dynamics extends beyond mere speculative fervor, encompassing broader macroeconomic factors and market sentiment.

Bitcoin’s scarcity narrative, finite supply cap of 21 million coins, and its ability to act as a store of value protected against inflationary pressures and sovereign manipulation make it comparable to digital gold.

Halving events serve as a means to strengthen this story, highlighting Bitcoin’s position as a safeguard against the decline of fiat currency and political instability.

The cryptocurrency ecosystem goes through significant changes in mining dynamics, investor sentiment, and market psychology.

The decrease in block rewards compels miners to reassess their strategies, prompting the consolidation of inefficient mining operations.

The combination of this change and the decrease in the creation of new Bitcoins can cause a shortage in supply that drives the value of Bitcoin higher and sparks excitement in the market.

After the halving event, there is usually a rise in media attention, an increase in investor interest, and a surge in institutional investments in the cryptocurrency industry.

Several factors support the positive outlook on Bitcoin’s enduring value proposition.

As institutional adoption gains traction and retail participation proliferates, Bitcoin’s price trajectory may exhibit sustained upward momentum, underpinned by fundamental demand drivers and scarcity-induced price discovery mechanisms.

Historically, there has been a connection between Bitcoin halving events and bullish price surges. Nonetheless, the interplay between halving and price dynamics is complex and uncertain.

Several factors, including regulatory developments, technological advancements, macroeconomic trends, and market sentiment, can affect the outcome of future halvings.

The Impact of Bitcoin Halving Events Goes Beyond Mere Price Speculation

Bitcoin halving events, price dynamics, and post-halving effects actively demonstrate the intricate relationship between supply-side economics, market psychology, and broader macroeconomic forces that shape the trajectory of the cryptocurrency market.

These pivotal milestones in the evolution of the cryptocurrency ecosystem go beyond mere price speculation, impacting monetary policy, financial innovation, and the democratization of global finance.

Bitcoin’s ongoing redefinition of the digital economy extends beyond the cryptocurrency realm, with halving events signaling a paradigm shift in how we perceive and engage with money in the digital age.

Blockchain

BlockDAG’s $331.5M Presale Steals The Show As TRON Transactions Jump & Dogecoin Eyes Breakout

Technical patterns often reveal more than short-term excitement. TRON has seen its daily transactions jump 80%, showing strong network activity. Dogecoin, on the other hand, is forming a descending triangle pattern that hints at a possible sharp move ahead. Both coins are drawing attention, one for higher usage, the other for possible price action.

But BlockDAG (BDAG) clearly leads with its real-world partnership and forward-thinking presale. With $331.5M raised and over 23.5 billion coins already sold, BlockDAG offers a unique combination of utility and opportunity. The limited-time $0.0016 GLOBAL LAUNCH release price opens the door for greater potential returns. For anyone looking at which crypto to buy today, BlockDAG’s offer stands out with real use and future upside.

TRON Daily Transactions Soar 80% Showing Strength

TRON technical data shows an 80% rise in daily transactions. Activity has grown from about 5 million to nearly 9 million a day since last September. The network’s real use has climbed, and higher fees paid in TRX on-chain point to steady demand beyond short-term moves. However, TRON’s price faces strong resistance at $0.28. Its price has remained between $0.275 and $0.283 where many liquidation points limit upward movement.

The Relative Strength Index is also close to overbought levels, suggesting the chance of a short-term dip unless volume builds to break higher. For TRON to leave the tight range of $0.26 to $0.28, continued buying power will be key. Larger holders adding quietly and increasing social media talk suggest that a breakout could happen if the $0.28 barrier is finally cleared.

Dogecoin Shapes Triangle Pattern Eyes Big Break

Dogecoin is forming a descending triangle pattern where the price keeps bouncing off steady support around $0.1369 while making lower highs. This points to a phase where price action tightens, often before a major move. The repeated tests of support match the classic “1-2-3” pattern often seen before price climbs, showing strong interest from buyers at these levels.

As the pattern narrows, price swings have become smaller, which usually sets up the conditions for a breakout. Many are watching for a push toward $1 if the price can move above the triangle. If momentum holds, the price could go even higher. As price nears the tip of the triangle, the odds of a large move increase, with traders positioning ahead of a possible sharp rise.

BlockDAG Raises $331.5M Presale Selling 23.5B Coins Fast

The Seattle Seawolves have teamed up with BlockDAG to deliver blockchain-driven fan experiences that reach beyond match days. This partnership brings a digital dimension to sports fandom. Fans can collect official digital items like NFTs and tradable digital pieces that mark special moments with the team. This creates a sense of digital ownership in the team’s story.

Through the X1 App, fans can gather memorable moments, earn rewards for engaging with content, and view exclusive videos like behind-the-scenes clips and highlights. This effort builds a stronger bond between the community and the technology shaping future fan experiences.

At the same time, BlockDAG’s presale has surpassed expectations. The project has raised $331.5M so far and sold over 23.5 billion coins. With Batch 29 coins priced at $0.0276, early supporters have already seen a 2,660% return since Batch 1. Thanks to the GLOBAL LAUNCH release, new participants can still access the $0.0016 price for a limited period until August 11. This chance offers clear utility and high potential for returns.

Summing Up!

While Dogecoin watchers focus on chart patterns and TRON followers note stronger network use, BlockDAG is delivering practical results. Its partnership with the Seattle Seawolves brings real value by linking sports fans with digital experiences, while the presale keeps setting new records.

BlockDAG has sold over 23.5 billion coins and provided a 2,660% return since Batch 1. With a special GLOBAL LAUNCH release price of $0.0016 active for a short time, this project offers clear access and potential for growth. For anyone weighing not just hype but real-world use, BlockDAG provides a stronger case for those thinking about which crypto to buy today.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Blockchain

BlockDAG’s GLOBAL LAUNCH Release Edge: Why It Outshines BONK and LINK with $0.0016 Presale Price Lock

Price stability is becoming a rare advantage in crypto, especially as traders weigh shifting momentum signals. LINK is currently holding at a technical crossroads with on-chain data showing a cautious tone among major holders. BONK, on the other hand, is seeing a surge in trading volume and buy-sell delta, pointing to short-term interest, but resistance levels could limit its next move.

BlockDAG, by contrast, is drawing attention for locking its presale price at $0.0016 despite batch 29 being priced at $0.0276. This calculated decision gives BlockDAG (BDAG) an edge by offering a consistent entry point as part of its GLOBAL LAUNCH release.

BONK Price Update: Volume Spike Signals Growing Momentum

The latest BONK price update shows a significant shift in market sentiment, with trading volume rising by 98.33% to $160.5 million. Alongside this surge, there’s a notable buy-sell delta of +127 billion tokens, indicating strong accumulation and bullish interest. After bouncing off the $0.000013 support, BONK briefly touched $0.00001480 before stabilizing around $0.00001446, showing that buyers are actively defending recent gains.

Technically, BONK faces a critical resistance near $0.000015. A break above this level could lead to a stronger rally, but failure to hold may cause a retest of lower support levels. Despite slight overbought conditions, the increase in volume and open interest indicates confidence in the upward trend, making BONK a closely watched asset in this phase of its price cycle.

LINK Price Faces Uncertainty as Traders Watch Key Levels

The LINK price forecast remains uncertain as the asset hovers at a crucial crossroads. Data reveals that investor activity is slowing, with whale wallet interactions dropping and fewer LINK tokens being moved off exchanges. This suggests caution among large holders, with potential overhead pressure. Although LINK is currently holding above a short-term support zone, it shows signs of hesitation that could impact short-term momentum.

Traders are closely watching whether LINK breaks above resistance or falls below the $13.5–$13.9 range, as this could signal the next move. The Relative Strength Index (RSI) is in neutral territory, indicating neither buyers nor sellers have clear control. As LINK stalls near these key levels, the price forecast will depend on whether accumulation picks up or a broader pullback occurs.

BlockDAG Locks In $0.0016 Presale Price with GLOBAL LAUNCH Release

BlockDAG has made a strategic move by freezing its presale price at $0.0016 as part of its highly anticipated GLOBAL LAUNCH release. This decision is designed to protect retail buyers from late-stage price increases, ensuring they get the same early pricing as the initial backers. While the official Batch 29 price is $0.0276, this special offer lowers the barrier to entry, giving participants the chance for a higher ROI.

BlockDAG’s presale has already raised over $329 million, with more than 23.5 billion coins sold, making it one of the most discussed presales of 2025. The ROI since Batch 1 has reached 2,660%, and the locked price of $0.0016 further increases the potential for buyers. This structured presale model sets BlockDAG apart, offering a predictable, user-first approach.

Rather than rushing toward unpredictable surges, BlockDAG’s approach prioritizes stability by locking in the presale price. This eliminates the fear of missing out that often comes with rapid price jumps, allowing buyers to invest with confidence. As the GLOBAL LAUNCH release approaches, BlockDAG offers a unique opportunity, attracting attention from those looking for a long-term, secure entry point.

Conclusion

While BONK’s rising volume and LINK’s indecision at key levels show that volatility still dominates short-term trading, BlockDAG is offering a more stable approach. By freezing its presale price at $0.0016, BlockDAG removes the uncertainty that typically accompanies late-stage investments. This stability has caught the attention of investors seeking a clear, reliable path ahead of major launches.

Unlike other projects that react to market shifts, BlockDAG is taking a proactive approach by focusing on structure and timing. As the GLOBAL LAUNCH release nears, BlockDAG is positioning itself not through speculation but by allowing buyers to participate under clear, predictable terms. This makes BlockDAG stand out as a crypto that’s not relying on hype, but offering real, tangible value for those preparing for long-term gains.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Blockchain

Russian Defense Manufacturer Eyes Stablecoin Launch on Tron Blockchain

A major Russian arms manufacturer is reportedly developing plans to launch its own stablecoin on the Tron blockchain, signaling a growing interest in decentralized finance (DeFi) solutions within state-linked industries.

According to sources close to the matter, the initiative is being explored as a means to bypass traditional financial systems and mitigate the impact of international sanctions. By leveraging blockchain technology—specifically the Tron network known for its low fees and fast transactions—the company aims to facilitate more efficient cross-border transactions and secure trade settlements.

While the identity of the defense contractor has not been officially disclosed, insiders suggest that the stablecoin project is intended for use in settling international arms deals and procuring critical materials. The move would allow the company to conduct business with foreign partners without relying on SWIFT or other Western-controlled financial infrastructures.

The choice of the Tron blockchain is particularly notable. Tron, founded by Justin Sun, has become a popular network for stablecoins like USDT due to its high throughput and low transaction costs. Its growing global user base makes it an attractive option for entities seeking financial flexibility and speed.

The development comes amid Russia’s broader push to integrate digital assets into its economy. The Russian central bank has already launched pilot programs for a digital ruble, while private and state-linked entities are increasingly exploring crypto-based alternatives to facilitate international trade.

If realized, this stablecoin project could set a precedent for other state-affiliated organizations seeking to harness blockchain technology in the face of geopolitical and economic restrictions.

-

Crypto3 years ago

Crypto3 years agoCardalonia Aiming To Become The Biggest Metaverse Project On Cardano

-

Press Release5 years ago

Press Release5 years agoP2P2C BREAKTHROUGH CREATES A CONNECTION BETWEEN ETM TOKEN AND THE SUPER PROFITABLE MARKET

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol partners with CoinPayments, the world’s largest cryptocurrency payments processor

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Press Release4 years ago

Press Release4 years agoProject Quantum – Decentralised AAA Gaming

-

Blockchain5 years ago

Blockchain5 years agoWOM Protocol Recommended by Premier Crypto Analyst as only full featured project for August

-

Press Release5 years ago

Press Release5 years agoETHERSMART DEVELOPER’S VISION MADE FINTECH COMPANY BECOME DUBAI’S TOP DIGITAL BANK

-

Blockchain5 years ago

Blockchain5 years ago1.5 Times More Bitcoin is purchased by Grayscale Than Daily Mined Coins